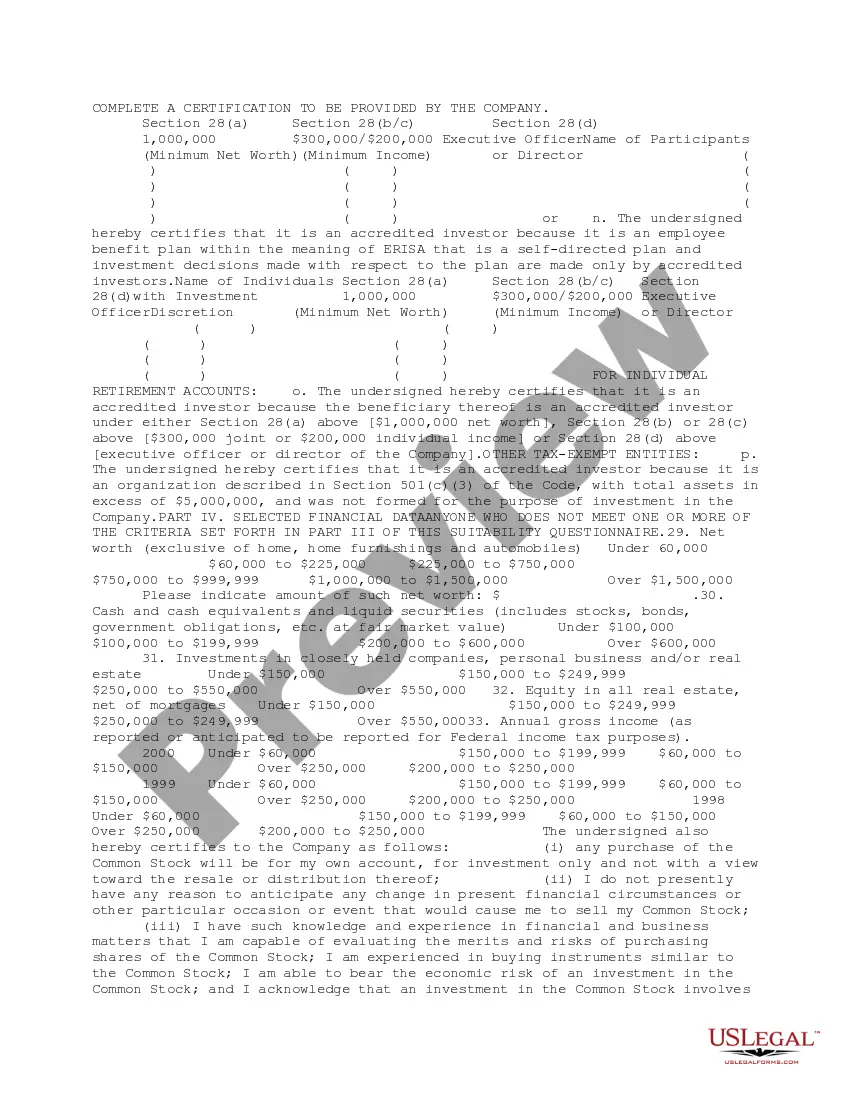

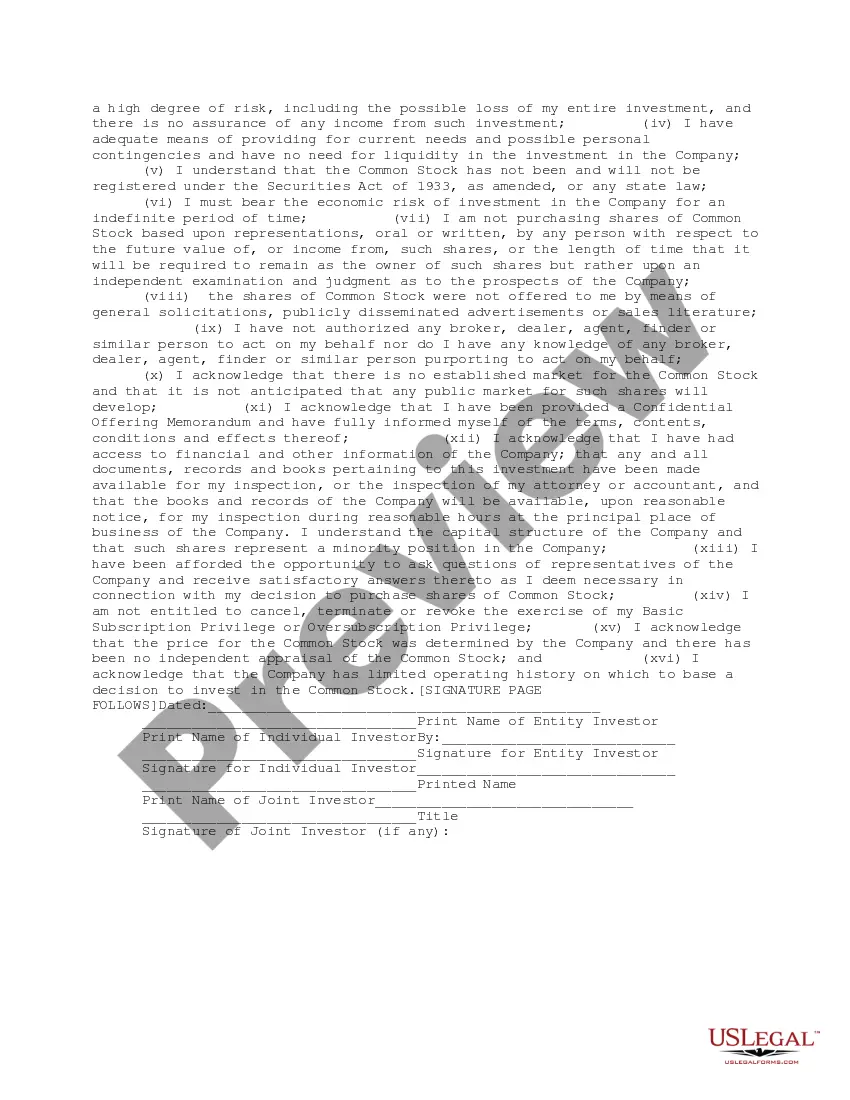

This due diligence questionnaire is to enable a company to discharge its responsibilities under the private placement and limited offering exemptions and that, as issuer and/or any of its sales personnel, a company will rely upon the information and representations and warranties contained in this questionnaire.

Texas Investor Suitability Questionnaire

Description

How to fill out Investor Suitability Questionnaire?

Should you desire to finalize, obtain, or print approved document templates, rely on US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal use are organized by categories and titles, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to all forms you've acquired within your account.

Stay competitive and obtain, and print the Texas Investor Suitability Questionnaire with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Texas Investor Suitability Questionnaire in just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and select the Download option to obtain the Texas Investor Suitability Questionnaire.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form applicable to the correct state/region.

- Step 2. Use the Preview feature to review the content of the form. Remember to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other forms within the legal form template.

- Step 4. Once you locate the form you need, click on the Acquire now button. Choose your preferred payment plan and provide your credentials to create an account.

- Step 5. Complete the transaction. You may utilize your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Texas Investor Suitability Questionnaire.

Form popularity

FAQ

The purpose of an accredited investor questionnaire is to confirm whether an individual meets the qualifications outlined by regulatory bodies for accredited investor status. By collecting relevant financial details, this questionnaire protects both investors and issuers. The Texas Investor Suitability Questionnaire can assist you in compiling the information needed to demonstrate your accredited status responsibly.

An investor questionnaire collects data on your financial status, investment goals, and experience. This tool helps facilitate conversations between investors and their advisors. The Texas Investor Suitability Questionnaire enhances this process, ensuring that investors receive tailored advice based on their specific circumstances.

An investor profile questionnaire provides insights into your financial situation, investment preferences, and risk tolerance. It is vital for advisors to understand your unique profile before making recommendations. The Texas Investor Suitability Questionnaire serves as an excellent resource to create a complete picture of your investor profile.

