Some cross-purchase agreements use a dollar amount to calculate the buy-out price, while others use a formula. A valuation of the interest that is the subject of the agreement should be made periodically.

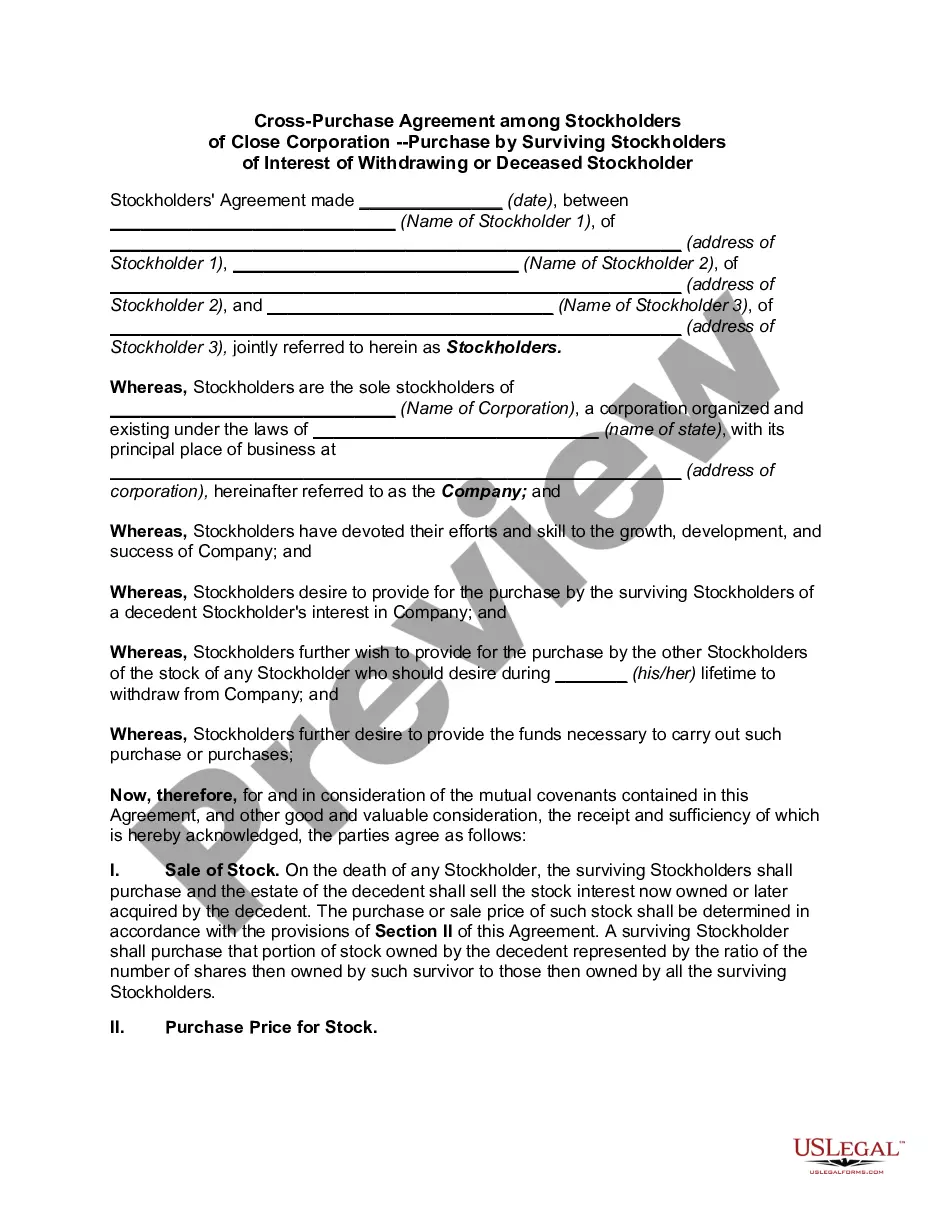

A Corporate Cross Purchase Agreement is a legal agreement between two or more entities, typically shareholders or business partners, to buy out the shares of a deceased party. In the event of death or disability, the surviving parties agree to take on the shares of the deceased, ensuring the ongoing success of the business. There are two primary types of Corporate Cross Purchase Agreements: Internal and External. Internal Cross Purchase Agreements are between two or more shareholders of the same company, while External Cross Purchase Agreements involve multiple companies. Both agreements are designed to provide financial security and continuity to the business in the event of death or disability. Additionally, these agreements help to ensure that the deceased's shares are passed on to the right person or persons.