This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Texas Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Have you ever been in a situation where you require documents for either business or personal purposes almost all the time.

There are many legal document templates available online, but locating reliable ones isn't straightforward.

US Legal Forms offers a vast selection of form templates, including the Texas Agreement Dissolving Business Interest in Relation to Certain Real Property, which are designed to meet state and federal requirements.

When you find the appropriate form, click Get now.

Choose a convenient file format and download your copy. Retrieve all the document templates you have purchased from the My documents section. You can download an additional copy of the Texas Agreement Dissolving Business Interest in Relation to Certain Real Property at any time by simply clicking on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates that can be used for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Texas Agreement Dissolving Business Interest in Relation to Certain Real Property template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/county.

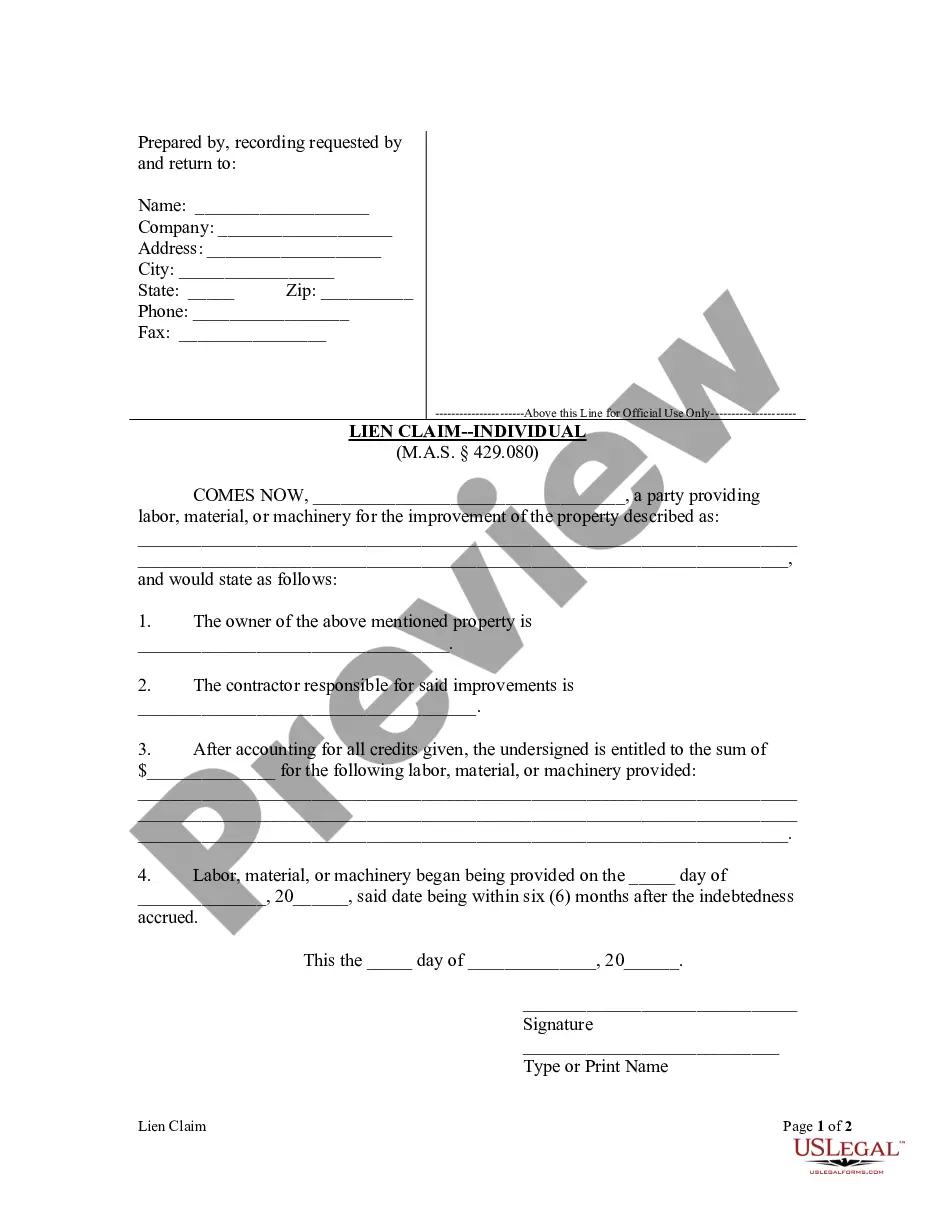

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Section 11.052 of the Texas Business Organization Code pertains to the procedures for amending company formation documents. Recognizing the importance of this section can enhance your approach when devising a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property, as it ensures compliance with state regulations during the dissolution process. Having proper documentation fosters trust and clarity among all parties involved.

Section 6.201 of the Texas Business Organization Code describes the management structure of limited liability companies. This section plays a significant role in how a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property is executed, particularly regarding decision-making and authority in dissolution. Understanding this section empowers stakeholders to navigate management dynamics effectively.

Section 11.101 of the Texas Business Organization Code sets forth the legal framework for forming a limited liability company. This section elaborates on the requirements needed for a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property, providing the necessary guidelines for interested parties. Familiarity with these regulations can ensure smooth transactions and compliance.

Section 1.002 of the Texas Business Organization Code defines various terms that are fundamental to Texas business law. This foundational section helps demystify legal jargon, making it easier for professionals to understand the nuances of a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property. Clear definitions support effective communication and decision-making.

Section 5.201 B of the Texas Business Organization Code relates to the distribution of assets upon dissolution. This section is crucial when parties seek to establish a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property, as it lays out the protocols for asset distribution among stakeholders. A clear understanding of these provisions can streamline the negotiation process.

Section 11.356 of the Texas Business and Organization Code addresses the rights of members in a limited liability company. This section includes stipulations for the dissolution of business interests and aligns closely with the Texas Agreement Dissolving Business Interest in Connection with Certain Real Property. Knowing this section aids businesses in better planning their exits and submits relevant documentation.

Section 6501 of the Business and Professions Code outlines the legal framework for various professional licenses in California. It provides guidance on maintaining professional accountability, which can influence agreements dissolving business interests, including those related to real property. Understanding this section helps stakeholders navigate the complexities involved with a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property.

Property code 47 in Texas pertains to various owner-occupant disclosures, particularly regarding the condition of the property before sale. This code ensures homeowners provide necessary details that prospective buyers must know. Utilizing a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property complies with these regulations, preventing misunderstandings in transactions.

Certain entities are exempt from seller disclosures in Texas, including banks and government agencies, when selling foreclosed properties. Additionally, individuals who inherit properties or are selling a home without ever occupying it may also qualify for exemptions. Understanding these provisions is important when navigating a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property.

Property code 5008 in Texas addresses specific disclosure requirements for sellers in real estate transactions. This is crucial as it stipulates the seller's obligation to disclose property conditions, protecting buyer interests. If you are planning to utilize a Texas Agreement Dissolving Business Interest in Connection with Certain Real Property, being informed of these codes helps ensure compliance and mitigates risks.