Lease Purchase Agreement for Equipment

Description

Key Concepts & Definitions

Lease Purchase Agreement for Equipment: A legal document between two parties where one party agrees to lease equipment with an option to purchase at the end of the lease term. Equipment Lease Purchase refers to the process of leasing the equipment with the intent to purchase eventually.

Step-by-Step Guide

- Identify the Equipment: Determine the equipment you need for your business or personal use.

- Choose a Suitable Vendor: Select a vendor who offers lease purchase options.

- Negotiate Terms: Discuss terms like lease duration, payment structure, and purchase options.

- Review Lease Agreement Samples: Consider reviewing multiple lease agreement samples to understand common clauses and terms.

- Customize Your Lease Purchase Agreement: Use a lease agreement template to tailor your contract specifics, like lease agreement conditions and cancellation policies.

- Sign the Agreement: Both parties sign the lease purchase agreement to make it legally binding.

- Execute the Lease: Start using the equipment as per the terms set in the agreement.

- Option to Purchase: Decide at the end of the lease term if you want to purchase the equipment.

Risk Analysis

- Financial Risk: The risk of unexpectedly high costs due to unclear terms in lease agreement conditions.

- Operational Risk: Equipment may not meet the evolving business needs over time.

- Legal Risk: Potential legal disputes due to inadequate understanding of the lease purchase agreement, especially lease agreement cancellation and duration clauses.

Common Mistakes & How to Avoid Them

- Not Reading the Fine Print: Always read and understand each clause in the lease agreement. Use lease agreement samples for reference.

- Ignoring Equipment Inspection: Inspect equipment thoroughly before leasing to avoid inheriting faulty or inadequate equipment.

- Failing to Consider Total Costs: Evaluate all costs including lease payments, maintenance, and potential purchase price.

Best Practices

- Use a comprehensive lease agreement template to ensure all critical aspects are covered.

- Regularly review the lease agreement conditions and ensure they align with both parties' expectations.

- Prepare for lease agreement cancellation scenarios by understanding the contractual obligations and penalties involved.

FAQ

- What is a lease purchase agreement for equipment? It's a contract that allows leasing equipment with an option to buy after the lease term ends.

- Where can I download a lease agreement? Lease agreement downloads are available from legal websites and template providers.

- Can I cancel my lease agreement? Yes, but specific conditions for cancellation and potential penalties should be defined in the agreement.

