Grant Writer Agreement - Self-Employed Independent Contractor

Description

Key Concepts & Definitions

Grant Writer Agreement Self Employed Independent: A contractual document outlining the terms of service between a self-employed, independent grant writer and their client, which can be a nonprofit organization, a real estate company, or any other entity requiring grant writing services. Independent Contractor: A person or entity contracted to perform work for another entity as a non-employee. Freelance Writer: A writer working on a self-employed basis, offering services like grant writing to various clients.

Step-by-Step Guide

- Identify Needs: The client defines their requirements for grant writing services.

- Select a Grant Writer: Choose a grant writer based on experience, specialty, and rates.

- Draft Contract: Using contract samples, draft a writing contract that is comprehensive and legally binding.

- Clarify Terms: Detail the scope of the work, payment terms, deadlines, and obligations.

- Sign Agreement: Both parties review, possibly negotiate changes, and sign the grant writer agreement.

- Commence Work: The grant writer begins the grant writing process according to the contract terms.

Risk Analysis

- Legal Risks: Improperly drafted contracts could lead to legal disputes.

- Financial Risks: Unclear payment terms can cause cash flow issues for the grant writer.

- Reputation Risks: Non-completion or poor performance can affect the reputation of both the grant writer and the client.

Best Practices

- Clear Scope of Work: Ensure the contract clearly defines what is expected from the grant writer.

- Payment Terms: Outline specific payment schedules and terms.

- Contract Flexibility: Build some flexibility into the agreement to cover possible project adjustments.

- Regular Communication: Maintain open lines of communication between the client and the grant writer throughout the project duration.

Common Mistakes & How to Avoid Them

- Vague Clauses: Avoid vague language in the agreement by being as specific as possible when detailing job scopes and terms.

- Lack of a Termination Clause: Always include a clear termination clause to address potential need for contract dissolution.

- Underestimating Timeframes: Allocate sufficient time for adequate research and writing to prevent rushing through grant applications.

