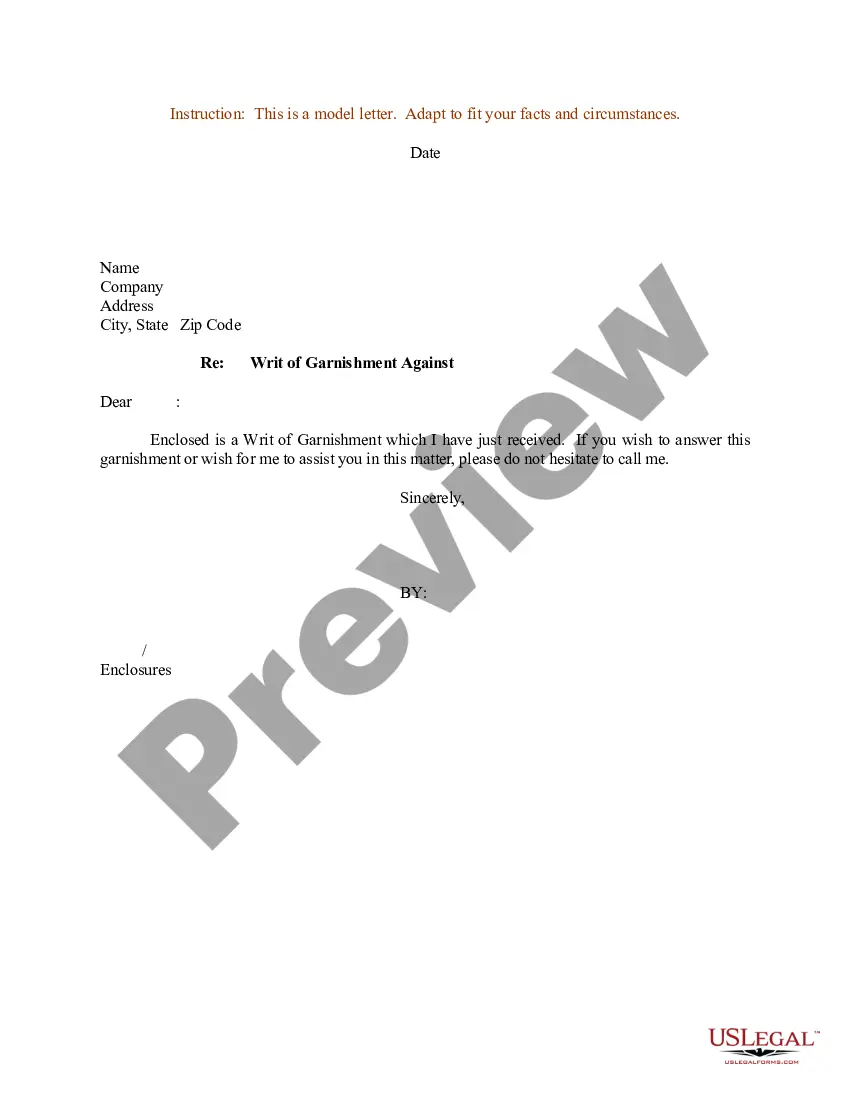

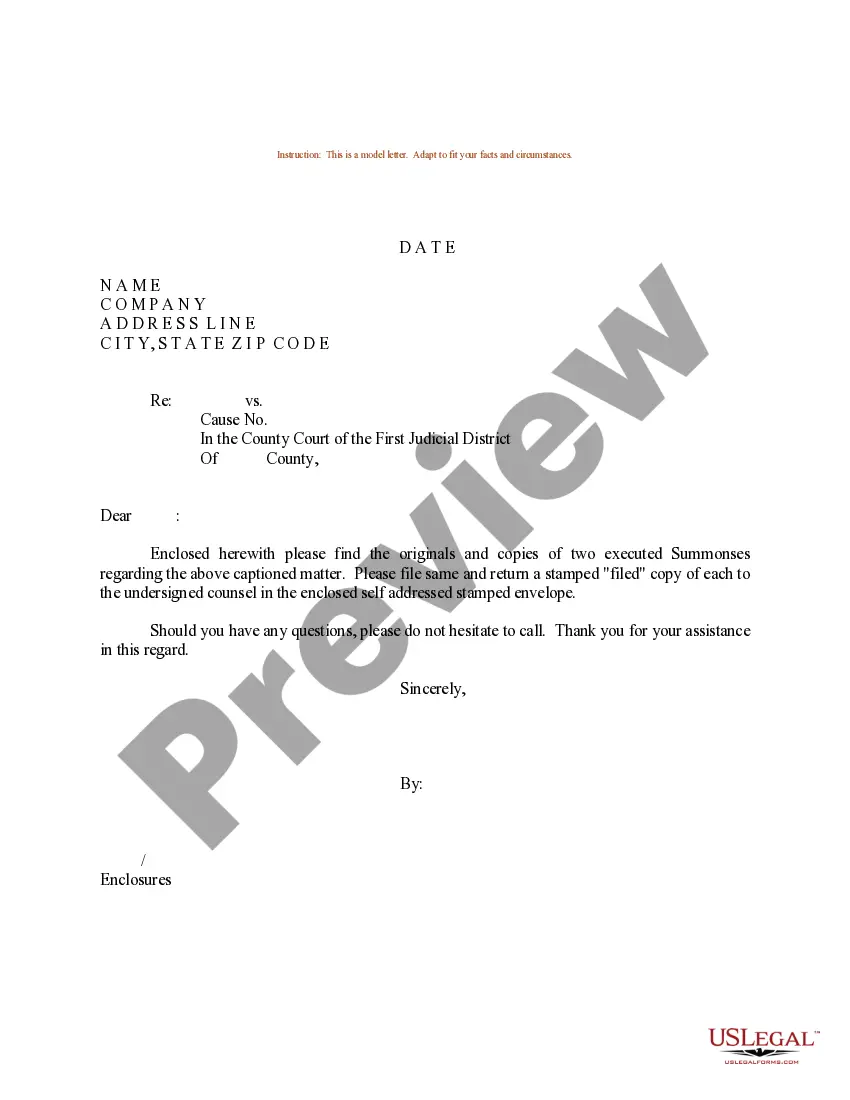

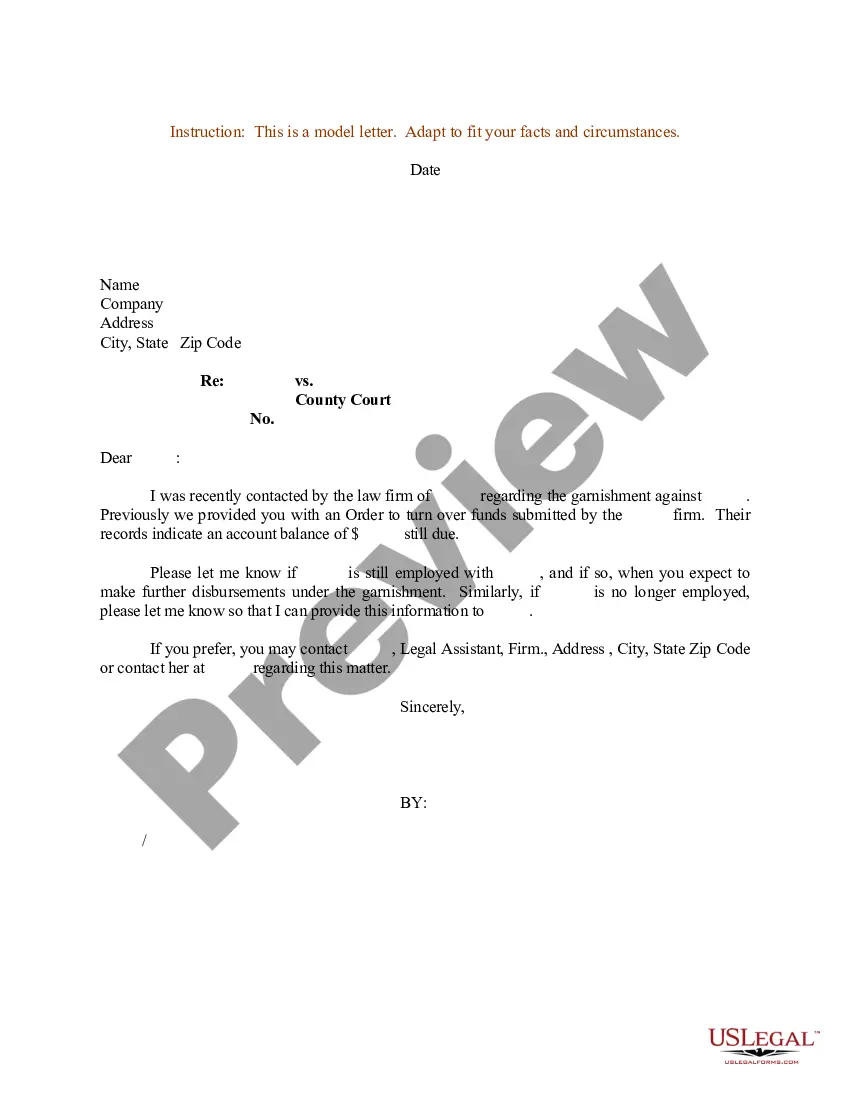

Texas Sample Letter for Garnishment

Description

How to fill out Sample Letter For Garnishment?

US Legal Forms - one of the largest libraries of authorized varieties in the United States - delivers a wide array of authorized file templates it is possible to obtain or produce. Making use of the site, you may get 1000s of varieties for business and personal functions, sorted by classes, claims, or keywords.You can find the latest types of varieties like the Texas Sample Letter for Garnishment within minutes.

If you currently have a registration, log in and obtain Texas Sample Letter for Garnishment through the US Legal Forms local library. The Obtain option will show up on every single develop you see. You gain access to all formerly delivered electronically varieties from the My Forms tab of your own bank account.

In order to use US Legal Forms initially, listed below are easy instructions to help you get started out:

- Make sure you have chosen the best develop for your metropolis/region. Select the Review option to examine the form`s articles. See the develop explanation to actually have selected the proper develop.

