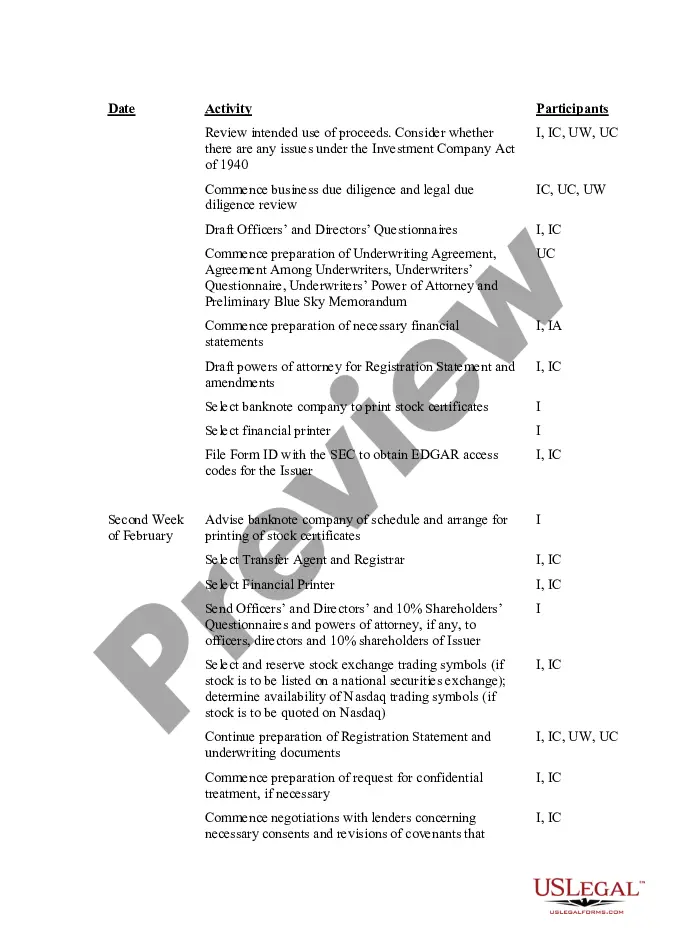

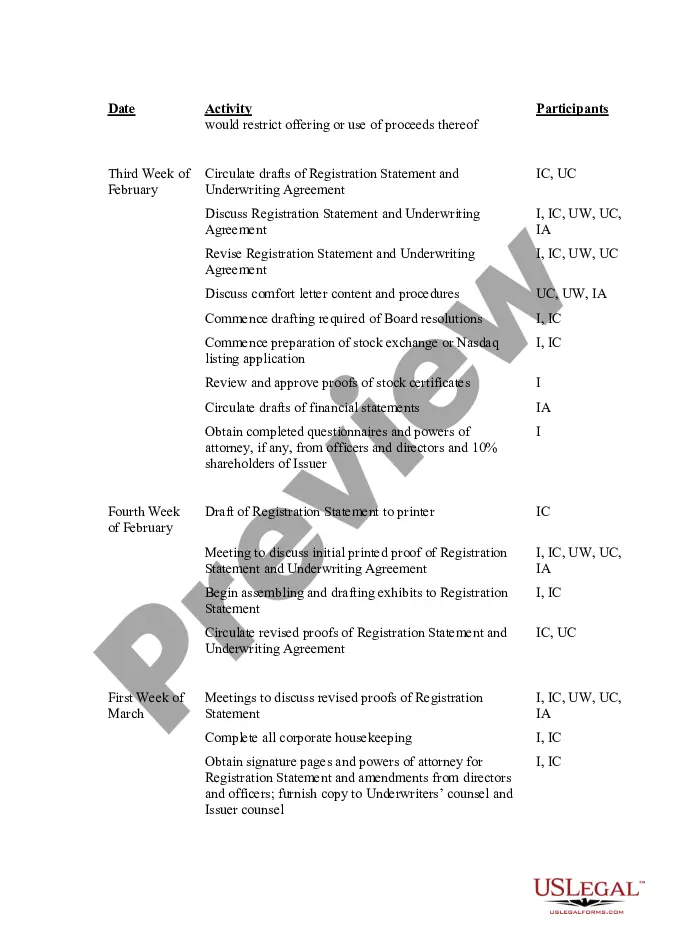

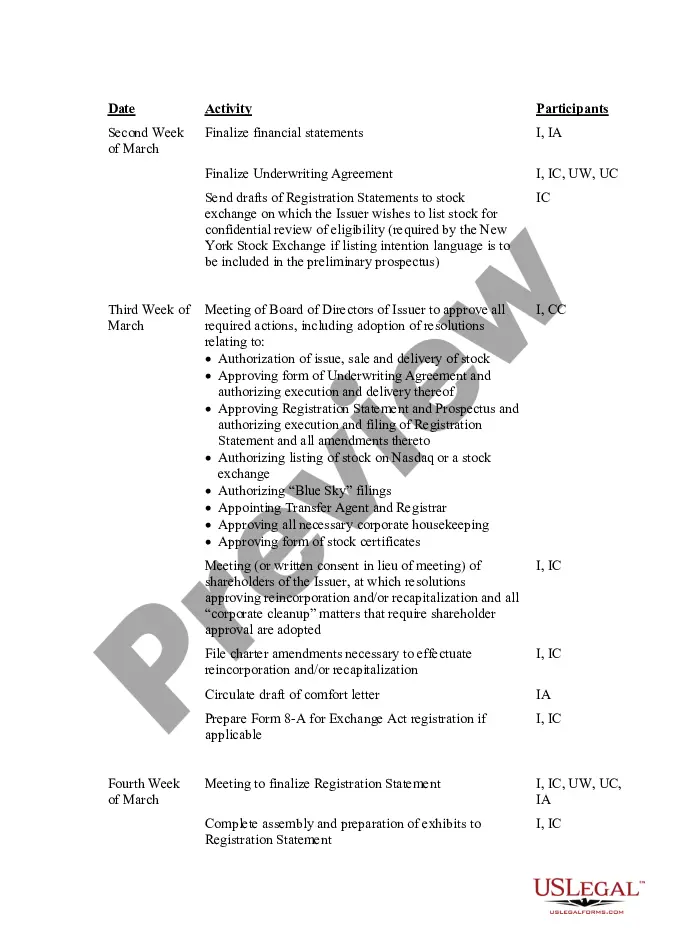

