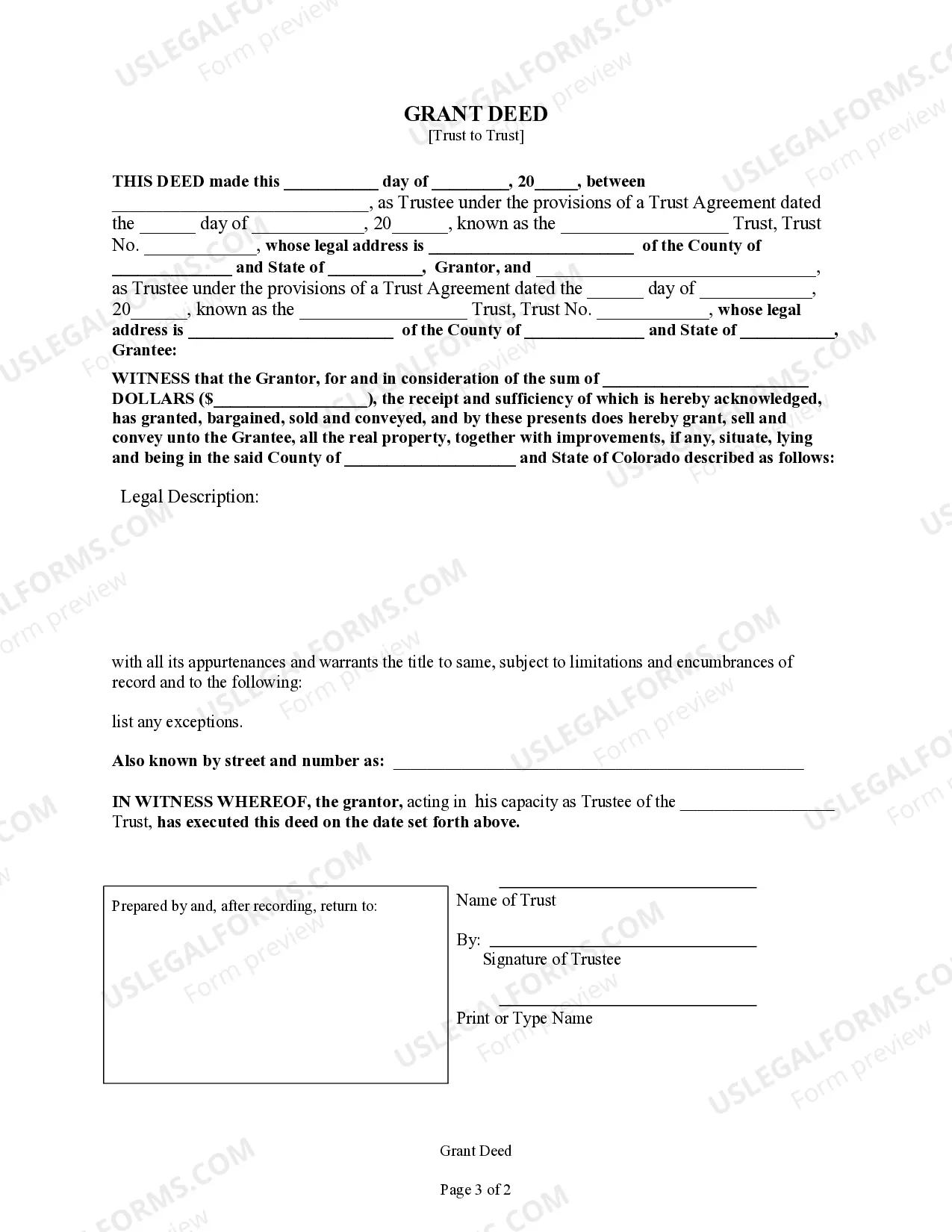

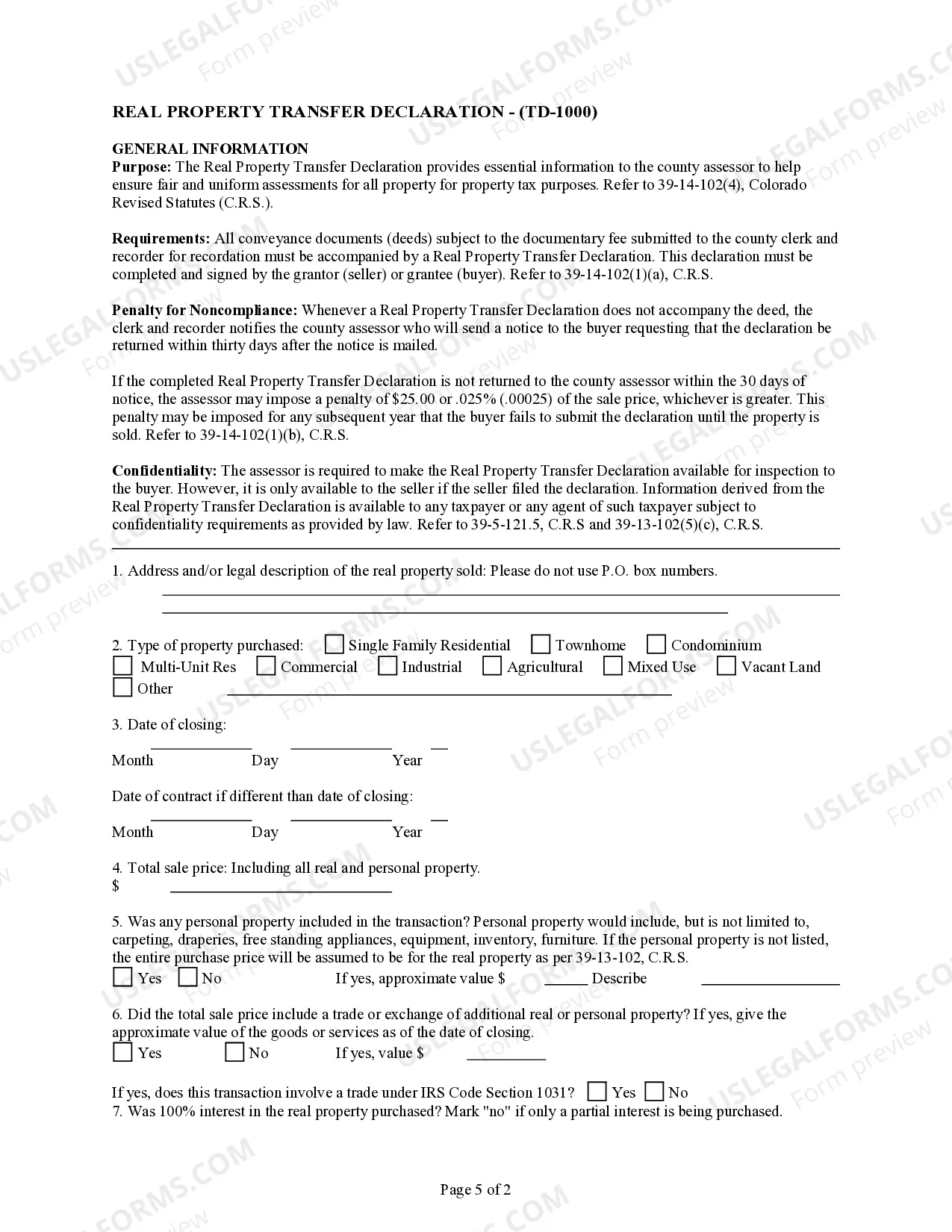