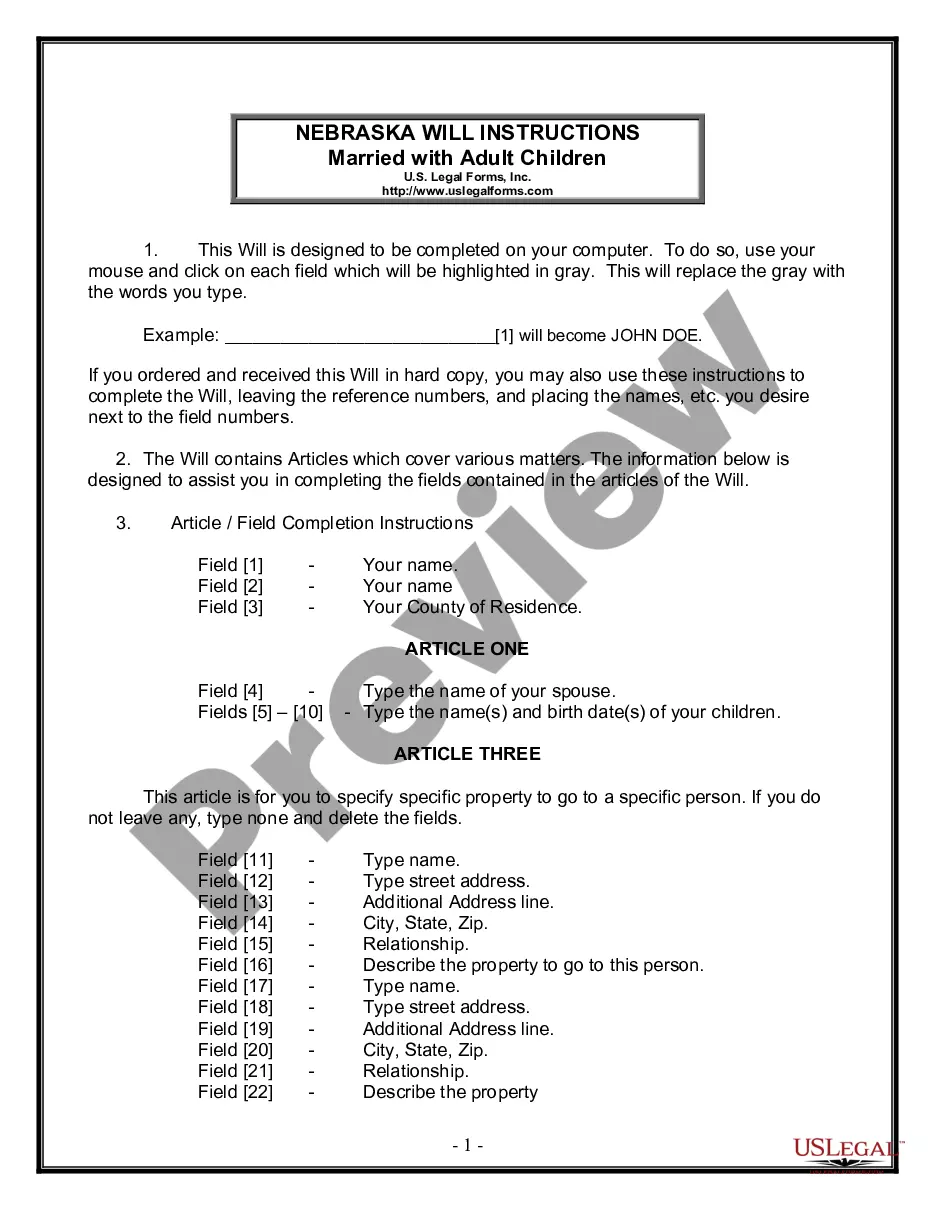

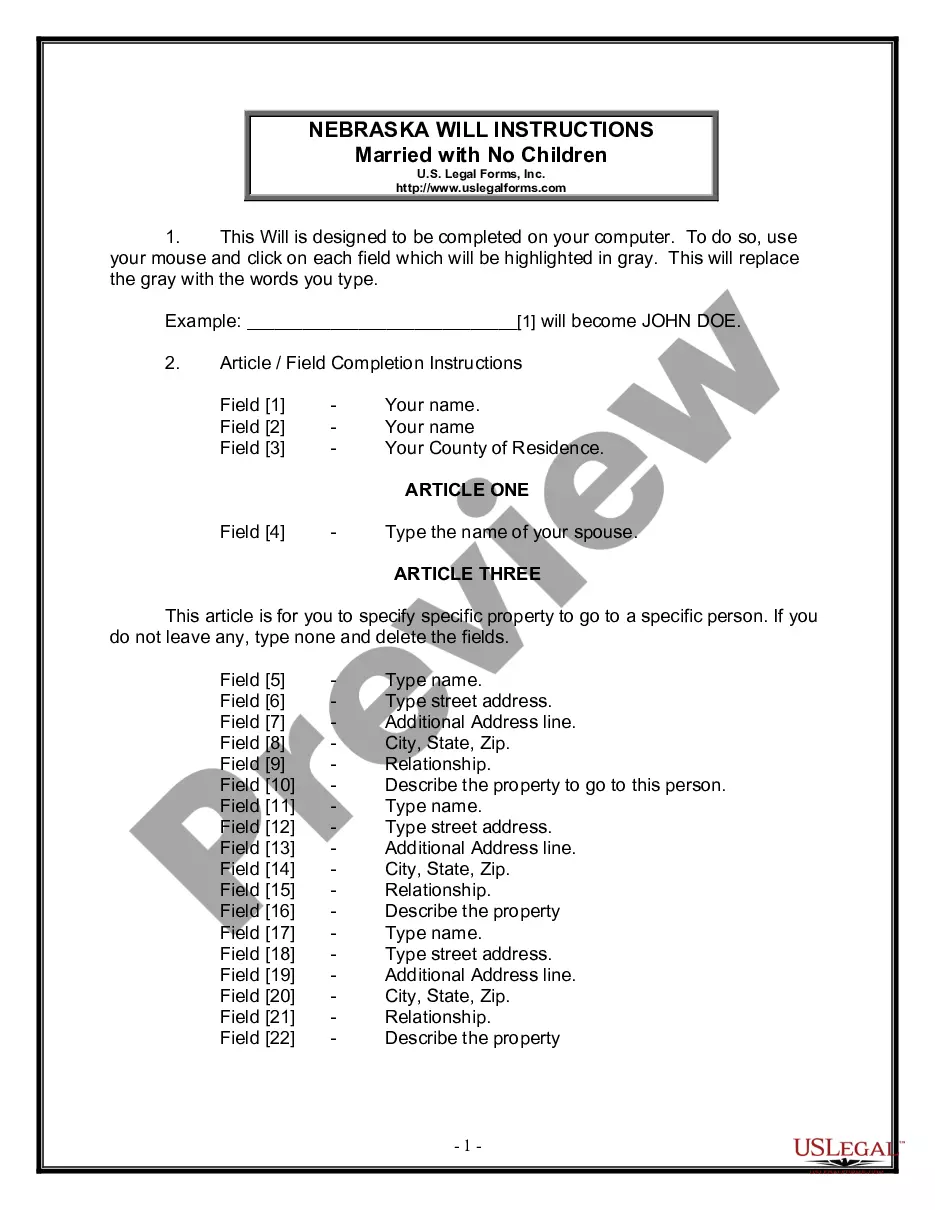

