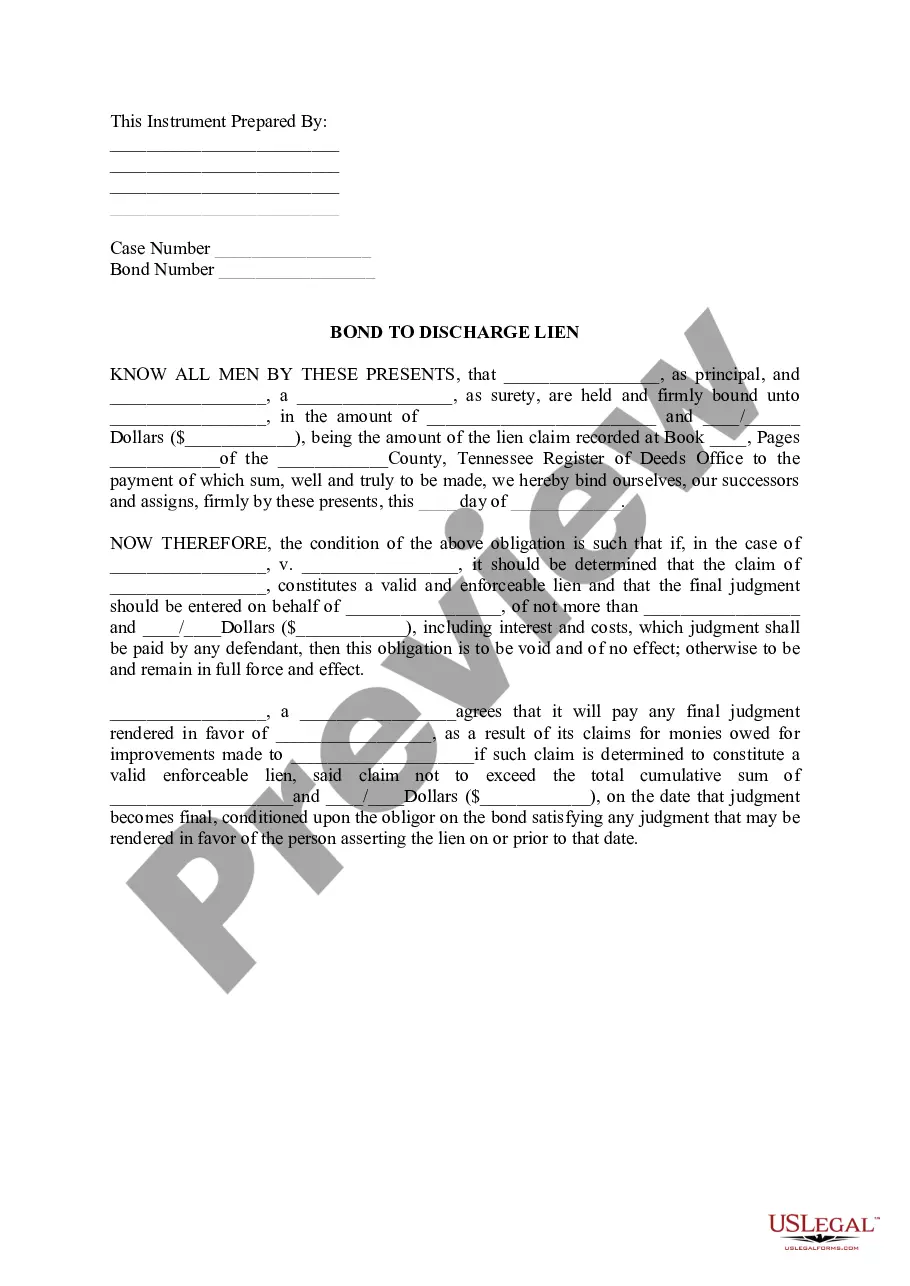

Utah Indemnity Bond Agent is a professional or company that provides surety bonds for businesses and individuals in the state of Utah. These surety bonds guarantee payment or performance of an obligation if the principal fails to fulfill their contractual obligations. These bonds are required in a variety of business and personal transactions, such as bid bonds, performance bonds, payment bonds, lease bonds, license bonds, and court bonds. The most common types of Utah Indemnity Bond Agents are surety bond agents, insurance agents, and bond brokers. Surety bond agents are licensed professionals who provide surety bonds for their clients. Insurance agents are licensed professionals who provide a variety of insurance products to their clients. Bond brokers are individuals or companies that specialize in the sale of surety bonds.

Utah Indemnity Bond Agent

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Utah Indemnity Bond Agent?

How much time and resources do you often spend on composing formal paperwork? There’s a better way to get such forms than hiring legal experts or wasting hours browsing the web for a proper blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Utah Indemnity Bond Agent.

To obtain and complete an appropriate Utah Indemnity Bond Agent blank, follow these simple instructions:

- Look through the form content to make sure it complies with your state requirements. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Utah Indemnity Bond Agent. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Select the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Utah Indemnity Bond Agent on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trusted web solutions. Join us today!

Form popularity

FAQ

The purpose of indemnity bonds is to guarantee financial reimbursement for any damage faced due to the illegal actions of the other party that is bonded through the agreement. The principal signs an agreement to indemnify with the surety provider as part of getting an indemnity bond.

The Indemnity bond should be signed by two witnesses and two sureties (name, address and signature). 12. Affidavit should be verified in presence of a First Class Magistrate or a Notary Public. In the event of verification in the presence of Notary Public, the Affidavit should contain the notarial stamp.

The Indemnity bonds promise financial compensation in case there is any breach of contract due to any illegal activities. The primary purpose of drawing an Indemnity bond is to safeguard either of the parties from the promised loss.

Ans. Indemnity bonds are issued by 3rd party institutions such as banks or insurance companies.

Insurance pays on behalf of you; surety bonds are just a guarantee of payment to another party. The primary difference between a surety bond and insurance is that insurance will pay for losses in a claim, whereas a bonding company will guarantee your obligations are fulfilled.

There are many types of surety bonds, and each state has its own bonding requirements for different industries. However, there are three major types of surety bonds that you should know: license and permit bonds, construction and performance bonds, and court bonds.

In short, indemnity compels a party to compensate another party. Regarding a surety bond, this means that the obligee has the legal right to collect from the surety if the principal of the bond fails to uphold their end of the bond.

An indemnity bond works by guaranteeing to indemnify and reimburse someone for financial losses they experience when the other party to the bond defaults on their responsibilities or obligations. In other words, they protect one party against wrongdoing by the other party.