The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

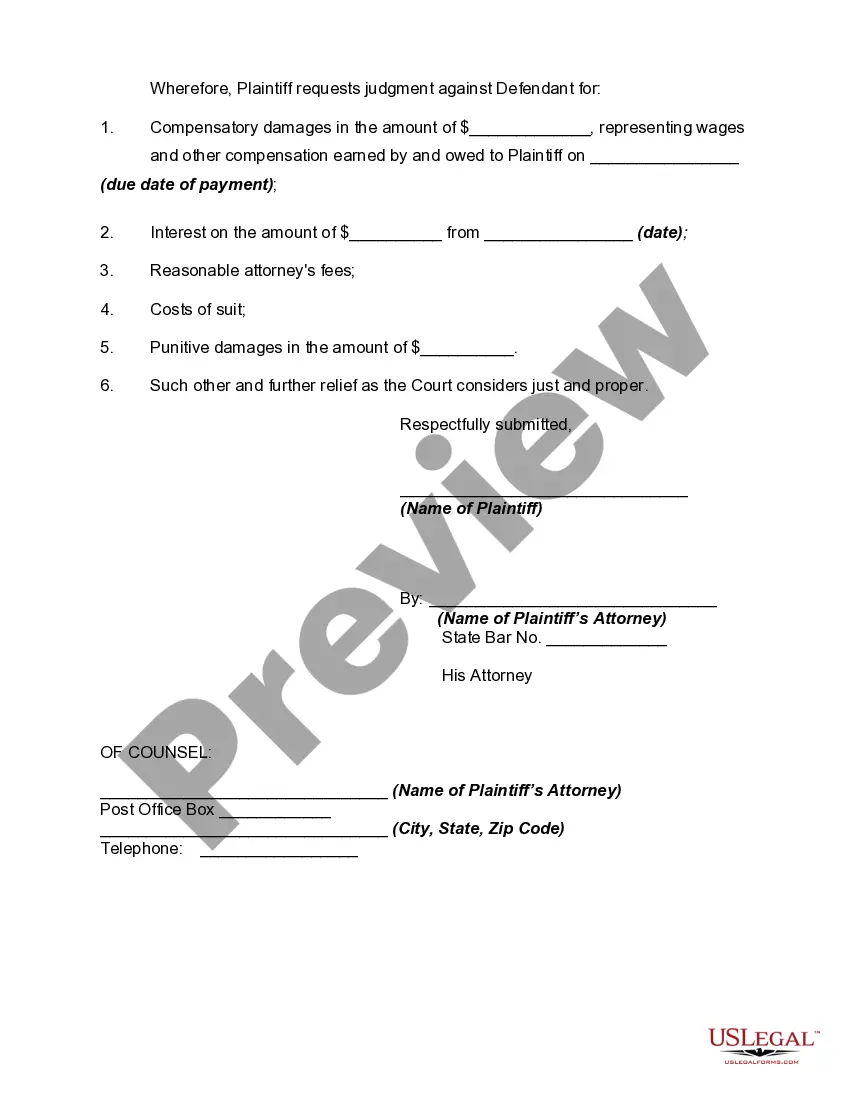

Complaint for Recovery of Unpaid Wages

Description

Key Concepts & Definitions

In the context of complaint for recovery of unpaid wages, it's important to understand specific terminology related to employment law in the United States. 'Unpaid wages' typically refer to the earnings an employee is legally entitled to receive but has not been paid. This can include minimum wages, overtime, bonuses, and other compensations promised under an employment contract or stipulated by law.

Step-by-Step Guide

- Determine the Amount Owed: Calculate the total amount of unpaid wages, including regular pay, overtime, bonuses, and any other compensation forms.

- Collect Documentation: Gather pay stubs, work schedules, employment contracts, and any communications regarding pay issues.

- Submit a Written Complaint: File a formal complaint with your employer detailing the unpaid wages claim.

- Contact the Department of Labor: If the issue remains unresolved, you may file a complaint with the U.S. Department of Labor's Wage and Hour Division or the appropriate state labor department.

- Consider Legal Action: Consult with an employment attorney who can advise on possibly filing a lawsuit for recovery of the unpaid wages.

Risk Analysis

Filing a complaint for recovery of unpaid wages comes with several risks, including potential job loss or retaliation from the employer, lengthy legal processes, and the possibility of not recovering the full amount owed. However, legal protections exist, such as the Fair Labor Standards Act (FLSA), to help mitigate these risks and protect employees from retaliation.

Key Takeaways

Recovering unpaid wages is a legal right for employees in the U.S., and several steps can be taken to address the issue, from internal complaints to legal actions. Understanding your rights and the proper procedures increases the likelihood of a favorable outcome.

Common Mistakes & How to Avoid Them

- Not Documenting Everything: Always keep detailed records of hours worked, payments received, and any related communications.

- Delaying Action: Waiting too long can complicate the recovery process. Address unpaid wages as soon as they are identified.

- Handling It Alone: Consider seeking advice from a lawyer or labor rights group to navigate the complaint process effectively.

How to fill out Complaint For Recovery Of Unpaid Wages?

Employ the most comprehensive legal library of forms. US Legal Forms is the best place for getting updated Complaint for Recovery of Unpaid Wages templates. Our platform provides thousands of legal forms drafted by certified lawyers and categorized by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our service, log in and select the template you need and buy it. After purchasing forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- When the form features a Preview option, utilize it to check the sample.

- If the template does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your expections.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with yourr debit/bank card.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and complete the Form name. Join thousands of satisfied subscribers who’re already using US Legal Forms!

Form popularity

FAQ

When an employer fails to pay an employee the applicable minimum wage or the agreed wage for all hours worked, the employee has a legal claim for damages against the employer. To recover the unpaid wages, the employee can either bring a lawsuit in court or file an administrative claim with the state's labor department.

If you are owed back pay or unpaid wages in California, you can file a lawsuit to recover the amount owed, including interest and any penalties. Talk to your California wage and hour law lawyer about your case and how to make your employer pay for the work you were never compensated for.

You are required to report your income regardless of whether your employer reports it to the IRS.You sue for damages and if you have reported your income you have no damages...

When an employer fails to pay an employee the applicable minimum wage or the agreed wage for all hours worked, the employee has a legal claim for damages against the employer. To recover the unpaid wages, the employee can either bring a lawsuit in court or file an administrative claim with the state's labor department.

File a complaint: If your boss won't respond to your concerns about payment under the minimum wage or failure to pay a premium for overtime hours, you can file a complaint with the U.S. Department of Labor, Wages and Hour Division, which enforces the Fair Labor Standards Act (FLSA).

The law says that all employees have the right to receive payment for the work that they have done.(Remember, you should never start work without a contract.) If your employer has failed to make payment on the predetermined date, as laid out in your contract, they are breaking the law by committing breach of contract.

Ontario: 1-800-531-5551. Toronto: 416-326-7160. TTY: 1-866-567-8893.

Following the law regarding employee pay is important to avoid lawsuits and costly penalties. It is illegal to pay your employees late, and doing so could result in legal action.

A) Approach Labour Commissioner:If an employer doesn't pay up your salary, you can approach the labour commissioner. They will help you to reconcile this matter and if no solution is reached labour commissioner will hand over this matter to the court whereby a case against your employer may be pursued.