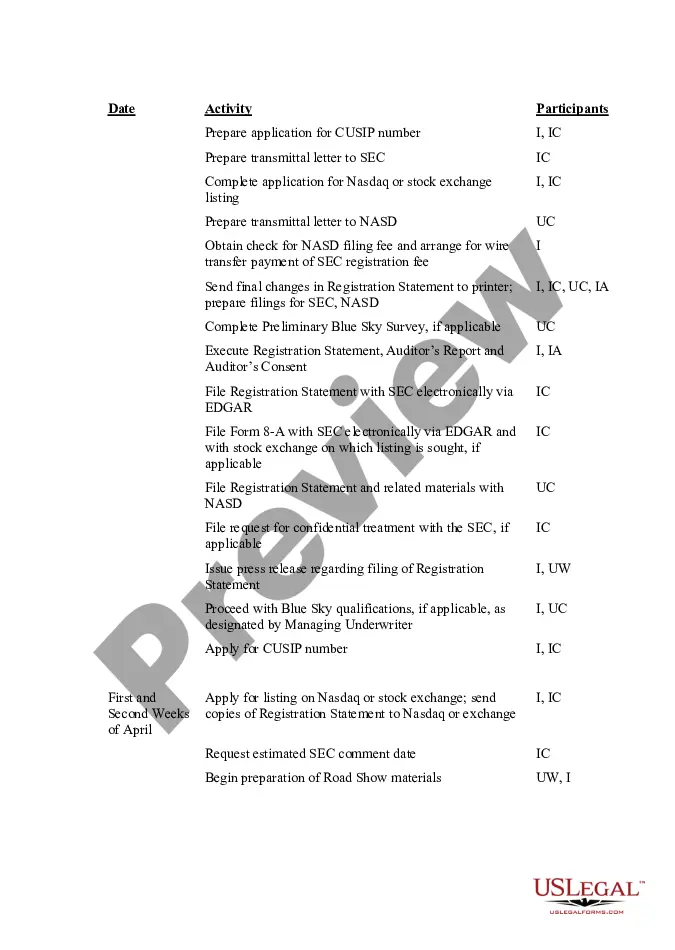

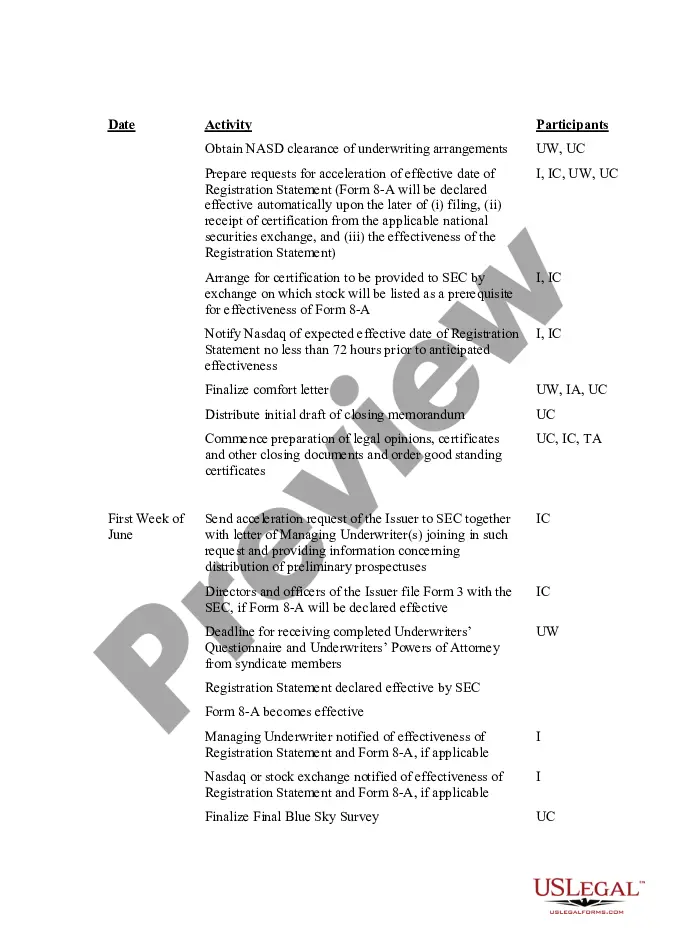

