Texas Demand for Indemnity from a Limited Liability Company LLC by Member

Description

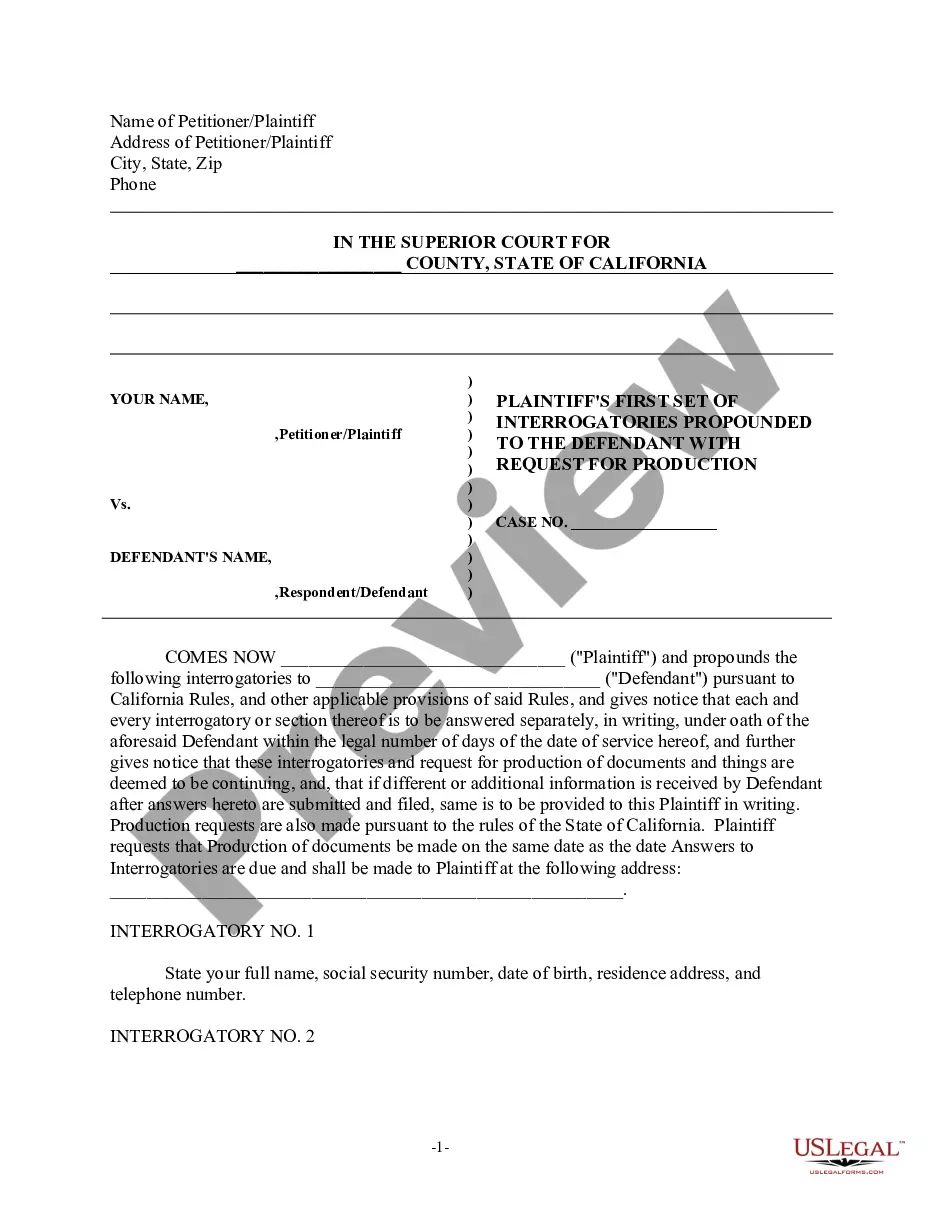

How to fill out Demand For Indemnity From A Limited Liability Company LLC By Member?

