Utah Security Agreement

Description

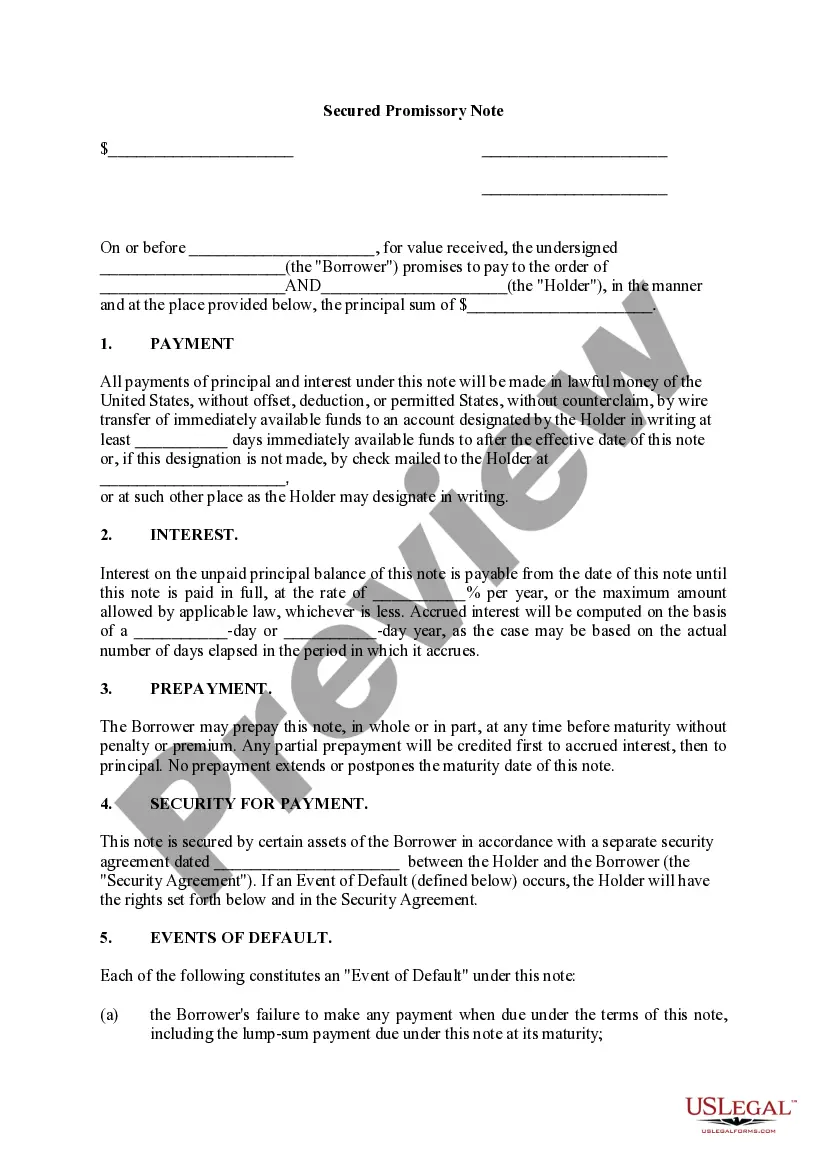

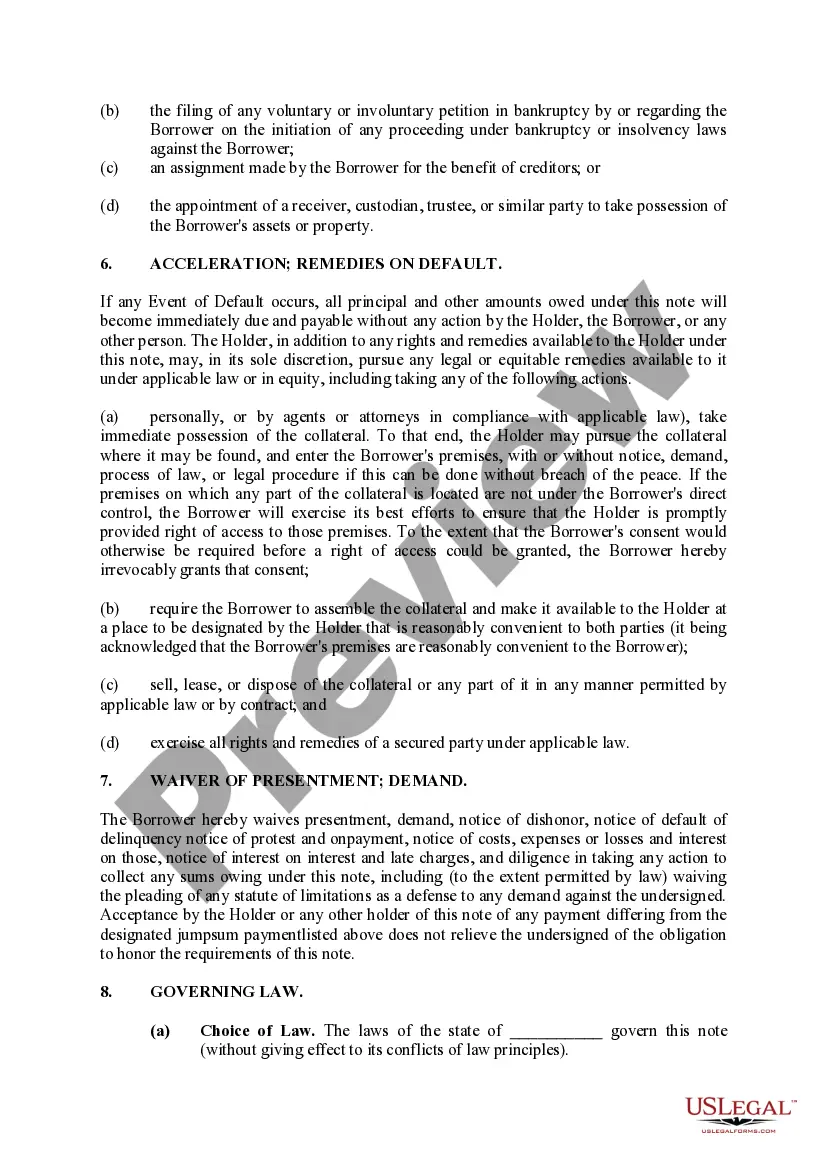

Note/ the Borrower has agreed to enter into this security

agreement for the benefit of the Lender and to grant the Lender a security interest in the Secured Property to secure the prompt payment, performance, and discharge in full of the Borrower's obligations under the Note.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Utah Security Agreement?

Looking for a Utah Security Agreement online can be stressful. All too often, you find documents that you believe are fine to use, but find out afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Get any form you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added to your My Forms section. If you don’t have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Utah Security Agreement from our website:

- See the document description and click Preview (if available) to verify whether the form meets your expectations or not.

- In case the form is not what you need, find others using the Search field or the provided recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- Right after downloading it, you are able to fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, users are also supported with step-by-step guidelines concerning how to find, download, and complete forms.

