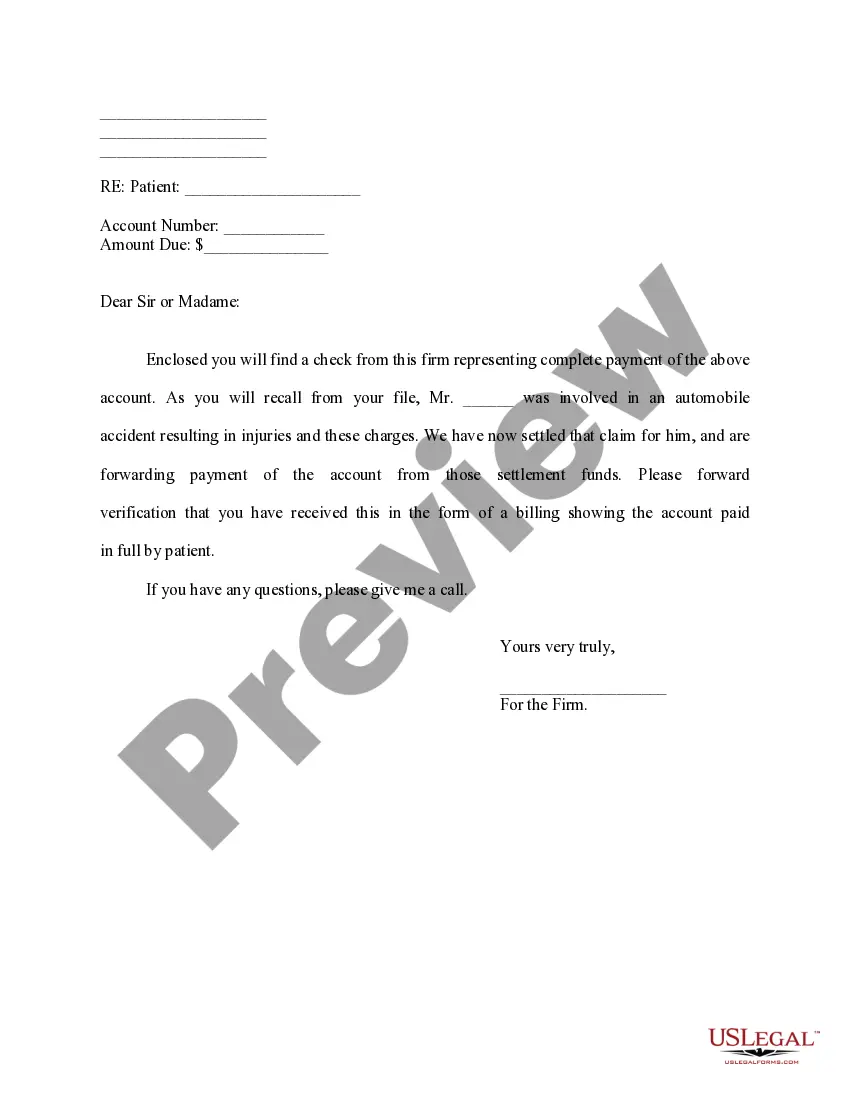

Texas Letter regarding Wage Statement

Description

How to fill out Letter Regarding Wage Statement?

Are you currently inside a position in which you need paperwork for sometimes organization or individual functions nearly every working day? There are plenty of legitimate file layouts available on the net, but finding types you can depend on is not straightforward. US Legal Forms gives a huge number of form layouts, like the Texas Letter regarding Wage Statement, that happen to be created to meet federal and state demands.

In case you are currently acquainted with US Legal Forms site and have your account, just log in. Afterward, you are able to obtain the Texas Letter regarding Wage Statement format.

If you do not have an account and would like to start using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is to the right area/region.

- Use the Preview switch to analyze the shape.

- See the explanation to actually have selected the proper form.

- When the form is not what you are searching for, take advantage of the Search industry to discover the form that fits your needs and demands.

- Whenever you find the right form, just click Get now.

- Opt for the prices prepare you need, submit the required details to create your account, and pay money for the order making use of your PayPal or credit card.

- Choose a handy data file file format and obtain your version.

