Prenuptial Property Agreement

Definition and meaning

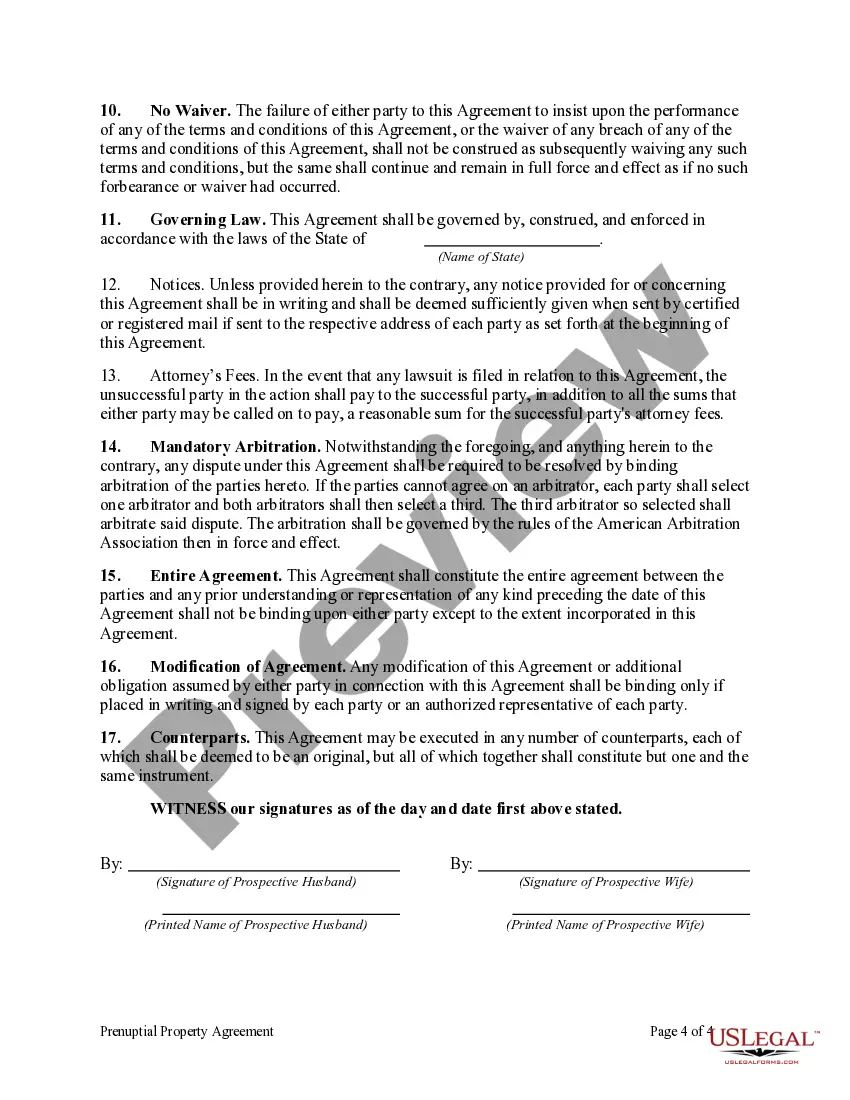

A Prenuptial Property Agreement is a legal document created by two parties prior to their marriage, detailing the ownership and division of property in the event of a divorce or separation. This agreement allows both partners to outline their respective rights to their individual properties, ensuring clarity and legal protection for both parties.

Who should use this form

A Prenuptial Property Agreement is suitable for individuals entering a marriage who want to protect their assets. This can include those with substantial personal or real estate, individuals with children from previous relationships, or parties who wish to clarify financial responsibilities after marriage.

Key components of the form

This agreement typically includes sections on:

- Intent of Parties: Clarifying the purpose of the agreement and property rights.

