Texas Customer Invoice

Description

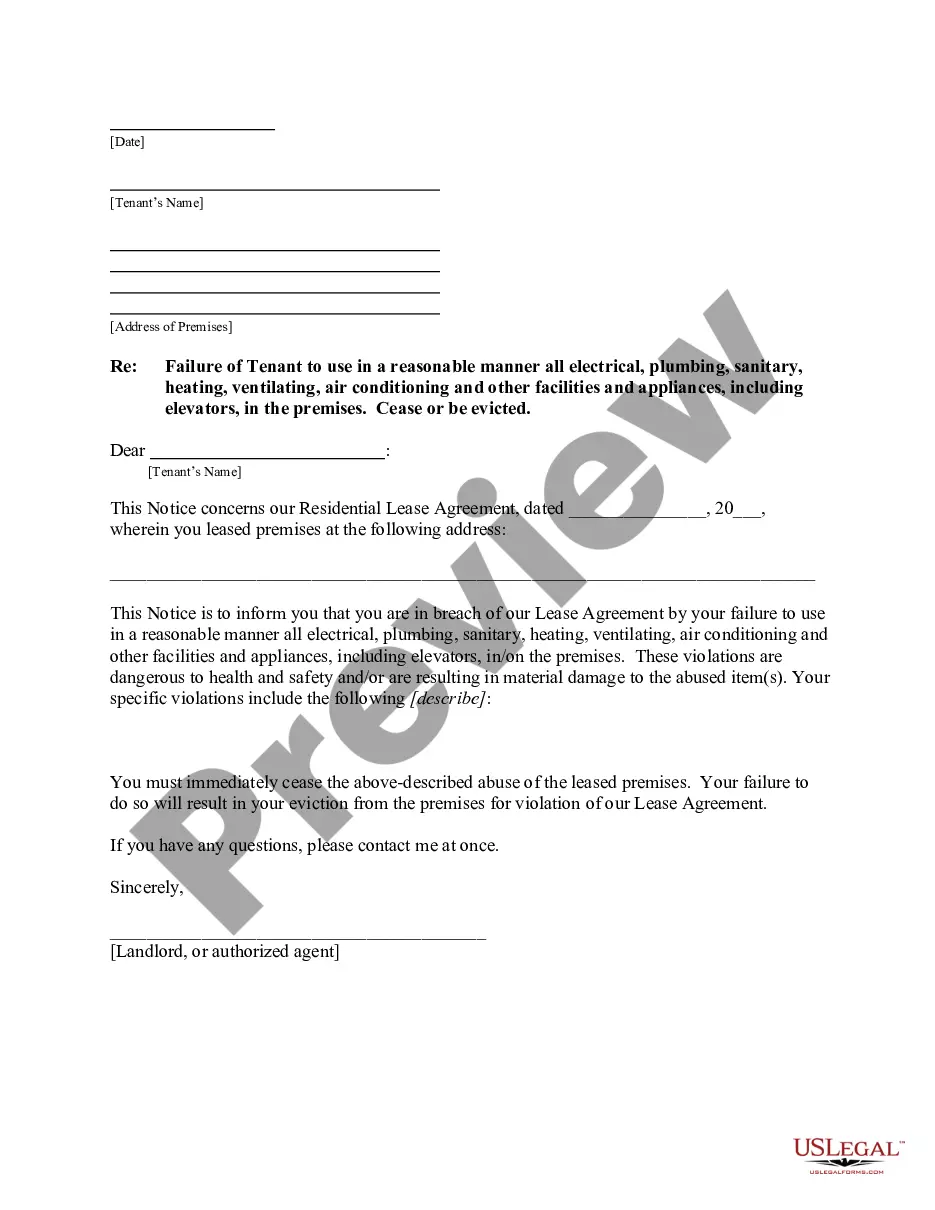

How to fill out Customer Invoice?

Locating the appropriate legal document template can be challenging.

Clearly, there are numerous templates accessible online, but how can you secure the legal document you require.

Utilize the US Legal Forms website. This platform provides a vast assortment of templates, including the Texas Customer Invoice, suitable for both business and personal use.

First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and read the description to confirm it is the right one for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are currently signed up, Log In to your account and click the Download button to obtain the Texas Customer Invoice.

- Use your account to browse through the legal documents you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

Filing your Texas franchise tax online begins by collecting your financial documents, including your Texas Customer Invoice. Go to the Texas Comptroller's website and use their online system to submit your information. Ensure your submission includes all required details and payment to avoid penalties. This online option streamlines the process and keeps your information secure.

To file a Texas PIR (Periodic Information Report), gather your necessary financial records first. Utilizing your Texas Customer Invoice can provide the essential sales data you need. Complete the report accurately and submit it to the Texas Comptroller's office by the designated filing date. This helps ensure compliance and maintains your business's good standing.

In Texas, sales tax applies to most transactions involving tangible personal property. The Texas Customer Invoice will help you determine taxable items and track sales efficiently. Use tax may apply to goods purchased out of state for use in Texas. Businesses must collect and remit applicable sales taxes to maintain compliance.

To record sales and use taxes, maintain accurate sales records through invoices. Utilizing a Texas Customer Invoice can greatly simplify tracking taxable sales. Keep all relevant transaction details, such as the date, items sold, quantity, and sales tax collected. Regularly update your records to keep your financial statements accurate.

Filing a sales and use tax return in Texas is straightforward. You'll need to complete the appropriate form with information from your Texas Customer Invoice. Submit it online through the Texas Comptroller's website or send a paper form by mail. Make sure to include accurate sales figures to ensure compliance.

To file sales and use tax in Texas, you must first gather your sales receipts and records. You can use the Texas Customer Invoice to track all taxable sales. Visit the Texas Comptroller's website to file online, or download the forms to submit by mail. Ensure you file on or before the due date to avoid penalties.

Properly filling an invoice requires entering accurate and complete information, such as your company details, the customer's information, and the services rendered. Ensure to include payment terms and due dates in your Texas Customer Invoice for transparency. Using tools like US Legal forms can simplify this process, offering structured guidance.

When filling out a contractor's invoice, specify the work completed, the dates it occurred, and the total charges. Make sure to include both your contact information and that of the customer. Utilizing a template can help streamline this process, ensuring your Texas Customer Invoice meets all necessary requirements.

To write a detailed invoice, begin with a complete listing of services or products with individual prices. Include any applicable taxes or discounts, and ensure to add a subtotal and total amount. A comprehensive Texas Customer Invoice fosters transparency and professionalism in your transactions.

An invoice should include your business name, contact information, the customer’s details, a description of goods or services, and the total amount due. Don't forget to add the date of the transaction and payment terms. The Texas Customer Invoice should clearly convey all necessary information to avoid confusion.