Determining the suitability of an investment involves analyzing your financial goals, risk level, and time horizon. Each investment type carries different risks and potential returns, so aligning these factors with your objectives is crucial. The Texas Investor Suitability Questionnaire can streamline this process and help clarify which investments are right for you.

To certify yourself as an accredited investor, you need to meet specific financial criteria set by the SEC. Typically, this includes having a net worth exceeding $1 million or an income of over $200,000 for the past two years. Using the Texas Investor Suitability Questionnaire can help you gather the necessary information to confirm your accredited status effectively.

An investor suitability questionnaire is a tool designed to assess an investor's profile and their unique financial circumstances. This questionnaire collects information about your income, net worth, investment experience, and goals. Completing the Texas Investor Suitability Questionnaire can guide you in making informed investment decisions that match your risk appetite.

Investor suitability refers to the process of determining whether an investment is appropriate for a particular investor. It takes into account factors like the investor's financial situation, investment goals, and risk tolerance. The Texas Investor Suitability Questionnaire helps in evaluating these aspects, ensuring that your investment choices align with your overall strategy.

Texas Form AP 114 is an application used by businesses to obtain a sales tax permit. This form is necessary for companies planning to make taxable sales. By filling out this form, you can ensure compliance with state tax laws. Additionally, the Texas Investor Suitability Questionnaire can provide insights into the necessary steps for setting up your business correctly.

Failing to file your franchise tax in Texas can lead to penalties and interest, which can add up quickly. The state may also revoke your company's good standing status, which can impact your ability to conduct business. To avoid these issues, it's advisable to stay informed about your tax obligations. The Texas Investor Suitability Questionnaire can guide you in understanding and meeting these requirements.

A Texas LLC must file formation documents with the Secretary of State, typically Articles of Organization. Additionally, ongoing filings, including the franchise tax report and public information report, are required annually. Staying organized with these filings is crucial for your LLC’s compliance. Tools like the Texas Investor Suitability Questionnaire can help keep your filing schedule on track.