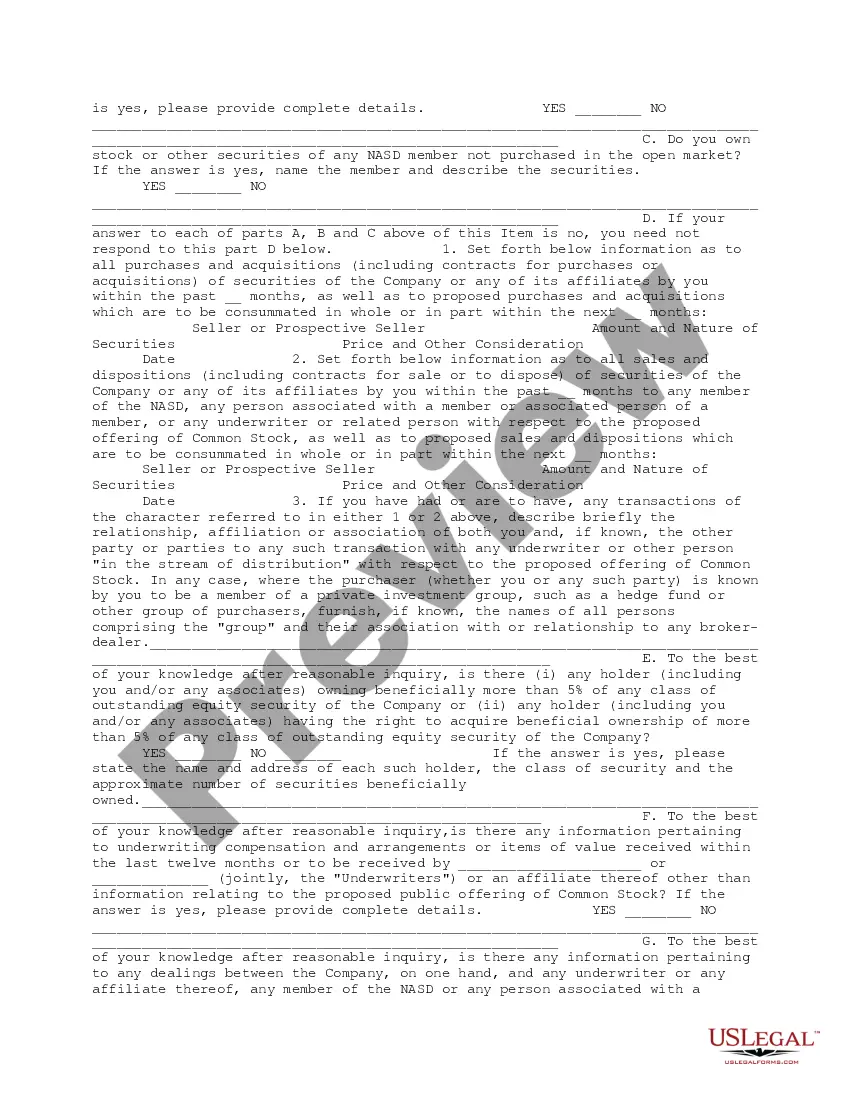

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent

Description

How to fill out Comprehensive Questionnaire For Shareholders Including Officers And Directors Holding At Least Five Percent?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide array of legal form templates that you can download or print.

Through the website, you can access thousands of forms for both business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms such as the Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent in just moments.

If you already have an account, Log In to download the Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Each template you save in your account does not have an expiration date and remains your property indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent through US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have selected the appropriate form for your state/region.

- Click the Review button to view the content of the form.

- Check the description of the form to make sure it is the correct one.

- If the form does not meet your needs, use the Search box at the top of the page to find the one that does.

- When you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, choose your preferred pricing plan and provide your details to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

- Make changes. Fill, edit, print, and sign the downloaded Texas Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent.

Form popularity

FAQ

Limited Liability Companies:The secretary of state does not maintain any information on the ownership of a LLC. The secretary of state has information on the initial members of a member-managed LLC. We also maintain records of an entity's registered agent and registered office address.

If the information is not available online, request a copy of the most recent PIR by contacting us at open.records@cpa.state.tx.us, or write to the Texas Comptroller of Public Accounts, Open Records Division, P. O. Box 13528, Austin, Texas 78711-3528.

4 Ways to Look Up LLC OwnersSearch State Databases. LLCs submit articles of organization and other public filings with the state's Secretary of State office or a comparable state agency.Submit a Public Information Request.Check the Company Website.Dig into Alternative Public Records.

Search for a business entity (Corporation, LLC, Limited Partnership) in Texas by going to the Secretary of State's Website. Preform a lookup by Name, Tax ID Number, or File Number.

Submit your PIR in writing by email. Include your full first and last names, email address, daytime telephone number or other contact information and a clear description of the records you want. PIRs will be accepted only at the following email address: open.records@tdhca.state.tx.us.

There are three main ways to check business name availability in Texas.Call. You can call State Business Information at 512-463-5555.Email.Online Database.Other Options.Identifies the Type of Business Entity.Distinguishable Name.Permitted Characters.Word Restrictions.

The Texas Business Organizations Code requires that for-profit corporations and professional corporations have at least one director, one president, and one secretary. A single person can be the president, secretary, sole director, and sole shareholder.

The updated franchise tax levies a 1 percent tax on the gross receipts of businesses in Texas (retailers pay a . 5 percent rate), but exempts sole proprietorships and general partnerships. Businesses can elect to deduct either the cost of goods sold or employment costs.

The Public Information Report (PIR) and Ownership Information Report (OIR) which are separate from the various Texas franchise tax return forms provide basic information about a Texas entity including the entity's address and governing authority and must be filed with the Texas Comptroller annually, typically

Information Reports: Corporations, LLCs, Limited Partnerships, Professional Associations and financial institutions must file the Public Information Report (PIR). All other entity types must file the Ownership Information Report (OIR).