Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

Key Concepts & Definitions

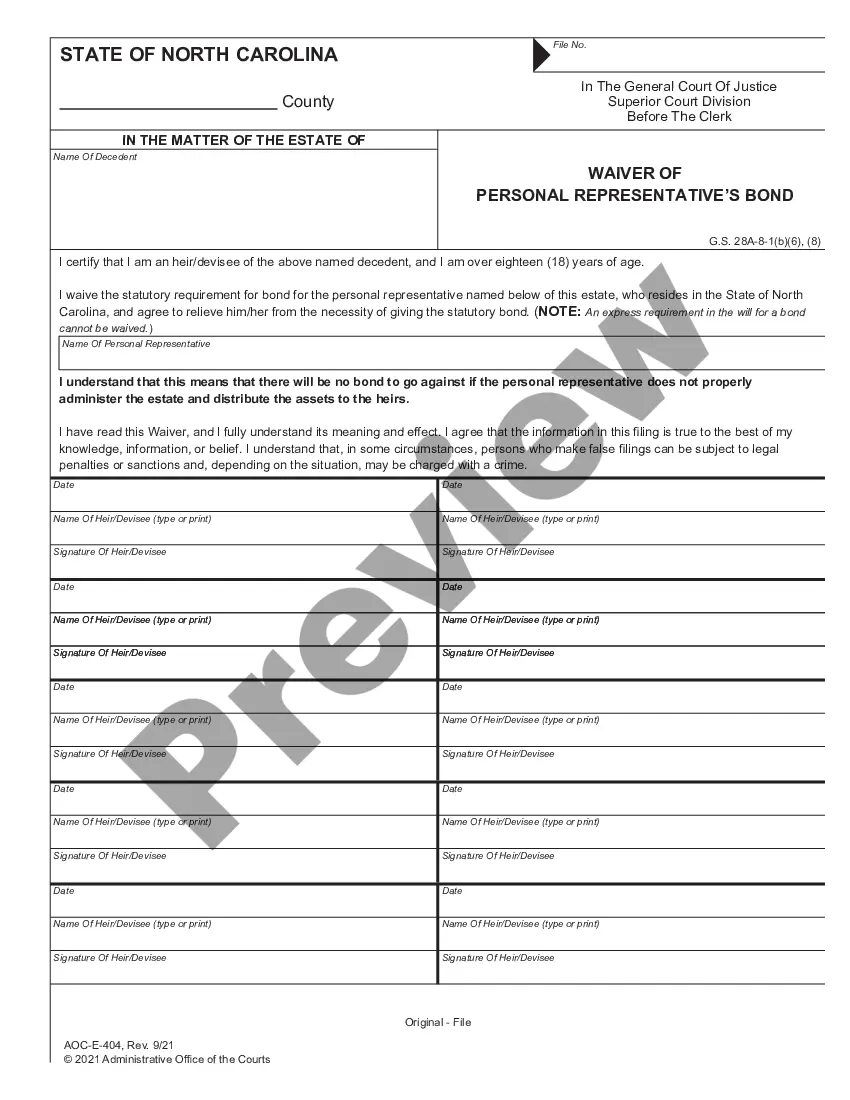

Renunciation and disclaimer of right to refers to the legal act where an individual voluntarily refuses to accept an inheritance, gift, property, or any other legal right. This is often done to avoid legal responsibilities attached to the inherited right or to permit the inheritance to pass to another beneficiary under the law.

Step-by-Step Guide to Renouncing a Right

- Review the Document: Identify the right or property you are entitled to and consider the implications of renouncing it.

- Seek Legal Advice: Consult with a lawyer to understand the legal consequences and necessary documentation.

- Prepare a Disclaimer: Your lawyer will help draft a formal renunciation or disclaimer document, stating clearly the intention to refuse the right.

