Texas Joint Filing of Rule 13d-1(f)(1) Agreement

Description

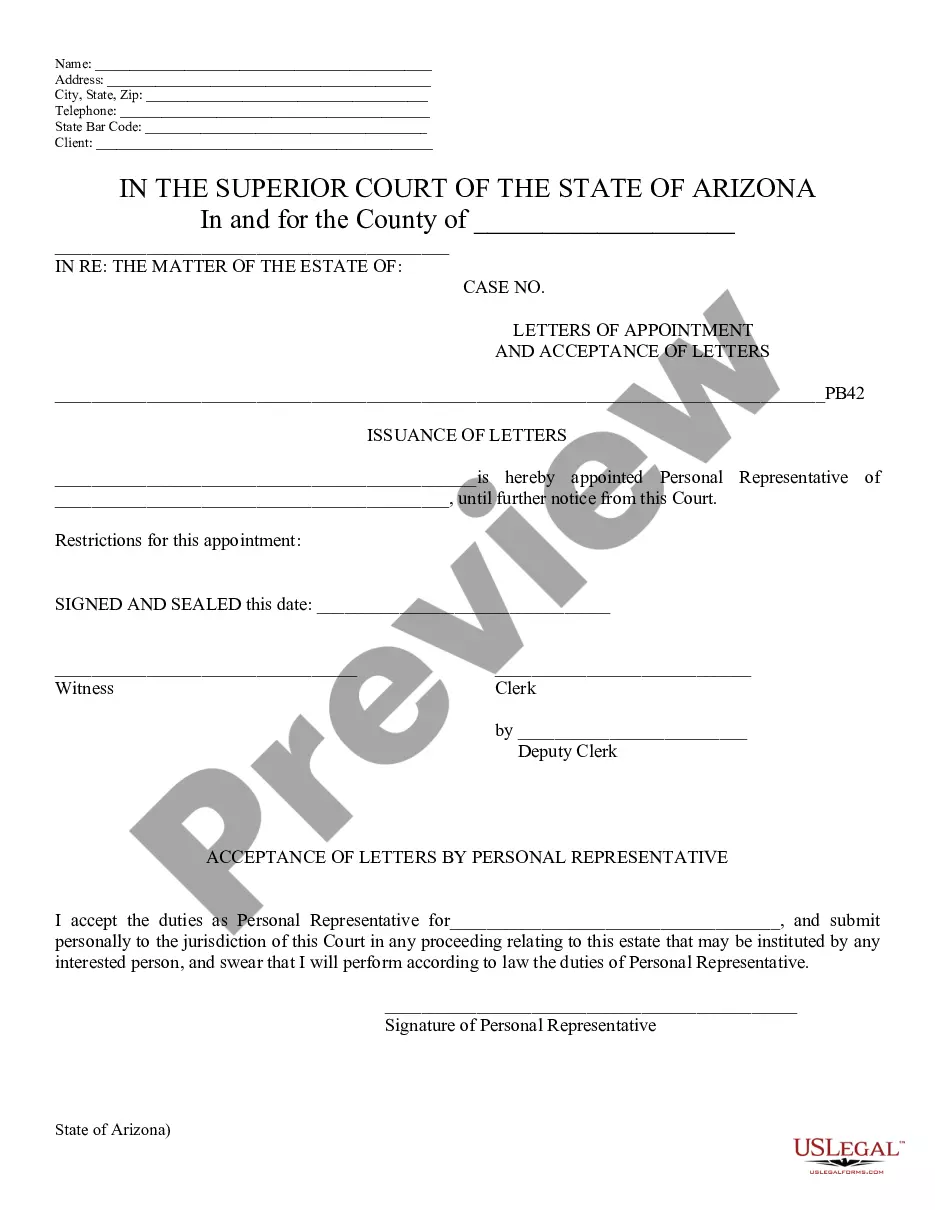

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

Choosing the best lawful papers web template can be quite a have difficulties. Obviously, there are a lot of templates available on the net, but how would you obtain the lawful form you will need? Make use of the US Legal Forms site. The services provides thousands of templates, such as the Texas Joint Filing of Rule 13d-1(f)(1) Agreement, which you can use for business and personal demands. All of the types are examined by pros and meet up with federal and state specifications.

In case you are currently authorized, log in to your accounts and click the Down load button to get the Texas Joint Filing of Rule 13d-1(f)(1) Agreement. Make use of your accounts to appear throughout the lawful types you possess purchased formerly. Proceed to the My Forms tab of the accounts and get another backup from the papers you will need.

In case you are a whole new end user of US Legal Forms, listed below are simple guidelines that you can stick to:

- Initial, make certain you have chosen the right form to your city/area. You can check out the form using the Preview button and browse the form outline to guarantee this is the right one for you.

- When the form will not meet up with your requirements, take advantage of the Seach field to find the right form.

- When you are certain the form is suitable, go through the Buy now button to get the form.

- Opt for the pricing plan you need and type in the required info. Make your accounts and pay for your order utilizing your PayPal accounts or credit card.

- Select the data file structure and obtain the lawful papers web template to your product.

- Comprehensive, modify and print out and signal the obtained Texas Joint Filing of Rule 13d-1(f)(1) Agreement.

US Legal Forms is definitely the greatest library of lawful types in which you will find different papers templates. Make use of the company to obtain expertly-created documents that stick to status specifications.

Form popularity

FAQ

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F.

Form 13Ds are similar to 13Fs but are more stringent; an investor with a large stake in a company must report all changes in that position within just 10 days of any action, meaning that it's much easier for outsiders to see what's happening much closer to real time than in the case of a 13F. 13F Instead of 13D: Activists Make Smaller Purchases - Investopedia investopedia.com ? news investopedia.com ? news

(a) Any person who, after acquiring directly or indirectly the beneficial ownership of any equity security of a class which is specified in paragraph (i) of this section, is directly or indirectly the beneficial owner of more than five percent of the class shall, within 10 days after the acquisition, file with the ...

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions.

An investor with control intent must file Schedule 13D, while ?Exempt Investors? and investors without a control intent, such as ?Qualified Institutional Investors? and ?Passive Investors,? file Schedule 13G. SEC Adopts Changes to Schedule 13D and Schedule 13G foley.com ? insights ? publications ? 2023/10 foley.com ? insights ? publications ? 2023/10

When a person or group acquires 5% or more of a company's voting shares, they must report it to the Securities and Exchange Commission. Among the questions Schedule 13D asks is the purpose of the transaction, such as a takeover or merger. Schedule 13D: What It Is, How to File, Requirements, Example investopedia.com ? terms investopedia.com ? terms

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility. SEC Accelerates Schedule 13D/G Filing Deadlines and Issues ... shearman.com ? perspectives ? 2023/10 ? se... shearman.com ? perspectives ? 2023/10 ? se...

Exchange Act Sections 13(d) and 13(g) and the related SEC rules require that an investor who beneficially owns more than five percent of a class of voting equity securities registered under Section 12 of the Exchange Act ("covered securities") report such beneficial ownership and certain changes in such ownership by ...