Sample Letter for Notification to Creditor to Probate and Register Claim

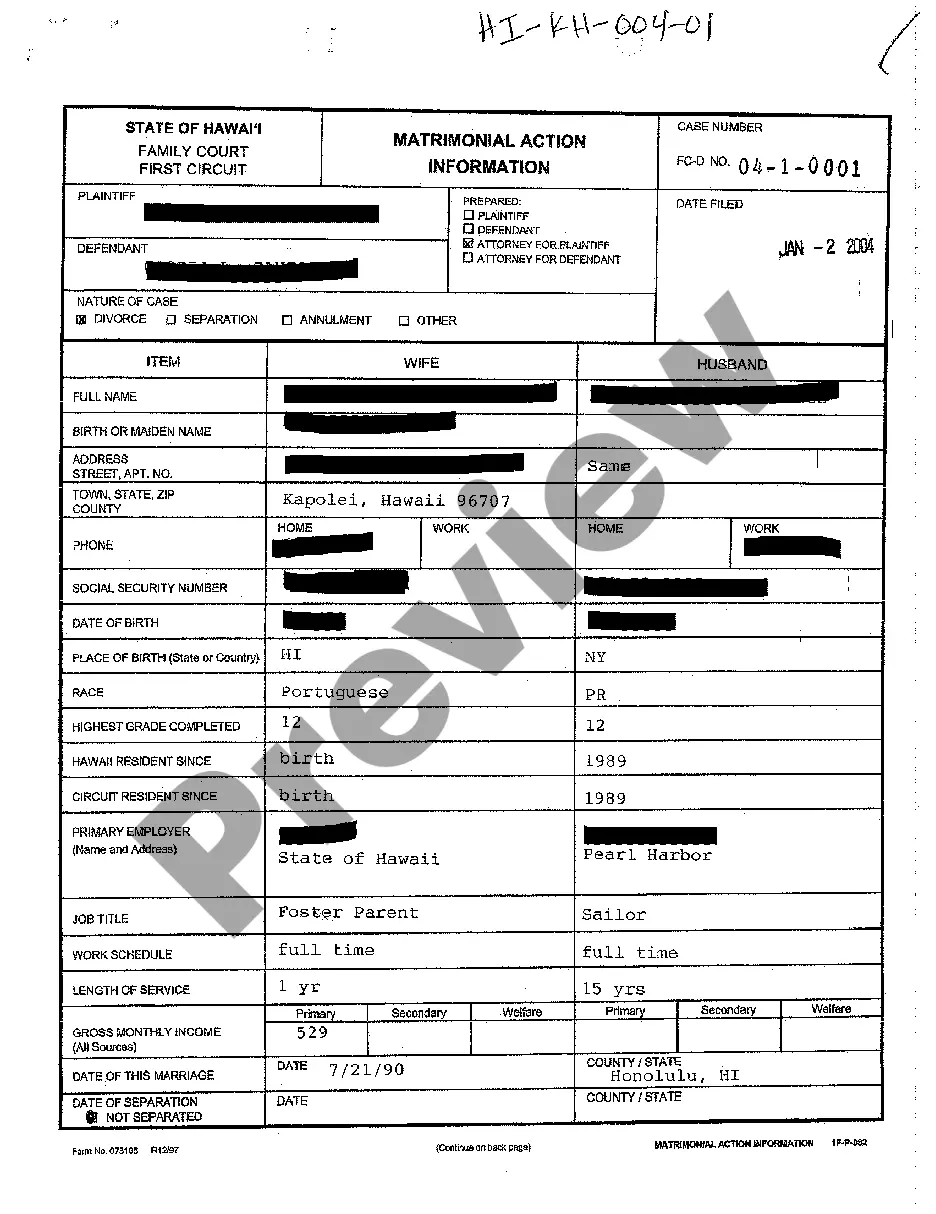

Overview of this form

This form is a sample letter designed to notify a creditor of the obligation to probate and register their claim against an estate. It serves to inform creditors that they must submit their claims within a specified time frame to avoid losing their rights to the claim. This is particularly important in estate management, as it helps ensure all debts are accounted for before the distribution of assets.

Key components of this form

- Date of the notification.

- Recipient's name and address.

- Account number for reference.

- Executor's name and details of the estate.

- Legal notice regarding the time frame for claim submission.

When to use this form

Who needs this form

- Executors of an estate.

- Representatives managing the deceasedâs debts.

- Administrators appointed by the court to oversee the probate process.

How to prepare this document

- Fill in the current date at the top of the letter.

- Provide the full name and address of the creditor.

- Enter the relevant account number for the creditor's records.

- Specify the names and details of the estate and the executor.

- State the legal deadline for submitting the claim to the designated court.

- Sign the letter as the executor of the estate.