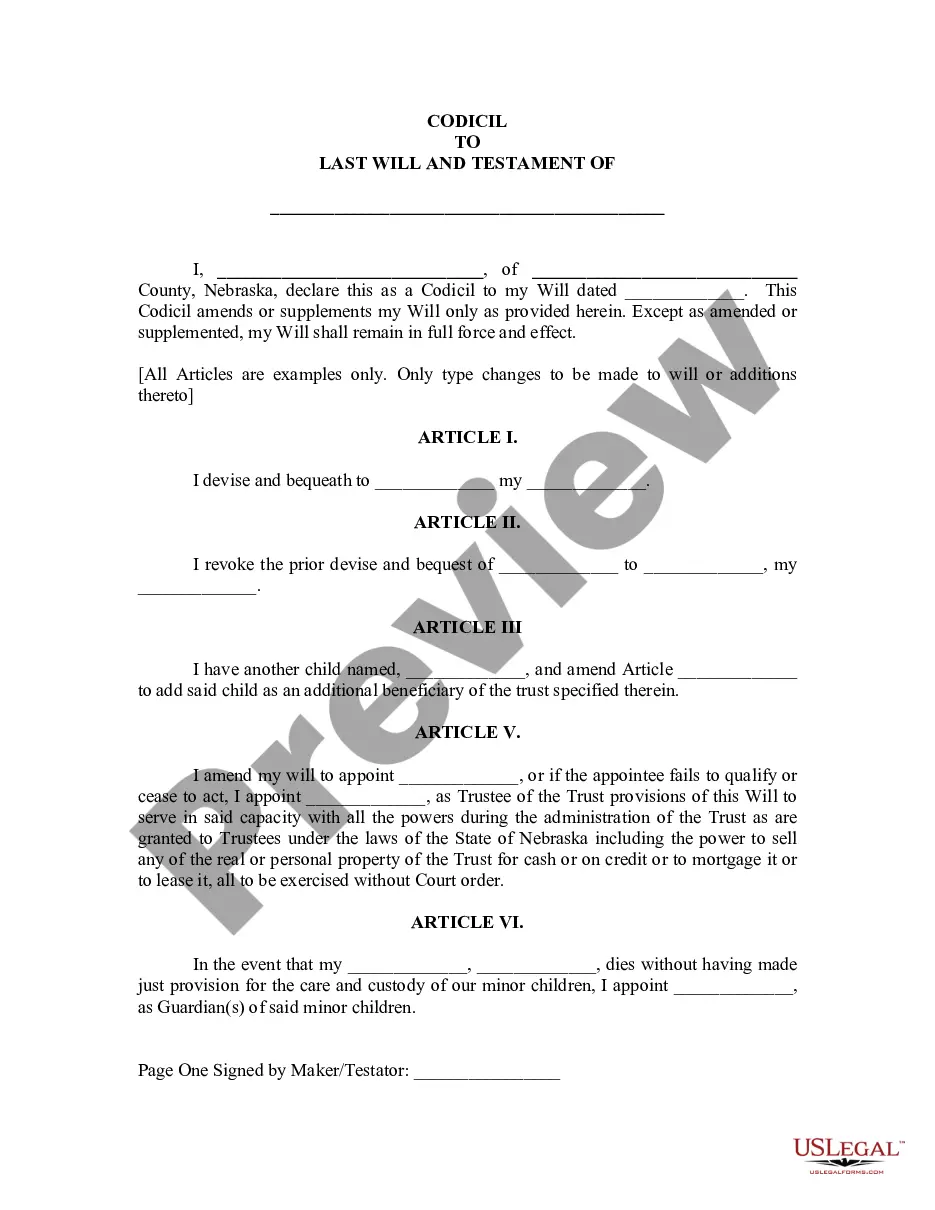

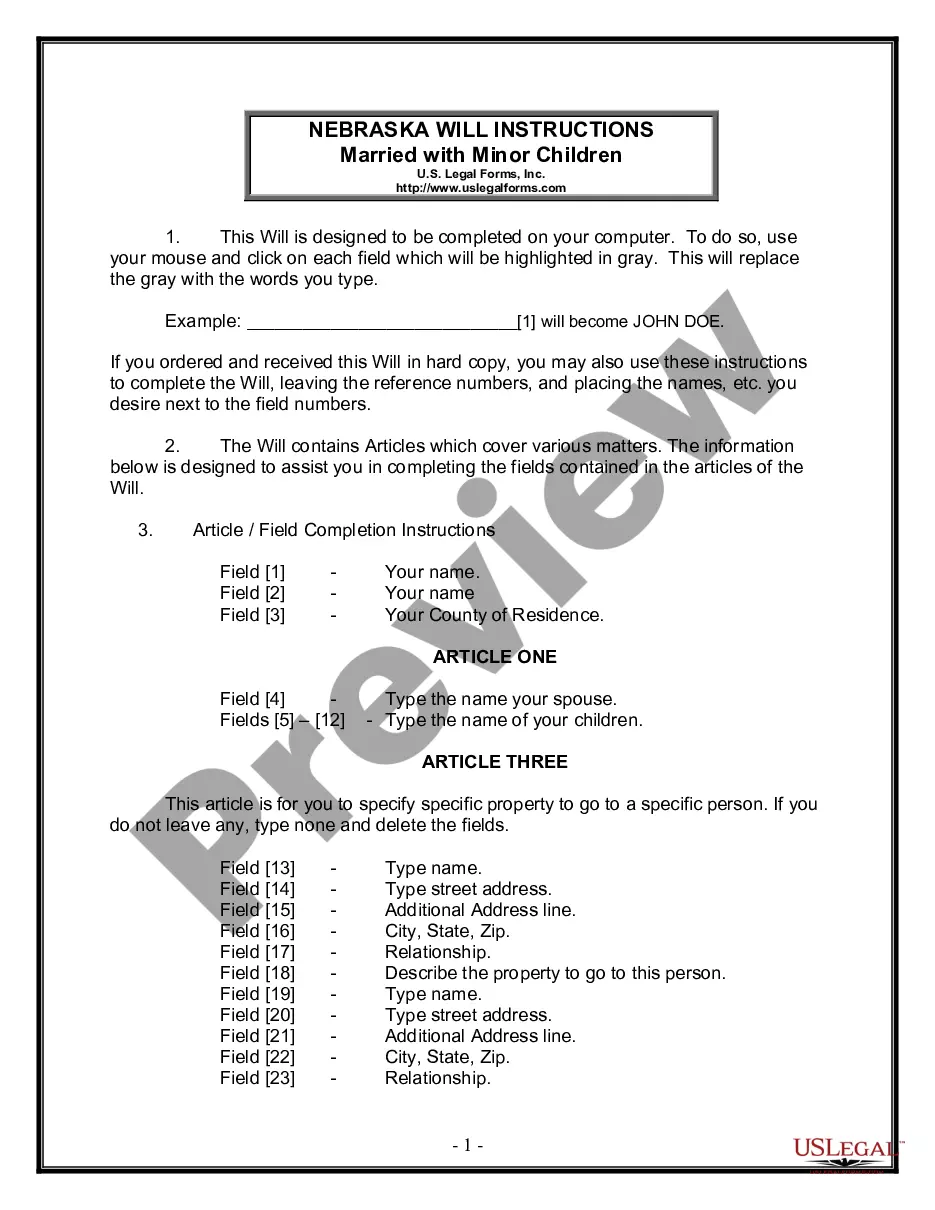

How to fill out Grant Writer Agreement - Self-Employed Independent Contractor?

