Texas Basic Debt Instrument Workform

Description

How to fill out Basic Debt Instrument Workform?

Selecting the optimal legal document web template can be challenging. Clearly, there are numerous templates accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Texas Basic Debt Instrument Workform, suitable for both business and personal use. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and then click the Download button to access the Texas Basic Debt Instrument Workform. Use your account to browse the legal forms you have previously purchased. Go to the My documents tab in your account to obtain another copy of the document you need.

Complete, modify, print, and sign the obtained Texas Basic Debt Instrument Workform. US Legal Forms is the largest repository of legal documents where you can find various paper templates. Use this service to obtain professionally crafted documents that meet state requirements.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

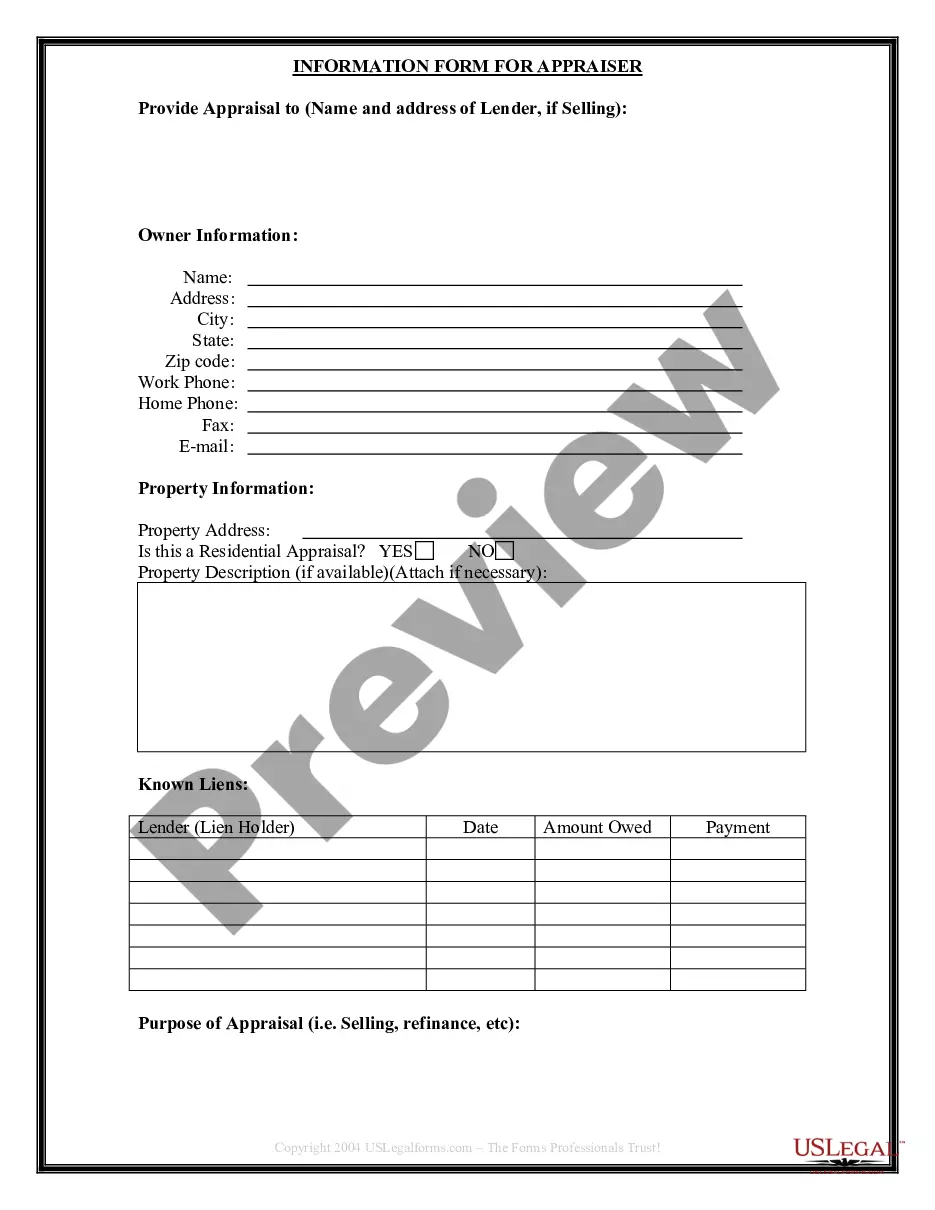

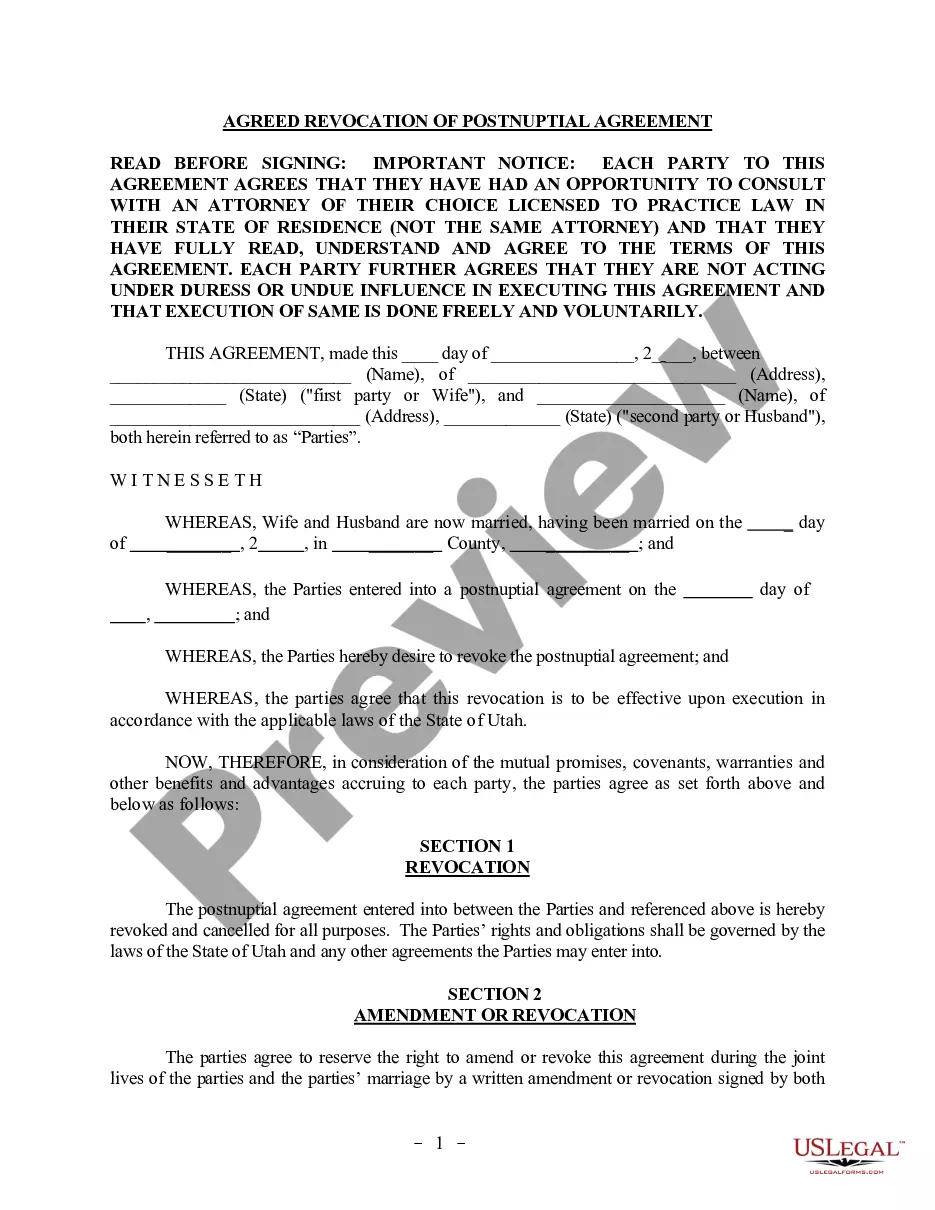

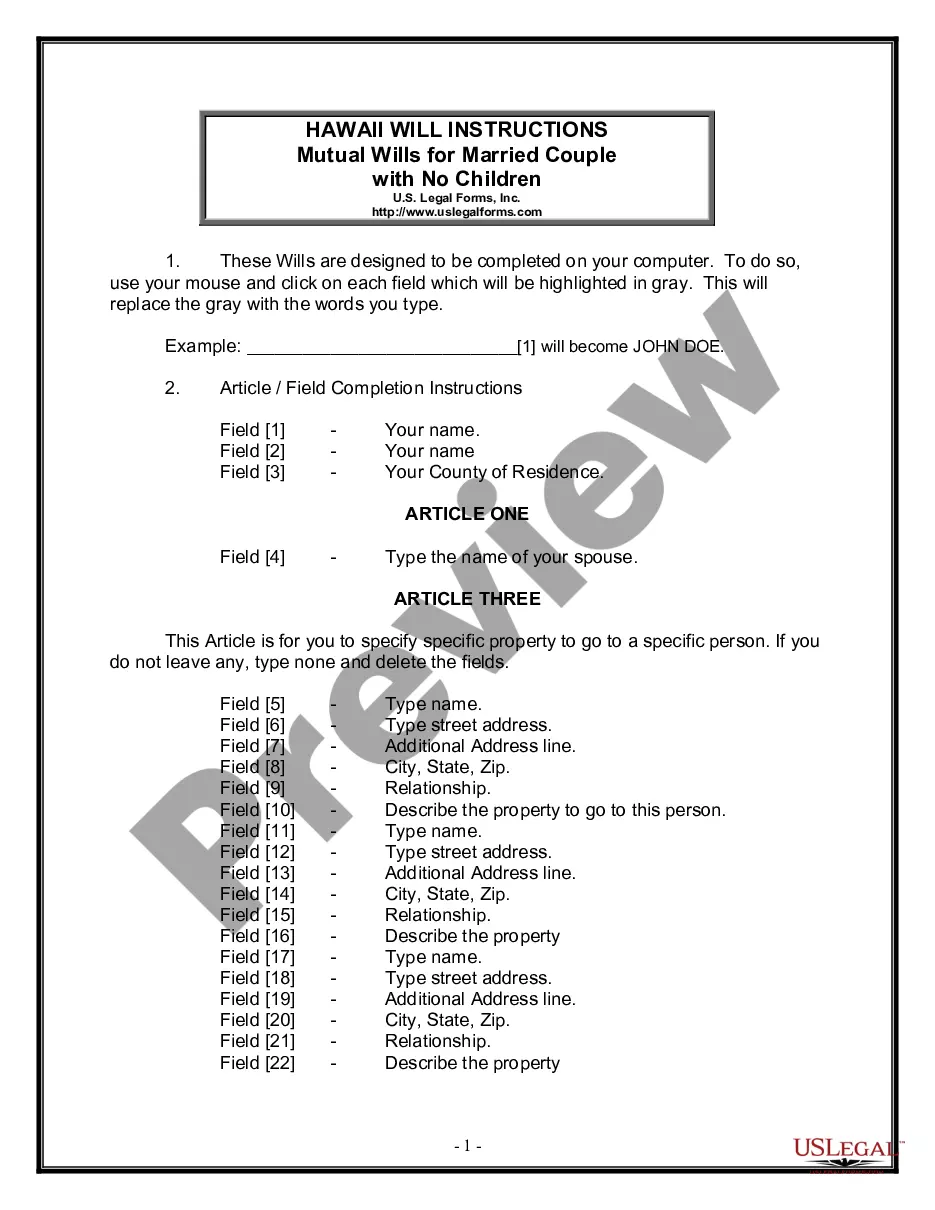

- First, ensure you have selected the appropriate form for your region/state. You can view the form using the Review button and read the form description to confirm it meets your needs.

