Pennsylvania Letter to Foreclosure Attorney - Payment Dispute

Description

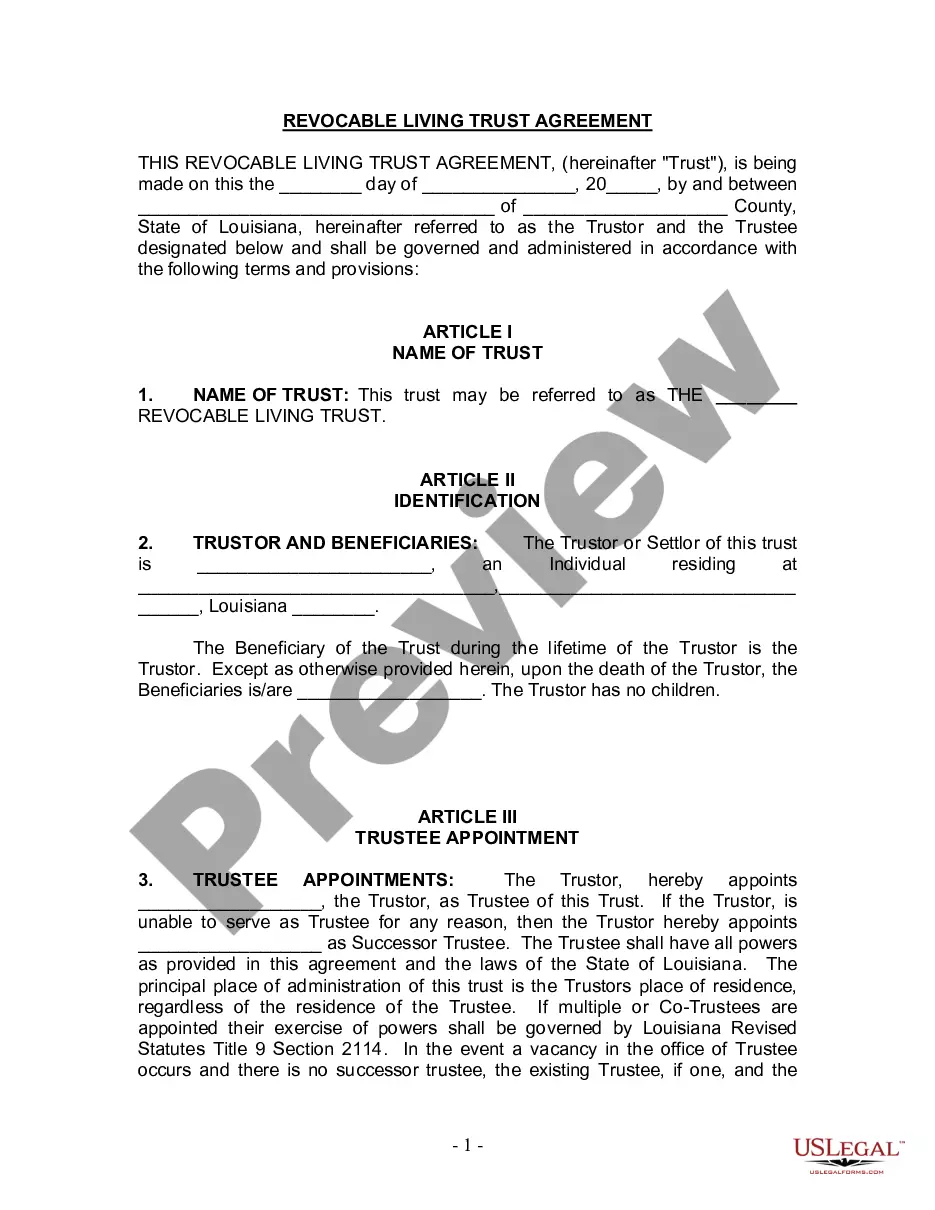

How to fill out Letter To Foreclosure Attorney - Payment Dispute?

Are you currently in a place in which you need to have documents for possibly business or specific purposes virtually every working day? There are a variety of legitimate record web templates available on the Internet, but locating ones you can rely isn`t easy. US Legal Forms offers a large number of kind web templates, much like the Pennsylvania Letter to Foreclosure Attorney - Payment Dispute, which can be composed to satisfy state and federal specifications.

Should you be presently informed about US Legal Forms site and possess a free account, simply log in. Following that, it is possible to download the Pennsylvania Letter to Foreclosure Attorney - Payment Dispute design.

If you do not offer an bank account and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is to the proper city/county.

- Take advantage of the Review option to review the shape.

- Read the information to actually have chosen the proper kind.

- When the kind isn`t what you`re trying to find, utilize the Look for discipline to obtain the kind that suits you and specifications.

- When you get the proper kind, just click Purchase now.

- Choose the prices program you desire, submit the specified information and facts to create your bank account, and buy the transaction with your PayPal or charge card.

- Choose a practical document format and download your copy.

Find all of the record web templates you have bought in the My Forms food list. You may get a extra copy of Pennsylvania Letter to Foreclosure Attorney - Payment Dispute at any time, if required. Just select the required kind to download or print the record design.

Use US Legal Forms, by far the most comprehensive variety of legitimate types, in order to save efforts and prevent errors. The assistance offers appropriately created legitimate record web templates that can be used for a range of purposes. Make a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Key Takeaways. In general, a lender won't begin foreclosure until you've missed four consecutive mortgage payments. Timing can vary from lender to lender as well as on the state of the housing market at the time. Lenders generally prefer to avoid foreclosure because it is costly and time-consuming.

California changed its law at the beginning of the 2023 to require that certain sellers of foreclosed properties containing one to four residential units only accept offers from eligible bidders during the first 30 days after a property is listed.

Some of the consequences include housing and employment issues. Your credit will affect what housing you can qualify for and the interest rates you receive on any future mortgages. That's if you can manage to get approved. Lenders may not lend to you if they know that you previously voluntarily foreclosed.

A foreclosure means that the lender takes control of a property after the borrower misses multiple mortgage payments. This is also referred to as defaulting on the loan. In doing so, the borrower is breaking the mortgage contract they signed with their lender.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Pennsylvania is a judicial foreclosure state, meaning all foreclosures must go through the courts, and lenders must file lawsuits against borrowers to foreclose.

Once you've missed three payments. Your lender will likely send another, more serious notice, known as a ?Demand Letter? or ?Notice to Accelerate.? It's essentially a notice to bring your mortgage current or face foreclosure proceedings. The process and timeline for foreclosure varies from state to state.

When Can a Pennsylvania Foreclosure Start? Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a couple of exceptions.