Missouri Woodworking Services Contract - Self-Employed

Description

How to fill out Woodworking Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of official templates in the United States - offers a variety of legal document templates you can obtain or create.

By using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Missouri Woodworking Services Contract - Self-Employed in moments.

If you have a subscription, Log In and download the Missouri Woodworking Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Missouri Woodworking Services Contract - Self-Employed. Each template you added to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, just go to the My documents section and click on the form you need. Access the Missouri Woodworking Services Contract - Self-Employed with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

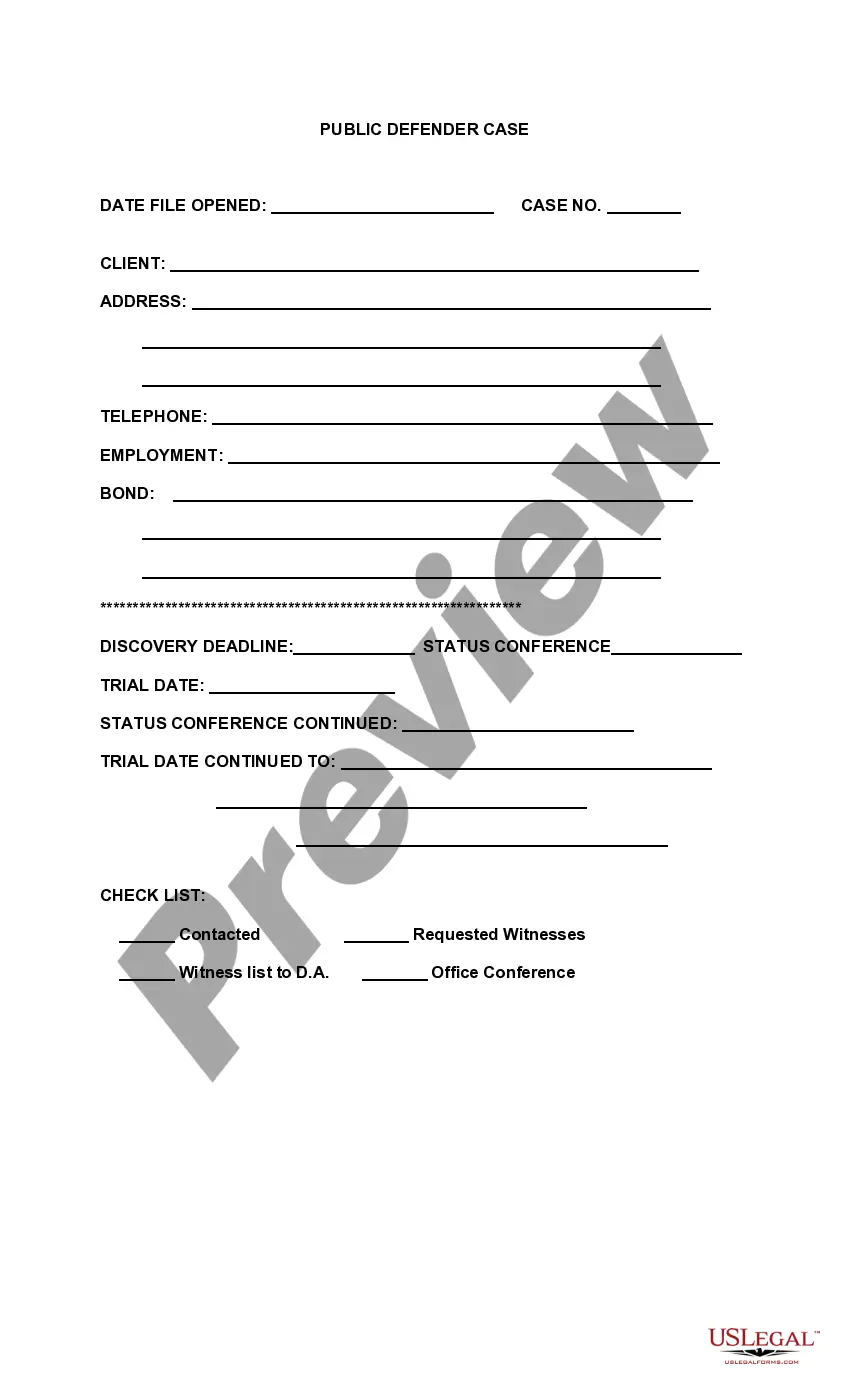

- Click the Preview button to review the form's content.

- Check the form summary to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Download now button.

- Then, choose the payment plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Filing taxes as an independent contractor requires understanding your income and expenses clearly. You'll need to report your earnings on Schedule C of your federal tax return. Remember to keep thorough records of all business-related expenses, as they can be deducted. Using a Missouri Woodworking Services Contract - Self-Employed can help clarify your income sources and simplify your tax filing process.

Yes, you generally need a business license to sell crafts in Missouri. Depending on your location and the type of crafts you sell, additional permits may be necessary as well. An important step is to check with your local city or county government for specific requirements. Additionally, establishing a Missouri Woodworking Services Contract - Self-Employed can help you formalize your business and ensure compliance.

Filling out an independent contractor agreement requires you to provide specific details about the work, payment agreement, and timelines. Be sure to tailor your agreement to fit your Missouri Woodworking Services Contract - Self-Employed needs. Additional information should include the parties' contact information and signatures for validation. Tools like US Legal Forms offer templates that simplify this process.

While Missouri does not legally require LLCs to have an operating agreement, having one is highly recommended. An operating agreement outlines the management structure and operational procedures of your LLC—important for clarity, especially if you offer Missouri Woodworking Services Contract - Self-Employed. This document can prevent future disputes among members.

To show proof of self-employment, you can provide tax documentation, such as a 1099 form, and business licenses relevant to your trade. Organizing invoices and client contracts, like the Missouri Woodworking Services Contract - Self-Employed, can also support your status. Maintaining detailed records ensures you have adequate proof in case it's needed.

Writing a self-employment contract involves defining the nature of the work, payment structure, and timelines. Be specific about the terms to align with a Missouri Woodworking Services Contract - Self-Employed. Also, include clauses regarding modifications and dispute resolution. Platforms like US Legal Forms can guide you through creating a comprehensive contract.

To write a self-employed contract, begin by detailing the services you will provide, payment terms, and schedule. Make sure your Missouri Woodworking Services Contract - Self-Employed includes confidentiality clauses and intellectual property terms if applicable. By outlining these aspects clearly, you protect yourself and your client. Consider using resources from US Legal Forms to help you draft a professional contract.

Yes, you can write your own legally binding contract. It's essential, however, to include necessary elements such as offer, acceptance, and consideration. For a Missouri Woodworking Services Contract - Self-Employed, clarity and specificity will strengthen the agreement. Using tools from US Legal Forms can ensure your contract meets legal requirements.

To write a contract for a 1099 employee, start by clearly defining the scope of work, payment terms, and deadlines. Incorporate details relevant to the Missouri Woodworking Services Contract - Self-Employed, ensuring compliance with state laws. Make sure to include a termination clause for both parties. Consider using a platform like US Legal Forms to access templates and streamline the process.