Notice to Beneficiary: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Notice to Beneficiary

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

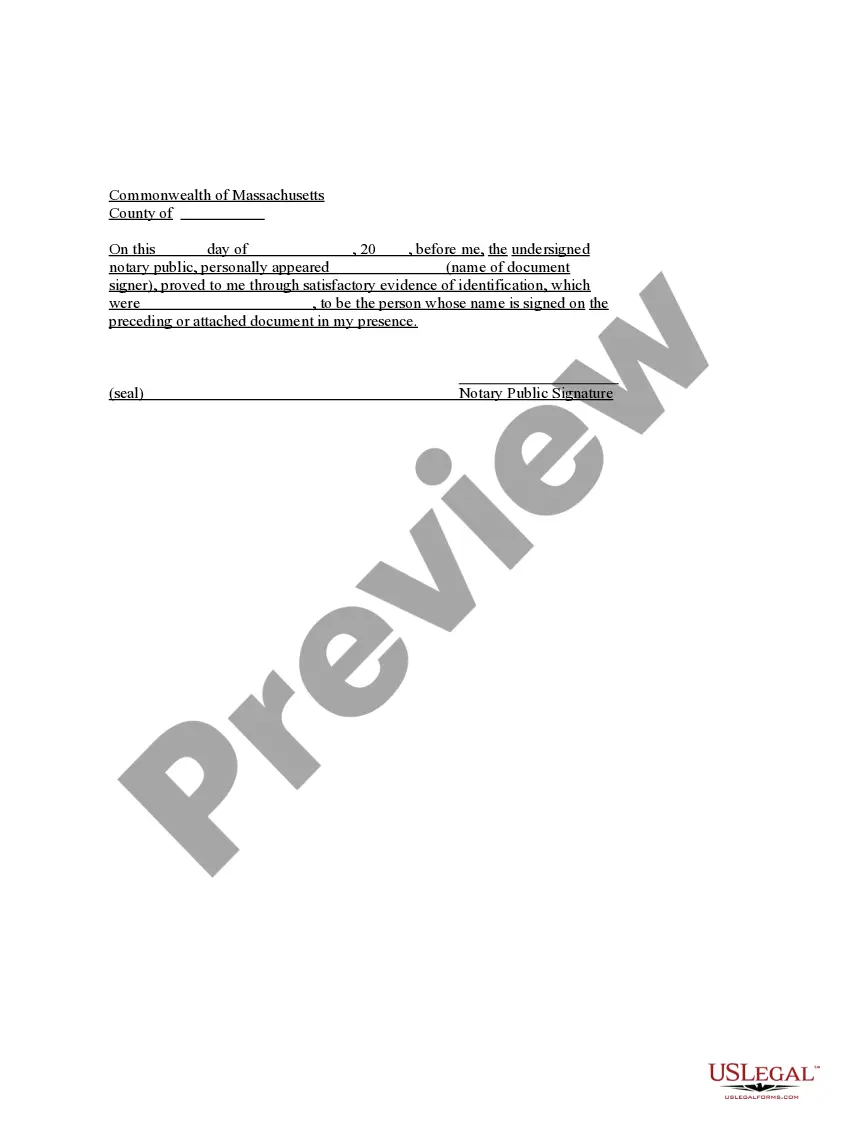

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Notice To Beneficiary?

Steer clear of costly lawyers and locate the North Carolina Notice to Beneficiary you desire at a budget-friendly rate on the US Legal Forms website.

Utilize our straightforward groups feature to search for and obtain legal and tax documents. Review their descriptions and preview them before downloading.

Choose to download the form in PDF or DOCX format. Click on Download and locate your form in the My documents section. You can easily save the template to your device or print it. After downloading, you can fill out the North Carolina Notice to Beneficiary either manually or using editing software. Print it out and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms offers users detailed instructions on how to acquire and fill out each template.

- US Legal Forms members simply need to Log In and download the particular document they require to their My documents section.

- Those who haven't subscribed yet should adhere to the following steps.

- Verify that the North Carolina Notice to Beneficiary is permissible for use in your location.

- If applicable, read the description and utilize the Preview feature before downloading the document.

- If you are confident that the document meets your needs, click on Buy Now.

- If the form is incorrect, use the search function to find the appropriate one.

- Subsequently, create your account and choose a subscription plan.

- Make payment via credit card or PayPal.

Form popularity

FAQ

Several states require you to send a notice to all trust beneficiaries within a certain time after you take over as successor trustee of the trust. Most states give you 30 or 60 days to send this initial notice.

A will remains a private document until probate is granted. Once the probate court declares the will as valid, beneficiaries must be notified within three months, though ideally, notification will much sooner.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

A trustee is required by law to notify beneficiaries of a trust upon the settlor's death. The settlor is the person who created the trust. The trustee has 60 days from the settlor's death to provide the notification to the beneficiaries.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.