Form popularity

FAQ

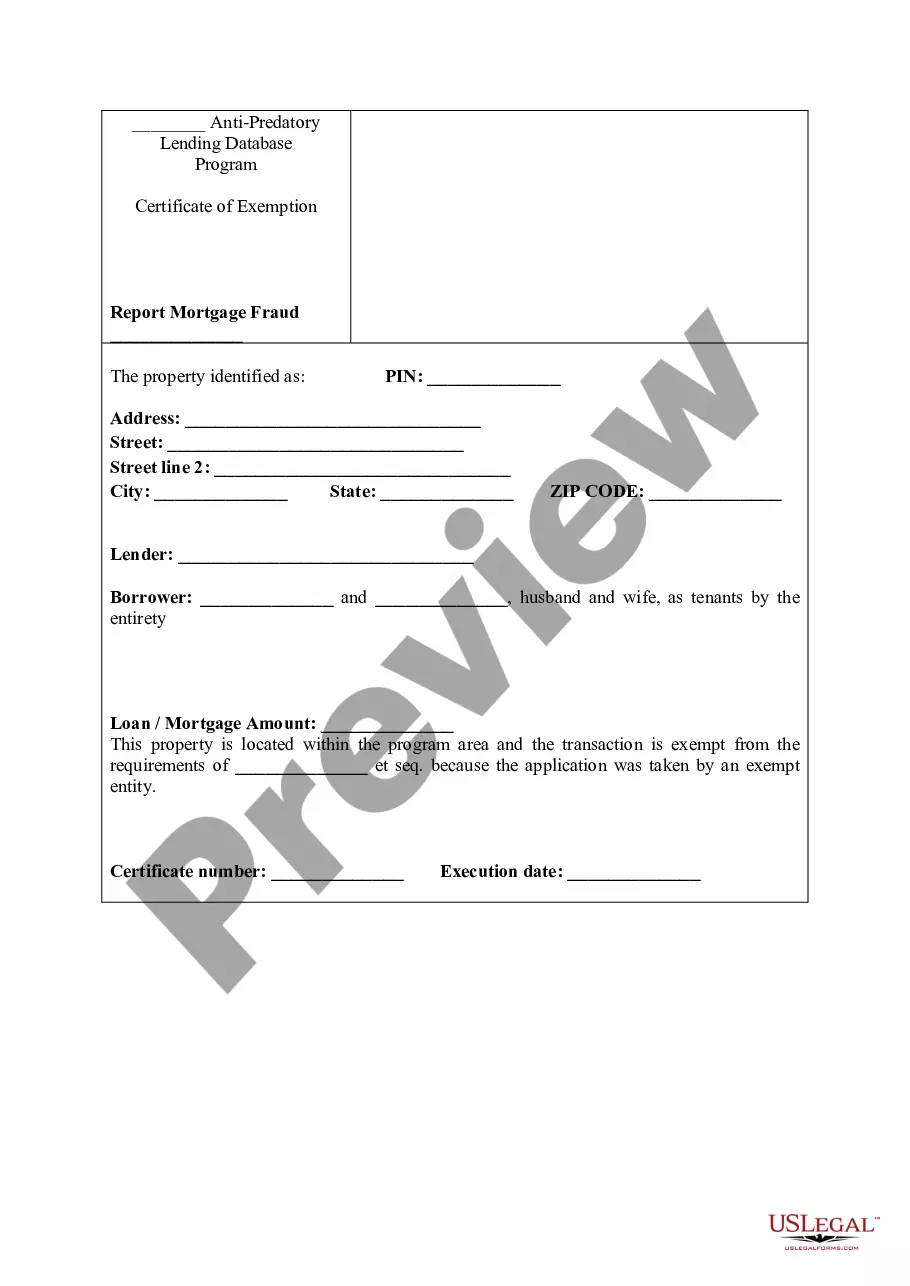

A security agreement is not used to transfer any interest in real property (land/real estate), only personal property.The document used by lenders to obtain a lien on real property is a mortgage or deed of trust.

A Specific Security Agreement (formerly known as Chattel Mortgage) is an equipment financing option that allows businesses to own their equipment upon purchase. BOQ Equipment Finance Limited secures the loan by registering a charge over the goods.

Three things must be present in order for the secured party to obtain a protected security interest in the collateral: 1) the secured party must pay for or give something of value in exchange for receiving the security interest, 2) the debtor must own the collateral or have proper authority over the collateral in order

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

After five years, it becomes invalid and must be renewed every five years. It is very important to check all the information provided under the agreement regarding the presented items.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A general security agreement creates a security interest in all present and future assets of the borrower. This means the lender would have access to all assets your business owns now and any future assets your business purchases as collateral for the loan issued.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

A secured party should have no trouble determining the correct lapse date of a record that perfects a security interest in fixtures. If perfected by the filing of a financing statement, the record is effective for five years. If perfected by a record of mortgage, the record does not lapse.