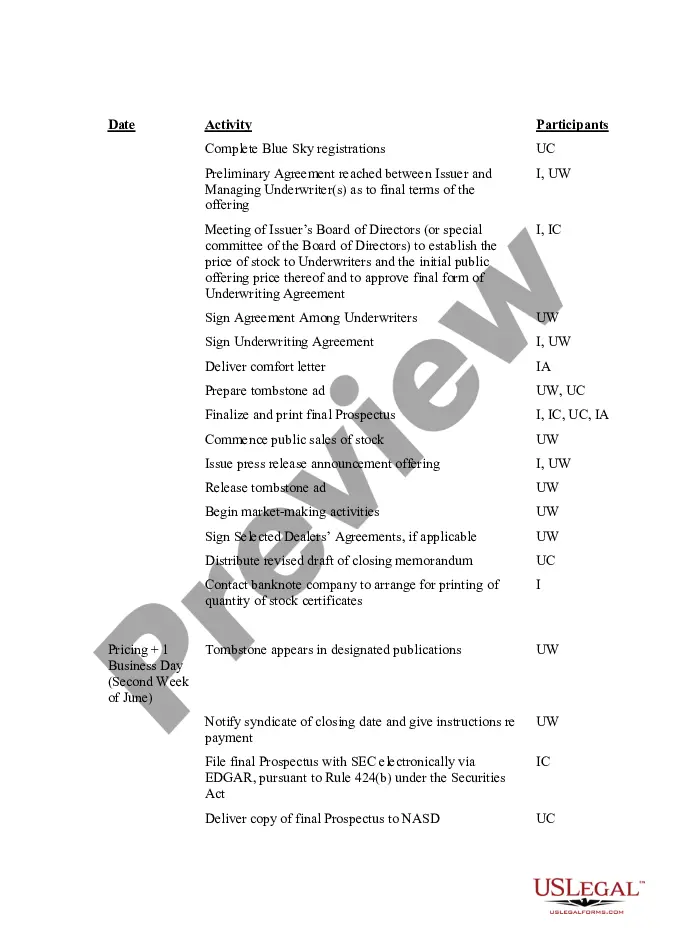

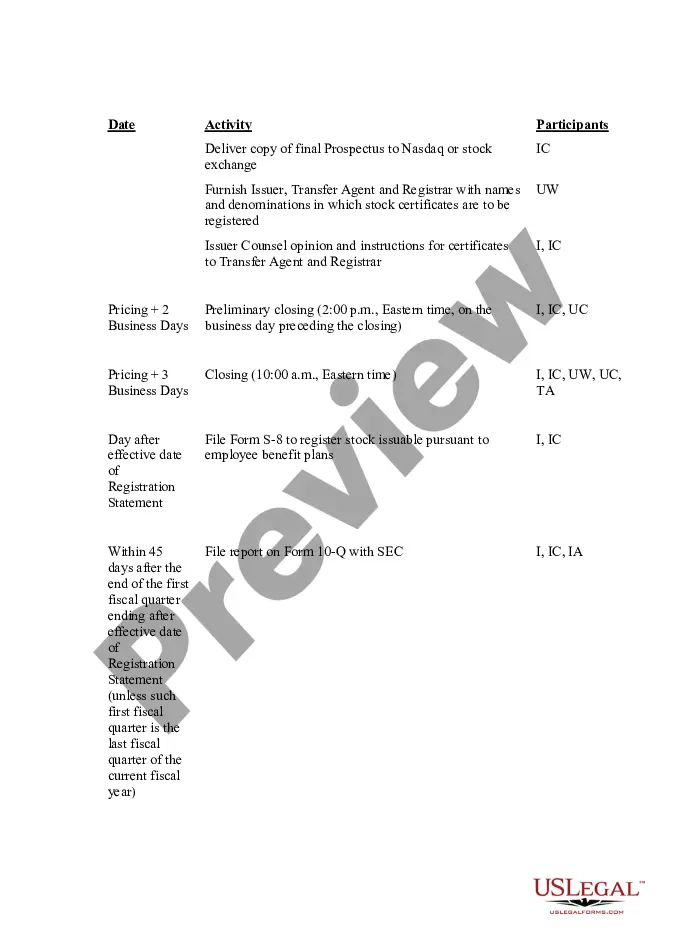

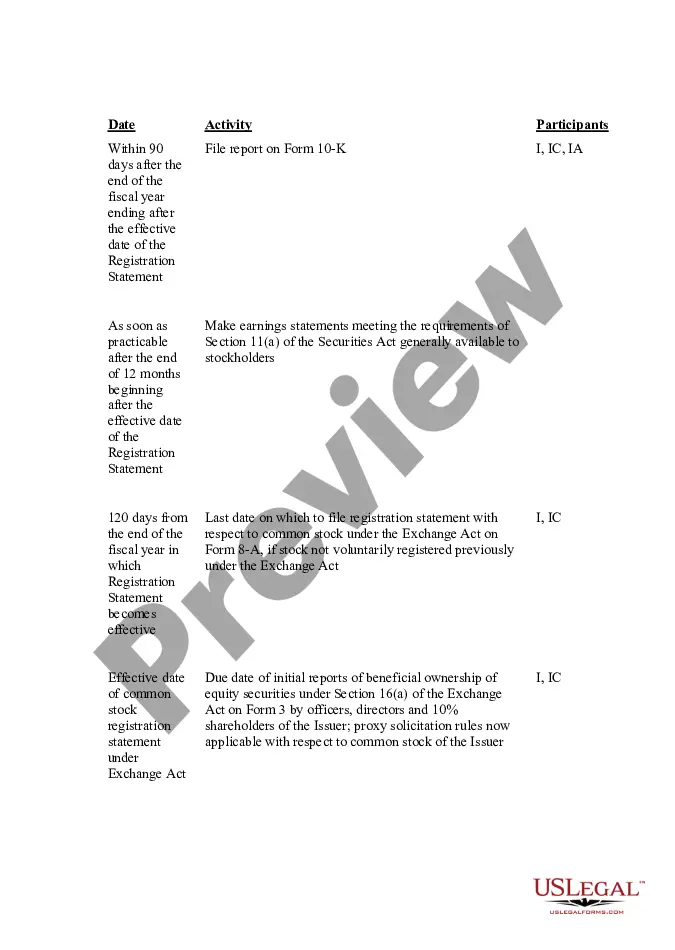

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Texas IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

