A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Offer to Purchase Commercial Property

Description

Definition and meaning

An Offer to Purchase Commercial Property is a formal document used by a potential buyer to propose the terms under which they intend to purchase commercial real estate. This document outlines significant details about the transaction, including the purchase price, terms of payment, and any conditions that must be met before the property can be sold. The offer serves as an initial step in the real estate transaction process, which, upon acceptance by the seller, leads to further legal documentation and arrangements.

How to complete a form

Completing an Offer to Purchase Commercial Property involves several steps:

- Enter Purchaser Information: Provide your full name, address, and contact details.

- Identify the Property: Clearly define the property you wish to purchase, including its legal description. This can often be found in public records.

- Set Purchase Price: State the offer amount you are willing to pay for the property.

- Include Terms: Outline the terms of payment, such as earnest money deposits and contingencies.

- Specify Closing Details: Indicate the desired closing date and any conditions required for the sale.

After filling in the necessary information, ensure you review the document for accuracy and sign it appropriately.

Key components of the form

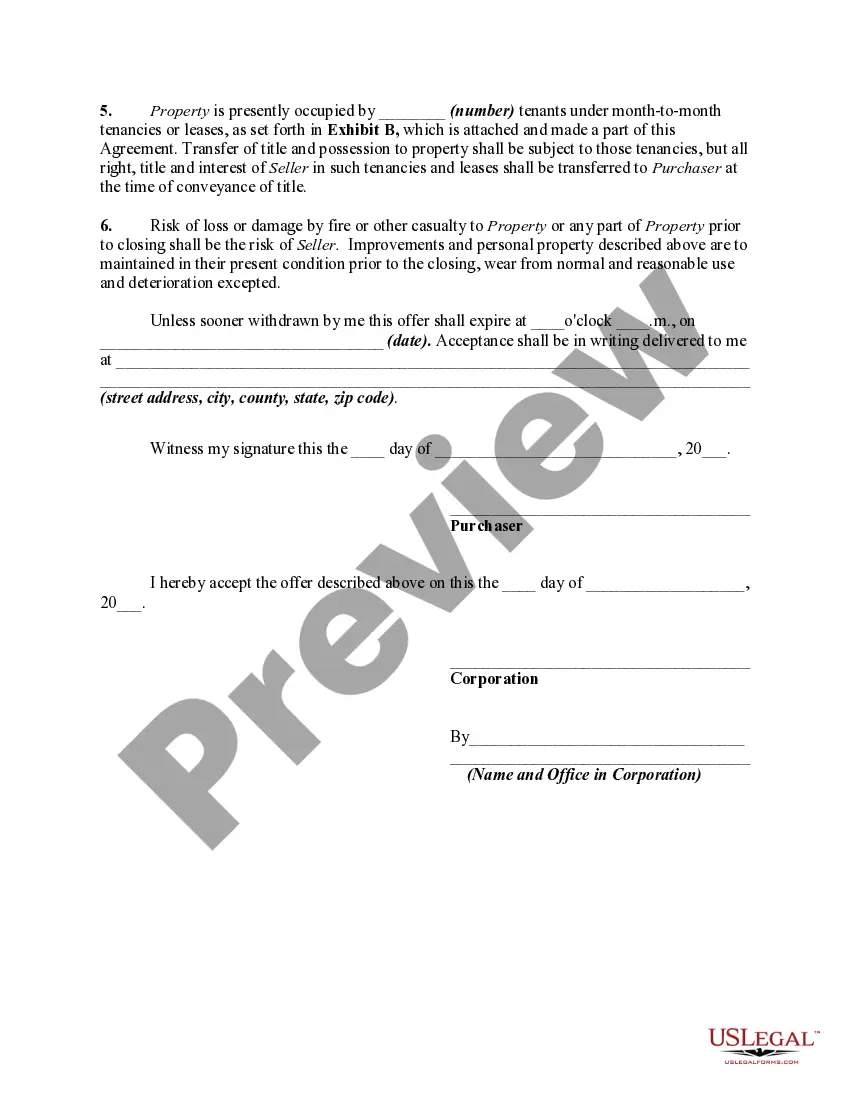

The Offer to Purchase Commercial Property includes several essential components:

- Purchaser and Seller Details: Names and addresses of both parties involved.