Get all the file layouts you possess purchased in the My Forms food selection. You can aquire a more version of Texas Letter regarding Wage Statement any time, if possible. Just go through the essential form to obtain or printing the file format.

Use US Legal Forms, by far the most comprehensive collection of legitimate varieties, to conserve time and stay away from blunders. The assistance gives expertly manufactured legitimate file layouts that you can use for a selection of functions. Produce your account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

Reductions in the pay rate are legal, but should never be retroactive (see below). Remember that pay cuts of 20% or more may give an employee good cause connected with the work to quit and qualify for unemployment benefits.

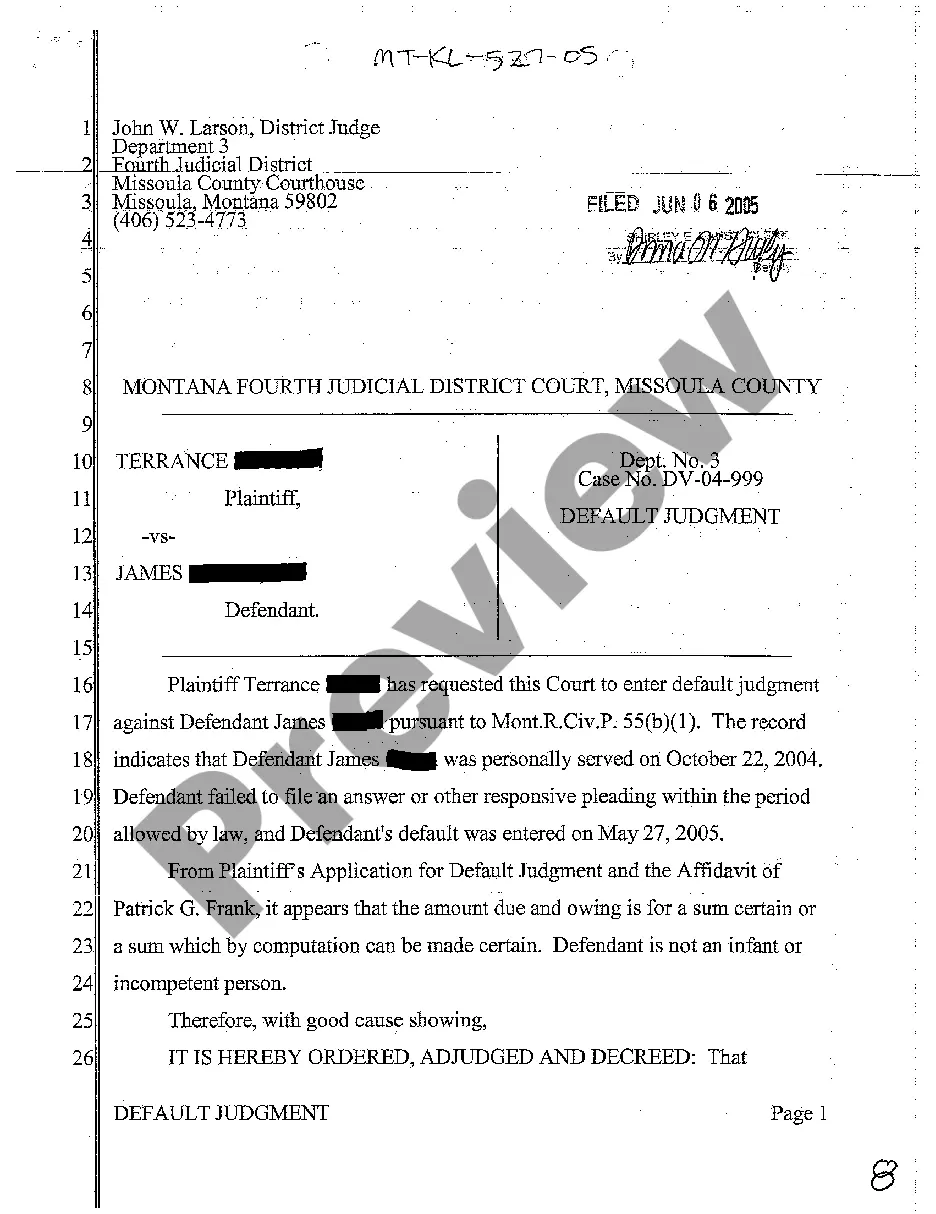

The rate of compensation to which an employee is entitled is based upon his or her average weekly wage as defined in the law. The information in the Employer's Statement of Wage Earnings Form (DWC-3) is necessary to properly calculate the employee's average weekly wage.