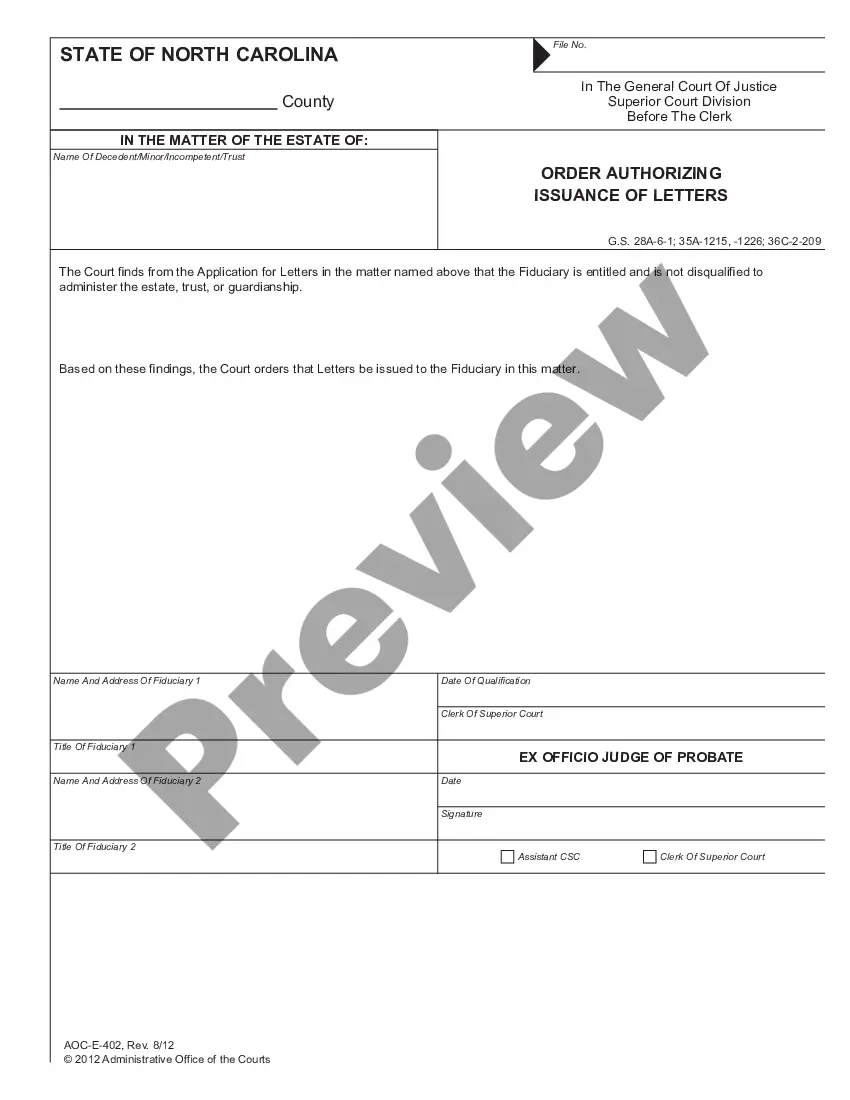

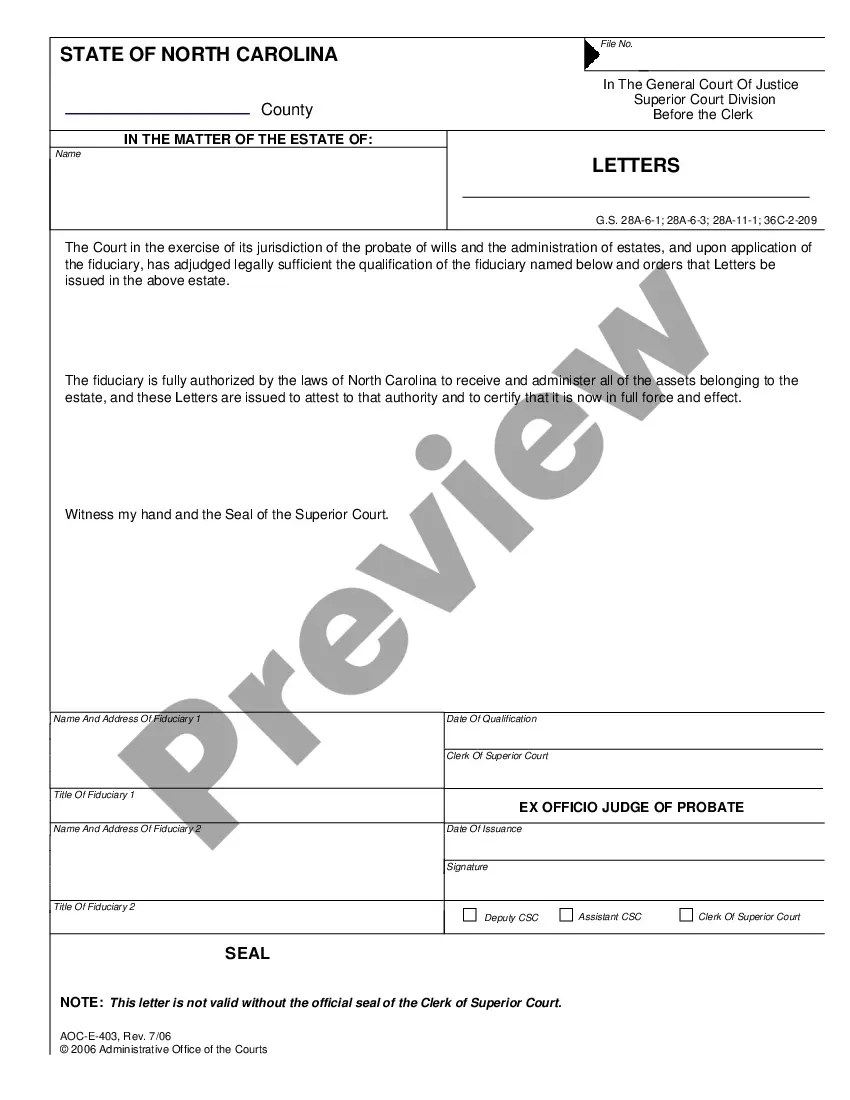

- File the Disclaimer: Submit the signed document to the relevant court or agency, often this is probate court when dealing with inheritances.