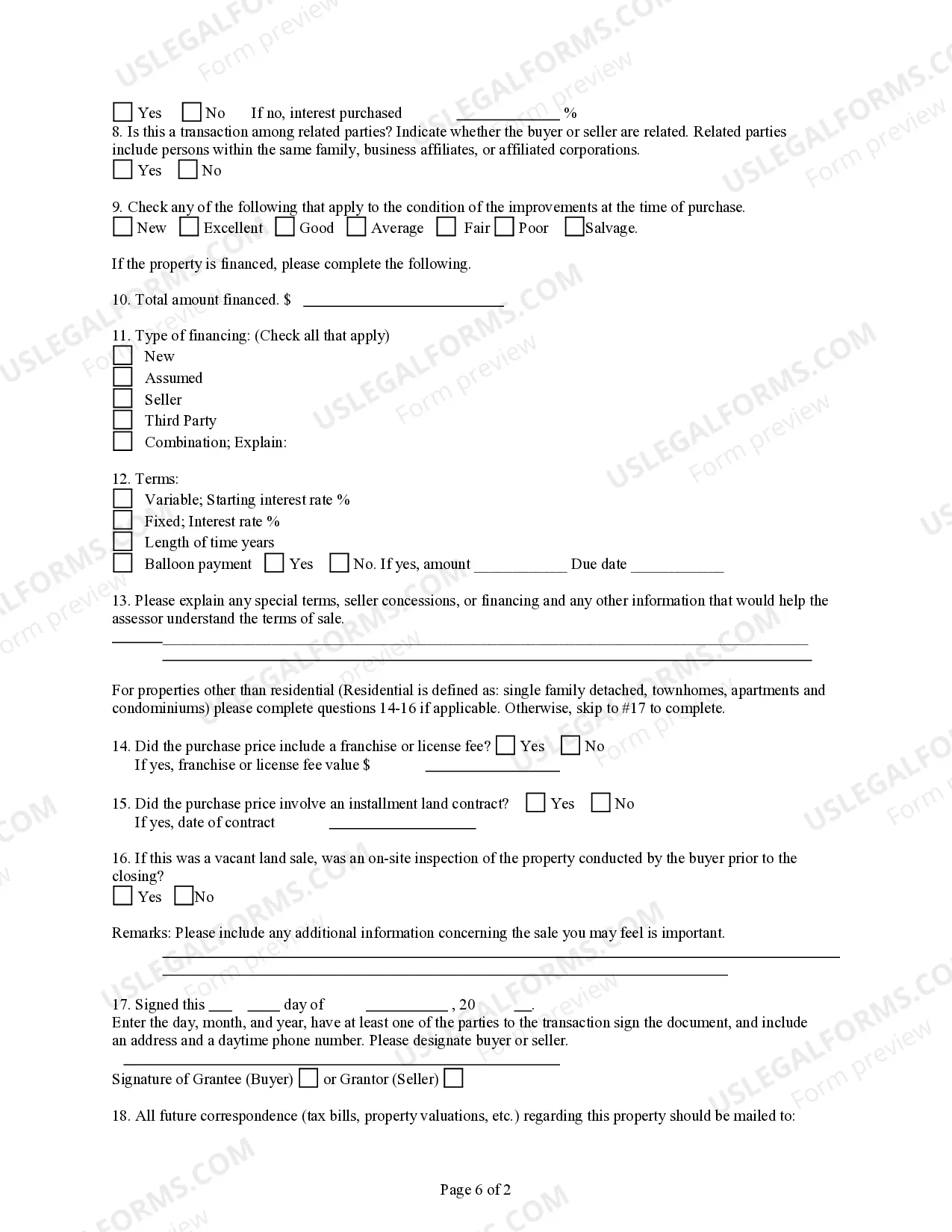

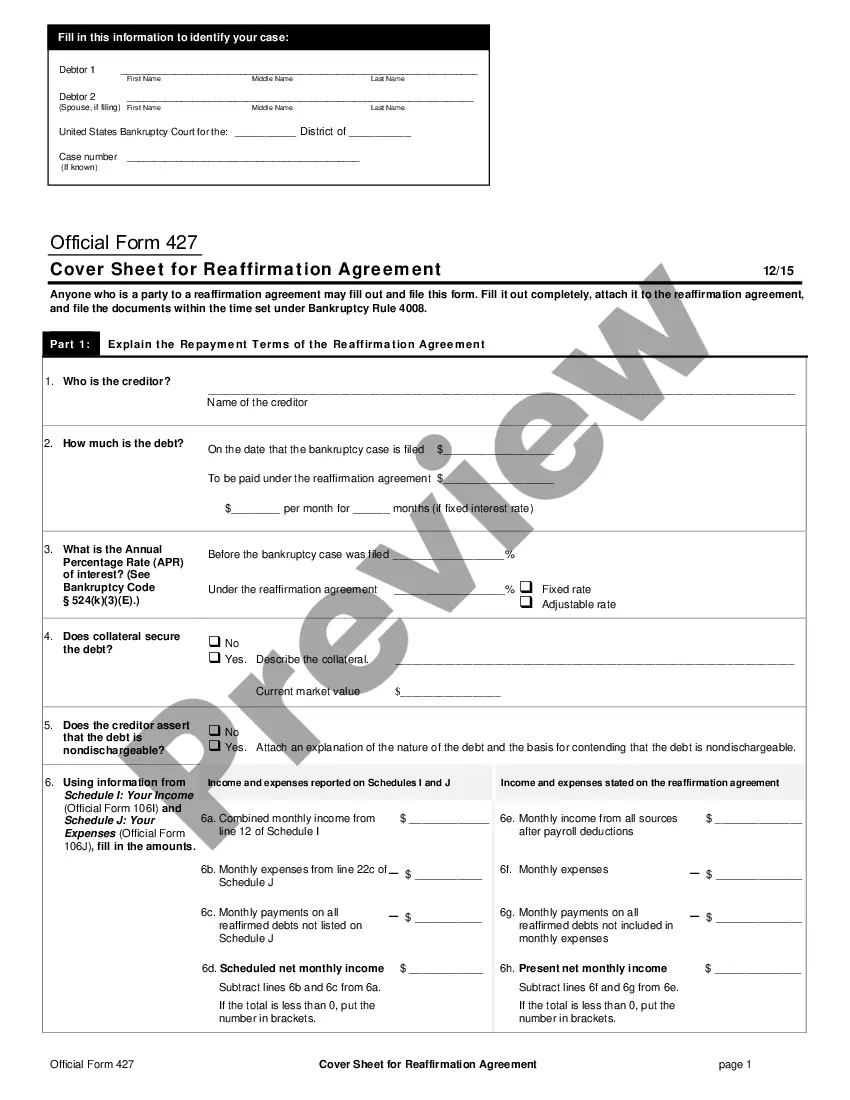

