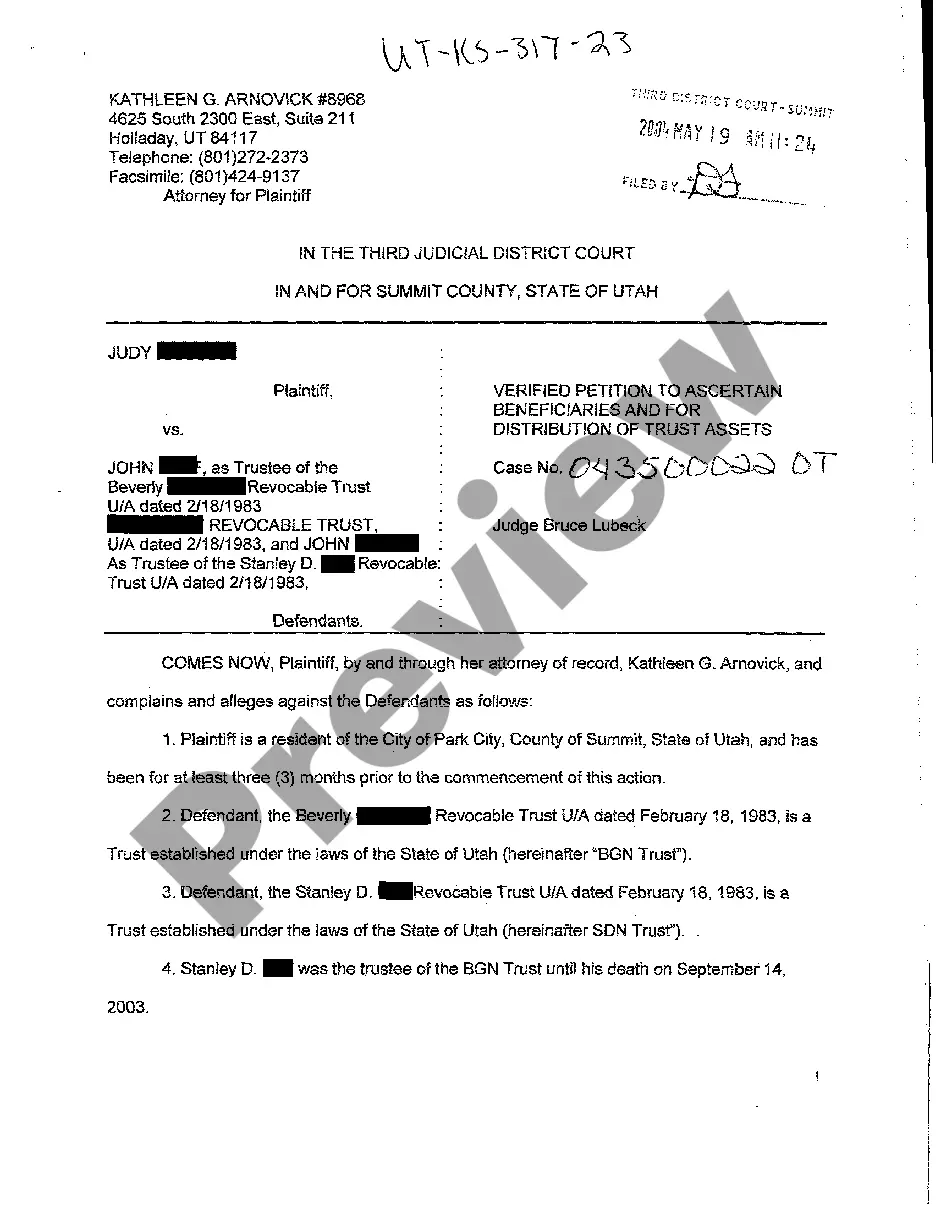

Utah Verified Petition to Ascertain Beneficiaries and for Distribution of Trust Assets

Description

How to fill out Utah Verified Petition To Ascertain Beneficiaries And For Distribution Of Trust Assets?