You can spend several hours on-line looking for the authorized document design which fits the state and federal requirements you want. US Legal Forms gives a large number of authorized varieties that happen to be analyzed by specialists. It is simple to acquire or print the Texas IPO Time and Responsibility Schedule from our services.

If you have a US Legal Forms accounts, you may log in and click the Obtain option. Following that, you may full, edit, print, or indicator the Texas IPO Time and Responsibility Schedule. Every single authorized document design you get is your own property forever. To have one more duplicate of the obtained kind, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website the first time, keep to the simple directions beneath:

- Very first, ensure that you have chosen the right document design for that region/metropolis of your choosing. Read the kind outline to ensure you have selected the appropriate kind. If available, take advantage of the Review option to look through the document design as well.

- If you want to get one more model from the kind, take advantage of the Lookup industry to discover the design that suits you and requirements.

- Once you have found the design you would like, click Buy now to proceed.

- Choose the costs program you would like, type in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the purchase. You can use your credit card or PayPal accounts to purchase the authorized kind.

- Choose the format from the document and acquire it to your product.

- Make changes to your document if possible. You can full, edit and indicator and print Texas IPO Time and Responsibility Schedule.

Obtain and print a large number of document themes while using US Legal Forms Internet site, that provides the largest assortment of authorized varieties. Use expert and state-specific themes to tackle your company or person needs.

Form popularity

FAQ

Companies must meet requirements by exchanges and the Securities and Exchange Commission (SEC) to hold an IPO. IPOs provide companies with an opportunity to obtain capital by offering shares through the primary market. Companies hire investment banks to market, gauge demand, set the IPO price and date, and more.

What Is The Process Of IPO In India Step 1: Hire An Investment Bank. ... Step 2: Prepare Rhp And Register With The Sebi. ... Step 3: Application To Stock Exchange. ... Step 4: Go On A Roadshow. ... Step 5: IPO Is Priced. ... Step 6: Available To The Public. ... Step 7: Going Through With The IPO.

5 Essential Guidelines to IPO for Beginners The primary rule of investing in an IPO is not borrowing funds from anyone because it does not giveguarantee returns. In any case, if you lose it, all your crucial money will be wasted. Also, you will have to bear the interest rate that you have to pay on the borrowed money.

The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance within the Government of India.

These requirements include filing a registration statement, preparing a prospectus and applying to be listed on a stock exchange. An initial step, however, is choosing an investment firm to be the underwriter. The first thing the underwriter will do is have his lawyers to a due diligence on the company.

IPO Process Steps: Step 1: Hiring Of An Underwriter Or Investment Bank. ... Step 2: Registration For IPO. ... Step 3: Verification by SEBI: ... Step 4: Making An Application To The Stock Exchange. ... Step 5: Creating a Buzz By Roadshows. ... Step 6: Pricing of IPO. ... Step 7: Allotment of Shares.

This IPO step involves the preparation of a registration statement along with the draft prospectus, also known as Red Herring Prospectus (RHP). Submission of RHP is mandatory, as per the Companies Act. This document comprises all the compulsory disclosures as per the SEBI and Companies Act.

Investment banks set the IPO price. The company decides how many of its shares it wants to sell to the public and then the nominated investment bank does a valuation of the business. Once that's done, an initial share price is released, and the public can start trading shares when the listing happens.

The company should be at least 3 years old. It should remain a registered business for more than 3 years. The net worth of the company on a consolidated basis for each of the past 3 years should be a minimum ?1 crore. Its net tangible asset value should be around ?3 crore for each of the past 3 full years.

Overview of the IPO Process. This guide will break down the steps involved in the process, which can take anywhere from six months to over a year to complete. Below are the steps a company must undertake to go public via an IPO process: Select a bank.