Notarization requirements for this form

This form does not typically require notarization unless specified by local law. It is important to check state regulations to ensure that all legal requirements are met.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the date of the letter.

- Not providing complete details of the creditor's address.

- Omitting the specific deadline for claim submission.

- Misidentifying the probate court or executor's information.

Advantages of online completion

- Convenient download for immediate use.

- Edit and customize the letter easily to suit specific needs.

- Professionally drafted to ensure legal compliance.

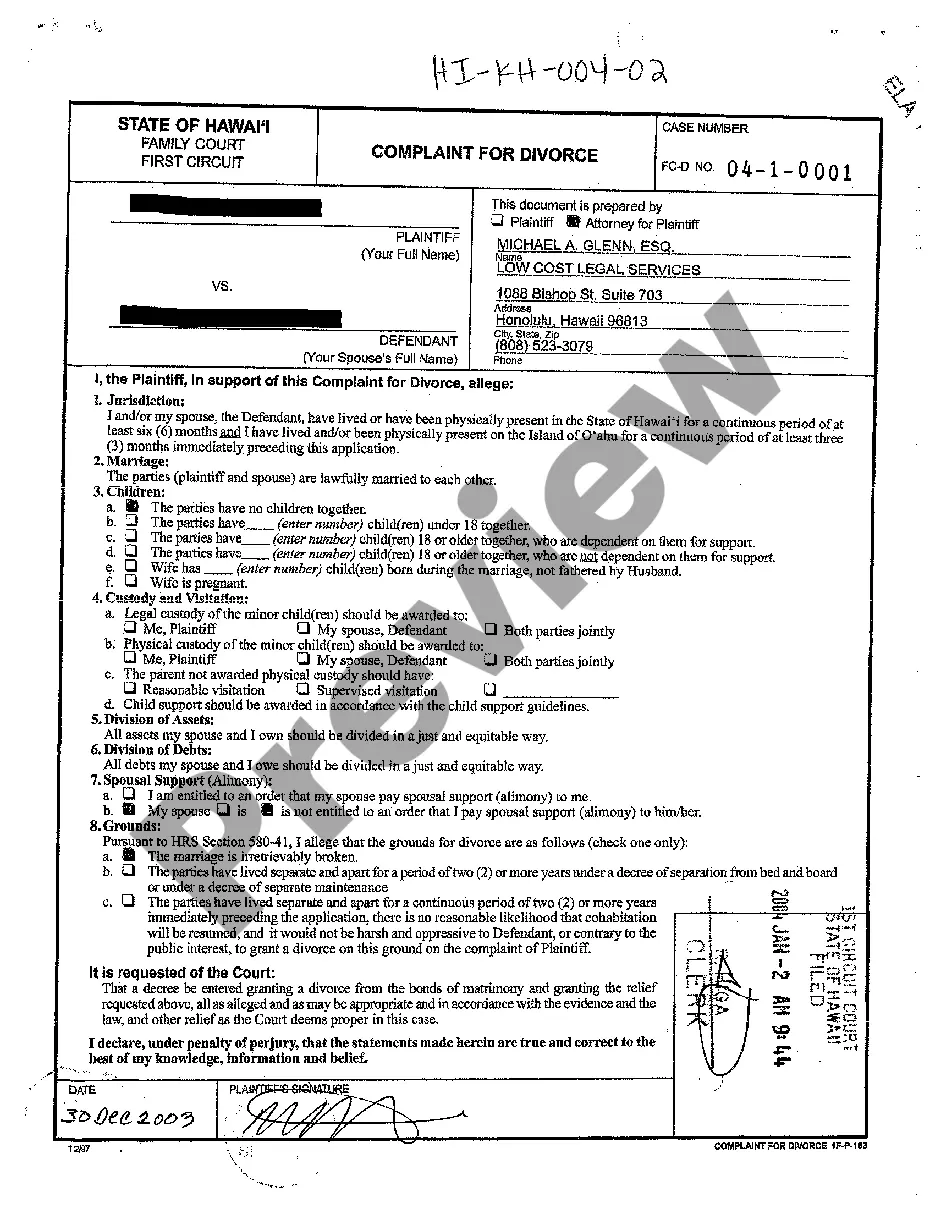

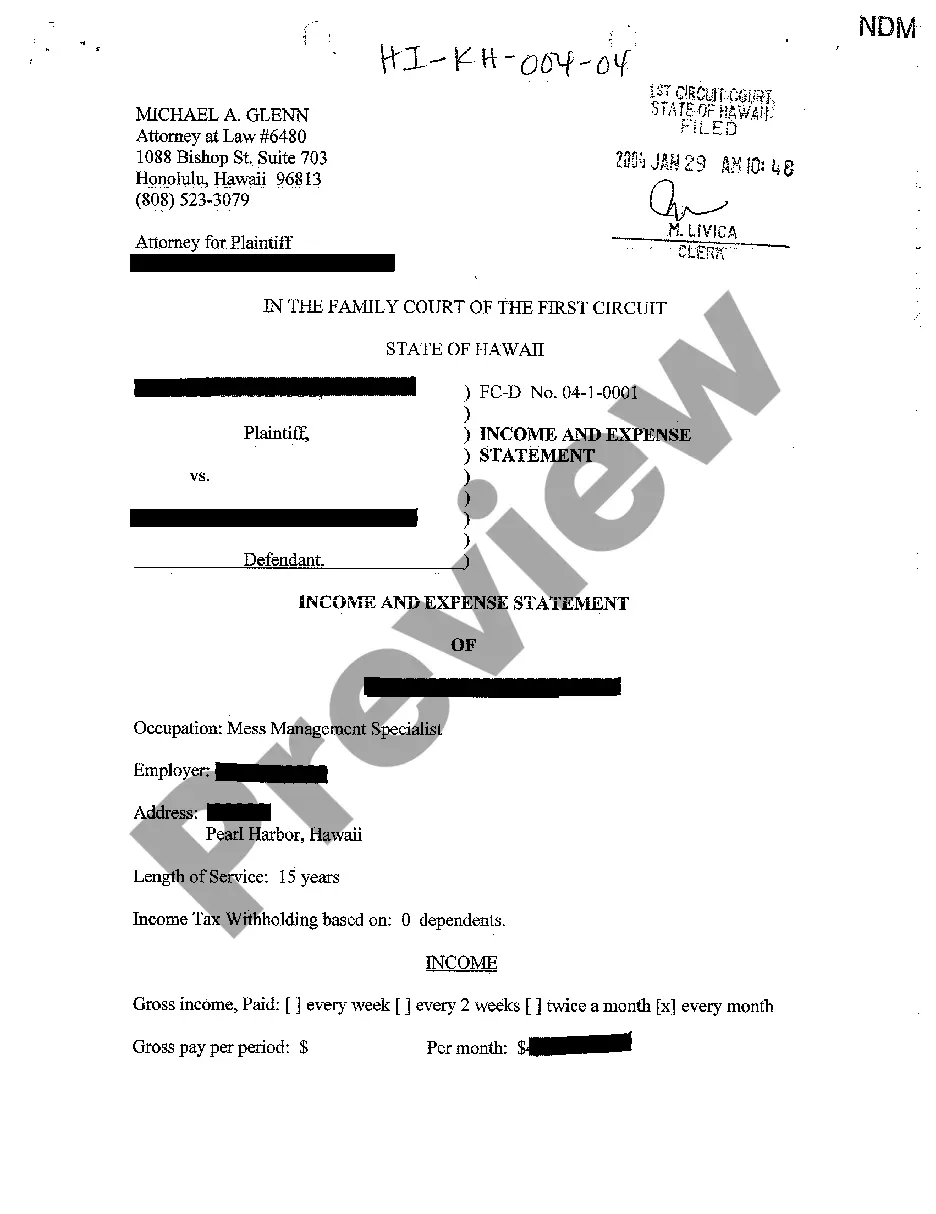

Legal use & context

- This letter serves as a formal notice to creditors regarding their claims against an estate.

- It plays a crucial role in the probate process, helping to ensure that creditors are informed and able to take action within the legal timeframe.

- Failure to properly notify creditors may result in complications during probate and could impact the distribution of the estate.

Summary of main points

- The Sample Letter for Notification to Creditor to Probate and Register Claim is essential for informing creditors of their rights.

- Creditors must act within a specified timeframe to register their claims successfully.

- Using a standardized form ensures clarity and compliance with legal norms.

Looking for another form?

Form popularity

FAQ

What Is The Statute Of Limitations To File A Claim Against A Decedent? One year. Upon a person's death, California Code of Civil Procedure section 366.2 provides for an outside time limit of one year for filing any type of claim against a decedent.

Timespan for Creditors to Make Claim For unsecured debts, the time limit ranges from 3-6 months in most states. State laws require executors to post notice of the death, either in a newspaper or directly to known creditors to give them a chance to file a claim. No claims are accepted after the time frame has expired.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

Mail the letter first class. You should send the letter first class, return receipt requested. The receipt will serve as proof that the creditor received the letter. Be sure to attach any supporting documentation, such as a copy of your credit report.

Dear {Name}, This letter is to inform you that {Name} has passed away and to request that a formal death notice be added to {his/her} file in your accounts. {Name}'s full name was {Full Name}. At the time of death, {his/her} residence was {Address}, {City} in {County} County, {State}.

If you or your loved one has completed a beneficiary form for each account such as your life insurance policy and 401(k) unsecured creditors typically cannot collect any money from those sources of funds.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.