If you need to total, download, or print out authorized papers web templates, use US Legal Forms, the most important variety of authorized types, which can be found on the web. Make use of the site`s basic and hassle-free search to get the paperwork you require. Different web templates for enterprise and personal purposes are sorted by classes and states, or key phrases. Use US Legal Forms to get the Texas Demand for Indemnity from a Limited Liability Company LLC by Member within a handful of mouse clicks.

If you are currently a US Legal Forms buyer, log in in your bank account and then click the Download switch to have the Texas Demand for Indemnity from a Limited Liability Company LLC by Member. You can also access types you earlier saved from the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the correct area/nation.

- Step 2. Take advantage of the Preview method to look through the form`s content material. Never forget about to read through the explanation.

- Step 3. If you are not happy with all the form, use the Look for industry at the top of the display to get other versions of the authorized form design.

- Step 4. When you have located the shape you require, select the Buy now switch. Select the pricing strategy you like and put your credentials to sign up to have an bank account.

- Step 5. Method the purchase. You may use your charge card or PayPal bank account to complete the purchase.

- Step 6. Select the format of the authorized form and download it in your system.

- Step 7. Full, change and print out or sign the Texas Demand for Indemnity from a Limited Liability Company LLC by Member.

Each authorized papers design you buy is your own permanently. You may have acces to each and every form you saved within your acccount. Select the My Forms section and select a form to print out or download again.

Be competitive and download, and print out the Texas Demand for Indemnity from a Limited Liability Company LLC by Member with US Legal Forms. There are millions of professional and status-distinct types you may use for your personal enterprise or personal needs.

Form popularity

FAQ

A limited liability company, or LLC, is a business entity that is formed under state law that combines characteristics of a corporation and a partnership. They are similar to corporations in that an LLC's members are not liable for the debts of the business, provided that certain formalities are observed.

Indemnification: An LLC manager may have financial protection against expenses and liabilities that may be incurred in defending themselves against claims based on their conduct. This is known as indemnification and some state LLC statutes require or permit the company to provide reimbursement. LLC Members vs. LLC Managers - How They Differ | BizFilings wolterskluwer.com ? expert-insights ? llc-m... wolterskluwer.com ? expert-insights ? llc-m...

The Benefits of Forming an LLC in Texas Tax Advantages. One major benefit associated is that you can take advantage of certain tax benefits for an LLC in Texas that are not available to other entities such as sole proprietorships or partnerships. ... Asset Protection. ... Flexible Management Structures.

The indemnity clause provided that the LLC's manager ?shall not be liable for and shall be indemnified and held harmless ? from any loss or damage incurred ? in connection with the business of the Company, including costs and attorneys' fees ?

Both corporations and LLCs authorize, and sometimes mandate, indemnification of agents but allow the entity to craft the indemnification terms. Indemnification encourages people to take on the responsibilities and risks of serving as decision makers for an entity.

Section 101.206 - Prohibited Distribution; Duty to Return (a) Unless the distribution is made in compliance with Chapter 11, a limited liability company may not make a distribution to a member of the company if, immediately after making the distribution, the company's total liabilities, other than liabilities described ...

The indemnification clause is a crucial element in commercial contracts as it helps mitigate the risks and consequences associated with potential breaches of contracts. This clause also ensures that the parties are fairly compensated for their losses and helps maintain a stable and predictable business relationship. The Indemnification Clause in Commercial Contracts - Ironclad Ironclad ? Contracts and clauses Ironclad ? Contracts and clauses

A Limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the business debts and liabilities.

For the most part, LLC and Ltd. are the same type of company. LLC (limited liability company) is more commonly used in the U.S. whereas Ltd. (limited) is more commonly used in the U.K. The differences in types and jurisdictions stipulate the different rules regarding ownership, taxes, and dividends.

LLCs are owned by members and managed by members, managers, or both. An LP is a partnership of one or more limited partners and one or more general partners.