- In the event the develop doesn`t suit your specifications, use the Research field near the top of the screen to obtain the one who does.

- When you are happy with the shape, verify your selection by simply clicking the Purchase now option. Then, opt for the costs strategy you favor and offer your accreditations to sign up on an bank account.

- Process the purchase. Make use of your charge card or PayPal bank account to complete the purchase.

- Find the format and obtain the shape in your product.

- Make alterations. Fill out, change and produce and sign the delivered electronically Texas Sample Letter for Garnishment.

Every single format you included in your money does not have an expiry particular date which is yours for a long time. So, if you wish to obtain or produce an additional duplicate, just check out the My Forms portion and click about the develop you require.

Get access to the Texas Sample Letter for Garnishment with US Legal Forms, probably the most substantial local library of authorized file templates. Use 1000s of skilled and state-distinct templates that satisfy your organization or personal requires and specifications.

Form popularity

FAQ

Dear Sir/Madam, I am writing to request that you stop the wage garnishment that is currently being imposed on me. I am unable to make the payments at this time due to [insert reason, such as financial hardship]. I have attached documentation that supports my claim.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

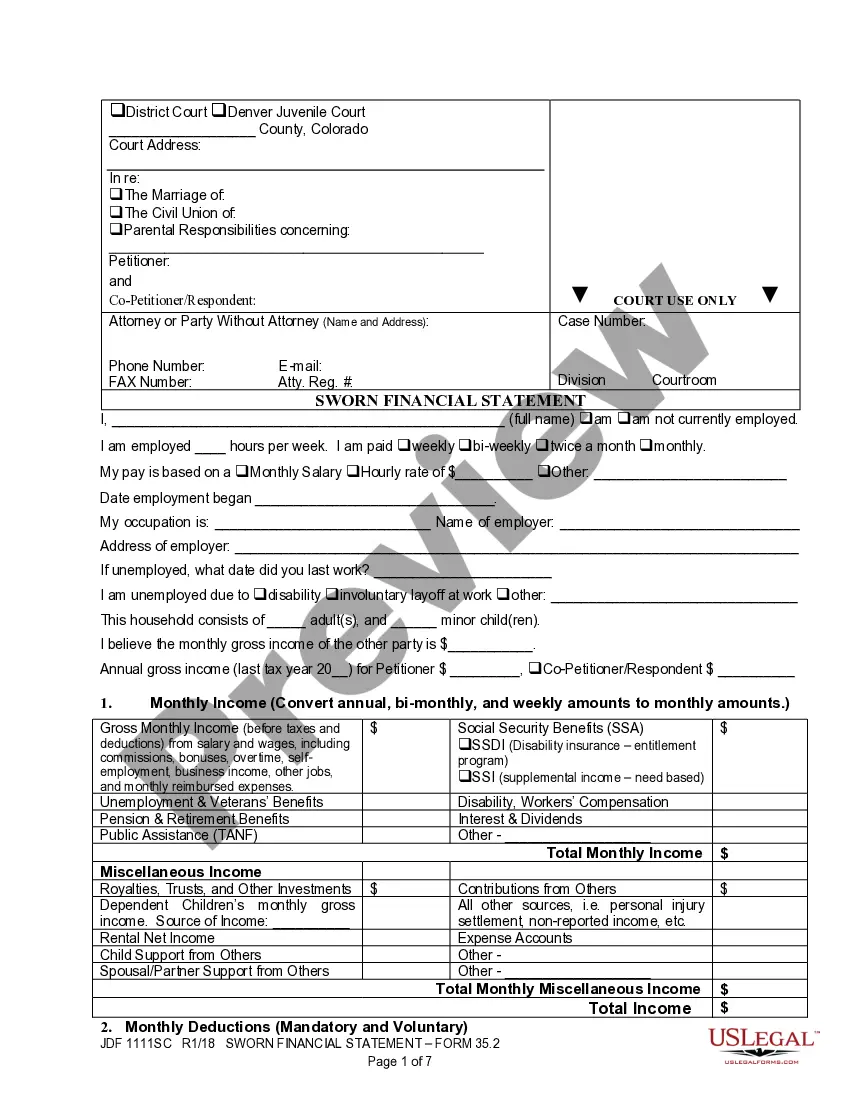

Pretty much all money in the account can be garnished. However, if you are on social security, at least two months of your monthly payments are supposed to be protected by your bank from garnishment. Money in retirement accounts is generally exempt from garnishment. Unemployment benefits are also exempt.

If you want to stop wage garnishment once and for all, filing for bankruptcy is your best option in Texas. As soon as your DebtStoppers lawyer files your petition, the court will grant you an automatic stay that forbids any creditor from garnishing your wages.

Collect evidence showing how detrimental the wage garnishment is to your financial stability or how you qualify for an exemption. In either case, the creditor may agree to a solution that doesn't involve a garnishment, such as an adjustment payment plan or a settlement for a lump sum.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.

Under Chapter 42 of the Texas Property Code, the following types of property are exempt from being taken or frozen to pay a judgment: Current wages. Social Security Administration benefits, including Social Security Retirement, SSI, and SSDI. Veterans Administration benefits. Railroad Retirement Board benefits.