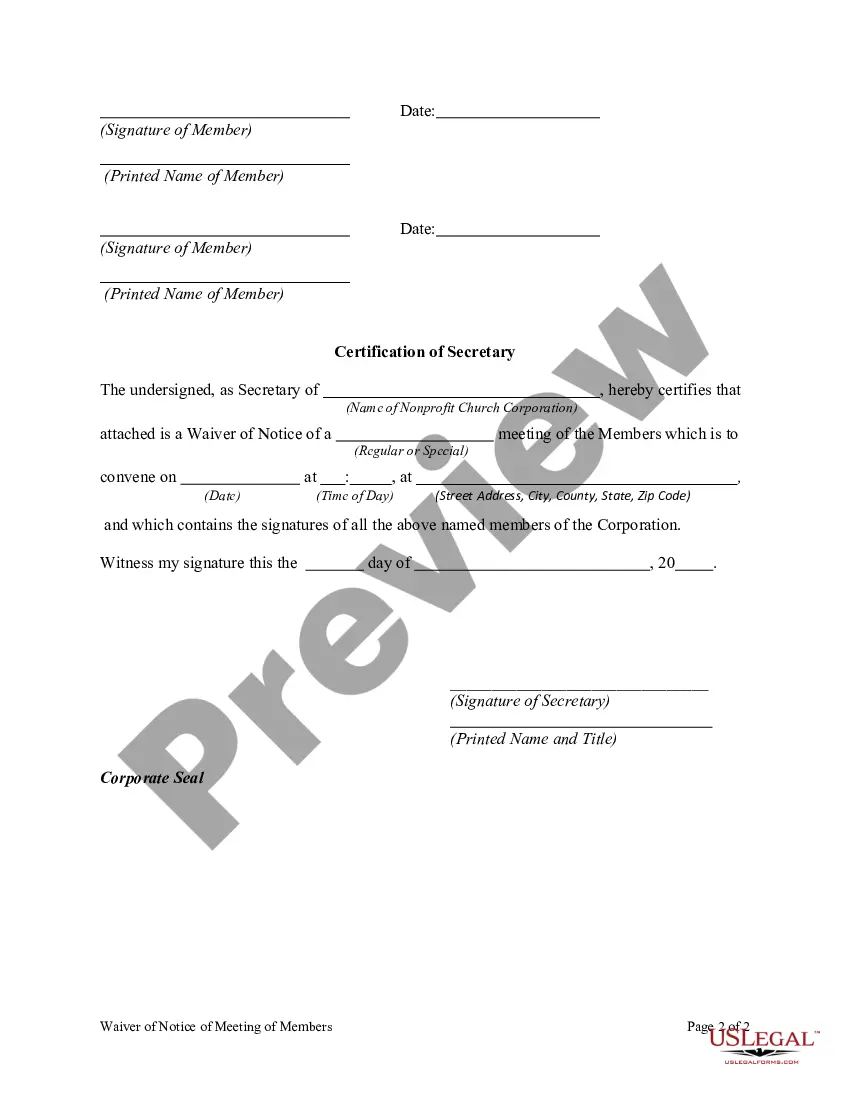

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

Locating the appropriate approved document format can be rather challenging.

Naturally, there is an array of templates accessible online, but how do you obtain the approved form you require.

Utilize the US Legal Forms platform. This service offers numerous templates, including the Texas Waiver of Notice of Meeting for members of a Nonprofit Church Corporation, which you can employ for corporate and personal needs.

First, ensure you have selected the correct form for your area/region. You can view the form using the Preview button and read the form description to confirm it is the right one for you.

- All forms are reviewed by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to acquire the Texas Waiver of Notice of Meeting for members of a Nonprofit Church Corporation.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

'Notice of presentation waived' indicates that members agree to proceed with a meeting without formal notice. This concept is a vital aspect of the Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation. By waiving this notice, members can expedite discussions and decision-making, allowing the organization to adapt quickly to emerging needs. This flexibility encourages proactivity and responsiveness in nonprofit activities.

In a nonprofit corporation, the assets are owned by the organization itself and not by its members or directors. This structure ensures that the resources are used solely for the mission of the organization, rather than for individual benefit. This principle is crucial for understanding processes such as the Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation, as it underlines the purpose of maintaining transparency in meeting practices.

Article 2.22 A of the Texas NonProfit Corporation Act deals with the notice of meetings for members. This article specifies how notices should be communicated, including the timing and delivery methods. Understanding this article is essential for nonprofits aiming to comply with state regulations while also considering the convenience of waiving these notices. This aligns directly with managing a Texas Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

The purpose of nonprofit organizations is generally to improve quality of life for others at a community, local, state, national, or even global level. These organizations are not dedicated to private or financial gain but to the advancement of public interest.

Nonprofit vs not-for-profit organizations Nonprofits run like a business and try to earn a profit, which does not support any single member; not-for-profits are considered recreational organizations that do not operate with the business goal of earning revenue.

The Texas Non-Profit Corporation Act requires any nonprofit seeking corporate status to file certain documents, known as the articles of incorporation and a certificate of formation with the secretary of state's office.

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

(a) If the bylaws of a corporation require notice of a meeting to be given to a director, a written waiver of the notice signed by the director entitled to the notice, before or after the meeting, is equivalent to the giving of the notice.

Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.