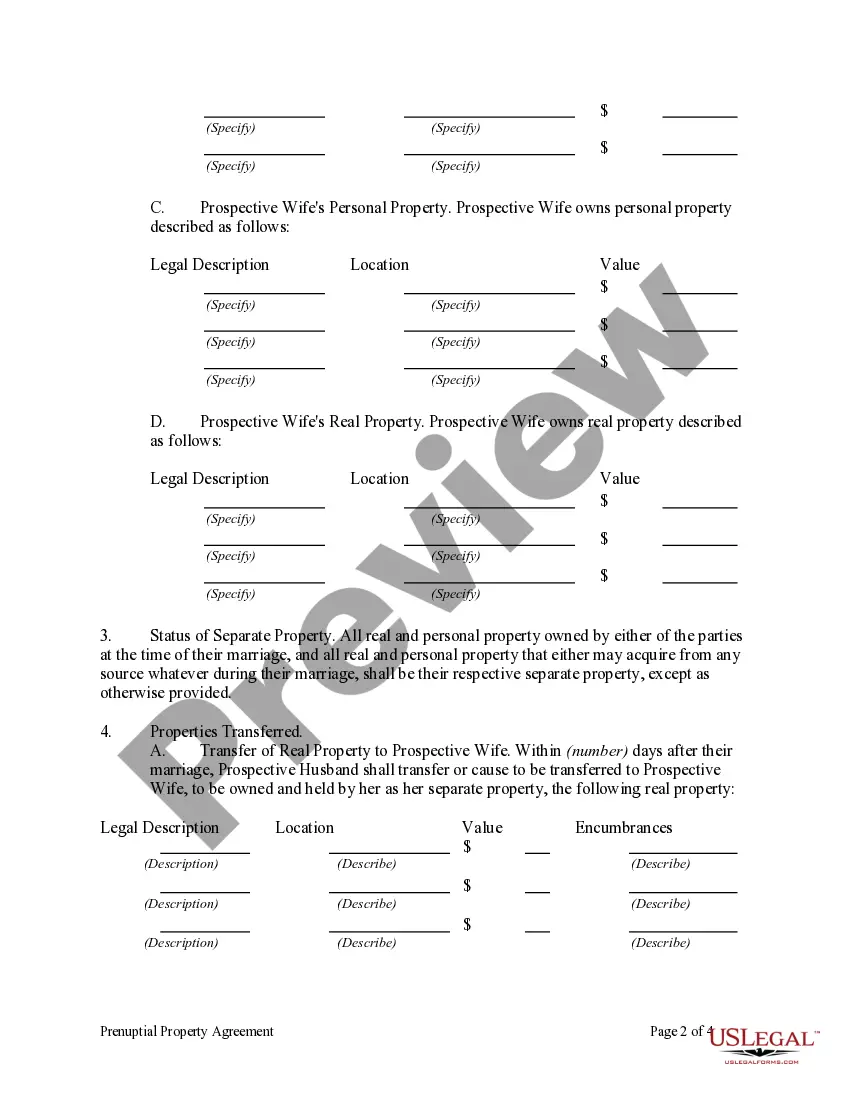

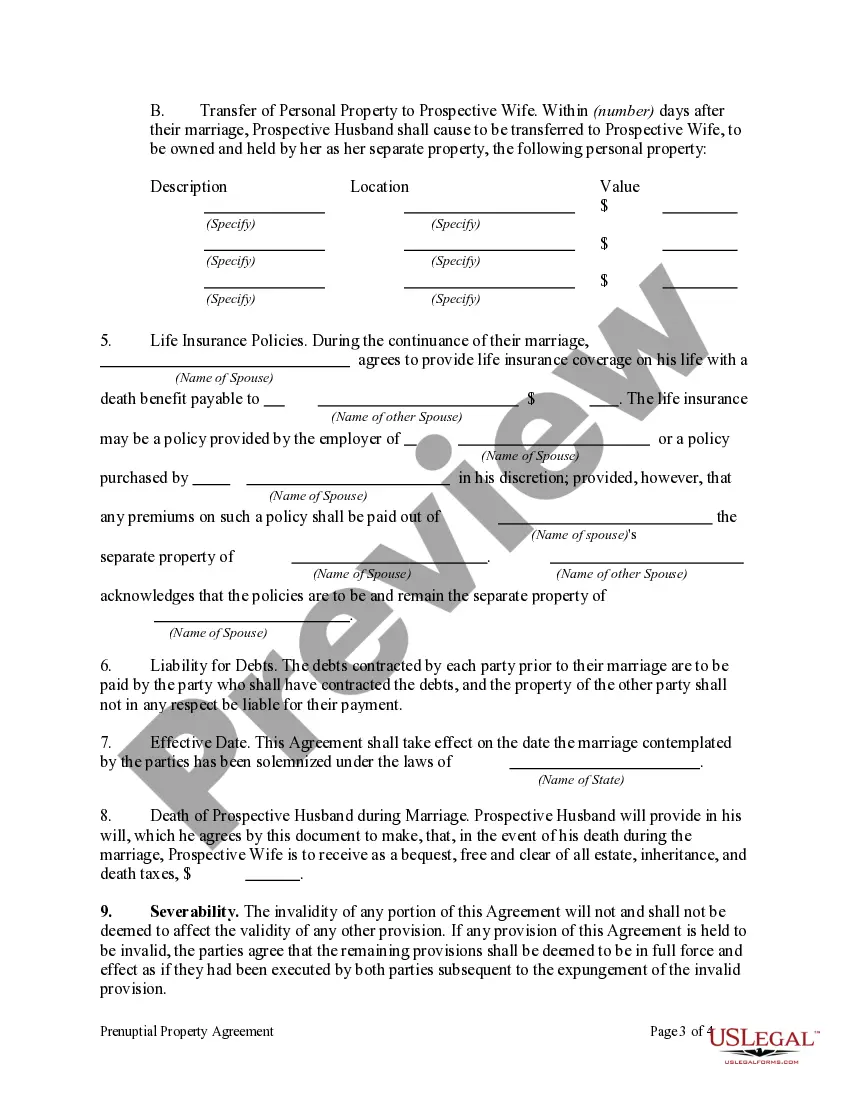

- Separate Property: Detailing what will be considered separate property owned by each party.

- Transfer of Property: Specifications regarding the transfer of assets post-marriage.

- Debts and Liabilities: Outlining responsibility for pre-marital debts.

These components collectively aim to protect individual properties and clarify the financial arrangements agreed upon by both parties.

