A reservation of rights defense is a means by which a liability insurance carrier agrees to protect and defend its insured against a claim or suit while reserving the right to further evaluate and perhaps even deny coverage for some or all of the claim. It is most commonly used when the claim or suit contains both covered and non-covered allegations, when the allegations are in excess of policy limits, or when the insurer is still investigating its defense and coverage obligations. For the insurer, a reservation of rights provides the flexibility to satisfy its duty to defend without committing to coverage. For the business owner who ultimately may have to pay for an adverse judgment, it requires careful monitoring and attention.

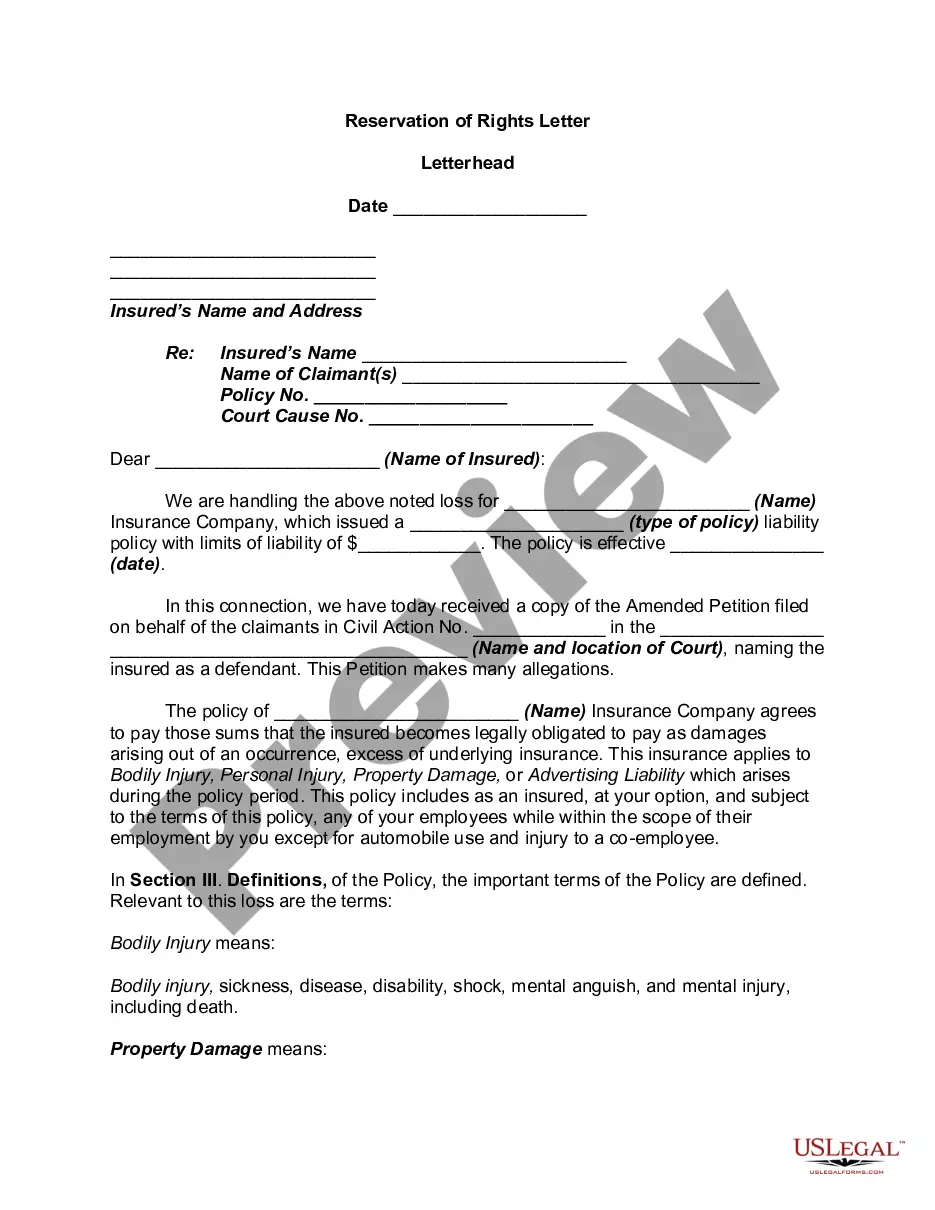

Reservation of Rights Letter

Description

Definition and meaning

A Reservation of Rights Letter is a formal document issued by an insurance company to inform the insured that the company is reserving its right to deny coverage for a claim while it investigates the underlying issues related to that claim. This letter does not constitute an acceptance of liability but rather a defensive measure to protect the insurer's interests.

Legal use and context

The Reservation of Rights Letter is significant in legal contexts, particularly after the filing of a lawsuit. It allows the insurer to continue assessing the claim while explicitly stating any coverage issues that may arise based on the allegations made. This form is commonly used in liability cases, such as personal injury claims or property damage disputes.

Who should use this form

This form is typically utilized by insurance companies and their legal representatives when a claim is made against an insured party. Insured individuals should be aware of this letter as it may indicate potential challenges in their coverage and could affect their legal strategy moving forward.

Key components of the form

A standard Reservation of Rights Letter should include:

- The date of the letter.

- The name and address of the insured party.

- The claimant's details.

- The insurance policy number.

- A description of the claims made.

- The potential coverage issues identified.