Among numerous free and paid examples that you’re able to find on the web, you can't be sure about their reliability. For example, who made them or if they’re skilled enough to take care of what you require these to. Always keep calm and use US Legal Forms! Find Utah Verified Petition to Ascertain Beneficiaries and for Distribution of Trust Assets samples developed by professional attorneys and avoid the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access all of your earlier acquired examples in the My Forms menu.

If you are making use of our service the first time, follow the tips below to get your Utah Verified Petition to Ascertain Beneficiaries and for Distribution of Trust Assets easily:

- Make certain that the document you see is valid in the state where you live.

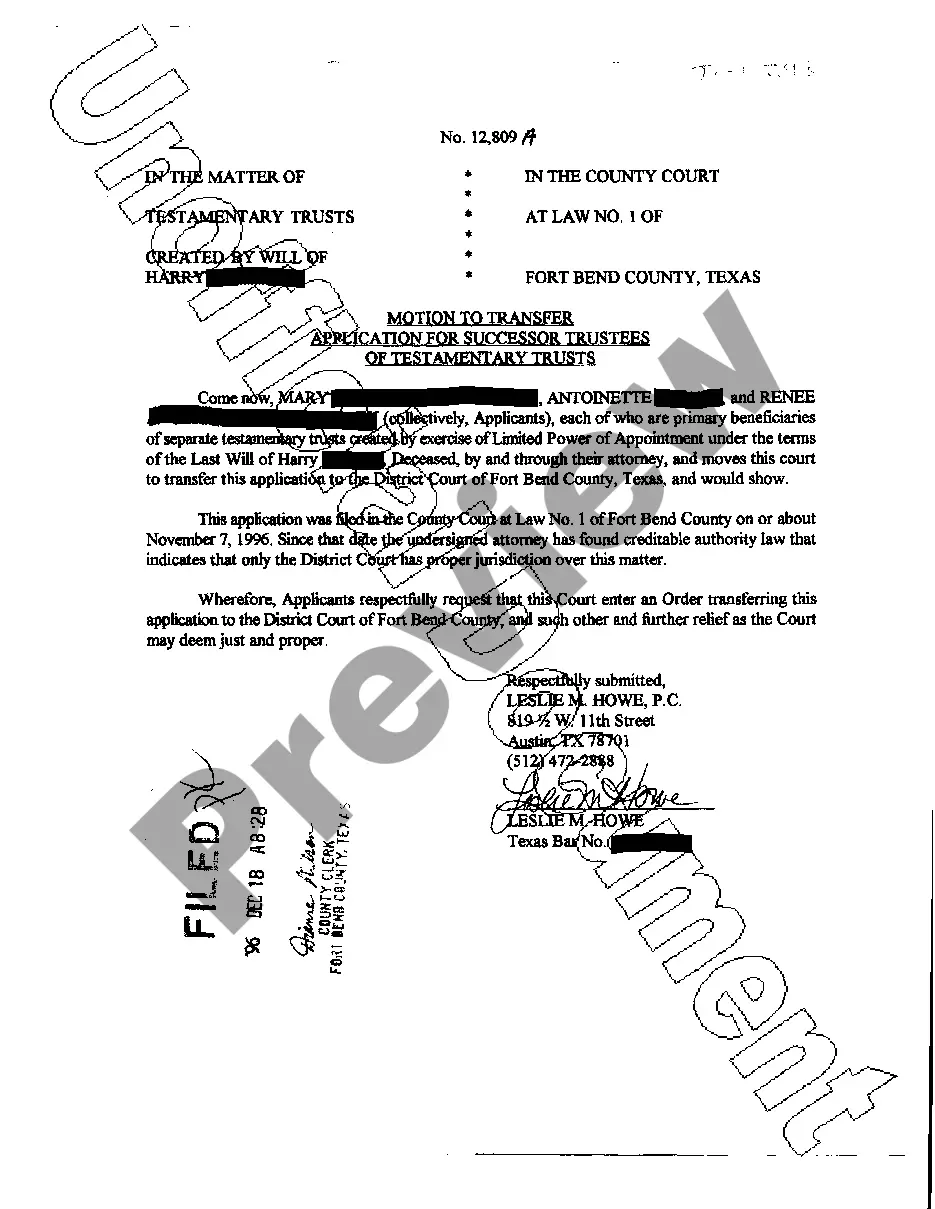

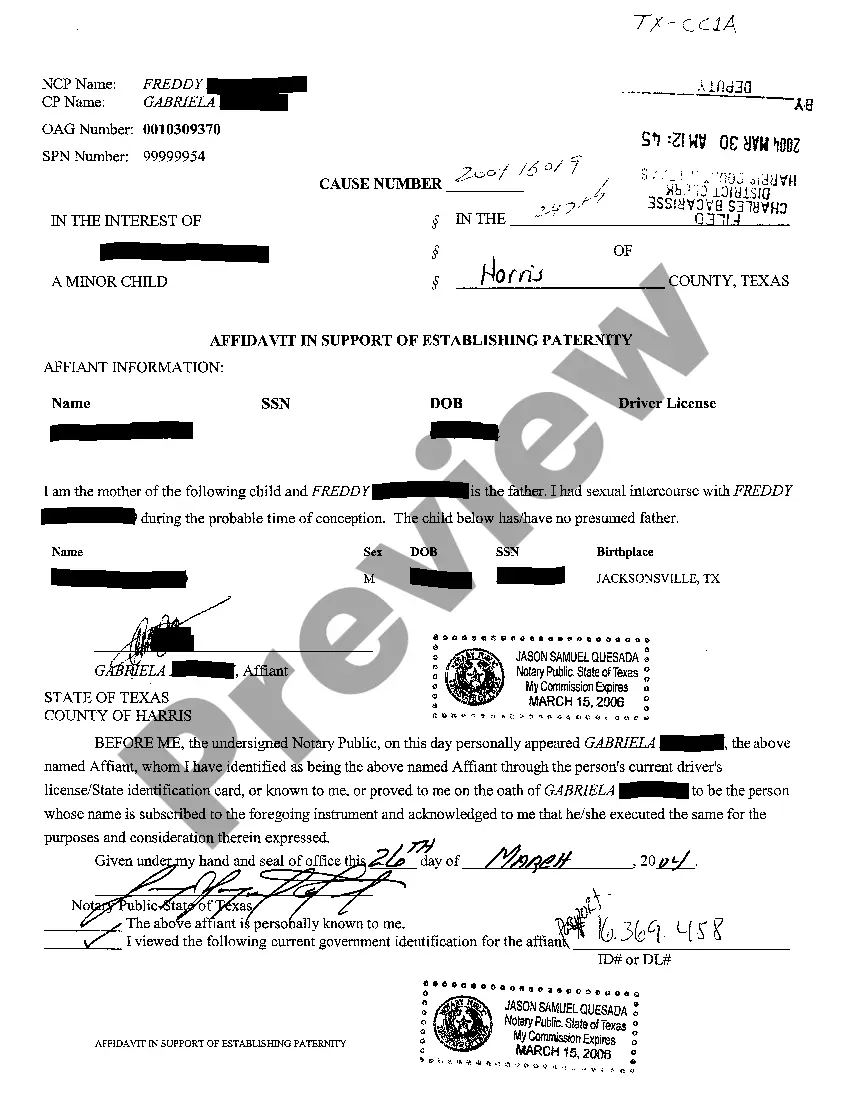

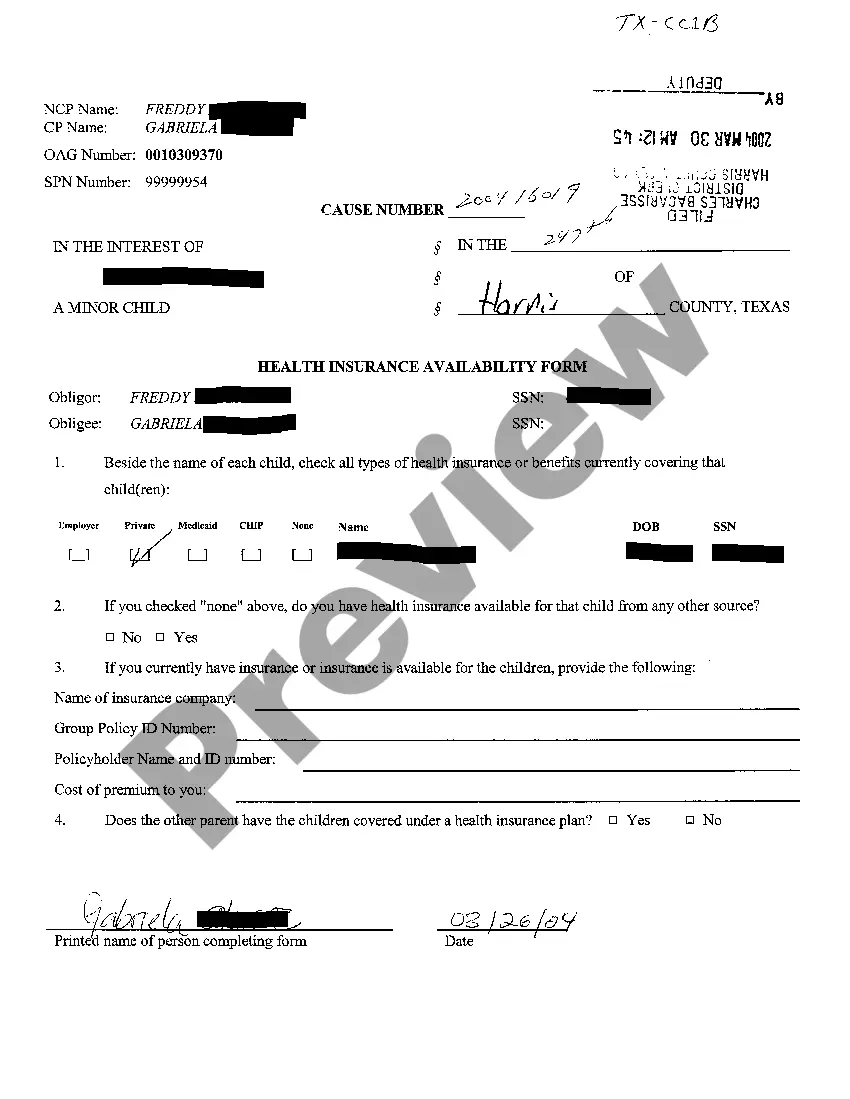

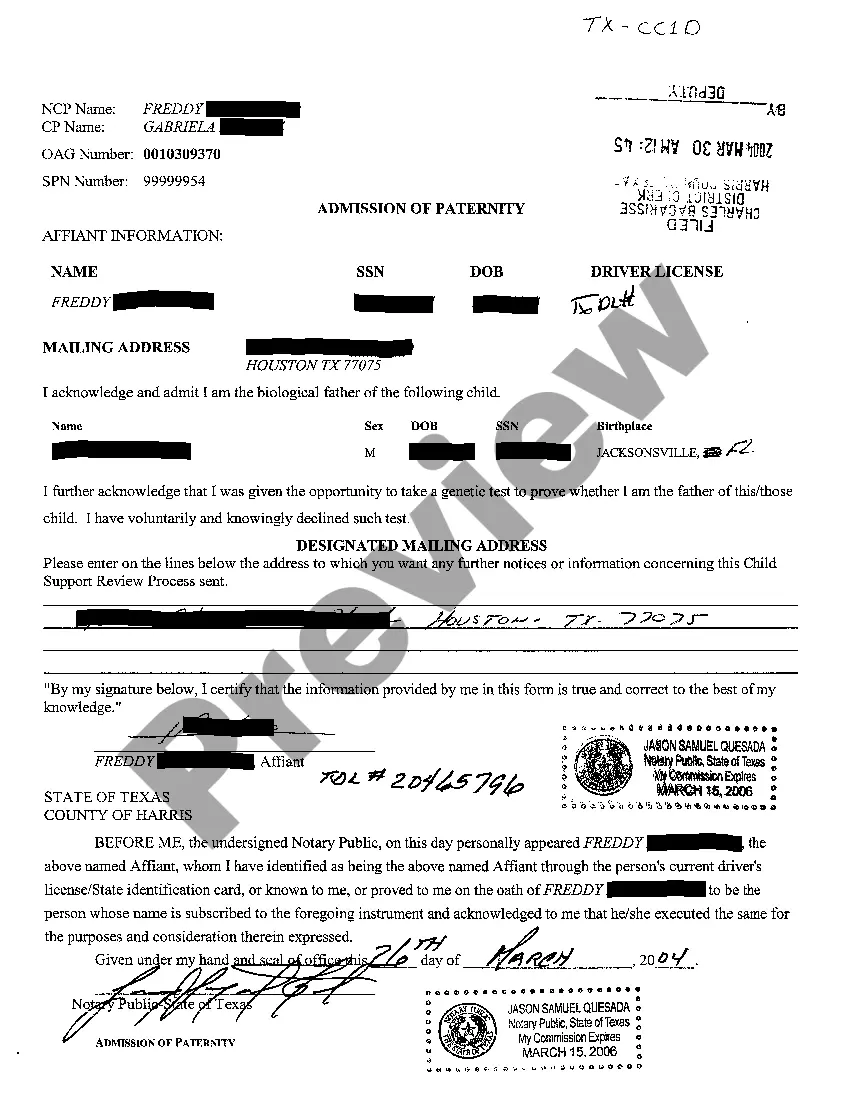

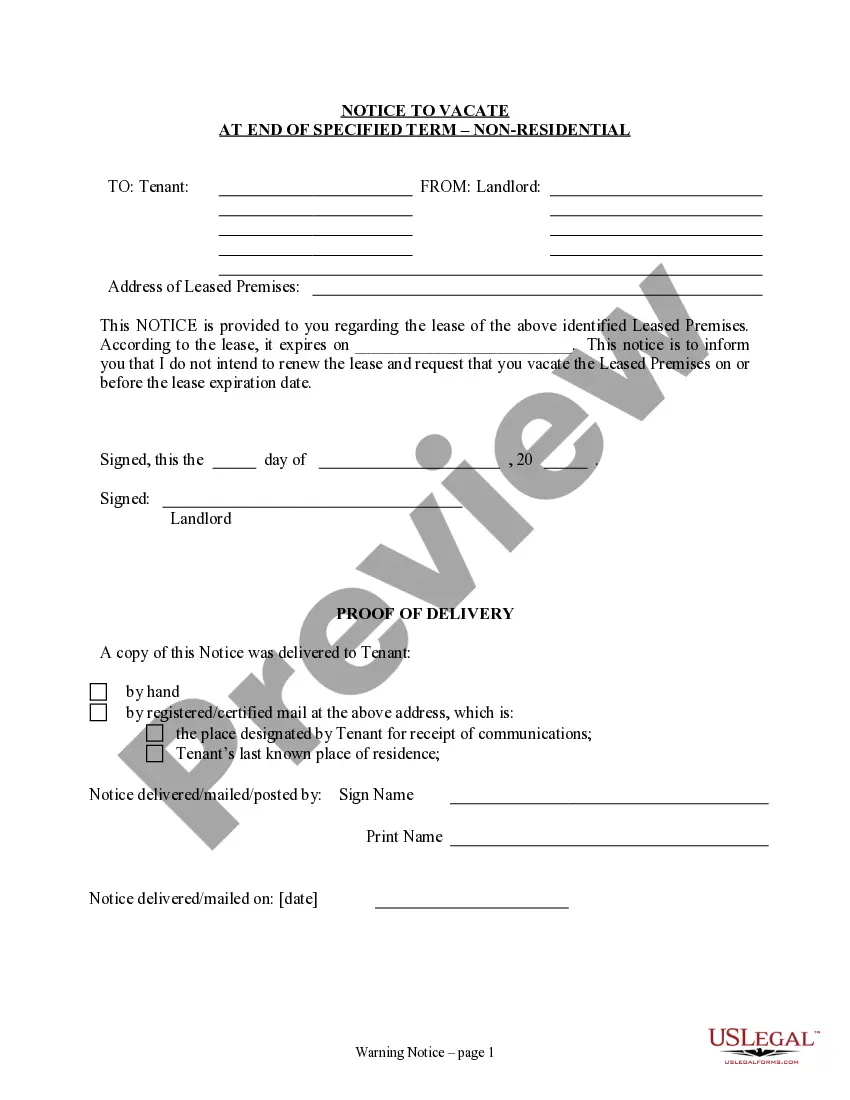

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you have signed up and purchased your subscription, you may use your Utah Verified Petition to Ascertain Beneficiaries and for Distribution of Trust Assets as often as you need or for as long as it remains active where you live. Change it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

