Texas Sample Letter for Tax Return for Supplement

Description

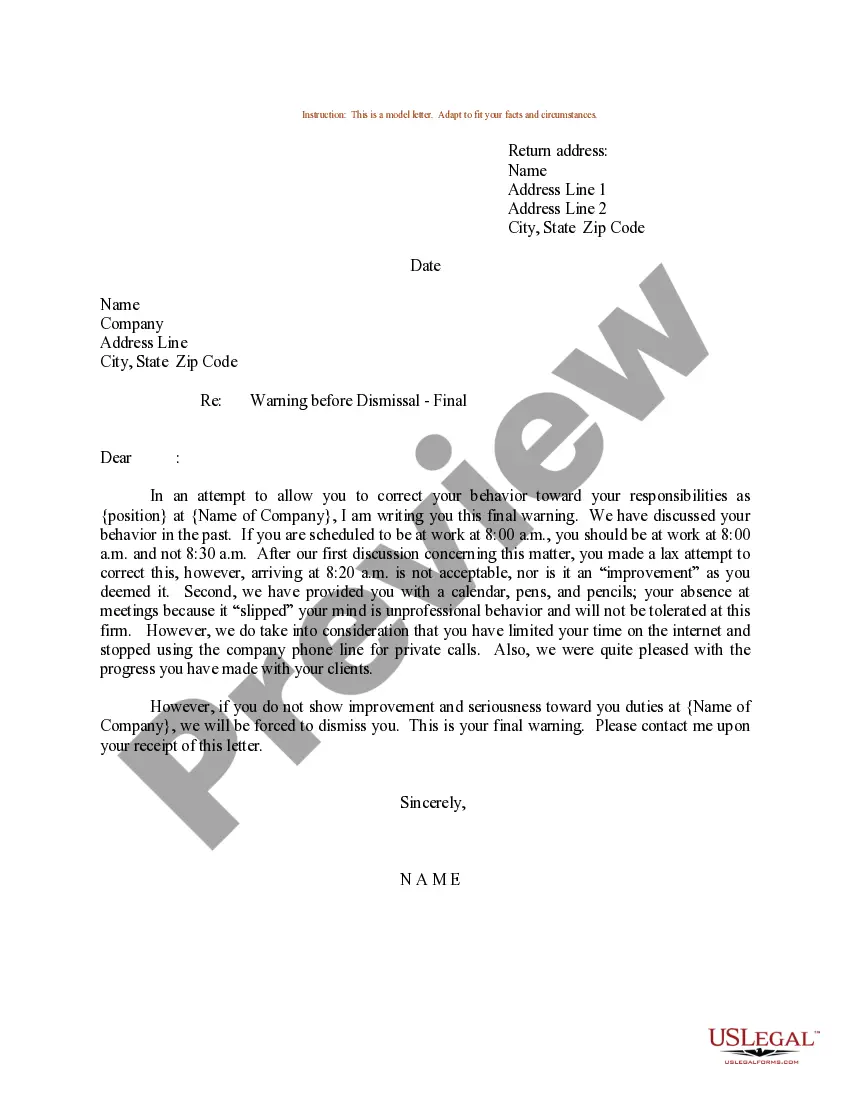

How to fill out Sample Letter For Tax Return For Supplement?

You can spend hours on the Internet looking for the legitimate document format which fits the state and federal demands you want. US Legal Forms provides thousands of legitimate kinds which are analyzed by professionals. You can actually down load or printing the Texas Sample Letter for Tax Return for Supplement from my assistance.

If you already have a US Legal Forms profile, it is possible to log in and click the Download option. Following that, it is possible to full, revise, printing, or signal the Texas Sample Letter for Tax Return for Supplement. Each and every legitimate document format you purchase is your own eternally. To get an additional backup of the obtained form, visit the My Forms tab and click the related option.

If you are using the US Legal Forms site the very first time, keep to the simple recommendations beneath:

- First, make certain you have chosen the proper document format for your region/area of your liking. Read the form information to ensure you have picked out the correct form. If accessible, use the Preview option to check from the document format too.

- If you want to find an additional version of the form, use the Research discipline to discover the format that fits your needs and demands.

- After you have identified the format you want, click on Buy now to continue.

- Select the rates prepare you want, key in your references, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal profile to cover the legitimate form.

- Select the format of the document and down load it to the system.

- Make changes to the document if necessary. You can full, revise and signal and printing Texas Sample Letter for Tax Return for Supplement.

Download and printing thousands of document web templates while using US Legal Forms web site, that provides the greatest variety of legitimate kinds. Use specialist and state-certain web templates to tackle your small business or personal demands.

Form popularity

FAQ

Drugs, Medicines and Dietary Supplements ? Nontaxable Over-the-counter drugs and medicines required by the Food and Drug Administration to be labeled with a Drug Facts panel are not taxable. For more information, see Publication 94-155, Sales Tax Exemptions for Healthcare Items. Dietary supplements are not taxable.

If your LLC's annualized total revenue is below $1,230,000, you will be selecting ?yes? for the ?Is the entity's annualized total revenue below the no tax due threshold? question. Or, if your Texas LLC made $0, you can select ?yes? for the ?Does this entity have zero Texas Gross Receipts? question.

You have three options for filing and paying your Texas sales tax: File online ? File online at the ?TxComptroller eSystems? site. You can remit your payment through their online system. ... File by mail ? You can also download a Texas Sales and Use tax return here. AutoFile ? Let TaxJar file your sales tax for you.

Exempt certificates and resale certificates are very similar documents with the major difference being that an exemption certificate does not require a taxpayer ID number to be legally valid.

Taxpayers who have questions about Texas taxes can receive help from the Comptroller's office through either a general information letter or a private letter ruling. General information letters answer most questions, but taxpayers can request a private letter ruling.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption ? Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Some customers are exempt from paying sales tax under Texas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.