- Property Identification: Legal description of the property to be purchased.

- Purchase Price: Total amount proposed by the purchaser.

- Earnest Money: Amount of money to be held as a deposit, confirming the purchaser's serious intent.

- Closing Conditions: Conditions that need to be met prior to finalizing the sale.

Each component is crucial for creating a legally binding agreement and clarifying the transaction's terms.

Who should use this form

The Offer to Purchase Commercial Property is intended for individuals or entities interested in acquiring commercial real estate. This includes:

- Investors looking to purchase properties for rental income or resale.

- Businesses seeking new locations for operations.

- Developers who plan to renovate or build on the property.

This form can be employed by both experienced real estate professionals and first-time buyers looking to navigate the commercial property market.

Common mistakes to avoid when using this form

When filling out an Offer to Purchase Commercial Property, be cautious of the following common pitfalls:

- Incomplete Information: Failing to include all necessary details can lead to misunderstandings.

- Neglecting to Specify Conditions: Not outlining conditions or contingencies may result in issues later in the process.

- Incorrect Legal Descriptions: Providing inaccurate property descriptions can invalidate the offer.

Taking care to avoid these mistakes will help ensure a smoother transaction process.

What documents you may need alongside this one

When preparing an Offer to Purchase Commercial Property, consider gathering additional supporting documents, such as:

- Proof of Funds: Documentation showing financial capability to complete the purchase.

- Property Appraisal: An evaluation of the property's value by a licensed appraiser.

- Inspection Reports: Any assessments regarding the condition of the property.

These documents will enhance your offer's credibility and demonstrate readiness to proceed with the transaction.

What to expect during notarization or witnessing

Notarization may be required for the Offer to Purchase Commercial Property to ensure the authenticity of signatures. During this process, you can expect the following:

- Identification: You will need to present valid identification to the notary.

- Signature Verification: The notary will confirm that you are signing the document voluntarily.

- Record Keeping: The notary may keep a record of the transaction for future reference.

This step adds an extra layer of legal protection to your offer, confirming that all parties have agreed to the terms outlined.

