Texas Filing System for a Business

Description

How to fill out Filing System For A Business?

Are you experiencing a scenario where you often need documents for commercial or specific objectives? There are numerous legal document templates obtainable on the internet, but finding ones you can depend on is challenging.

US Legal Forms provides thousands of template options, similar to the Texas Filing System for a Business, which can be customized to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Texas Filing System for a Business template.

Choose a convenient file format and download your copy.

Find all the document templates you may have purchased in the My documents list. You can download an additional copy of the Texas Filing System for a Business at any time, if needed. Just click on the required form to download or print the document template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Obtain the required form and ensure it is suitable for the correct city/region.

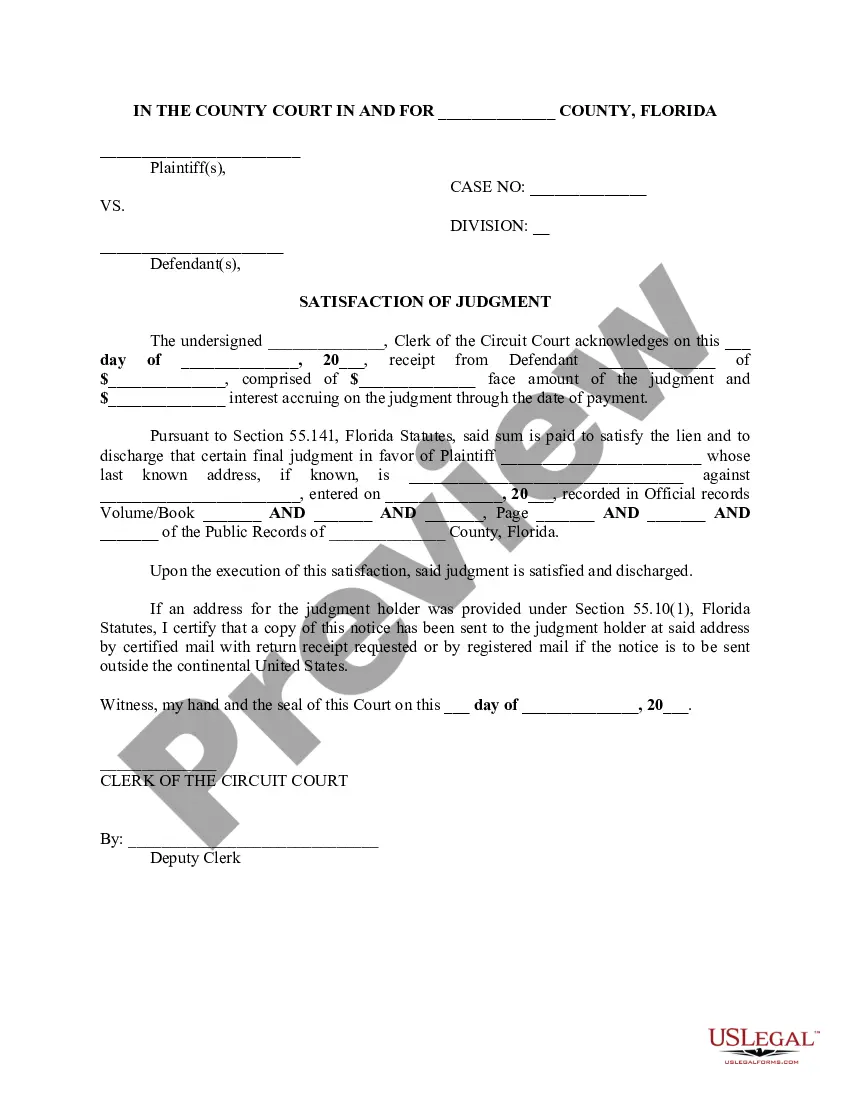

- Utilize the Preview feature to review the document.

- Read the details to confirm you have chosen the right form.

- If the form is not what you're looking for, use the Research section to find the form that meets your requirements.

- Once you locate the correct form, simply click Get now.

- Select the pricing option you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

Form popularity

FAQ

Articles of organization LLC Texas is a document you are required to file if you want to form a limited liability company (LLC) in Texas. Similar to articles of incorporation, articles of organization provide the basic information needed to register your company with the Texas secretary of state.

Articles of organization LLC Texas is a document you are required to file if you want to form a limited liability company (LLC) in Texas. Similar to articles of incorporation, articles of organization provide the basic information needed to register your company with the Texas secretary of state.

The IRS will automatically classify your LLC as either a sole proprietorship or a partnership depending on how many members (owners) the LLC has. If you are the only member in your LLC then the IRS will tax your LLC as if it were a sole proprietorship.

To register your Texas LLC, you'll need to file Form 205 - Certificate of Formation with the Texas Secretary of State. You can apply online, by mail, or in person. When filing your Certificate of Formation, you'll need to state whether your LLC will be member-managed vs. manager-managed.

Yearly Cost of an LLC in TexasThere are no annual registration fees imposed on LLCs in Texas. However, your LLC may need to file an annual franchise tax statement with the Texas Comptroller.

Texas LLC Filing Fee: $300 To form an LLC in Texas, you'll need to file the Certificate of Formation (Form 205) with the Secretary of State. The Texas Secretary of State charges a $300 fee to process and record this document online.

Registering a Business In TexasTo set up a corporation, there is a fee of $300. For an LLC, it's $200 per partner. DBAs cost $25 to file. SOS Direct is up 24/7 and may charge a credit card fee, or you can file in person at the office in Austin.

Texas LLC Filing Fee: $300 To form an LLC in Texas, you'll need to file the Certificate of Formation (Form 205) with the Secretary of State. The Texas Secretary of State charges a $300 fee to process and record this document online.

Registering a Business In TexasTo set up a corporation, there is a fee of $300. For an LLC, it's $200 per partner. DBAs cost $25 to file. SOS Direct is up 24/7 and may charge a credit card fee, or you can file in person at the office in Austin.

An LLC is organized with members who own the business and managers who handle daily operations. Any LLC can be managed by either its members or by Managers. An LLC may even be owned by another LLC. The most common type of LLC is a Member-Managed LLC.