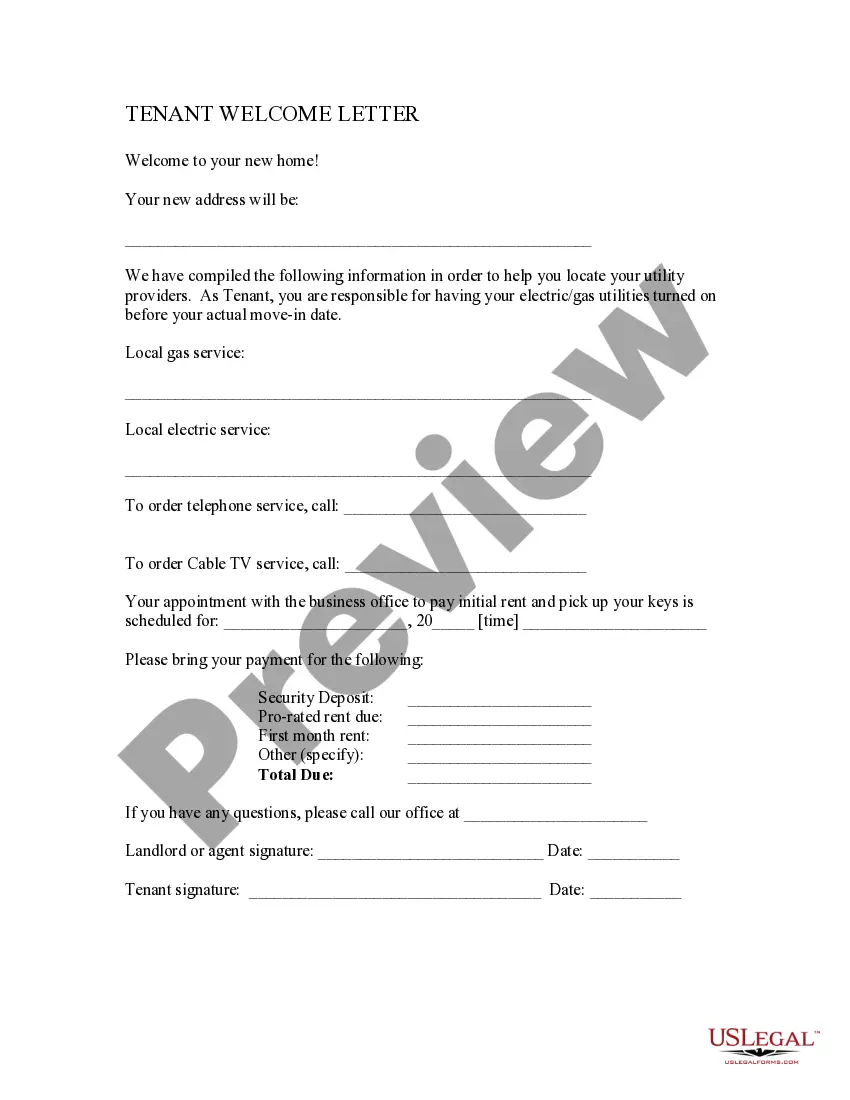

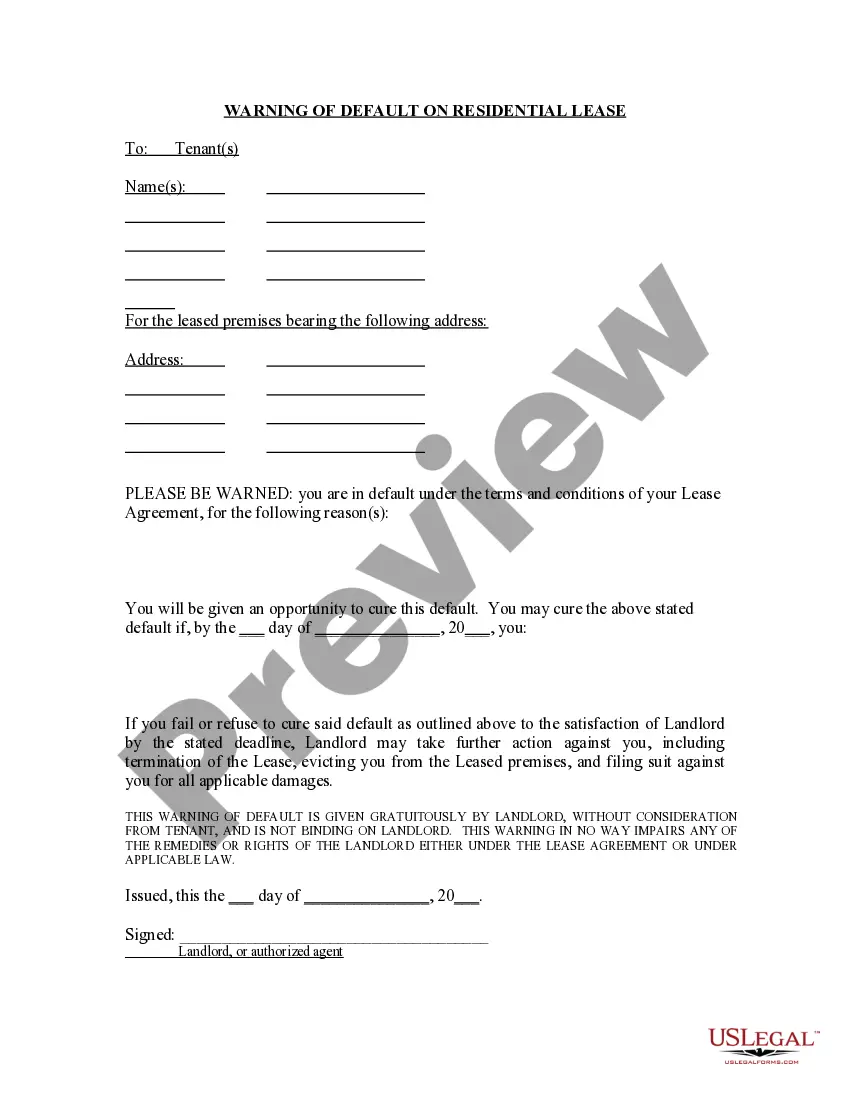