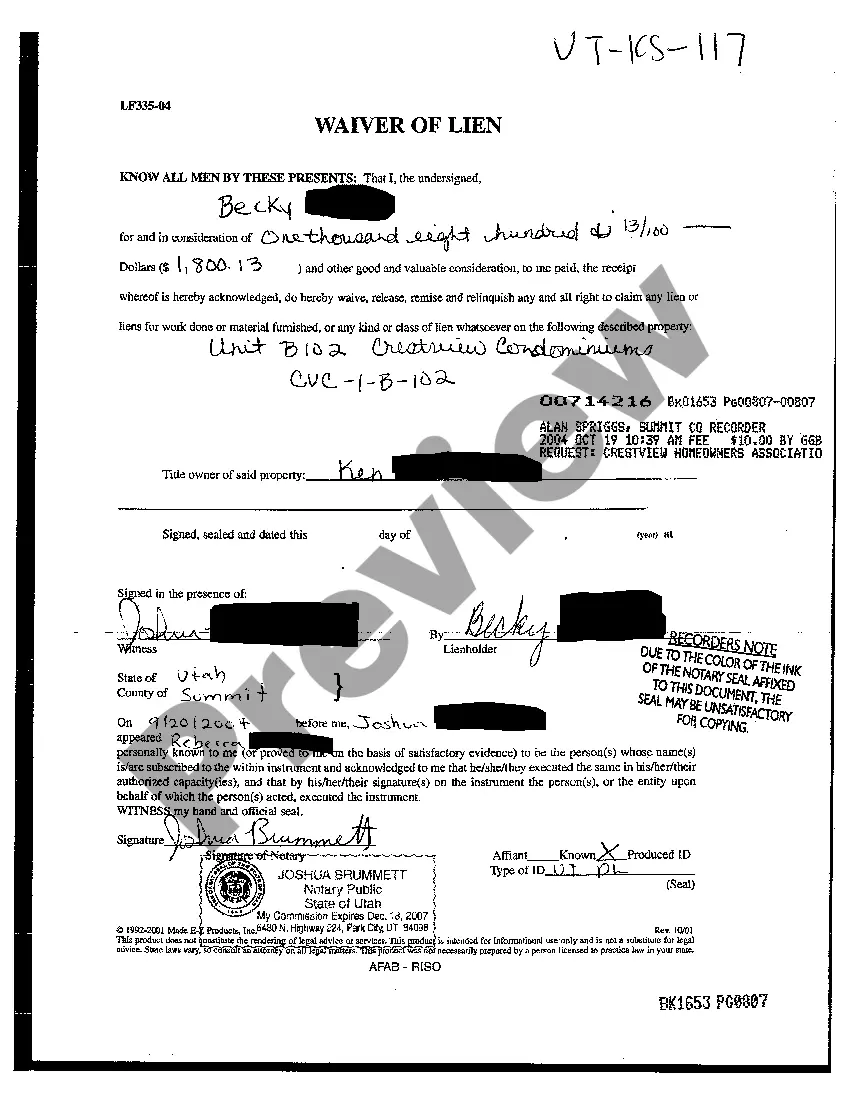

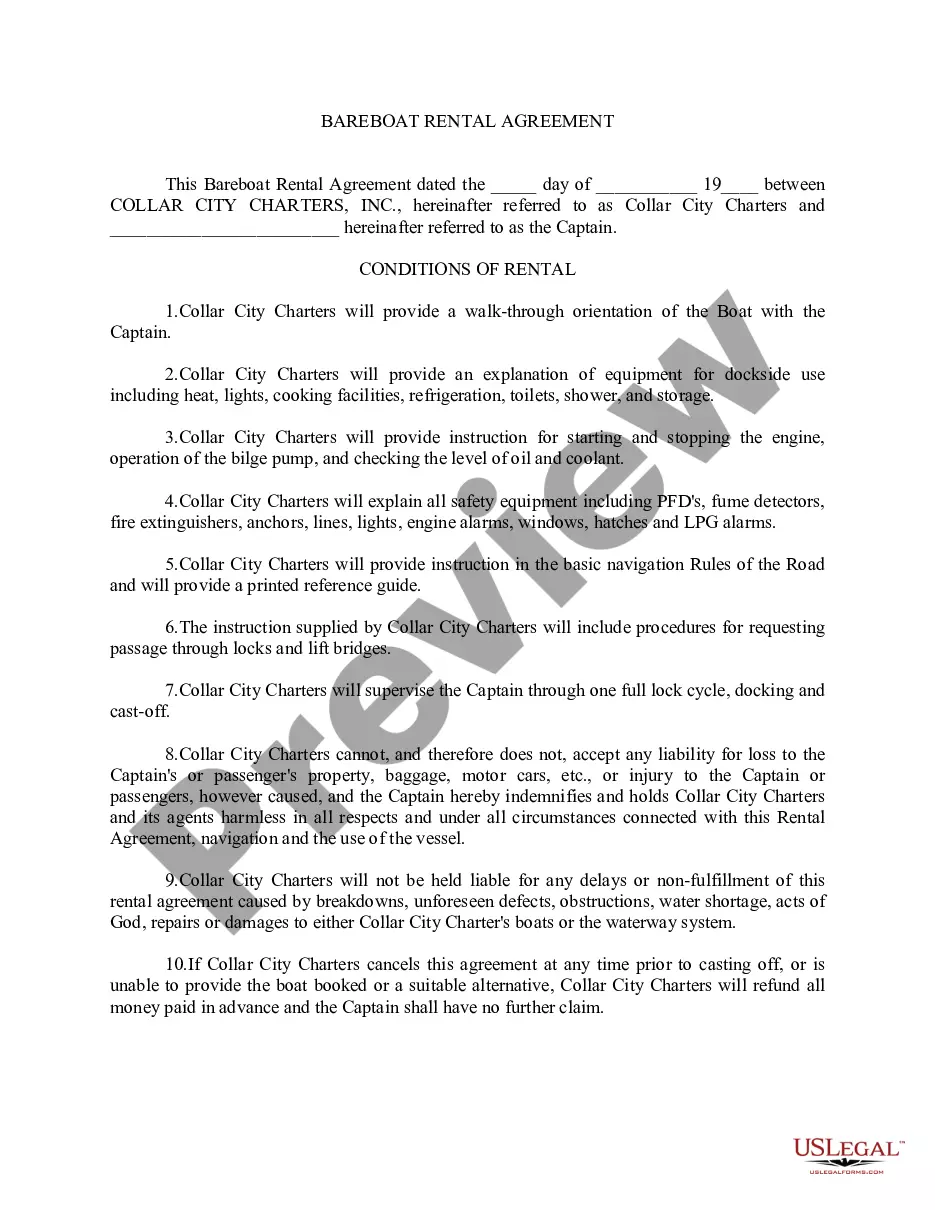

