Texas Letter regarding trust money

Description

How to fill out Letter Regarding Trust Money?

It is feasible to invest multiple hours online searching for the legal document template that aligns with the federal and state stipulations you require.

US Legal Forms provides thousands of legal documents that are assessed by experts.

You can conveniently download or print the Texas Letter regarding trust money from their service.

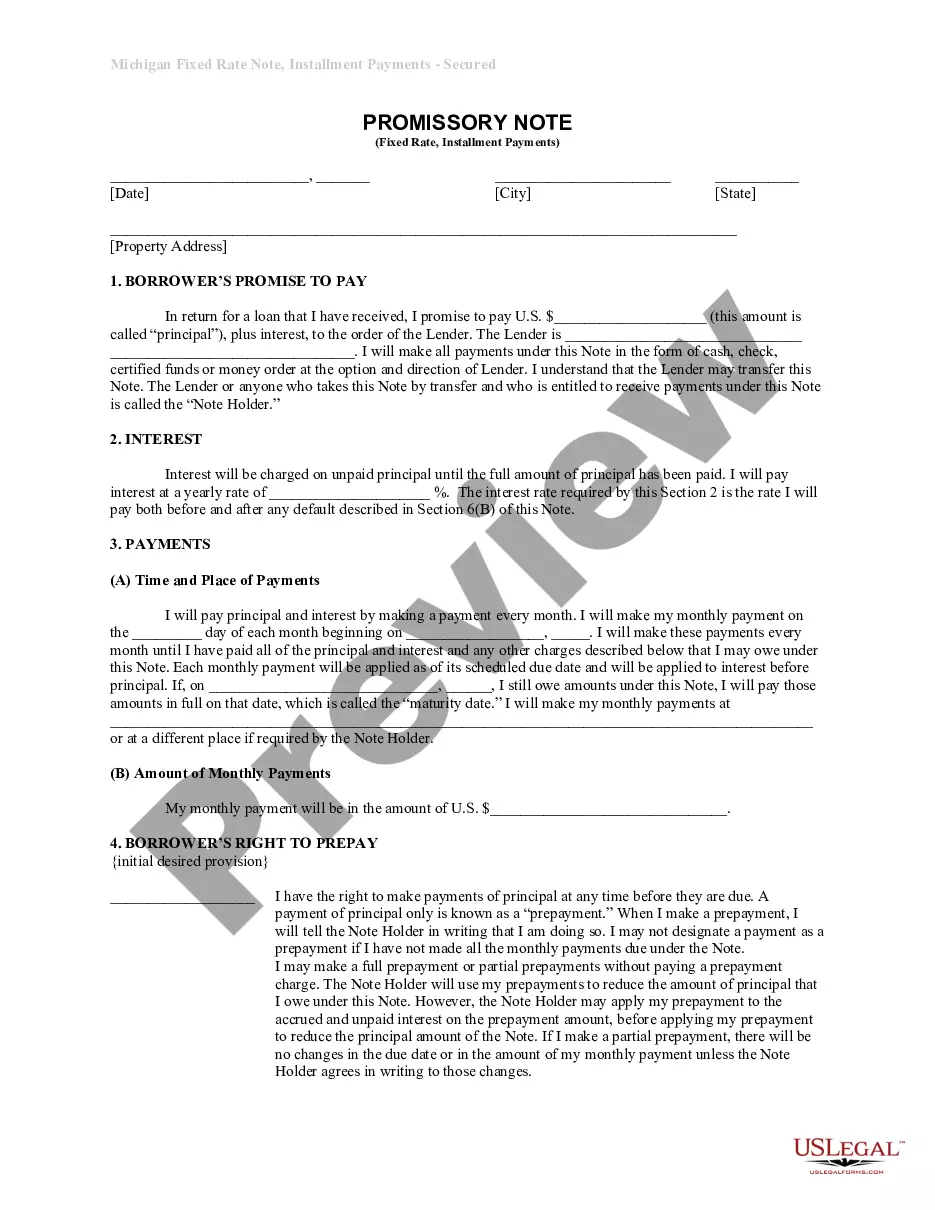

If available, use the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Texas Letter regarding trust money.

- Every legal document template you acquire is permanently yours.

- To obtain another copy of the downloaded form, visit the My documents tab and click on the related button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- Initially, make sure you have selected the appropriate document template for your area/city that you choose.

- Check the form summary to ensure you have chosen the correct document.

Form popularity

FAQ

Yes, Texas has a trust code, which outlines the laws and regulations governing trusts in the state. These provisions help ensure that trust fiduciaries act in the best interest of beneficiaries. If you seek to understand the specifics of the Texas trust code, US Legal Forms provides resources to simplify the legal framework for your needs.

Finding a trust document in Texas can involve searching through public records or directly asking the trustee for a copy. You can also look into online databases maintained by local courthouses or specific record-keeping offices. If you need more specialized help, US Legal Forms can provide templates and instructions to streamline your search.

In Texas, trusts generally are not public records unless they have been filed with the court or if the trust involves a probate estate. However, certain aspects of the trust may become public when a trust is contested or goes through the probate process. For more information on this subject, US Legal Forms can guide you through understanding the nuances of trust visibility in Texas.

You can obtain proof of trust by requesting a copy of the trust document from the trustee. This document should include details about the trust's terms and the identity of the beneficiaries. If you encounter difficulties, consider using US Legal Forms, which provides templates and guidance for obtaining trust documentation in Texas.

To locate a trust document in Texas, start by contacting your local county clerk’s office. They may have records or information about where the trust is filed. Additionally, you can check with the trustee or the person who established the trust. For more detailed assistance, US Legal Forms offers resources to help you navigate this process effectively.

Reference the name of the irrevocable trust, and the trust account number if applicable. Write a salutation followed by a colon. Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request.

While they are both alive, the beneficiaries are not legally entitled to see a copy of the trust. However, when one or the other dies, part of the trust typically becomes permanent. At that point, the rights of the beneficiaries and heirs to have a copy of the trust comes into being.

People or organizations named as beneficiaries in a revocable trust do not have a right to see the trust agreement because it is not yet set in stone. The settlor could remove the current beneficiaries and select others to replace them.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

You cannot receive your inheritance until the estate has been properly administered. This generally takes between nine and 12 months, although it can take longer in complex estates.