Texas Acoustical Contractor Agreement - Self-Employed

Description

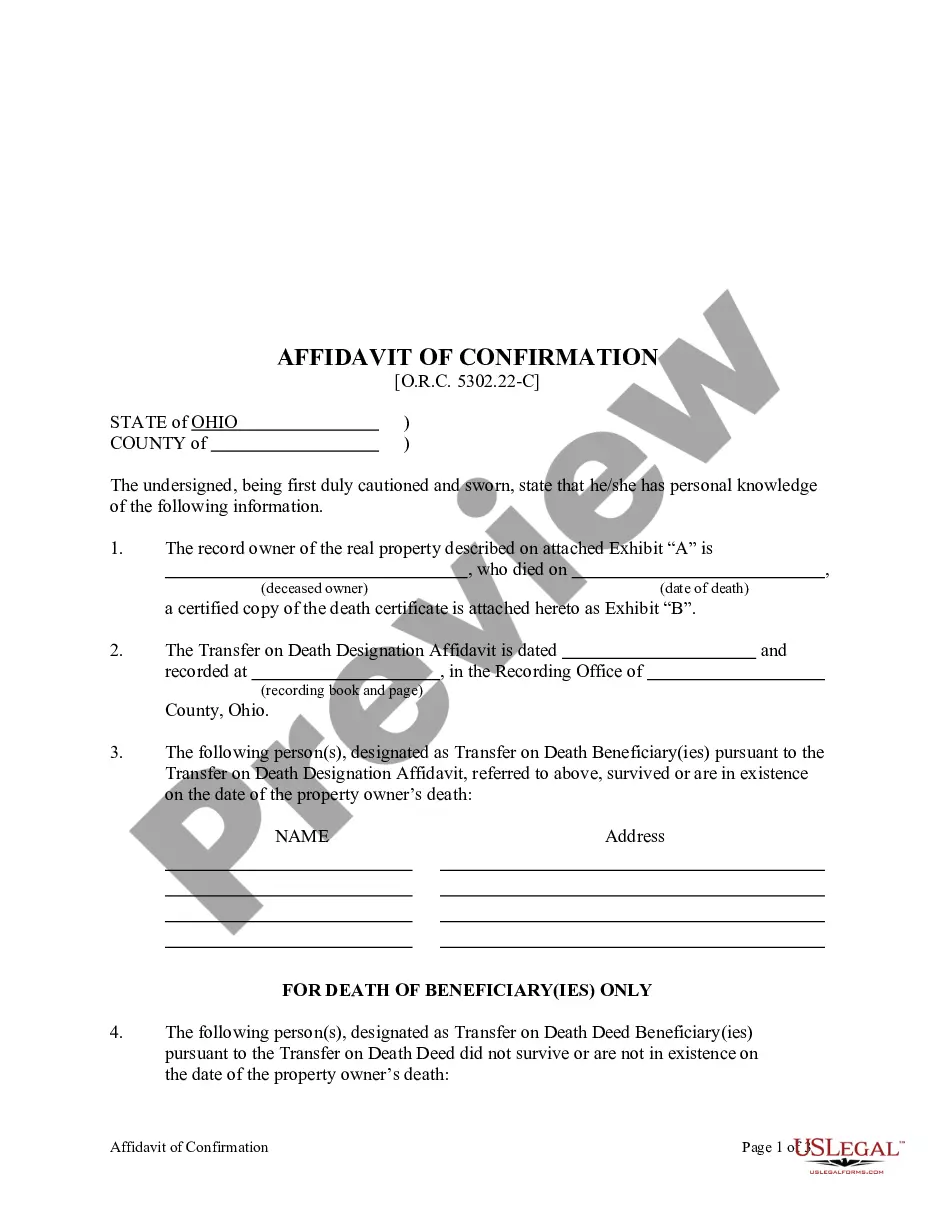

How to fill out Acoustical Contractor Agreement - Self-Employed?

Selecting the optimal authentic document template can be challenging. Naturally, there are numerous designs accessible online, but how can you find the genuine type you require? Utilize the US Legal Forms website. The platform offers a multitude of designs, including the Texas Acoustical Contractor Agreement - Self-Employed, which can serve both business and personal purposes. All of the forms are vetted by professionals and meet state and federal standards.