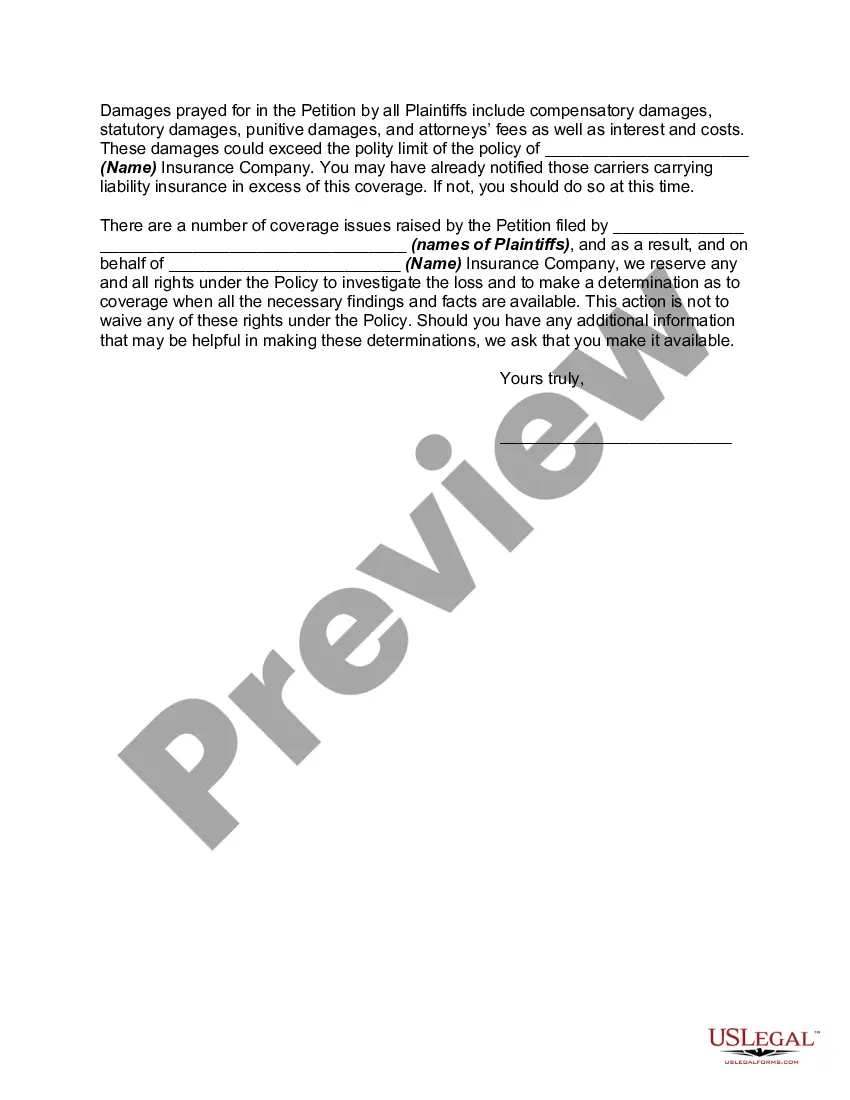

- A clear statement reserving all rights under the policy.

Common mistakes to avoid when using this form

When completing a Reservation of Rights Letter, it's vital to avoid the following mistakes:

- Failing to include all necessary details, such as policy numbers and pertinent dates.

- Using ambiguous language that could confuse the insured party.

- Neglecting to specify which rights are being reserved, leading to misunderstandings.

What to expect during notarization or witnessing

While a Reservation of Rights Letter may not always require notarization, if it does, it typically involves the following steps:

- The signatory will present the letter to a notary public.

- The notary will verify the identity of the signatory.

- The document will be signed in the presence of the notary, who will then affix their seal.

Key takeaways

The Reservation of Rights Letter is a crucial tool for insurance companies to manage claims effectively. Understanding its definition, use, and components can help insured parties be better prepared for the implications it carries regarding their coverage.

How to fill out Reservation Of Rights Letter?

Aren't you tired of choosing from countless templates every time you want to create a Reservation of Rights Letter? US Legal Forms eliminates the wasted time millions of Americans spend exploring the internet for ideal tax and legal forms. Our skilled group of attorneys is constantly modernizing the state-specific Samples catalogue, to ensure that it always provides the proper documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Users who don't have an active subscription need to complete a few simple actions before having the capability to get access to their Reservation of Rights Letter:

- Utilize the Preview function and read the form description (if available) to ensure that it’s the right document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample to your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your document in a required format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step guidelines above, you'll always be able to sign in and download whatever document you require for whatever state you want it in. With US Legal Forms, completing Reservation of Rights Letter templates or any other legal paperwork is not hard. Begin now, and don't forget to look at the examples with certified lawyers!

