Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering

Description

How to fill out Form - Stock Purchase Agreement For Strategic Investment Made At Time Of Initial Public Offering?

US Legal Forms - one of many biggest libraries of authorized forms in America - offers a variety of authorized record templates you are able to down load or produce. Utilizing the internet site, you may get 1000s of forms for enterprise and personal functions, categorized by types, claims, or keywords and phrases.You can get the most recent models of forms like the Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering in seconds.

If you currently have a registration, log in and down load Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering from your US Legal Forms library. The Obtain button will show up on every single type you perspective. You have accessibility to all earlier downloaded forms within the My Forms tab of your profile.

In order to use US Legal Forms for the first time, allow me to share basic directions to help you started out:

- Ensure you have picked out the proper type for your town/county. Click on the Preview button to analyze the form`s content material. See the type information to ensure that you have chosen the proper type.

- When the type does not satisfy your requirements, utilize the Research discipline near the top of the display screen to get the one that does.

- When you are content with the shape, verify your option by simply clicking the Acquire now button. Then, choose the rates strategy you favor and give your credentials to register to have an profile.

- Approach the transaction. Use your Visa or Mastercard or PayPal profile to complete the transaction.

- Find the formatting and down load the shape on your own system.

- Make adjustments. Fill up, change and produce and indication the downloaded Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering.

Each and every web template you added to your account does not have an expiration day and it is your own property eternally. So, if you would like down load or produce yet another version, just proceed to the My Forms section and click around the type you require.

Gain access to the Texas Form - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public Offering with US Legal Forms, the most extensive library of authorized record templates. Use 1000s of specialist and express-particular templates that meet your organization or personal needs and requirements.

Form popularity

FAQ

Most stock purchase agreements do not require notarization, and a simple acknowledgment of the willful desire to enter into a contract is usually sufficient.

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

Here are 11 things to include in a stock purchase agreement. Buyer and Seller Information. The stock purchase agreement opens with an introduction of the buyer and seller. ... Transaction Date and Time. ... Value of Shares. ... Number of Shares Being Sold. ... Representations and Warranties. ... Payment Terms. ... Due Diligence. ... Indemnification.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount.

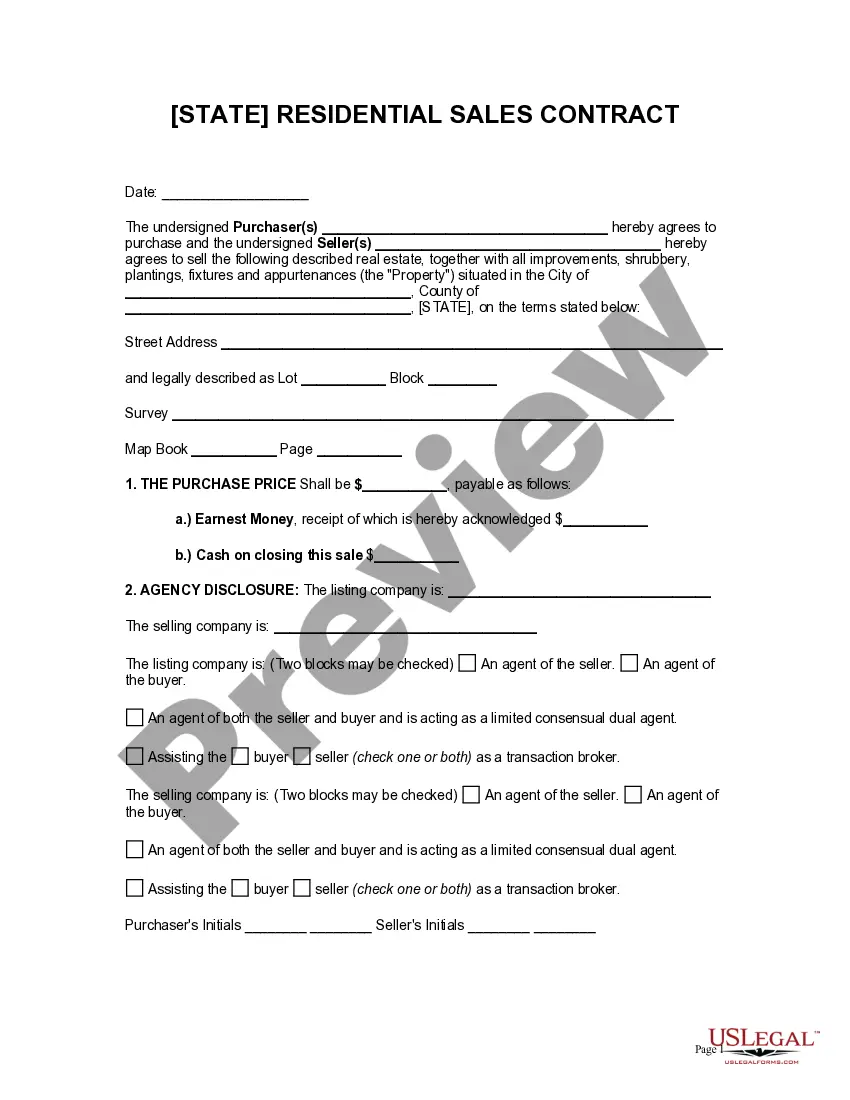

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.