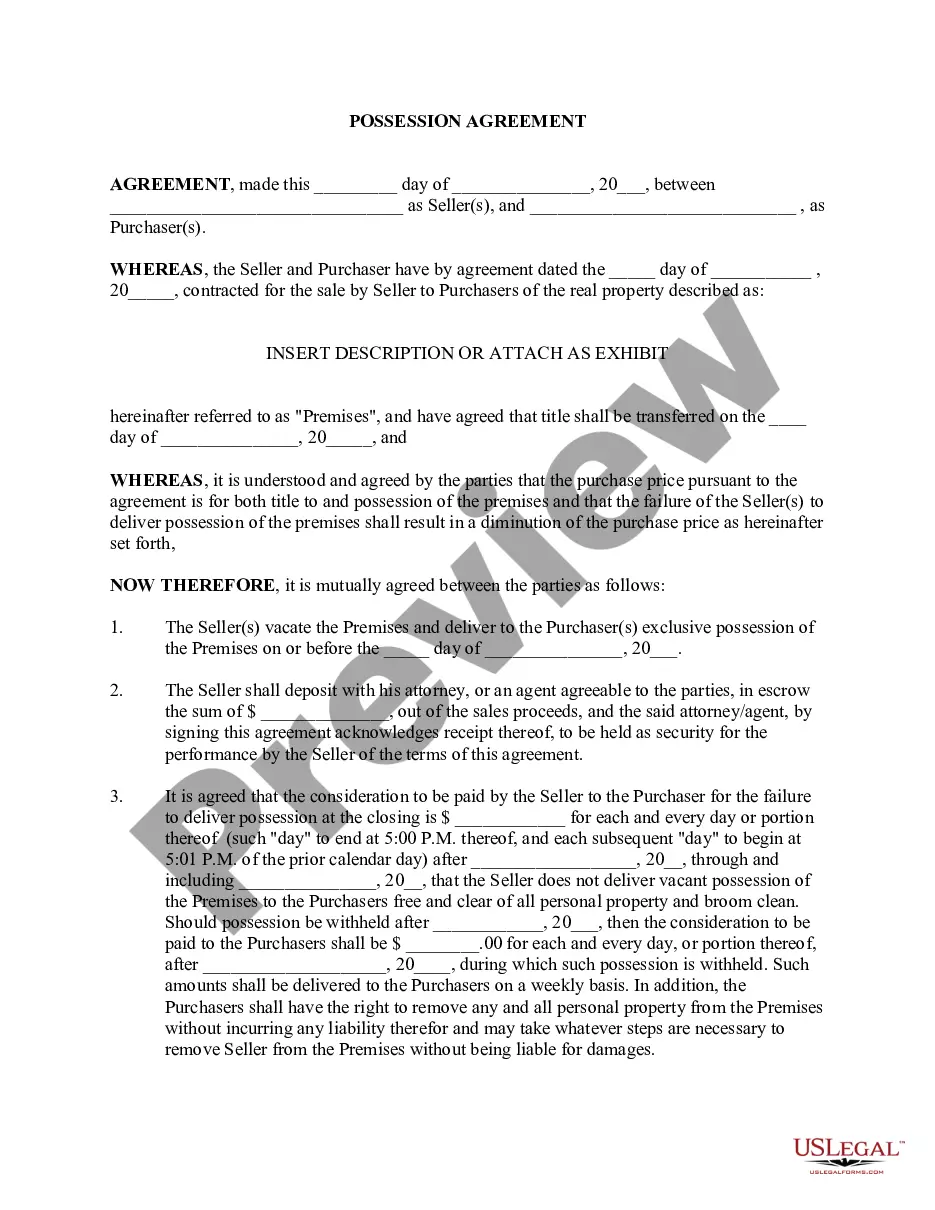

This form is a Grant Deed where the grantor is a trust and the grantee is also a trust. Grantor grants and conveys the described property to the grantee. This deed complies with all state statutory laws.

