Texas Term Mineral Deed of Undivided Interest

Description

How to fill out Term Mineral Deed Of Undivided Interest?

Are you currently within a place in which you will need paperwork for either business or person functions virtually every day time? There are a lot of legal file templates available on the net, but finding versions you can rely is not easy. US Legal Forms delivers a huge number of kind templates, much like the Texas Term Mineral Deed of Undivided Interest, that are written to fulfill federal and state needs.

In case you are presently knowledgeable about US Legal Forms website and possess your account, just log in. Afterward, you may acquire the Texas Term Mineral Deed of Undivided Interest format.

Unless you have an account and would like to start using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for your right metropolis/region.

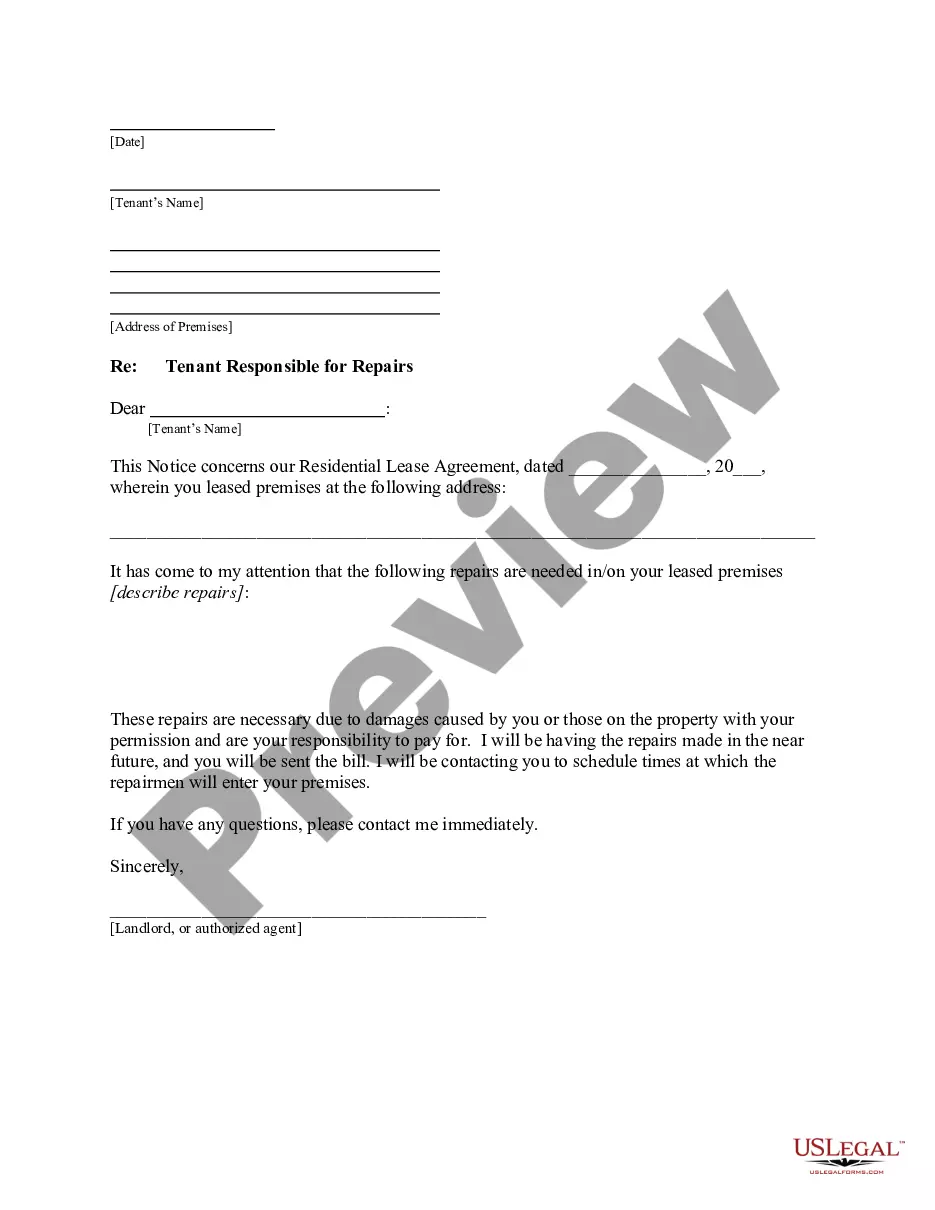

- Utilize the Preview switch to check the form.

- Look at the information to ensure that you have chosen the right kind.

- In the event the kind is not what you`re looking for, use the Research field to get the kind that fits your needs and needs.

- If you discover the right kind, just click Get now.

- Pick the prices prepare you would like, fill out the desired information and facts to produce your money, and buy the transaction using your PayPal or Visa or Mastercard.

- Pick a practical paper file format and acquire your duplicate.

Discover each of the file templates you may have purchased in the My Forms menu. You may get a additional duplicate of Texas Term Mineral Deed of Undivided Interest any time, if needed. Just go through the required kind to acquire or printing the file format.

Use US Legal Forms, probably the most considerable variety of legal forms, to conserve time and stay away from blunders. The service delivers appropriately made legal file templates which can be used for a variety of functions. Produce your account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

You will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

Are Mineral Rights and Royalties Taxable? Any income you earn from the sale or lease of your land's mineral rights is taxable. Income, severance and ad valorem taxes are some of the taxes you might need to pay. Each type comes from a different entity.

After a death, assets like mineral rights often go through probate, which is a legal process to authenticate a will and distribute assets ing to it. If no will exists, probate helps determine how assets should be divided.

Owning a property's ?mineral rights? refers to ownership of the mineral deposits under the surface of a piece of land. The rights to the minerals usually belong to the owner of the surface property, or surface estate. In Texas, though, those rights can be transferred to another party.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.