- If the form does not meet your requirements, use the Search box to find the correct form.

- Once you are certain that the form is suitable, click the Buy now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Debt - Private PlacementAll Government securities and Treasury bills are deemed to be listed automatically as and when they are issued. Other securities, issued publicly or placed privately, could be listed or admitted for trading, if eligible, as per rules of the Exchange by following prescribed procedure.

Held-to-maturity debt investments are accounted for using the amortized cost; trading debt investments are carried at fair value and any changes in fair value are reported in income statement and the available for sale debt investments are carried at fair value and any changes in fair value are reported other

Under the amortized cost method, the debt investment is initially recorded as an asset at its cost; any excess of the purchase price over par value is recorded as bond premium and any excess of par value over bond price is recorded as a bond discount.

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

There are different types of Debt Instruments available in India such as;Bonds.Certificates of Deposit.Commercial Papers.Debentures.Fixed Deposit (FD)G - Secs (Government Securities)National savings Certificate (NSC)29 June 2009

A debt instrument can be in paper or electronic form. Bonds, debentures, leases, certificates, bills of exchange and promissory notes are examples of debt instruments....Debt instruments provide fixed and higher returns, thus giving them an edge over bank fixed deposits.Bonds.Mortgage.Treasury Bills.10 July 2017

Credit cards, credit lines, loans, and bonds can all be types of debt instruments. Typically, the term debt instrument primarily focuses on debt capital raised by institutional entities.

A company lists its long-term debt on its balance sheet under liabilities, usually under a subheading for long-term liabilities.

The fair value of the debt is simply its value if you adjust the price of the debt so that a buyer would be earning the market rate of interest. For example, Say I borrow £100 for a year at 10% interest, then say the market rate of interest immediately halves to 5%.

A debt instrument is a fixed income asset that allows the lender (or giver) to earn a fixed interest on it besides getting the principal back while the issuer (or taker) can use it to raise funds at a cost.