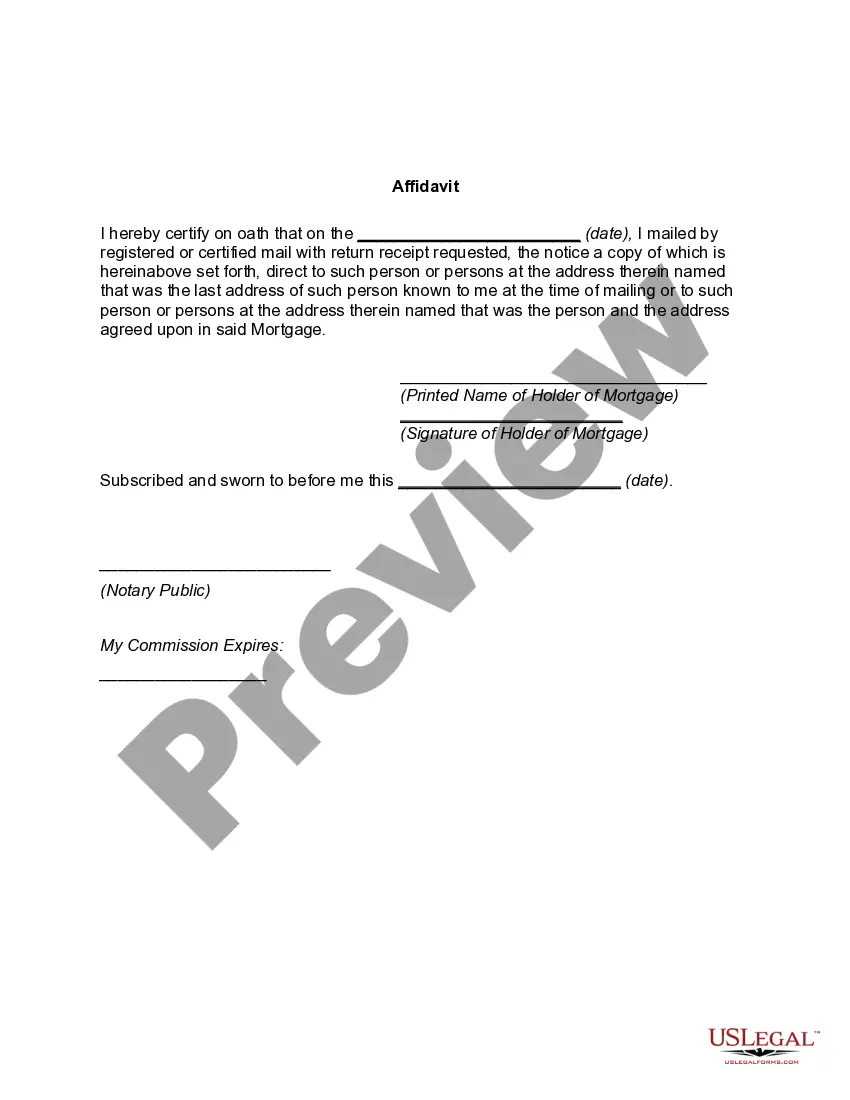

Texas Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

Finding the right legal file web template might be a have difficulties. Of course, there are a lot of themes available online, but how would you get the legal type you will need? Use the US Legal Forms web site. The service gives a huge number of themes, such as the Texas Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage, that you can use for business and private requirements. Each of the kinds are checked out by specialists and fulfill state and federal requirements.

If you are presently authorized, log in in your accounts and click on the Acquire switch to obtain the Texas Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage. Make use of accounts to appear from the legal kinds you might have purchased earlier. Proceed to the My Forms tab of your accounts and obtain one more copy of your file you will need.

If you are a whole new user of US Legal Forms, allow me to share easy instructions that you can follow:

- First, make certain you have chosen the right type for your personal town/county. You can check out the shape making use of the Preview switch and study the shape description to make certain this is basically the right one for you.

- When the type fails to fulfill your preferences, utilize the Seach industry to obtain the correct type.

- Once you are sure that the shape would work, select the Get now switch to obtain the type.

- Choose the pricing plan you need and type in the necessary info. Design your accounts and buy an order using your PayPal accounts or bank card.

- Choose the submit file format and acquire the legal file web template in your system.

- Comprehensive, revise and print out and signal the received Texas Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

US Legal Forms will be the largest local library of legal kinds where you can find numerous file themes. Use the company to acquire skillfully-produced documents that follow condition requirements.

Form popularity

FAQ

Most loans from a bank must be 120 days delinquent before any foreclosure activity starts. However, smaller lenders can sometimes start foreclosure even if you are only one day late. The lender is only required to send you two notices before a foreclosure sale.

After the sale, if the property sells for less than what is owed, the creditor may try to come after the borrower for the remainder of what is owed to them. This is referred to as a deficiency judgment.

If the property was residential homestead, the owner has 2 years to redeem the property. If the property was not residential, the owner has 6 months to redeem.

Texas law requires the servicer to send you (the borrower) a notice of default and intent to accelerate by certified mail that provides at least 20 days to cure the default before a notice of sale can be given. The 30-day breach letter sent pursuant to the terms of the deed of trust can satisfy this requirement.

Non-Judicial Foreclosure The most common foreclosure process in Texas is non-judicial, which means the lender can foreclose without going to court, so long as the deed of trust contains a power of sale clause. A power of sale clause is a paragraph in the deed of trust that authorizes the non-judicial foreclosure sale.

Texas law requires the servicer to send you (the borrower) a notice of default and intent to accelerate by certified mail that provides at least 20 days to cure the default before a notice of sale can be given. The 30-day breach letter sent pursuant to the terms of the deed of trust can satisfy this requirement.

This is basically a document telling you that the lender will foreclose on your property if you do not take action to stop it. Ignoring it will only lead to further legal trouble, and it could prevent you from being able to negotiate with the lender to find a solution that allows you to keep your home.