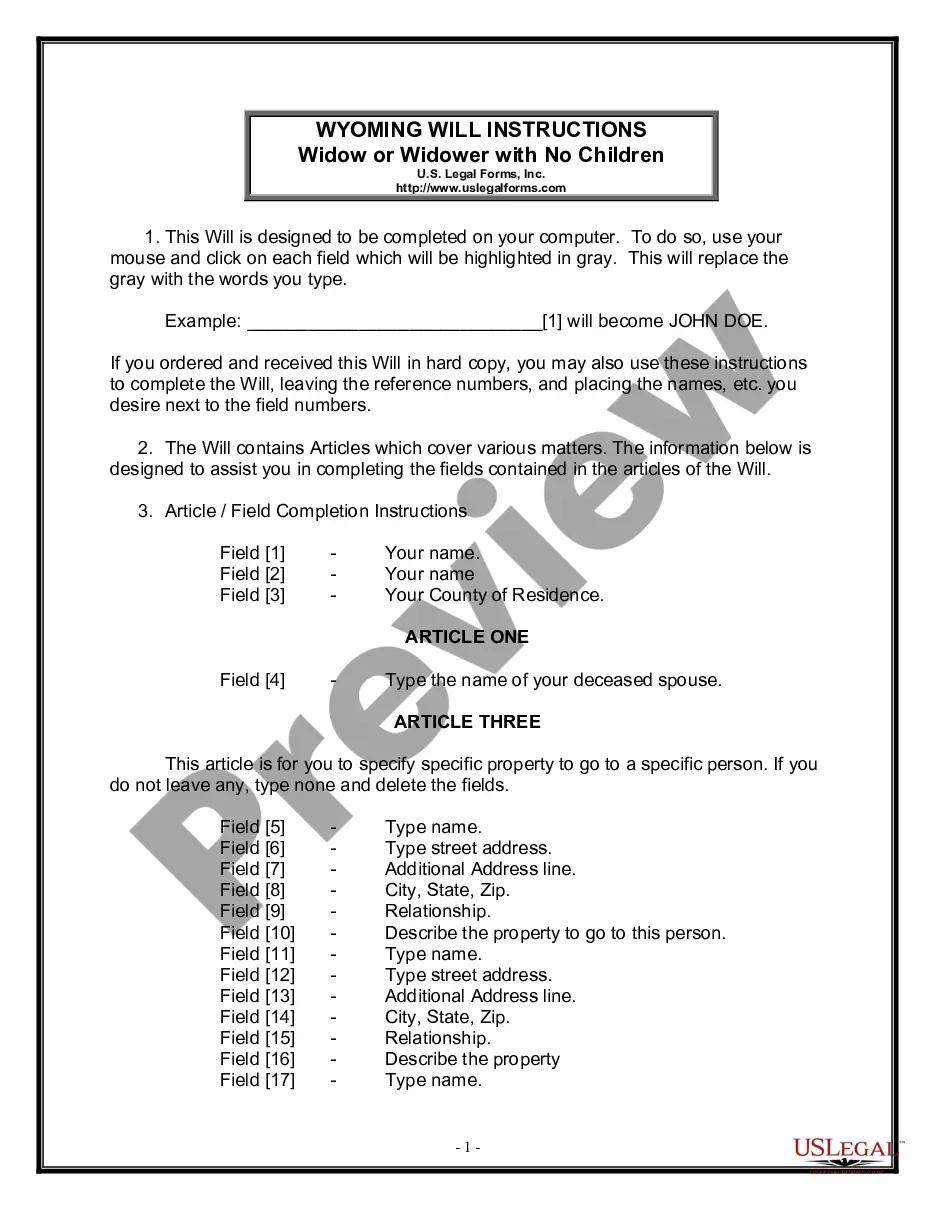

How to fill out Offer To Purchase Commercial Property?

Aren't you tired of choosing from countless templates each time you want to create a Offer to Purchase Commercial Property? US Legal Forms eliminates the lost time countless American citizens spend exploring the internet for perfect tax and legal forms. Our expert group of lawyers is constantly updating the state-specific Templates collection, so that it always has the right documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete simple actions before having the capability to download their Offer to Purchase Commercial Property:

- Use the Preview function and look at the form description (if available) to make certain that it is the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right template for your state and situation.

- Make use of the Search field on top of the webpage if you have to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your template in a needed format to complete, create a hard copy, and sign the document.

After you have followed the step-by-step recommendations above, you'll always be capable of log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Offer to Purchase Commercial Property samples or any other legal paperwork is not difficult. Get started now, and don't forget to examine your samples with certified attorneys!

Form popularity

FAQ

Your legal name, the name of the seller and the address of the property. the amount you're offering to pay (the purchase price) and the amount of your deposit. any extra items you want included in the purchase (for example, window coverings) the date you want to take possession (closing day)

Know Your Needs. The first step in an effective negotiation is to have a firm grasp on what you need out of the lease or sale. Set Budget Beforehand. Now that you have a general idea of what you're looking for, it's time to set a budget. Due Diligence. Making an Offer. Treat All Parties With Respect.

Know Your Needs. The first step in an effective negotiation is to have a firm grasp on what you need out of the lease or sale. Set Budget Beforehand. Now that you have a general idea of what you're looking for, it's time to set a budget. Due Diligence. Making an Offer. Treat All Parties With Respect.

The Person Liable for the Lease. Your Business Structure. How Long You Have Been in Business. The Nature of Your Business. Contact Information. Your Proposed Terms (or, Counter Offer) The Length of the Lease. Condition of the Property.

LoopNet. LoopNet is one of the most recognized CRE search engines. For those more involved in multi family or residential real estate, LoopNet is often considered the Zillow of commercial real estate.

Yes, buying commercial property has proven to be a smart investment for those who know what to expect. The income potential alone is what draws so many real estate investors to this asset type. Commercial real estate is known to have a higher return on investment when compared to residential properties.

7 Key Steps for Buying a Commercial Real Estate Property Understand your motivations for investing in commercial real estate. Assess your investment options. Secure financing.Find the right property in your market.

Income potential.Commercial properties typically have an annual return off the purchase price between 6% and 12%, depending on the area, current economy, and external factors (such as a pandemic). That's a much higher range than ordinarily exists for single family home properties (1% to 4% at best).