If you are already registered, Log In to your account and click the Download button to obtain the Texas Acoustical Contractor Agreement - Self-Employed. Use your account to browse through the legitimate forms you may have purchased previously. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions that you can follow: First, ensure you have selected the correct form for your city/county. You can preview the form using the Review button and read the form details to confirm it is the right one for you. If the form does not meet your needs, use the Search box to locate the appropriate form. Once you are confident that the form is suitable, click the Buy now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the obtained Texas Acoustical Contractor Agreement - Self-Employed.

Use the US Legal Forms service to simplify your search for authentic document templates that comply with legal standards.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the service to obtain professionally-crafted paperwork that adhere to state requirements.

- The platform provides a wide selection of forms that have been reviewed by experts.

- Ensure the form you choose is appropriate for your specific needs and location.

- The downloading process is straightforward and allows for easy access to necessary documents.

- Maintain your account to track your previous purchases and access other required forms.

Form popularity

FAQ

An independent contractor agreement in Texas outlines the terms of the working relationship between a contractor and a client. This agreement typically includes payment details, scope of work, and other important conditions surrounding the project. For those entering into a Texas Acoustical Contractor Agreement - Self-Employed, having a clear and legally binding document helps protect both parties and sets clear expectations. Utilizing platforms like uslegalforms can simplify the process of drafting and understanding these agreements.

You can earn less than $600 from a client without receiving a 1099 form. However, you should still document all income, as it might not be reported to the IRS by the payer. This information is crucial when you’re managing a Texas Acoustical Contractor Agreement - Self-Employed, since you are responsible for declaring all your income on your tax return. Understanding this aspect ensures you comply with tax regulations and avoids any potential issues.

Yes, even if you earn less than $5000 as a self-employed individual, you still need to file your taxes. The IRS requires you to report all income, regardless of the total amount earned. Filing taxes ensures you remain in good standing and can potentially qualify for deductions associated with your Texas Acoustical Contractor Agreement - Self-Employed. Therefore, it is advisable to maintain good records of your income and expenses.

As an independent contractor, you need to be aware that earnings above $600 in a calendar year typically trigger the requirement for a 1099 form. This threshold is important for tax reporting, as it helps keep track of your income. If you earn less than this amount, you may not receive a 1099 from your clients. However, regardless of whether you receive a 1099 or not, you are still required to report all your income when filing taxes.

To write a self-employed contract, start by clearly defining the roles and responsibilities involved. Include essential details such as payment terms, deadlines, and the scope of work. It's important to specify the nature of the Texas Acoustical Contractor Agreement - Self-Employed, ensuring both parties understand their obligations. Utilizing platforms like US Legal Forms can simplify this process by providing templates that guide you through the necessary components.

To fill out an independent contractor agreement, begin by entering your name and contact information, followed by the client's details. Clearly describe the scope of work, payment terms, and deadlines. Utilizing a Texas Acoustical Contractor Agreement - Self-Employed template can significantly streamline this process, ensuring you do not overlook any critical elements while fostering a professional working relationship.

Writing an independent contractor agreement involves outlining the services to be provided, the terms of payment, and the duration of the contract. It's crucial to include clauses related to confidentiality and termination to ensure mutual understanding. A Texas Acoustical Contractor Agreement - Self-Employed can guide you through this process, offering a framework that covers all necessary aspects to protect both parties involved.

In the United States, if you earn $600 or more from a single client during a tax year, that client is required to issue you a 1099 form. This form reports your earnings to the IRS and helps you document your income from various sources. It's beneficial to maintain thorough records of all agreements, such as a Texas Acoustical Contractor Agreement - Self-Employed, to ensure clarity in your business dealings and earnings.

To fill out an independent contractor form effectively, gather all necessary information first, including your personal details, business information, and work scope. Ensure you clearly outline the services you provide and the payment terms. Using a standardized Texas Acoustical Contractor Agreement - Self-Employed can simplify this process, as it provides structured fields and essential clauses that protect both you and your client.