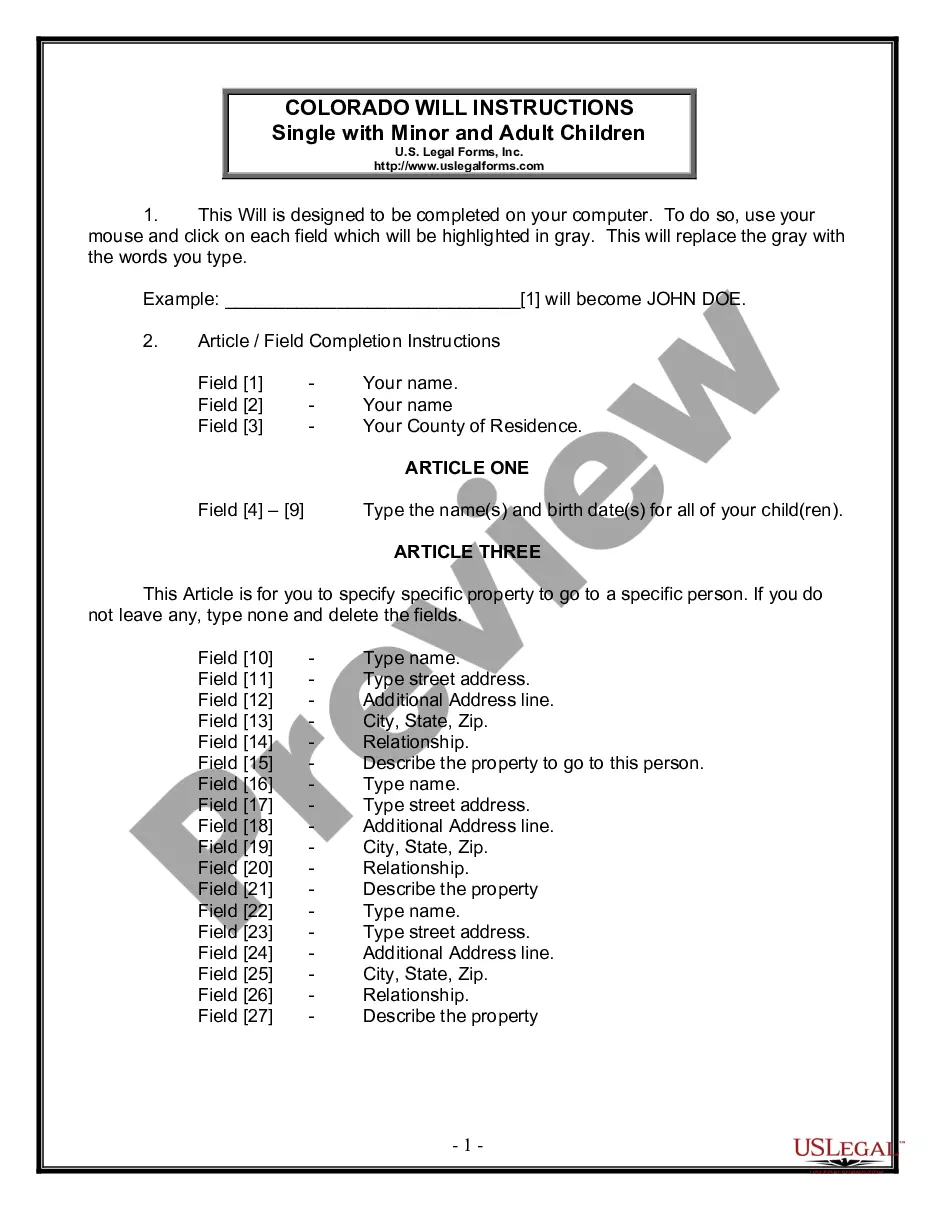

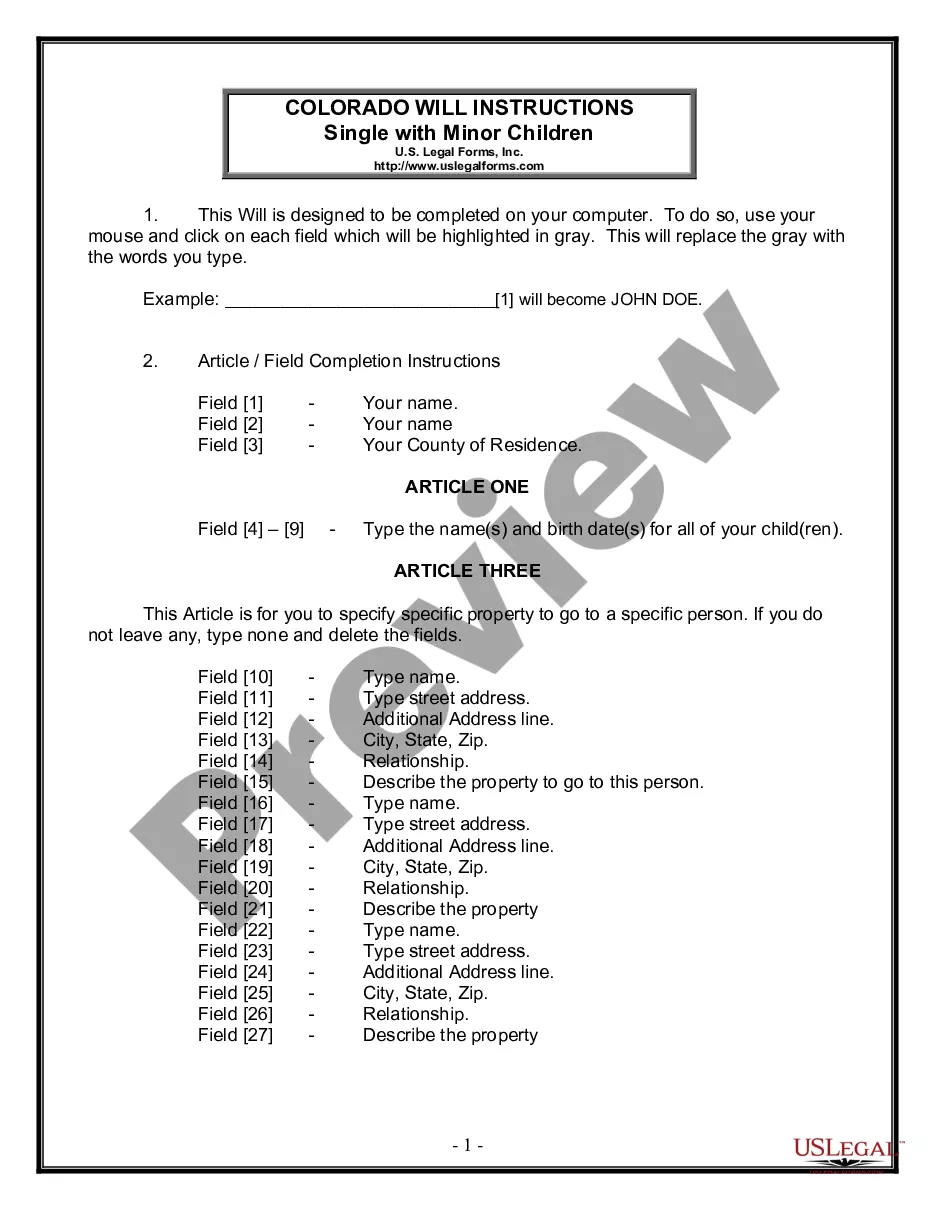

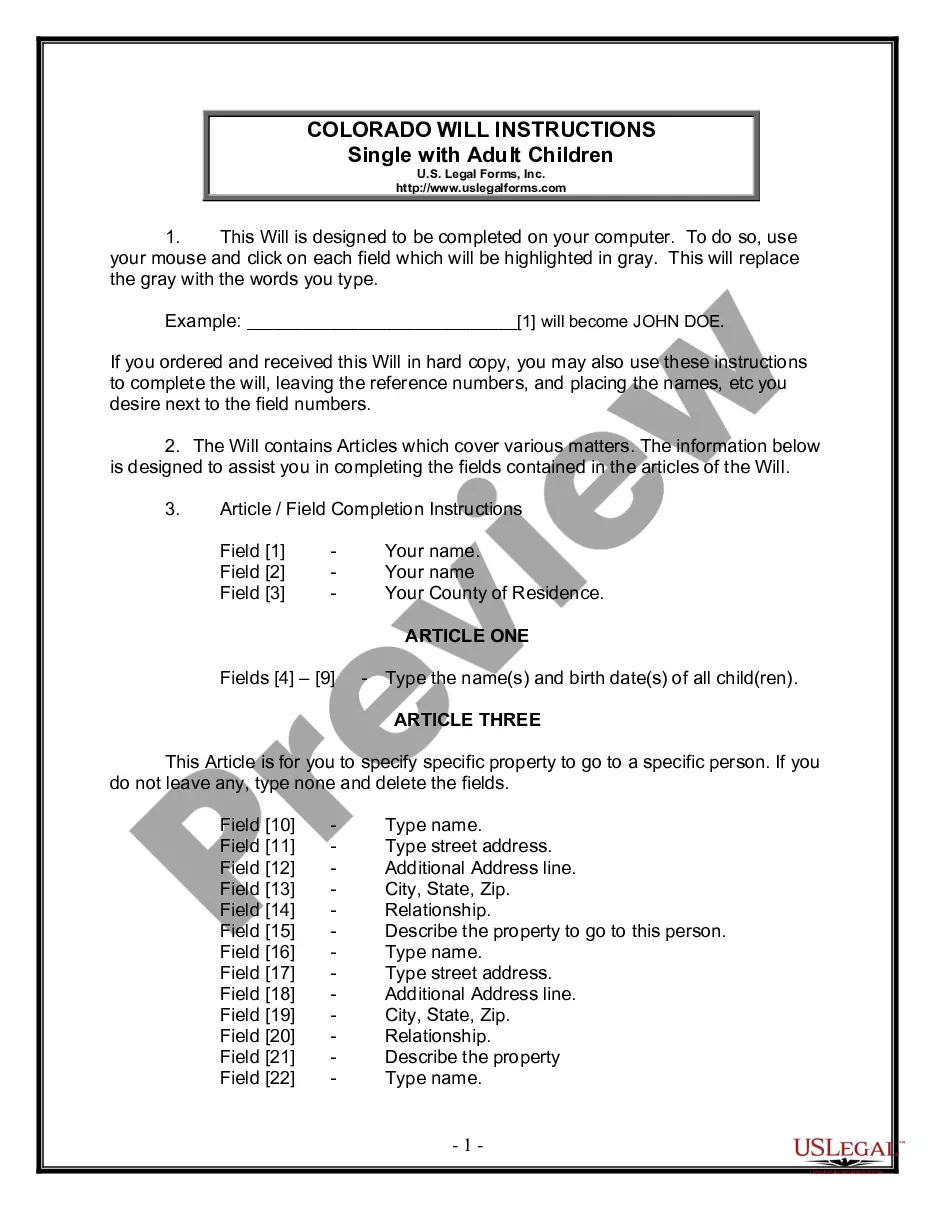

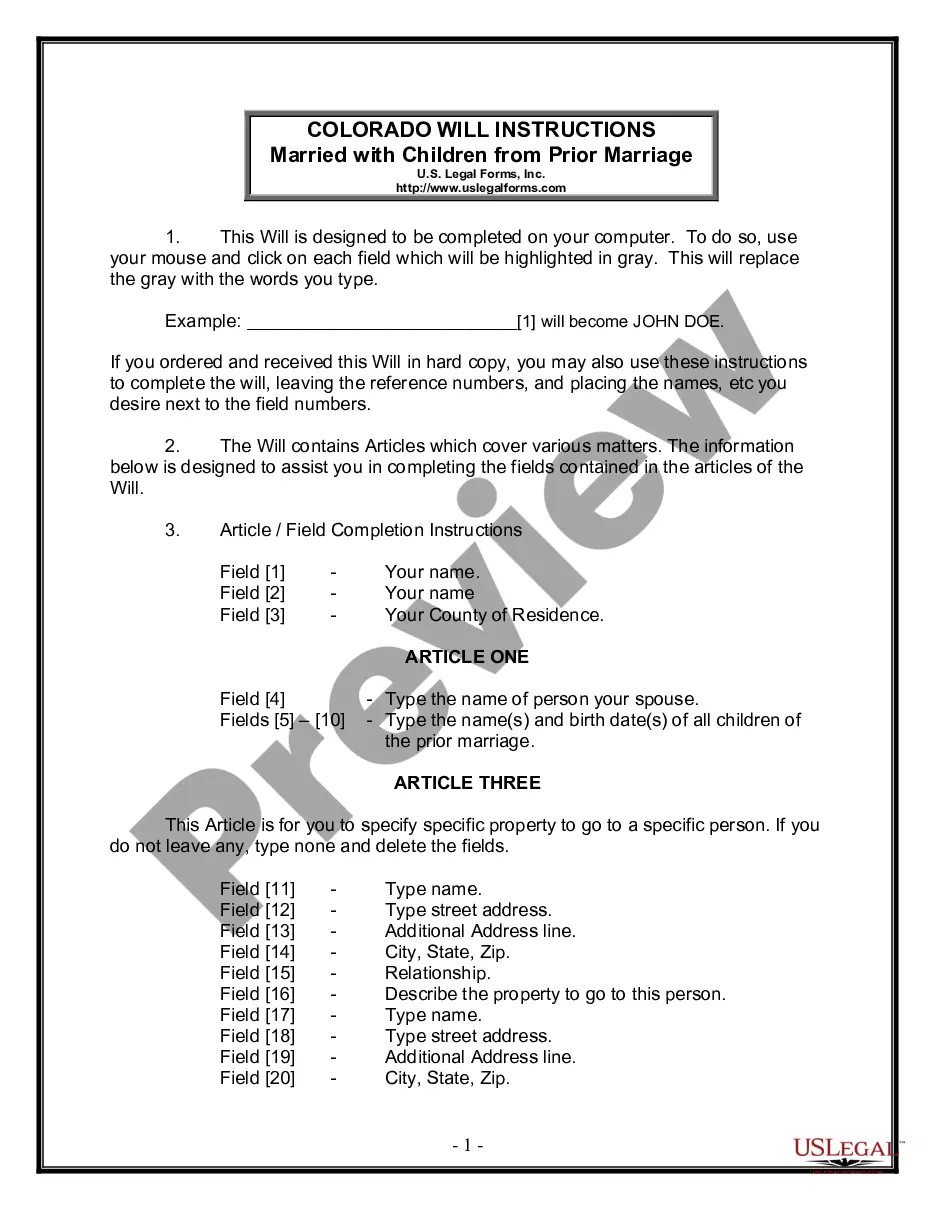

How to complete a form

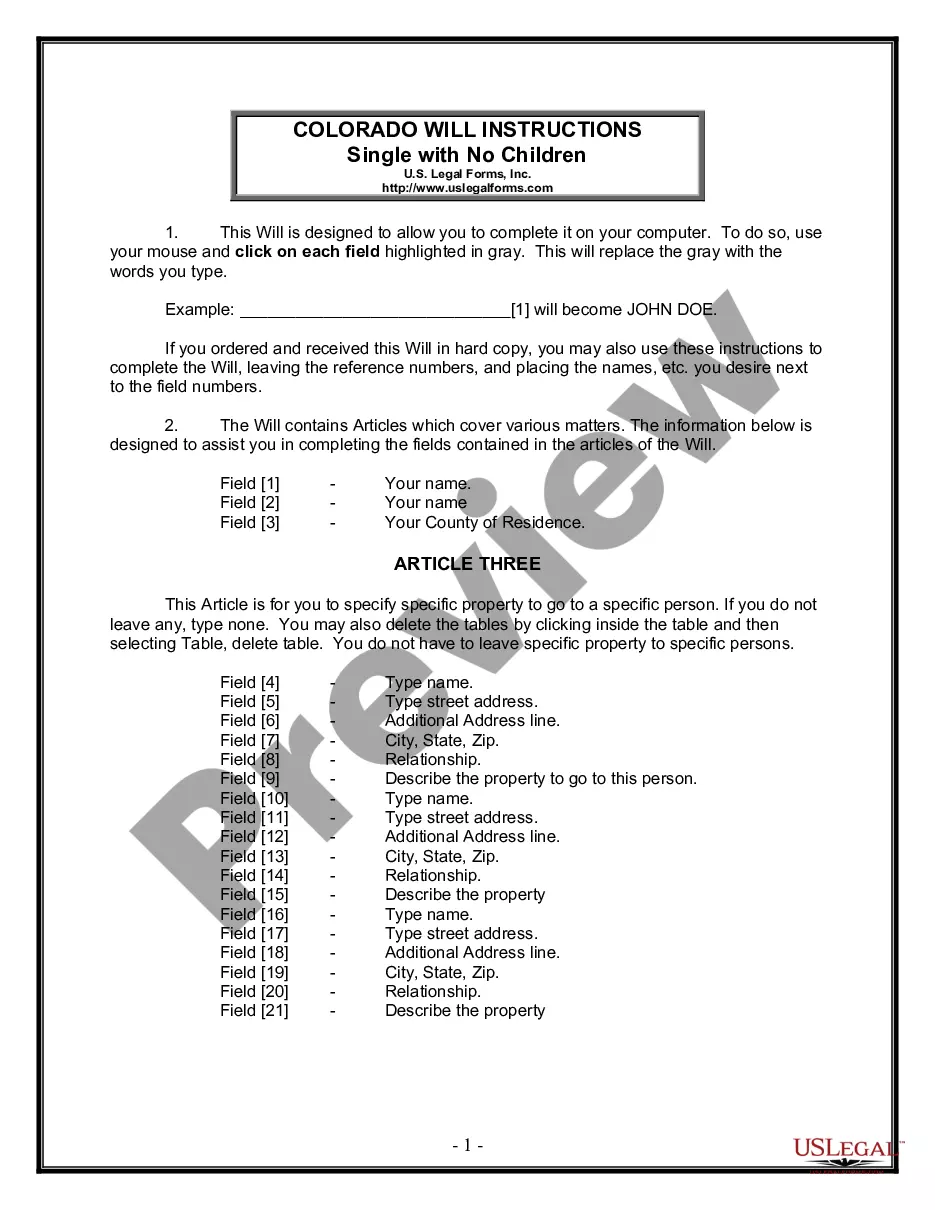

To complete a Prenuptial Property Agreement, follow these steps:

- Gather Information: Both parties should compile a list of their assets, debts, and properties.

- Discuss Terms: Engage in open discussions about what you both wish to include in the agreement.

- Fill Out the Form: Complete the form, ensuring all necessary details are included.

- Review with Legal Counsel: It is advisable to have each party consult with an attorney to ensure understanding and legality.