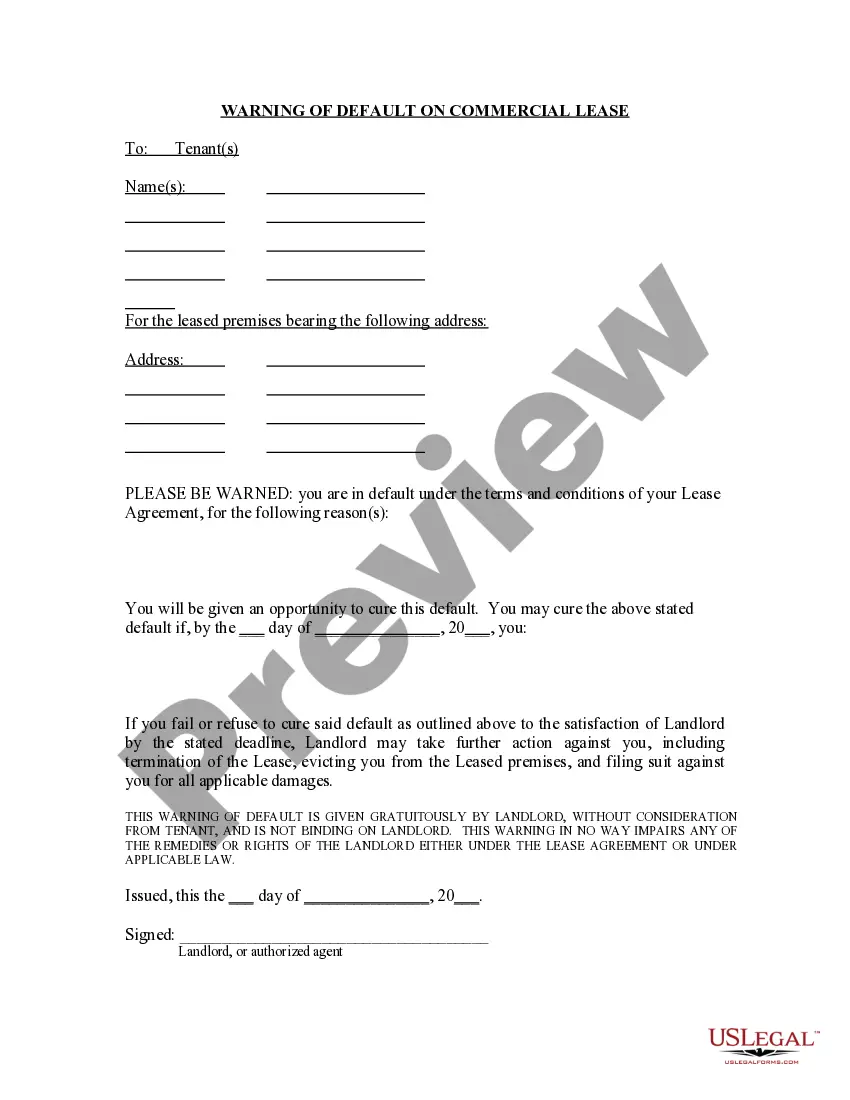

How to fill out Lease Purchase Agreement For Equipment?

