Oregon Amendment to Living Trust

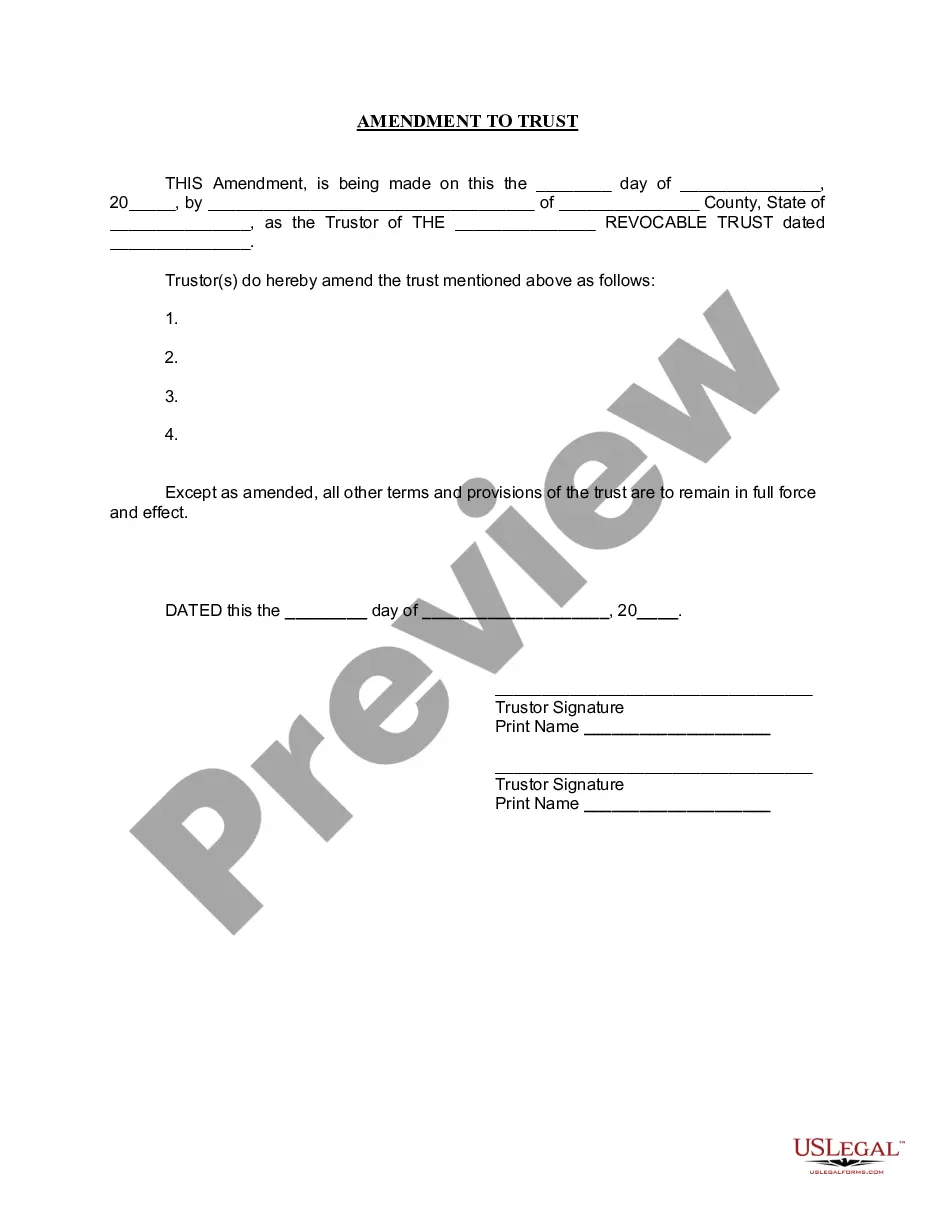

What this document covers

The Amendment to Living Trust is a legal document used to make changes to an existing living trust. A living trust is set up during a person's lifetime to manage their assets and provide for their distribution after death, and this amendment allows the Trustor to modify certain aspects of the trust without altering its fundamental purpose. This form helps ensure that all specified changes are legally recognized, while the unaltered sections of the trust remain valid and in effect.