- Sign the Agreement: Both parties should sign in the presence of a notary to validate the agreement.

Completing this form thoroughly ensures that both parties are legally protected and aware of their rights.

Benefits of using this form online

Utilizing an online platform to create a Prenuptial Property Agreement offers several advantages:

- Accessibility: Access the form anytime and from anywhere, making it convenient for busy couples.

- Guided Process: Online templates often provide step-by-step instructions, helping users navigate the completion process.

- Cost-effective: Online forms can be more affordable compared to hiring an attorney for standard forms.

- Quick Completion: Streamlined processes can reduce the time taken to finalize the agreement.

Form popularity

FAQ

Saving and Spending Strategies A prenuptial agreement should address the couple's future financial plans, including investment and retirement strategies. It should also cover how much income is to be paid into joint and/or separate bank accounts, and whether or not their will be any specific spending allowances.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

In California, individuals can draft their prenups. However, without a legal background, it is easy for the prenuptial agreement to be invalidated.Other requirements include a written contract, legal terms within the prenup and the voluntary signatures of both parties.

Assets and Debts. A Prenuptial Agreement is a good way for you and your partner to maintain separate control over personal assets or property that you accumulated before you were together. Dependent Children. Protection of Your Estate Plan.

Decide if you need a prenup. Hire an Attorney to Draft The Agreement. Talk to Your Spouse About Finances. Make a List of Each Spouse's Assets, Debts, and more. Draft the Prenuptial Agreement. Define Separate Property. Define Shared Property. Decide How to Pay Existing Debts.

The premarital agreement is not a notarized document, therefore there is no per se obligation to notarize it.For instance, whenever the prenuptial agreement, in dividing assets between the spouses, also refers to a real estate property transfer, having the document notarized is highly recommended.

A prenuptial agreement ("prenup" for short) is a written contract created by two people before they are married. A prenup typically lists all of the property each person owns (as well as any debts) and specifies what each person's property rights will be after the marriage.

A good prenuptial agreement should be fair. It should be entered into between two consenting adults who know what they are doing. The agreement should be fair when it is signed and entered into, and also fair when it is be enforced, whether in the event of a divorce or death.

The agreement is in writing and signed by both parties Oral prenups are not valid in any state.A party who fails to disclose all assets will suffer at the hands of a court that will find the prenup invalid.