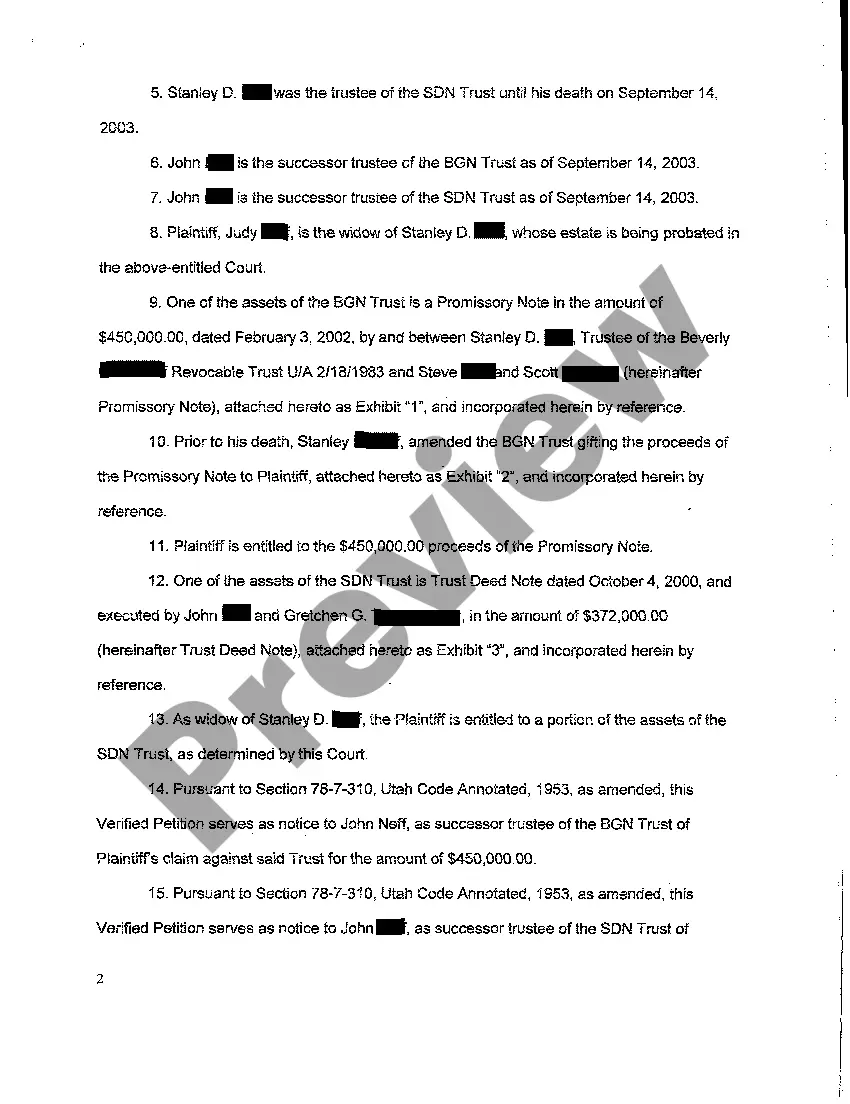

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Distribution of trust funds after death The Trustee simply transfers all assets to the beneficiary. Distribution is also fairly easy if the trust document identifies all assets and specific amounts to be paid to each beneficiary.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

Does a Beneficiary Have the Right to See the Trust? The California Probate Law section 16061.7 provides for the beneficiaries right to see the trust. Trustees should furnish beneficiaries and heirs with copies of the trust document.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.