Texas Revocable Trust Agreement with Corporate Trustee

Description

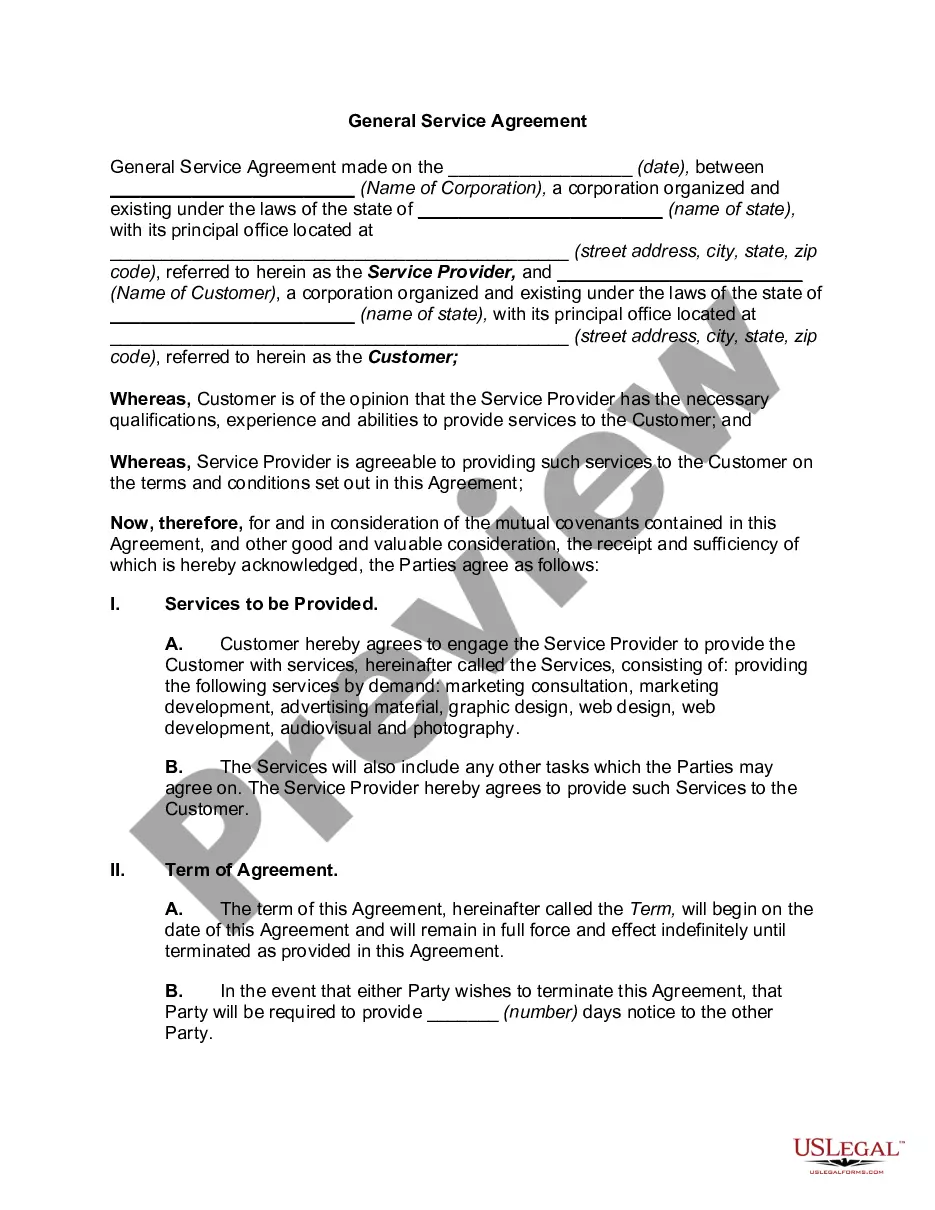

How to fill out Revocable Trust Agreement With Corporate Trustee?

US Legal Forms - one of the largest collections of legal documents in the country - provides a comprehensive selection of legal document templates you can download or print.

By utilizing the site, you can access thousands of documents for both business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of documents such as the Texas Revocable Trust Agreement with Corporate Trustee in no time.

Read the document details to ensure you have chosen the right one.

If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already possess a membership, Log In and download the Texas Revocable Trust Agreement with Corporate Trustee from your US Legal Forms library.

- The Download button will appear on each form you view.

- You can find all previously downloaded documents in the My documents section of your account.

- To start using US Legal Forms for the first time, here are simple steps to get you underway.

- Ensure you have selected the correct document for your location/region.

- Click on the Preview button to review the contents of the document.

Form popularity

FAQ

Yes, a corporate trustee can be the beneficiary of the trust - as long as you include the trustee's name and their capacity.

Prop. Code § 111.004(18) (emphasis added). So, each co-trustee or additional trustee have common law duties. imperative or discretionary, personal or attached to the office, are held jointly.

Corporate trustees are departments at banks or other investment firms hired to build and manage a trust. People hire corporate trustees for their professional experience in trust matters that a family member or friend may not have.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Your trustee can be a trusted family member or friend, an entity such as a bank, a corporation or an individual with professional expertise working as a trustee. A subchapter S or S corporation can serve as a trustee, but there are some considerations to make if the S corporation is to serve in this capacity.

Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas. This includes chartered financial institutions, but not most general businesses incorporated under the Texas Business Corporation Act.

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

Requirements for Trustee The trustee named in a Texas deed of trust can be any individual person who has the legal capacity to hold and transfer property. Under Texas law, if the named trustee is a corporation, the corporation must be authorized to act as a trustee in Texas.

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.