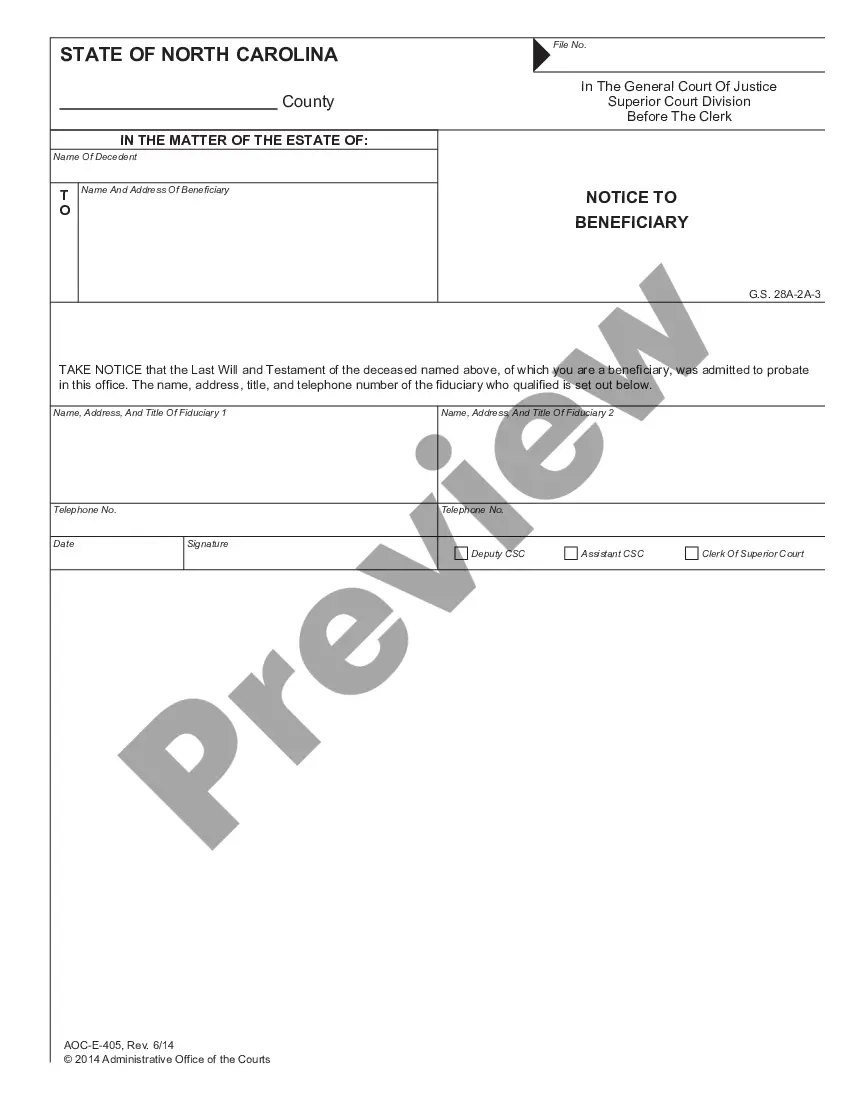

- Notify Interested Parties: Inform all parties involved, such as other heirs or trustees, about your decision.

Risk Analysis of Renouncing Legal Rights

- Financial Impact: Refusal of rights like inheritance could lead to loss of potential financial wealth.

- Tax Consequences: There may be tax advantages or disadvantages which should be carefully evaluated.

- Legal Ramifications: Missteps in the process can lead to unintended legal complications.

Pros & Cons of Disclaimer of Rights

- Pros:

- Avoiding liability from inherited debts or obligations.

- Possibility of passing the right to other beneficiaries more in need.

- Cons:

- Potential loss of valuable assets.

- Irreversible decision once processed.

Common Mistakes & How to Avoid Them

- Delay in Filing: Failing to file the disclaimer in a timely manner can result in the accidental acceptance of the right. It's essential to act within the legal time frame, usually within nine months to one year.

- Inadequate Documentation: Not having the disclaimer properly drafted or witnessed can invalidate the renunciation.

Case Studies / Real-World Applications

Examining past renunciation cases, like individuals renouncing inheritances to avoid taking on the deceased's debts, showcases the practical utility and possible complexities of disclaiming legal rights in the US.

FAQ

- What is a disclaimer of inheritance? It's a legal statement declaring refusal to accept an inheritance.

- Can rights once disclaimed be reclaimed? No, once you disclaim a right, the decision is irreversible and the said right can't be reclaimed by you.

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

When it comes to drafting a legal document, it is better to leave it to the specialists. Nevertheless, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself cannot get a template to utilize, nevertheless. Download Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property fast:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property is downloaded you may fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Definitions of letter of renunciation a form sent with new shares that can be completed and returned as written notification that the person who has been allotted shares resulting from a rights issue refuses to accept them. The shares can then be sold or transferred to someone else.

An individual can step down without stating a reason prior to formal appointment by the court. This is known as renunciation and is a legal document providing the person named in the will is not going to act as executor.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.