Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

Use the most complete legal catalogue of forms. US Legal Forms is the best platform for finding updated Joint Trust with Income Payable to Trustors During Joint Lives templates. Our service offers 1000s of legal documents drafted by licensed attorneys and sorted by state.

To get a template from US Legal Forms, users just need to sign up for an account first. If you are already registered on our service, log in and select the template you are looking for and purchase it. After buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your requirements.

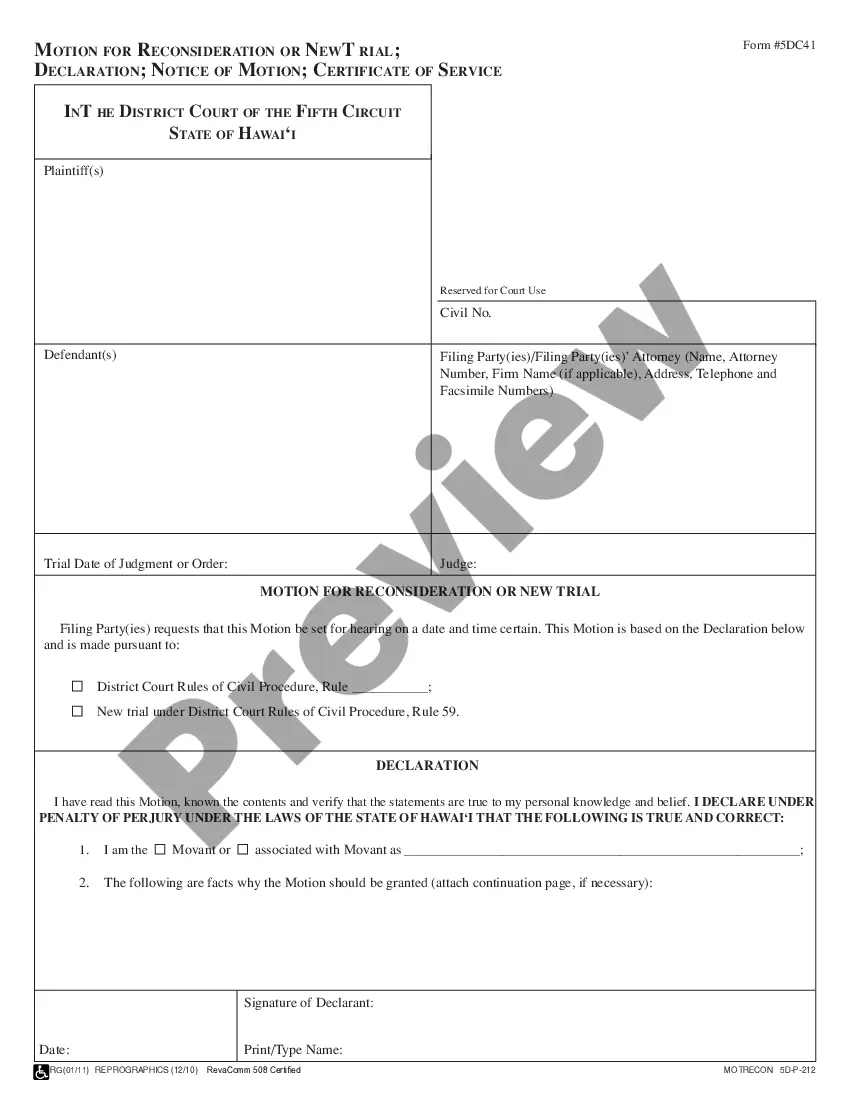

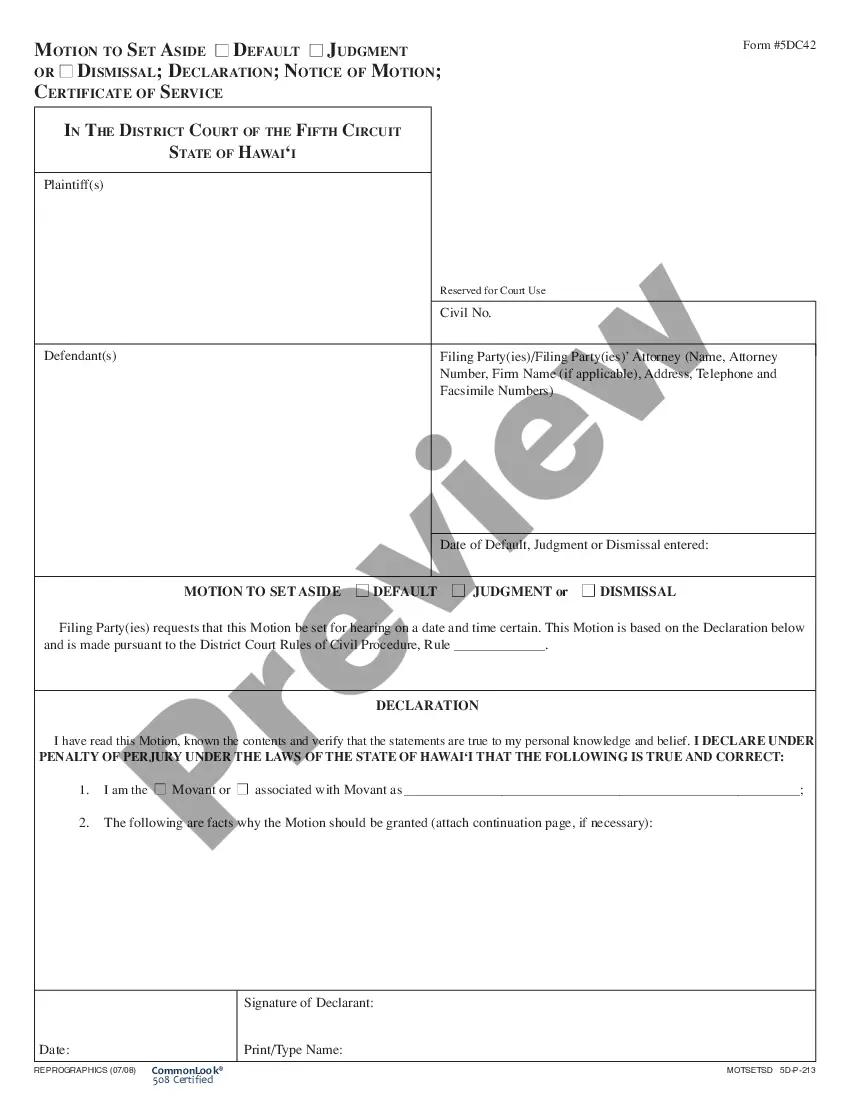

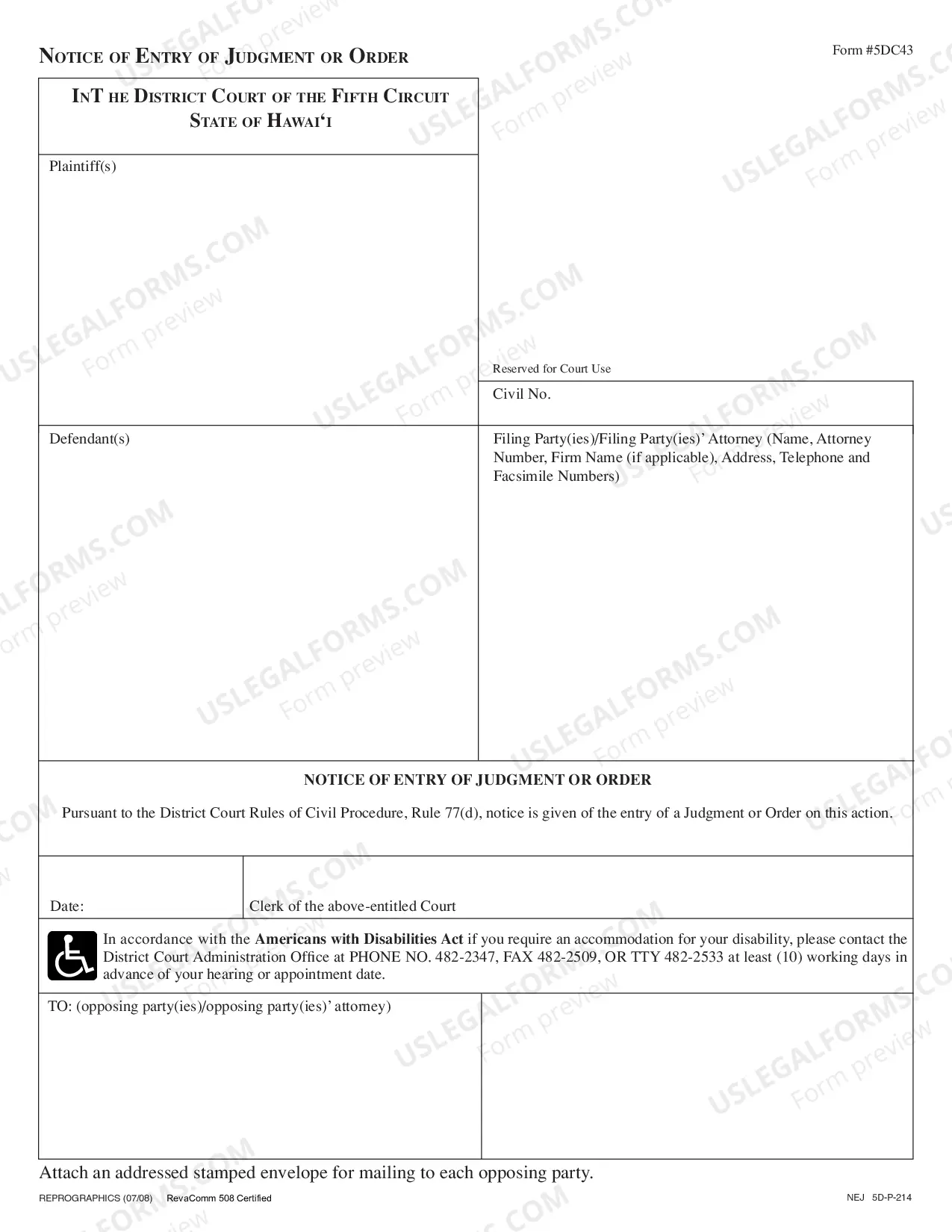

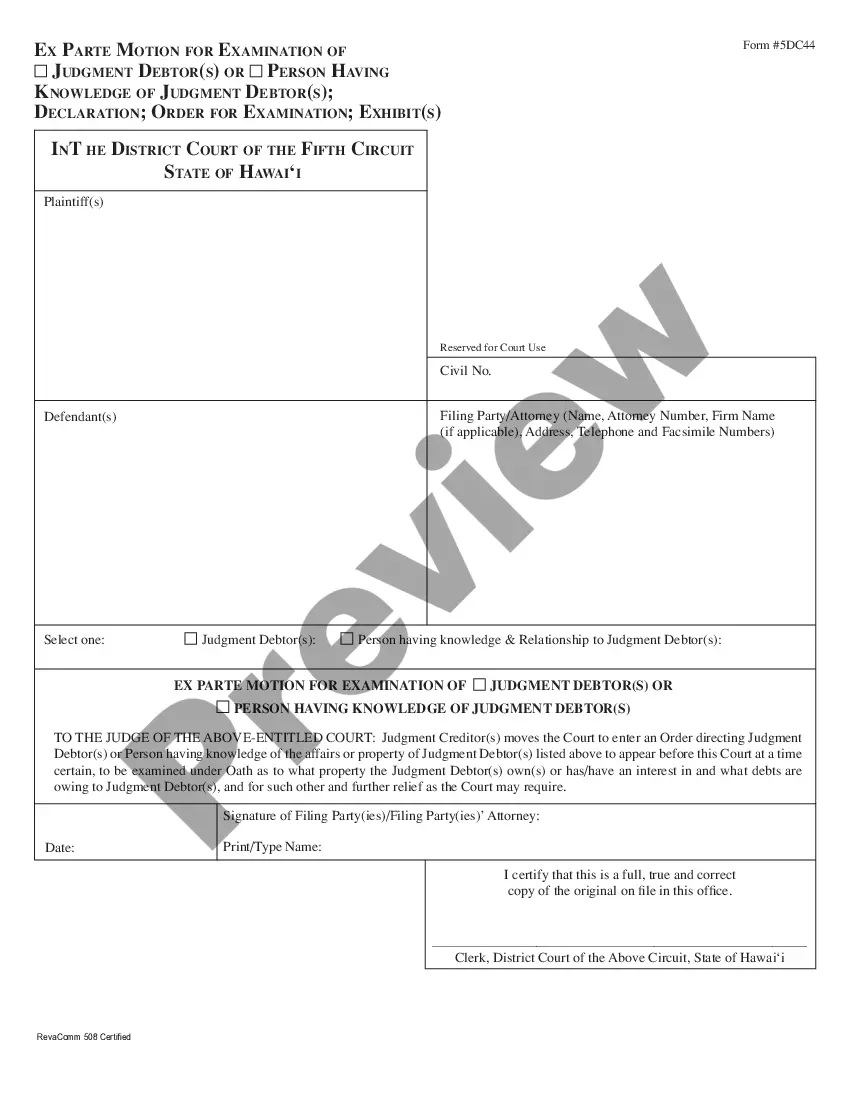

- In case the template features a Preview function, use it to check the sample.

- If the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr debit/bank card.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and fill out the Form name. Join a huge number of satisfied customers who’re already using US Legal Forms!

Form popularity

FAQ

Single and Joint Revocable Living Trusts Trusts can be both single and joint.Joint trusts are particularly useful in community property states, such as Arizona, California, Nevada, Idaho, New Mexico, Louisiana, Texas, Washington, and Wisconsin.

If the Trust list you both as Co-Trustees, both signature are required. Make sure you have the right, as specified in the Trust Agreement, to sell the real property. Equally important, is the party entitled to the proceeds.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.