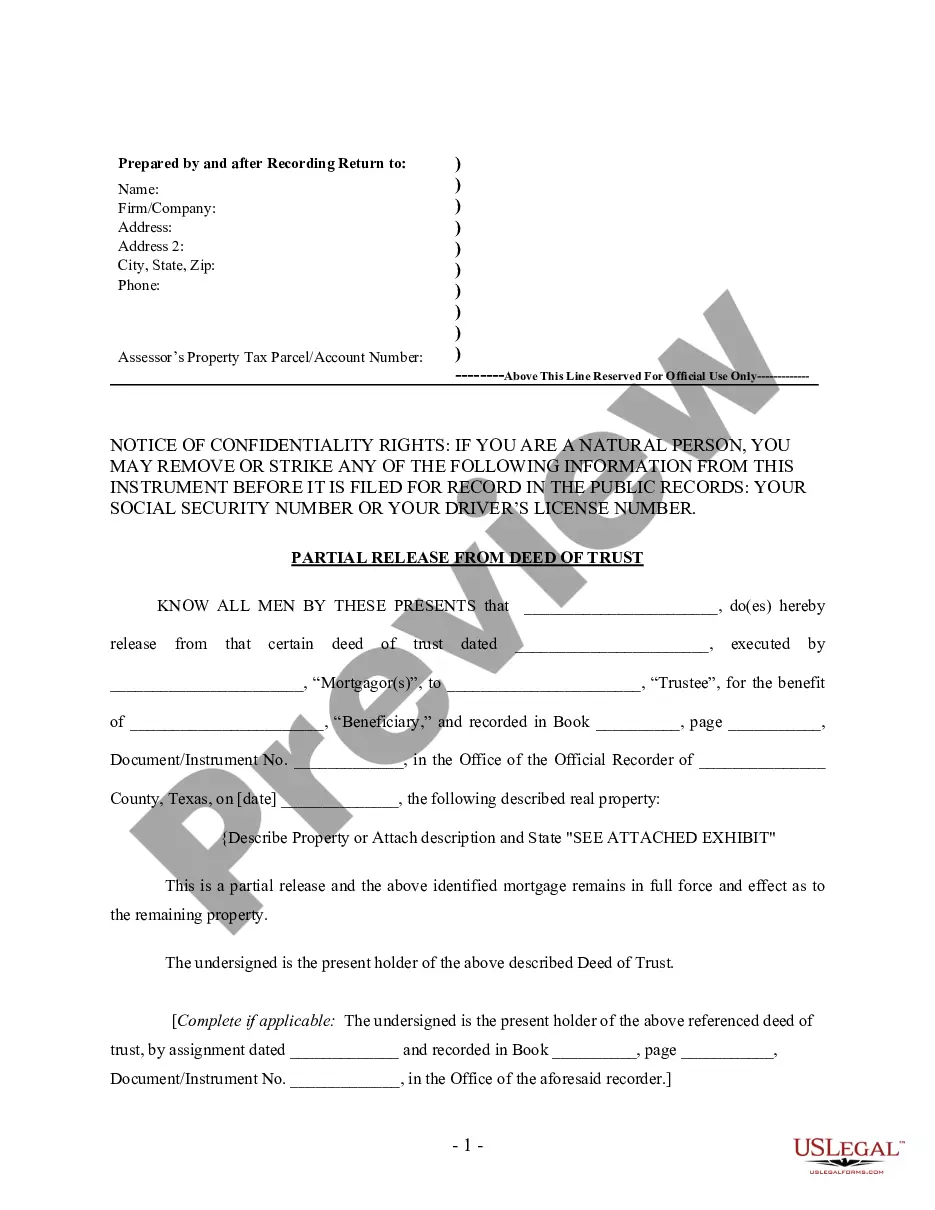

Texas Loan Agreement for Family Member

Description

How to fill out Loan Agreement For Family Member?

Finding the right authorized papers template can be a battle. Of course, there are tons of themes accessible on the Internet, but how would you obtain the authorized type you will need? Utilize the US Legal Forms site. The assistance offers a huge number of themes, for example the Texas Loan Agreement for Family Member, that can be used for company and private needs. Every one of the kinds are checked out by experts and meet up with state and federal specifications.

If you are already listed, log in in your bank account and click the Acquire key to get the Texas Loan Agreement for Family Member. Make use of bank account to check through the authorized kinds you may have acquired in the past. Visit the My Forms tab of your bank account and acquire an additional copy of the papers you will need.

If you are a new end user of US Legal Forms, here are straightforward recommendations that you should follow:

- First, ensure you have selected the correct type for your town/state. It is possible to look through the form while using Preview key and look at the form information to guarantee this is the right one for you.

- In case the type does not meet up with your preferences, use the Seach area to discover the correct type.

- Once you are certain that the form would work, go through the Get now key to get the type.

- Choose the prices program you need and type in the needed information. Design your bank account and pay for an order with your PayPal bank account or Visa or Mastercard.

- Select the submit file format and acquire the authorized papers template in your product.

- Full, revise and produce and signal the obtained Texas Loan Agreement for Family Member.

US Legal Forms is the most significant local library of authorized kinds for which you can find numerous papers themes. Utilize the company to acquire professionally-produced papers that follow express specifications.

Form popularity

FAQ

Once executed a loan agreement will be legally binding and in effect.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

Note that you will be responsible for repaying the debt if your family member defaults on their loan, so enter this financial arrangement with the same caution that you would in extending a personal loan.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

A loan agreement between two individuals is more simplistic but similar to a standard bank promissory note. Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable)

The $100,000 De Minimis Exception If the total sum of lending is less than $100,000, the IRS allows you to charge interest based on the lesser of either the AFR rate or the borrower's net investment income for the year. If their investment income was $1,000 or less, the IRS allows them to charge no interest.

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).