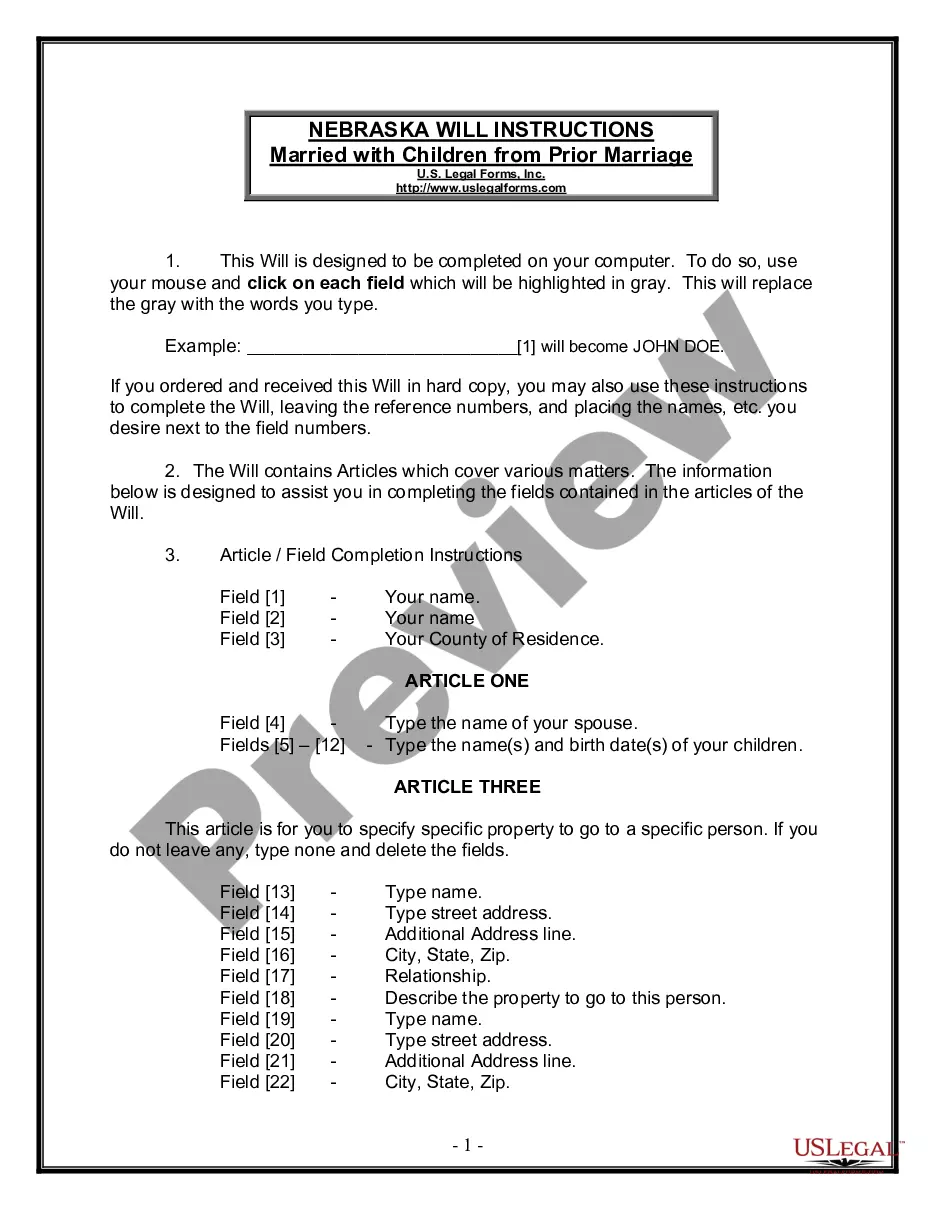

Among numerous paid and free samples which you find online, you can't be sure about their accuracy and reliability. For example, who made them or if they are competent enough to take care of the thing you need these people to. Always keep relaxed and utilize US Legal Forms! Discover Grant Writer Agreement - Self-Employed Independent Contractor samples developed by skilled legal representatives and avoid the costly and time-consuming process of looking for an lawyer and after that having to pay them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all of your earlier acquired examples in the My Forms menu.

If you are making use of our service the first time, follow the tips below to get your Grant Writer Agreement - Self-Employed Independent Contractor easily:

- Make sure that the document you discover is valid in the state where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another example using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you have signed up and paid for your subscription, you can use your Grant Writer Agreement - Self-Employed Independent Contractor as many times as you need or for as long as it remains valid where you live. Edit it in your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.