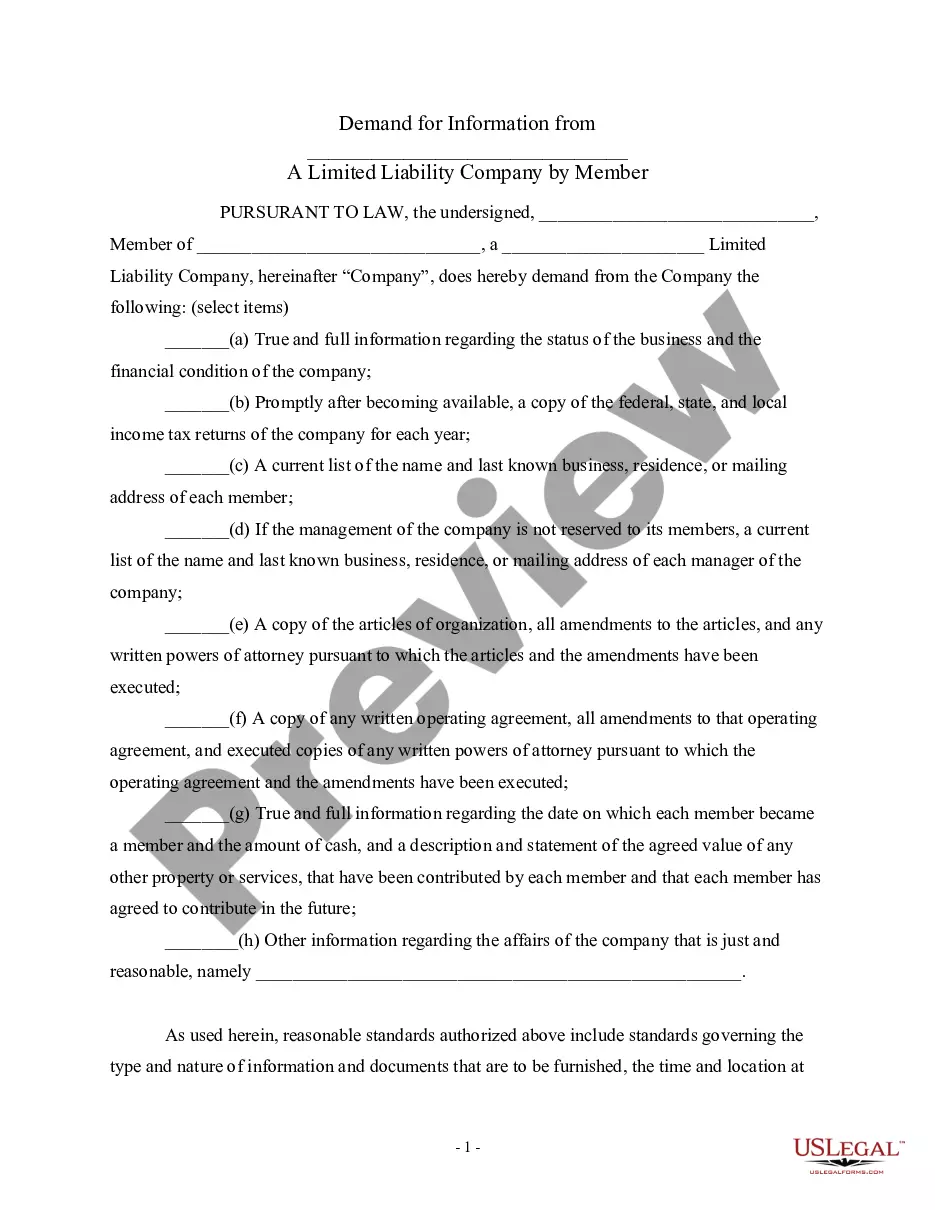

Texas Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

How to fill out Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

If you need to complete, download, or produce authorized papers layouts, use US Legal Forms, the largest assortment of authorized varieties, which can be found on the web. Utilize the site`s simple and easy handy lookup to obtain the documents you require. Various layouts for business and personal functions are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Texas Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. within a number of click throughs.

When you are already a US Legal Forms consumer, log in to the account and click the Obtain button to obtain the Texas Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.. Also you can entry varieties you formerly saved inside the My Forms tab of your account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have selected the form for the right metropolis/country.

- Step 2. Take advantage of the Review method to look over the form`s content. Don`t forget about to see the information.

- Step 3. When you are not satisfied with the form, use the Look for discipline on top of the display screen to locate other types of your authorized form template.

- Step 4. Once you have discovered the form you require, go through the Buy now button. Select the prices plan you choose and include your accreditations to register for the account.

- Step 5. Process the purchase. You can utilize your credit card or PayPal account to finish the purchase.

- Step 6. Select the formatting of your authorized form and download it on the device.

- Step 7. Complete, modify and produce or sign the Texas Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc..

Each and every authorized papers template you buy is your own property eternally. You have acces to every single form you saved within your acccount. Click the My Forms segment and choose a form to produce or download once again.

Contend and download, and produce the Texas Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. with US Legal Forms. There are thousands of professional and status-distinct varieties you may use for your business or personal needs.

Form popularity

FAQ

Entities Not Subject to Franchise Tax sole proprietorships (except for single member LLCs); general partnerships when direct ownership is composed entirely of natural persons (except for limited liability partnerships);

Start a Texas LLC in 5 Steps Name Your LLC. You need to name your business. ... Hire a Registered Agent. ... File the Texas Certificate of Formation?Limited Liability Company. ... Obtain a Texas LLC Employer Identification Number (EIN) ... Create an LLC Operating Agreement.

Each taxable entity that is legally formed as a corporation, limited liability company, professional association, limited partnership or financial institution files a public information report (PIR). Associations, trusts and all other taxable entities file the OIR.

Each year an LLC is required to file the annual report and pay a filing fee.

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

Texas LLC Filing Requirements For example, Texas single member LLCs do not need to file an annual report. You will be required, however, to submit an annual franchise tax report. In general, single member LLCs are pass-through entities, which means the organization itself does not pay taxes.

Annual report and franchise tax. Texas requires LLCs to file a Franchise Tax and Public Information Report with the Comptroller of Public Accounts. The report is due between January 1 and May 15.