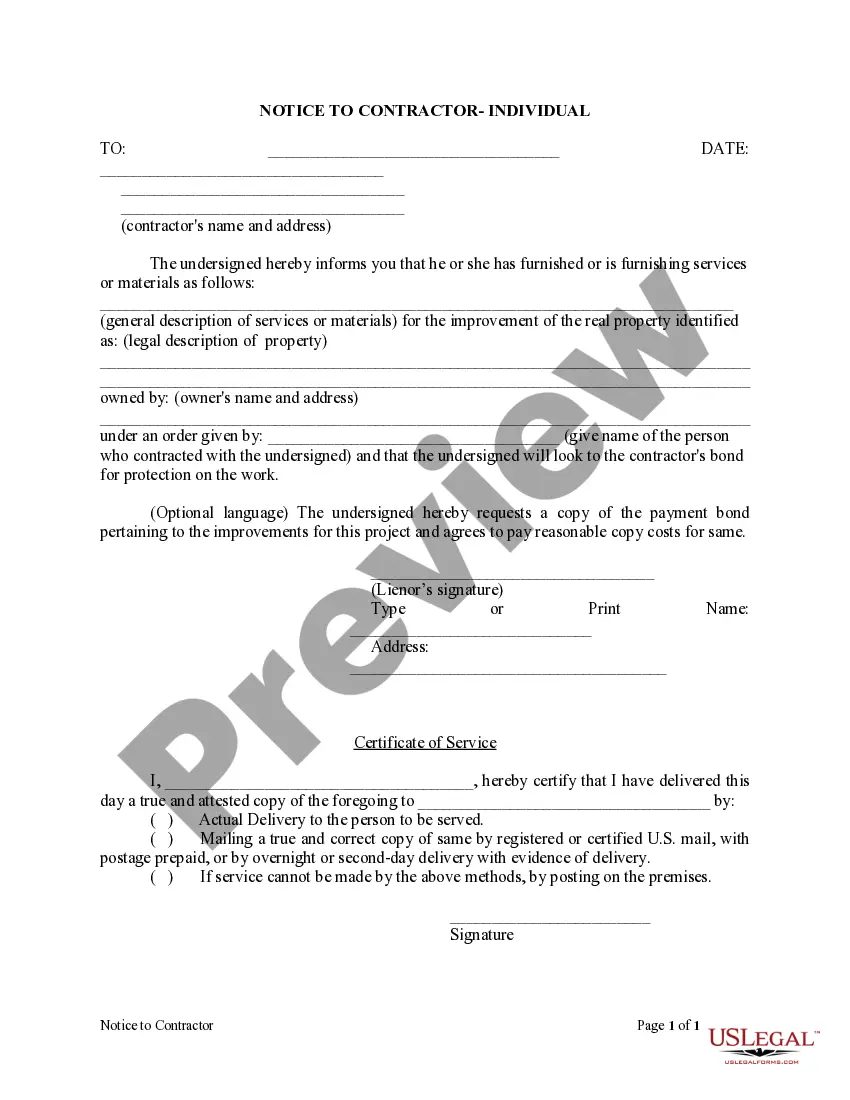

An employer is allowed to deduct certain items from an employee's paycheck if the employee has voluntarily authorized the deduction in writing. Examples of such deductible items are union dues, charitable contributions, or insurance premiums.

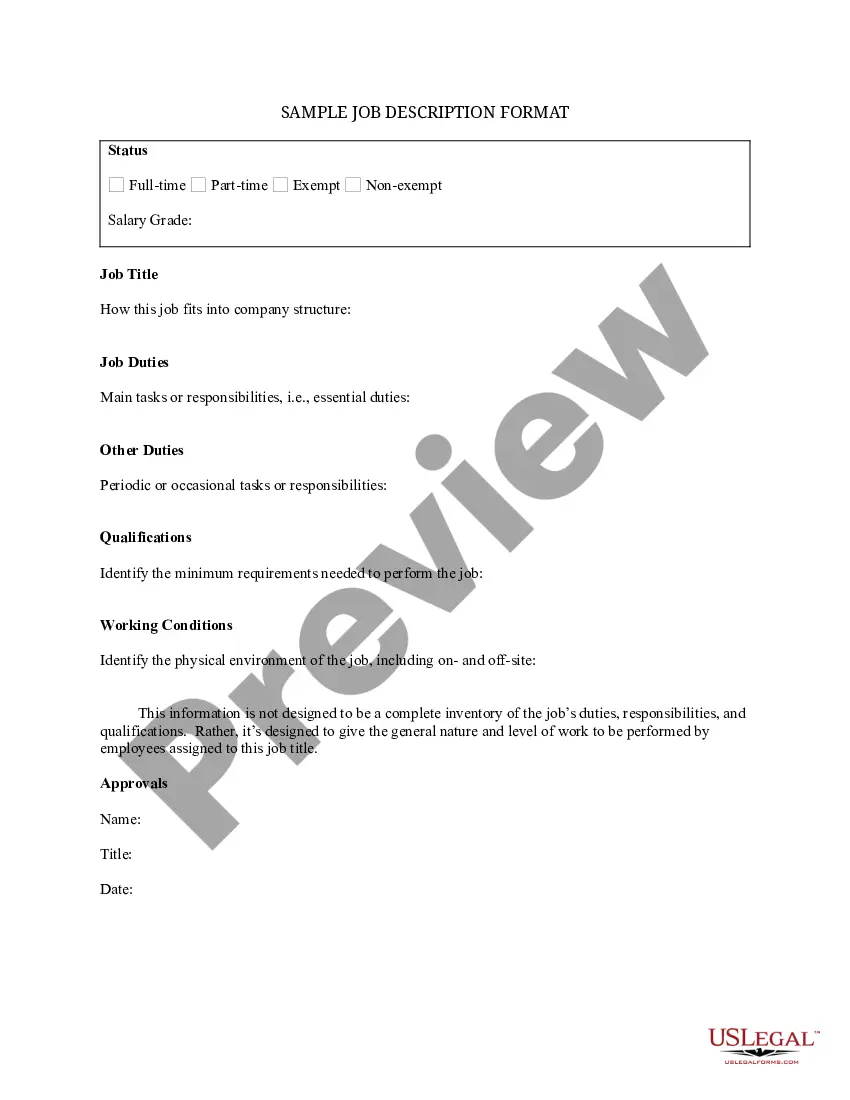

It must show hours and dates worked or pieces completed, payroll deductions, net wages, your name, and the name and address of your employer. The right to be paid for all time spent doing something for your employer, including waiting time, reporting time, cleanup time, and travel time.

Definitions of wage claim. the wage demanded from management for workers by their union representatives. synonyms: pay claim. type of: demand. an urgent or peremptory request.

Under section 61.018 of the Texas Payday Law, all deductions, other than payroll taxes, court-ordered garnishments, and other deductions either required by law or specifically authorized by statute, must be both lawful and specifically authorized in writing by the employee.

After sending in your Back Wage Claim Form, it will take the Wage and Hour Division 6 weeks to process it, and then send you a check for your owed wages.

If an employee believes they are owed wages, they need to file a wage claim within 180 days from the original date the wages were supposed to be paid. If the employer filed for bankruptcy, TWC cannot investigate the claim and the employee may need to file directly with the Bankruptcy Court.

Workers in California have the right to file a wage claim when their employers do not pay them the wages or benefits they are owed. A wage claim starts the process to collect on those unpaid wages or benefits. California's labor laws protect all workers, regardless of immigration status.

Call 800-832-9243, 512-475-2670, or TDD 800-735-2989 (hearing impaired) if you need assistance. breakdown of the days and hours of work or complete the Wage Claim Form Attachment. If your address or phone number changes, it is your responsibility to notify the Wage and Hour Department in writing immediately.