Form popularity

FAQ

State that you are reserving all of your rights under the policy; state that you will cooperate and will provide the information the insurer requested to the attorney the insurer retained to defend you; correct any errors as to dates or facts set forth in the ROR letter;

ROR letters are used when an insurer identifies coverage defenses and/or policy defenses. Insurance companies routinely send reservation of rights letters, as failing to send one can waive their rights. If you receive one, you should contact your insurance company to find out why your claim may not be covered.

The reservation of rights letter contains specific information about the claim, including the policy in question, the claim made against the policy, and the part of the claim that may not be covered.

Insurance companies send a reservation of rights letters because not doing so could be considered a waiver of their rights at a later time.Under a liability insurance policy, your insurer may have a broader obligation to defend the insured than to actually secure against losses.

There are states that required insurance companies to send a letter by certified mail when your rates are transitioned to a much higher premium. Also, if you have been in a bad wreck and they have been seeking verbal recordings or written information from you on the accounts of the incident.

A court might wonder why the insurer abandoned the claim after it initially thought it was covered. The court could say that by its own acts, the insurer waived its rights to deny coverage. The legal system often refers to this as bad faith.A reservation of rights letter does not mean the claim isn't covered.

This creates a potential conflict of interest because the insurer-retained defense counsel may be able to control the insured's defense in such a way as to affect the outcome of the coverage issue.

Reservation of rights is a useful tool for the insurer to protect itself against the risk of loss of coverage or avoidance rights.