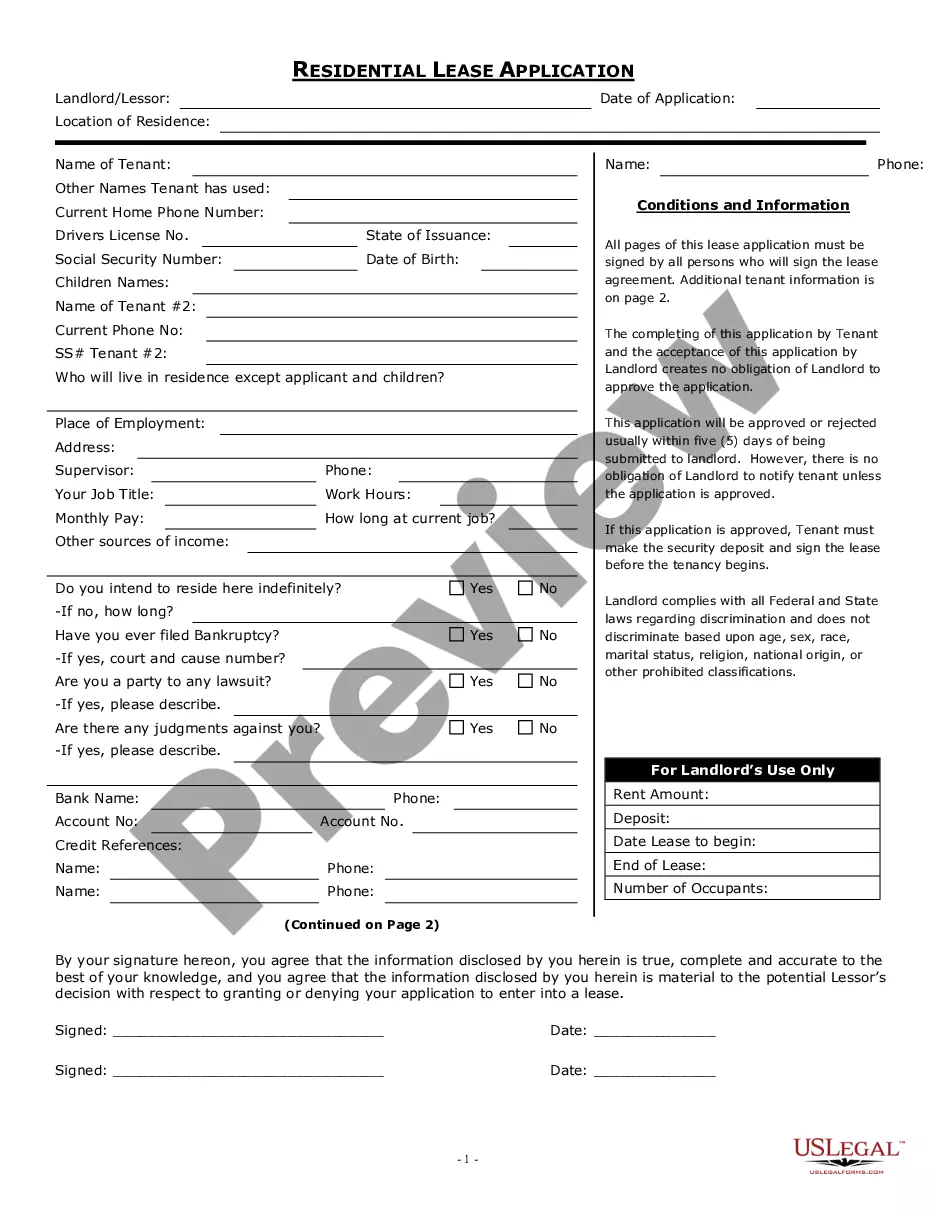

Use US Legal Forms to obtain a printable Lease Purchase Agreement for Equipment. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms catalogue online and provides reasonably priced and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Lease Purchase Agreement for Equipment:

- Check out to ensure that you get the correct form in relation to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search engine if you need to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Lease Purchase Agreement for Equipment. More than three million users already have utilized our platform successfully. Choose your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

Equipment leasing is a type of financing in which the small business owner rents the equipment rather than purchasing it. Business owners can lease expensive equipment such as machinery, vehicles, computers and other tools needed to run a business.

Create Other Current Liability account for the loan/lease payable. Create Fixed Asset account for Computer Equipment. You must use a General Journal Entry, as taxes cannot be entered from the register. On the first line, enter the Computer Equipment asset account and enter the total loan amount as a Debit.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

Leasing companies will be quick to tell you that your lease agreement cannot be canceled. Which is true because the only way you can get out of a lease is by completing all the payments early and paying the inevitable additional costs and penalties for doing so?

Accounting Treatment Of Leased Asset The lease payments also include interest, and the lessee needs to record it separately. For instance, if in a lease payment of $1000, $200 is for the interest expense, then $800 would be a debit to the capital lease liability account and $200 to the interest account.

At the end of the lease, you typically have the option to purchase the equipment at its fair market value, as determined by the leasing company, renew the lease, or return the equipment. An FMV lease is an operating lease, which means it doesn't offer the benefits or responsibilities of ownership to the small business.

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

In simple terms, equipment leasing has some similarities to an equipment loan, however it's the lender that buys the equipment and then leases (rents) it back to you for a flat monthly fee. Most equipment leases come at a fixed interest rate and fixed term to keep those payments the same every month.