The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Texas Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

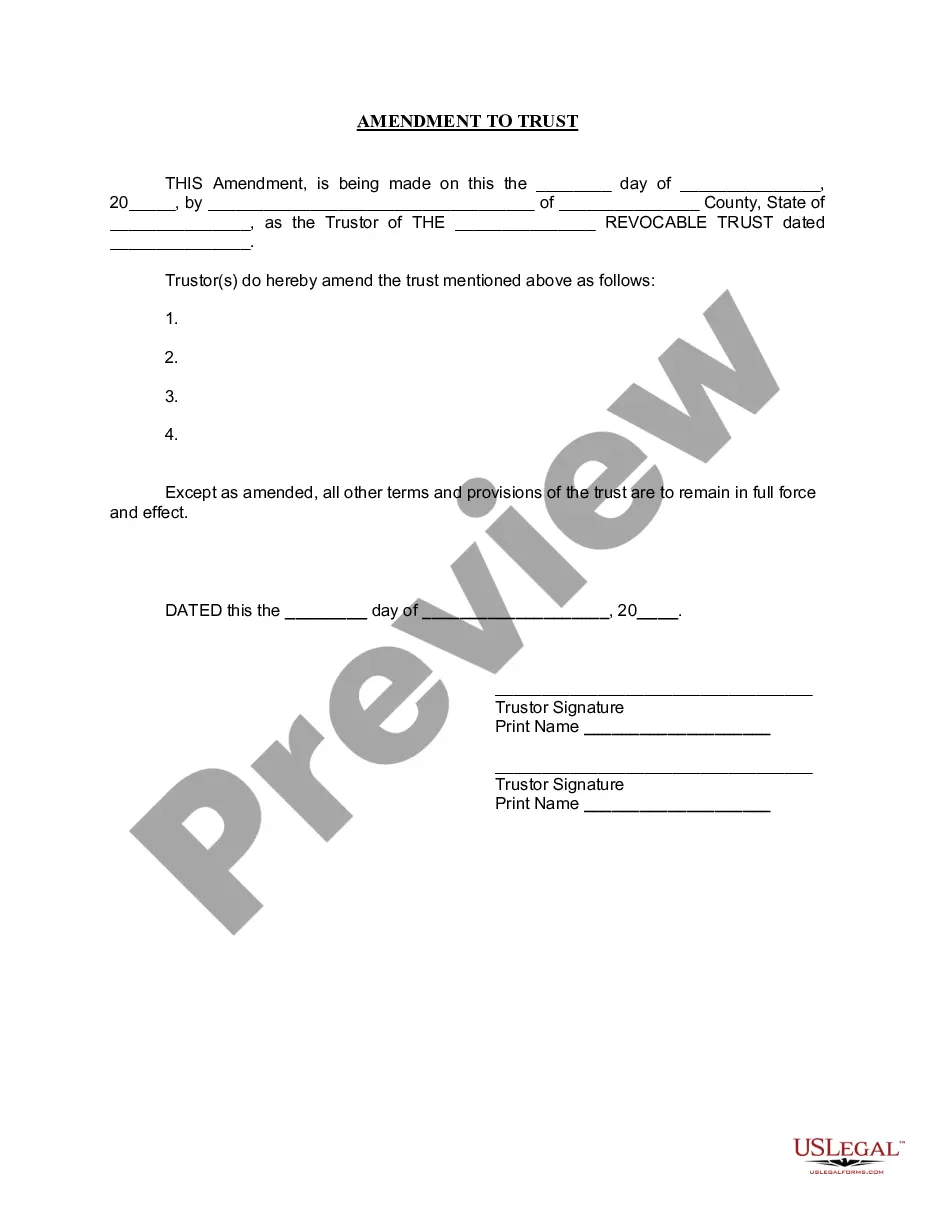

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

You are able to invest several hours on-line searching for the lawful file web template that fits the state and federal needs you require. US Legal Forms provides 1000s of lawful forms that happen to be analyzed by pros. You can actually acquire or printing the Texas Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from the service.

If you currently have a US Legal Forms account, it is possible to log in and then click the Down load button. After that, it is possible to comprehensive, edit, printing, or signal the Texas Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Every lawful file web template you buy is the one you have eternally. To acquire yet another copy associated with a purchased type, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms internet site the very first time, keep to the easy recommendations beneath:

- First, make sure that you have chosen the best file web template for that area/metropolis of your choice. Browse the type description to ensure you have picked the correct type. If available, take advantage of the Review button to appear with the file web template as well.

- If you would like discover yet another model of your type, take advantage of the Look for area to find the web template that fits your needs and needs.

- Once you have discovered the web template you desire, just click Purchase now to proceed.

- Find the pricing strategy you desire, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can use your charge card or PayPal account to cover the lawful type.

- Find the structure of your file and acquire it to your product.

- Make modifications to your file if possible. You are able to comprehensive, edit and signal and printing Texas Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Down load and printing 1000s of file web templates making use of the US Legal Forms Internet site, that provides the largest collection of lawful forms. Use skilled and state-distinct web templates to take on your small business or person demands.

Form popularity

FAQ

Any person who obtains a consumer report from a consumer reporting agency under false pretenses or knowingly without a permissible purpose shall be liable to the consumer reporting agency for actual damages sustained by the consumer reporting agency or $1,000, whichever is greater.

Notice is not required if: The transaction does not involve credit; A credit applicant accepts a counteroffer; A credit applicant expressly withdraws an application; or.

Federal Legislative Activity in 2023 Amend Section 604(c) of the FCRA to address the treatment of pre-screening report requests. Section 604(c) governs the furnishing of reports in connection with credit or insurance transactions that are not initiated by the consumer.

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit reporting. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.

Duty to Promptly Correct and Update Information. Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

Common violations of the FCRA include: Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number.

(a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).