Colorado Grant Deed - Trust to a Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Grant Deed - Trust To A Trust?

The larger quantity of documents you are required to produce - the more anxious you become.

You can find a vast array of Colorado Grant Deed - Trust to a Trust templates online, but you may be uncertain about which ones to trust.

Eliminate the inconvenience and simplify the search for examples with US Legal Forms.

Click on Buy Now to initiate the registration process and choose a pricing plan that meets your needs. Enter the required information to create your account and settle your purchase using your PayPal or credit card. Choose a convenient document format and obtain your template. Access any documents you download in the My documents section. Go there to complete a new version of the Colorado Grant Deed - Trust to a Trust. Even when utilizing professionally created forms, it is still crucial to consider consulting a local attorney to review the completed template to ensure your document is properly filled out. Achieve more for less with US Legal Forms!

- Obtain expertly drafted documents that comply with state regulations.

- If you have an active US Legal Forms membership, Log In to your account, and you will find the Download option on the Colorado Grant Deed - Trust to a Trust page.

- If you are new to our platform, complete the registration process by following these steps.

- Verify that the Colorado Grant Deed - Trust to a Trust is legal in your state.

- Review your selection by examining the description or using the Preview mode if available for the document you selected.

Form popularity

FAQ

To release a Deed of Trust in Colorado, you need to follow a few straightforward steps. First, ensure that all obligations secured by the Deed of Trust have been met. After that, you can file a release form with the county clerk and recorder's office, highlighting the Colorado Grant Deed - Trust to a Trust. Using USLegalForms can simplify this process by providing necessary forms and guidance to ensure your release is handled properly.

Yes, you can transfer a deed without an attorney when dealing with a Colorado Grant Deed - Trust to a Trust. However, it's important to ensure that you follow the correct procedures for your specific situation. Using a service like USLegalForms can help guide you through the process, making it easier to complete the deed transfer accurately. Remember, while you can do it on your own, expert assistance can prevent potential pitfalls.

One disadvantage of a deed of trust compared to a traditional mortgage is the potential for a quicker foreclosure process. In Colorado, a deed of trust allows the lender to foreclose without going through a court, which may be concerning for some borrowers. Additionally, if you fail to meet payment obligations, you could quickly lose your property. For clarity and support when dealing with a deed of trust, explore the helpful resources offered by US Legal Forms.

To release a deed of trust in Colorado, you will need to obtain a Release of Deed of Trust document, which must be signed by the beneficiary. After the document is signed, you should file it with the county clerk and recorder where the original deed of trust was recorded. This process will officially remove the property lien and clear the title. If you're seeking assistance, consider using US Legal Forms, which offers templates to simplify this process.

Filling out a trust fund generally involves detailing the assets you want to place in the trust, along with appointing a trustee to manage those assets. You will also outline the purpose of the trust and the beneficiaries who will receive distributions. Properly documenting this information ensures that your trust fund performs as intended and complies with legal standards.

To transfer property into a trust in Colorado, begin by creating the trust document that specifies the property details. Next, prepare a Deed for the property, naming the trust as the new owner. Using a Colorado Grant Deed - Trust to a Trust simplifies this process, ensuring everything is legal and meets state requirements.

While placing property in a trust has many benefits, it also comes with some disadvantages. One concern is the upfront costs associated with creating the trust, including legal fees and paperwork. Additionally, once property is in a trust, you may have less direct control over it, which can complicate decisions related to the asset.

To transfer property into a trust in Colorado, you should prepare a new Deed that identifies the trust as the new owner. This document should comply with Colorado’s regulations and be properly executed and notarized. After drafting the Colorado Grant Deed - Trust to a Trust, record the deed with the county clerk to complete the transfer legally.

Transferring assets into a trust involves several key steps. First, you need to create the trust document, which outlines the assets being transferred and the terms of the trust. Then, you must change the ownership of the assets to reflect the trust. For properties, using a Colorado Grant Deed - Trust to a Trust can streamline this process, ensuring proper legal compliance.