Form components explained

- Date of amendment

- Trustor's name and county of residence

- Name of the original revocable trust

- Details of the amendments being made

- Signatures of the Trustor(s)

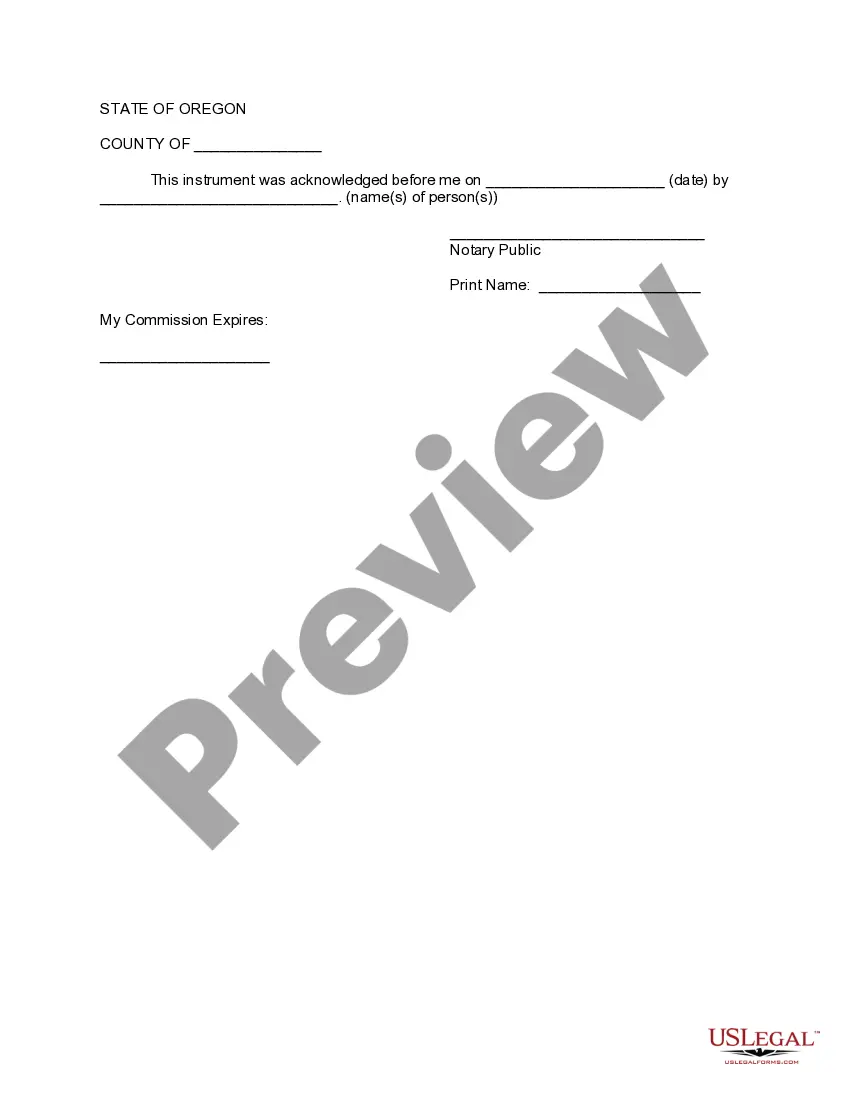

- Notary acknowledgment section

Situations where this form applies

This form should be used when changes need to be made to an existing living trust. Situations may include updating the beneficiaries, changing trustee information, adding or removing assets, or clarifying specific terms of the trust. By using this amendment, the Trustor can ensure that the trust accurately reflects their current wishes and circumstances.

Who should use this form

- Individuals who have established a living trust

- Trustors seeking to modify terms or assets within their trust

- Beneficiaries or family members involved in estate planning

- Those who wish to ensure compliance with current legal standards

How to prepare this document

- Enter the date of the amendment at the beginning of the document.

- Write the name and county of the Trustor.

- Specify the name of the revocable trust being amended.

- Clearly state the changes being made to the trust.

- Sign the document in front of a notary public to validate it.

- Ensure the notary public completes the acknowledgment section.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Forgetting to include specific details about the amendments.

- Not obtaining the necessary signatures or notarization.

- Leaving out the date of the amendment.

- Using vague language that could lead to misunderstandings.

- Failing to communicate changes to relevant parties, such as beneficiaries.

What to keep in mind

- The Amendment to Living Trust allows you to change specific terms of your existing living trust.

- This form must be signed in front of a notary public to be binding.

- It's essential to clearly outline the amendments you wish to make.

- Using this form helps maintain compliance with state laws and ensures your estate plan is up to date.

Looking for another form?

Form popularity

FAQ

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

200b200b200b200bIn Oregon, our electricity comes from a variety of resources, from hydroelectricity and coal to wind and nuclear energy. Oregon has diverse electricity resources, including increasing amounts of renewable power from water, wind, and the sun.

Can I contest a trust in California? Yes, you can contest a trust, and it is more common than most people think.

To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument.