Montana Woodworking Services Contract - Self-Employed

Description

How to fill out Woodworking Services Contract - Self-Employed?

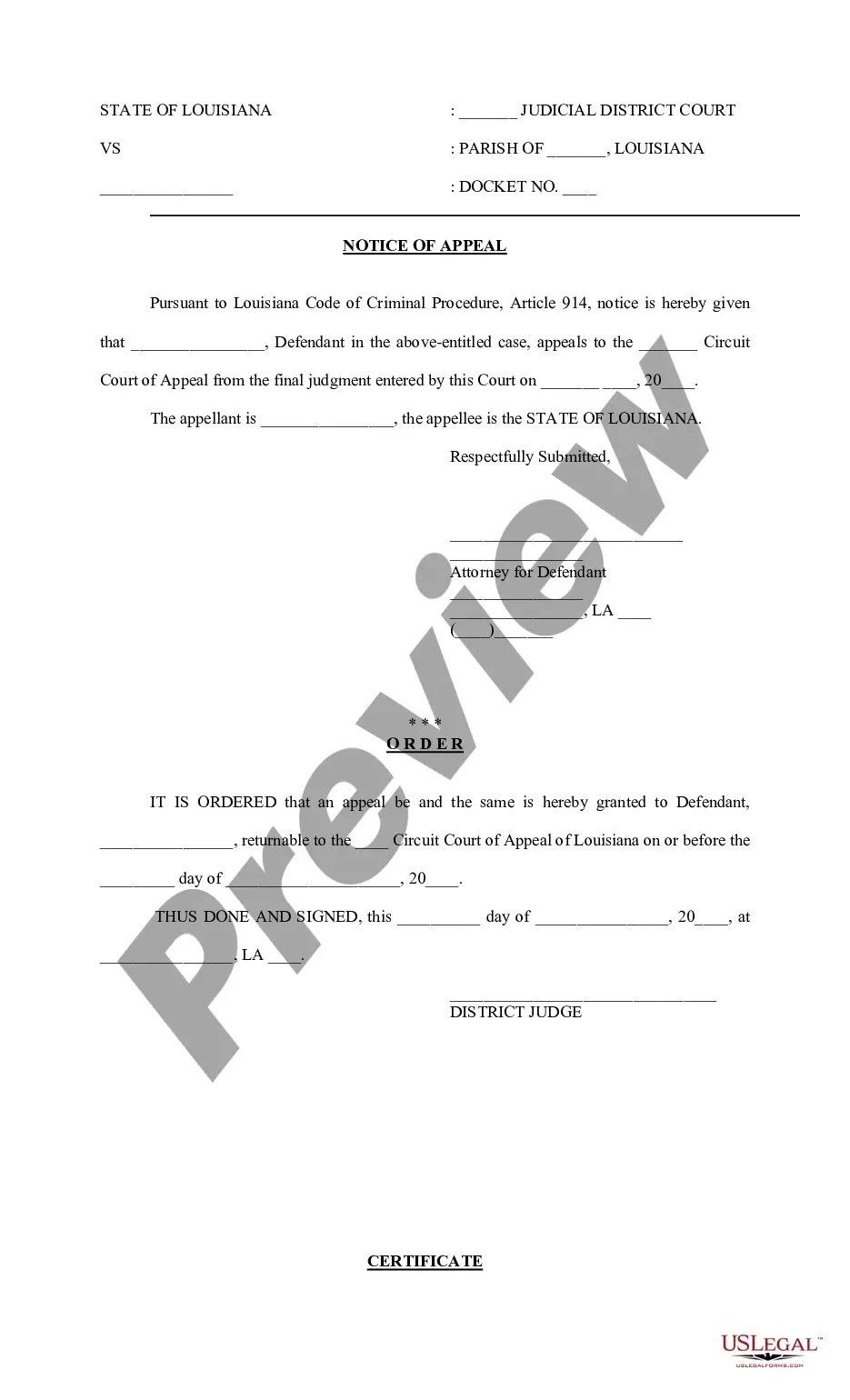

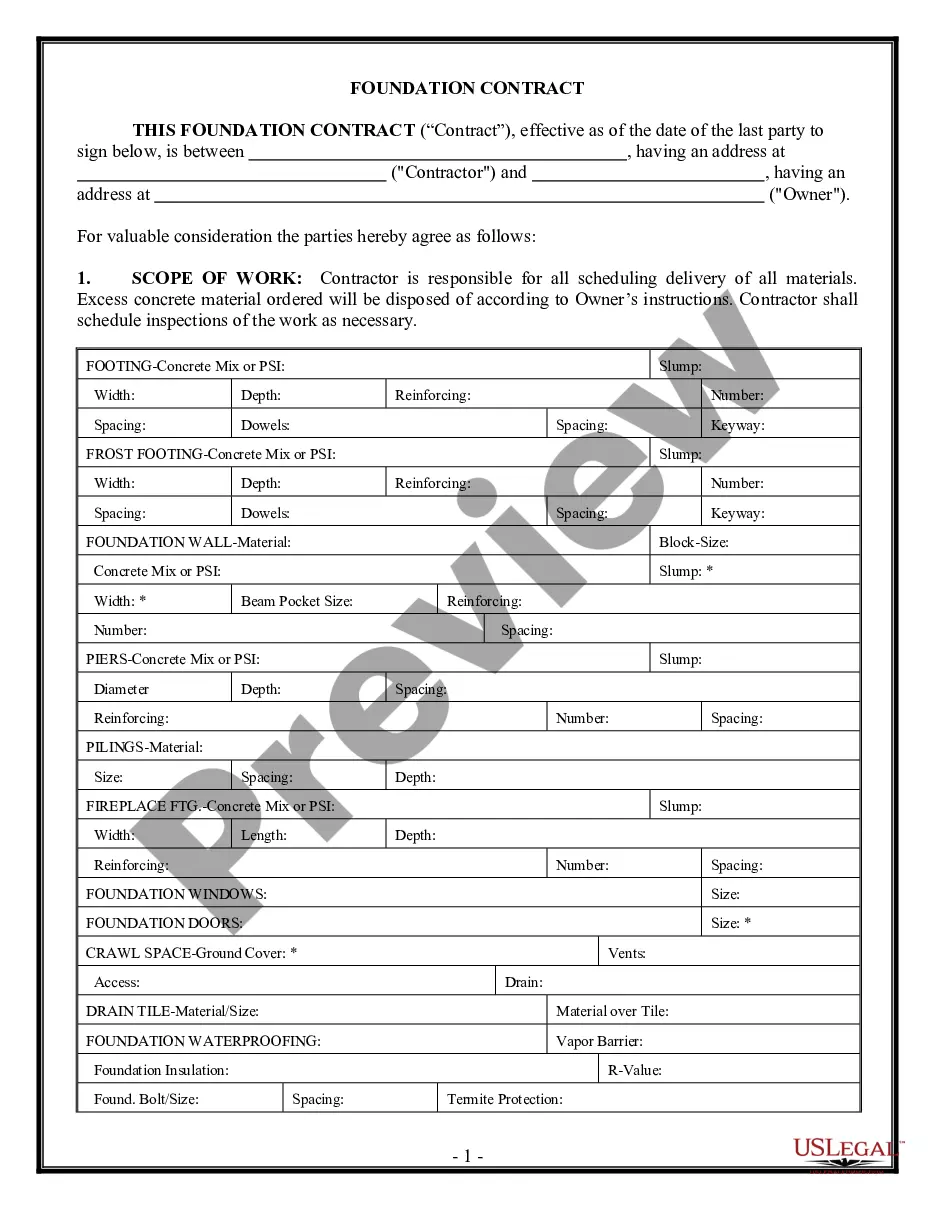

Selecting the appropriate legal document template can be quite a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Montana Woodworking Services Contract - Self-Employed, which you can utilize for business and personal purposes. All of the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to locate the Montana Woodworking Services Contract - Self-Employed. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure you have chosen the correct form for your area/region. You can review the document using the Review button and read the form summary to confirm this is suitable for you. If the form does not meet your requirements, use the Search area to find the right form. Once you are confident that the form is accurate, click the Get now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the received Montana Woodworking Services Contract - Self-Employed.

The US Legal Forms platform is an essential resource for accessing a vast array of legal templates tailored to your needs.

- US Legal Forms is the largest library of legal forms where you can find a multitude of document templates.

- Utilize the service to download professionally crafted documents that adhere to state regulations.

- Explore a wide range of templates catered to different legal needs.

- Access forms for various states and legal matters with ease.

- Benefit from expert verification ensuring compliance with legal standards.

- Enjoy a user-friendly interface for a seamless document retrieval experience.

Form popularity

FAQ

To become an independent contractor in Montana, you first need to understand the requirements for self-employment. You'll need to register your business and obtain any necessary licenses or permits relevant to your field. Additionally, consider creating a Montana Woodworking Services Contract - Self-Employed, as this document will define your relationship with clients and outline the specifics of your projects. By using resources like uSlegalforms, you can easily access templates and guidance to ensure you meet all legal obligations.

To write a contract for a 1099 employee, you'll need to detail the nature of the work, compensation rates, and the timeline for deliverables. Incorporate clauses that clarify responsibilities and how disputes will be resolved. Using an established template, such as the Montana Woodworking Services Contract - Self-Employed from US Legal Forms, can help you ensure that your contract is solid and legally valid.

Filling out an independent contractor agreement involves inputting specific information about the services provided, compensation, and confidentiality clauses. Additionally, make sure to clarify deadlines and any provisions related to termination. You can use the Montana Woodworking Services Contract - Self-Employed from US Legal Forms as a helpful reference for completing this document properly.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. Be sure to include essential elements like the names of parties involved, terms of the agreement, and signatures. For assistance, consider using templates from US Legal Forms, like the Montana Woodworking Services Contract - Self-Employed, which can simplify this process and help ensure compliance.

To show proof of self-employment, you can present tax documents, business licenses, and financial statements that detail your income. Additionally, contracts, such as the Montana Woodworking Services Contract - Self-Employed, may also serve as verification of your work arrangements. Always keep your records organized to demonstrate your self-employed status.

Writing a self-employed contract involves outlining the responsibilities and expectations of both parties. Ensure you specify payment rates and any conditions related to project completion. Resources like US Legal Forms offer customizable options, including the Montana Woodworking Services Contract - Self-Employed, to help you create an effective document.

To write a self-employment contract, start by clearly defining the scope of work and the services you will provide. Include details like payment terms, deadlines, and requirements for both parties. Using a template can streamline this process, and you can find reliable ones like the Montana Woodworking Services Contract - Self-Employed on platforms such as US Legal Forms.

To establish yourself as an independent contractor in Montana, first, create a solid network of potential clients and collaborators. Next, build a professional portfolio showcasing your work. Implementing a Montana Woodworking Services Contract - Self-Employed helps you present a professional image while clarifying your services and payment terms to clients.

In Montana, a contractor license is typically required for general contractors. However, for specific woodworking jobs, licensing may vary based on project scope. It’s crucial to verify whether your work falls under licensing requirements and consider a Montana Woodworking Services Contract - Self-Employed for clarity on your services.

Legal requirements for independent contractors in Montana include registering your business and adhering to tax obligations. You must follow local regulations regarding safety and zoning. Utilizing a Montana Woodworking Services Contract - Self-Employed can help you comply with these requirements while outlining the scope of your work and protecting both you and your clients.