Texas Bank Account Monthly Withdrawal Authorization

Description

How to fill out Bank Account Monthly Withdrawal Authorization?

Choosing the best lawful record template can be a have a problem. Obviously, there are plenty of templates available online, but how would you find the lawful kind you want? Take advantage of the US Legal Forms internet site. The services provides a large number of templates, including the Texas Bank Account Monthly Withdrawal Authorization, which can be used for company and private requires. All the kinds are checked by professionals and fulfill federal and state specifications.

In case you are previously authorized, log in to your accounts and then click the Download button to get the Texas Bank Account Monthly Withdrawal Authorization. Utilize your accounts to check from the lawful kinds you might have ordered previously. Check out the My Forms tab of your accounts and obtain one more backup in the record you want.

In case you are a new user of US Legal Forms, listed below are straightforward instructions so that you can follow:

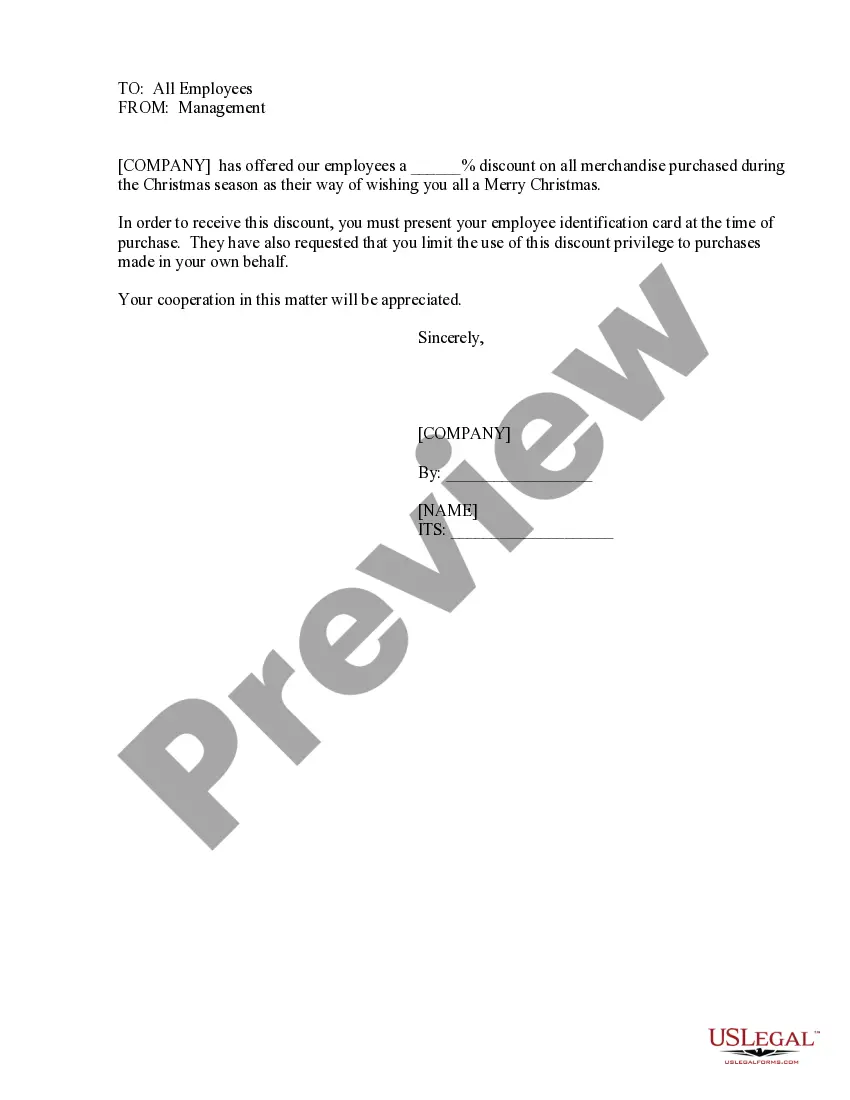

- First, be sure you have selected the correct kind for the city/state. You may look over the shape utilizing the Preview button and read the shape outline to make certain this is basically the best for you.

- In case the kind fails to fulfill your needs, take advantage of the Seach industry to discover the proper kind.

- Once you are certain the shape is proper, select the Get now button to get the kind.

- Select the costs prepare you need and enter the essential info. Create your accounts and pay for an order with your PayPal accounts or Visa or Mastercard.

- Pick the submit formatting and acquire the lawful record template to your device.

- Total, change and produce and sign the acquired Texas Bank Account Monthly Withdrawal Authorization.

US Legal Forms is the most significant local library of lawful kinds where you will find different record templates. Take advantage of the company to acquire appropriately-manufactured papers that follow state specifications.

Form popularity

FAQ

Yes. Generally, banks may close accounts, for any reason and without notice. Some reasons could include inactivity or low usage. Review your deposit account agreement for policies specific to your bank and your account.

Both state and federal laws prohibit unauthorized withdrawals from being taken from your bank account or charges made to your credit card without your express consent having first been obtained for that to occur. Some laws require this consent to have first been obtained expressly in writing.

Some sources of income are considered protected in account garnishment, including: Social Security, and other government benefits or payments. Funds received for child support or alimony (spousal support) Workers' compensation payments.

There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.

Seven Ways to Protect Your Assets from Litigation and Creditors Purchase Insurance. Insurance is crucial as a first line of protection against speculative claims that could endanger your assets. ... Transfer Assets. ... Re-Title Assets. ... Make Retirement Plan Contributions. ... Create an LLC or FLP. ... Set Up a DAPT. ... Create an Offshore Trust.

In some cases, they may take legal action and request a bank levy. This may freeze your bank account and give creditors the right to take the funds directly from it. You won't be able to access the money in your account until the debt is paid.

Online Visit the NetBanking registration page. Enter your customer ID and confirm your mobile number to generate an OTP. Enter the OTP. Select your debit card and enter details. Set your IPIN. Login to NetBanking using your customer ID and new IPIN.

A certificate of deposit, or CD, typically earns you interest at a higher rate than either a savings or checking account. The catch is that a CD has a specified term length. You cannot touch your money during that term. A term can range anywhere from three months to five years (60 months).