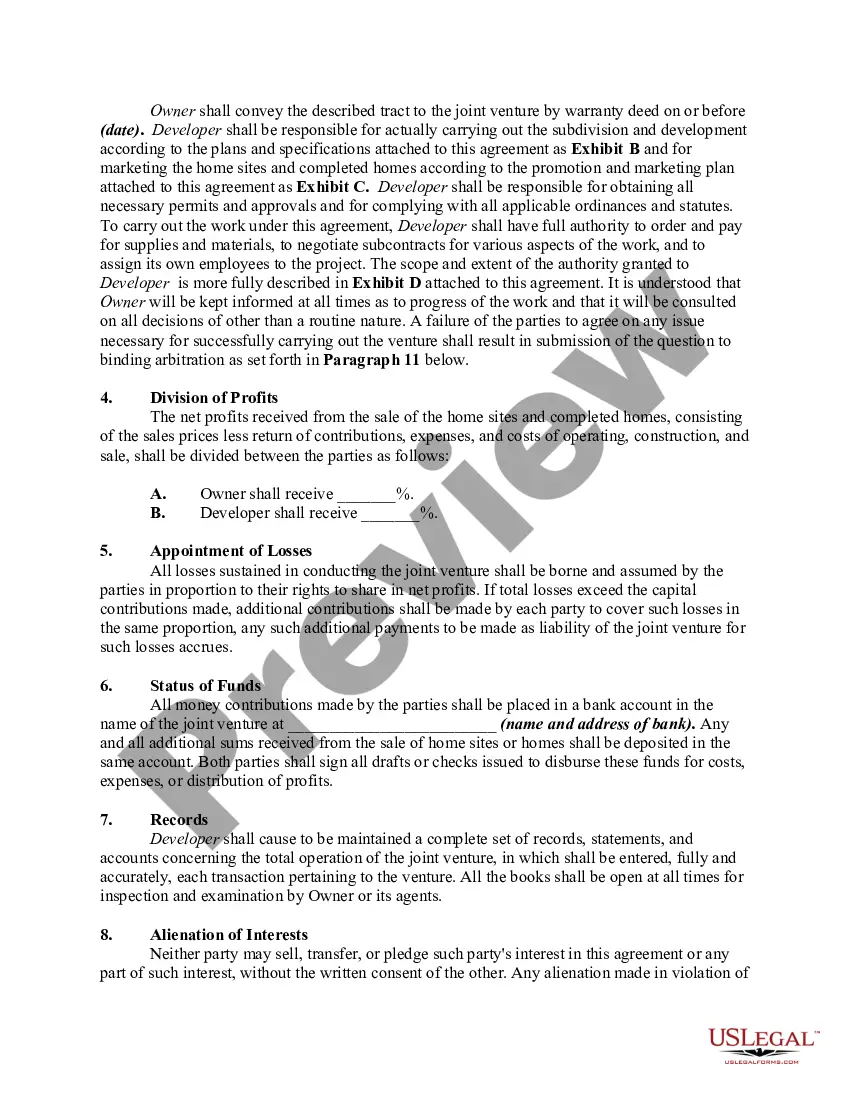

Texas Joint Venture Agreement to Develop and to Sell Residential Real Property

Description

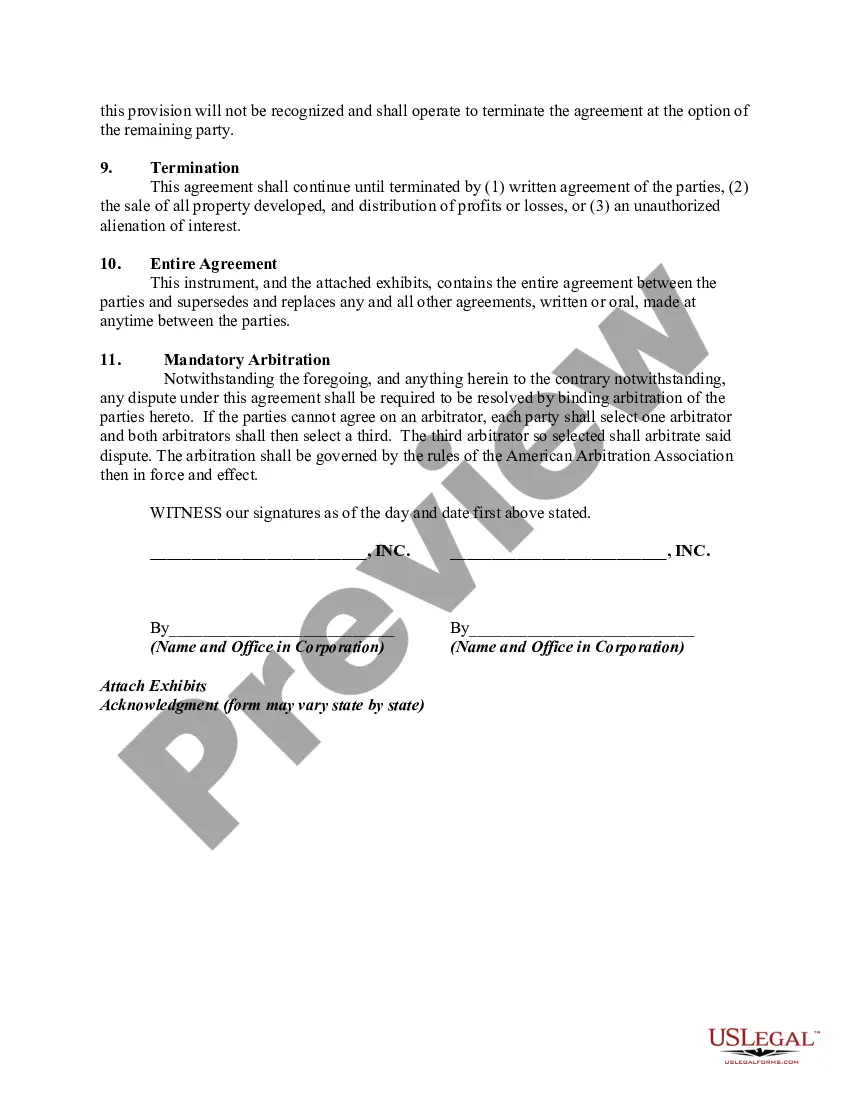

A joint venture will last generally as long as stated in the joint venture agreement. If the joint venture agreement is silent on this, it can be terminated by any participant unless it clearly relates to a particular transaction. For example, if a joint venture is created to construct a particular bridge, it will last until the project is completed or becomes impossible to complete because of bankruptcy or some other type situation.

With regard to liability to third persons, generally, joint venturers have the same liability as partners in a general partnership.

How to fill out Joint Venture Agreement To Develop And To Sell Residential Real Property?

Have you ever been in a situation where you require paperwork for certain organizations or specific tasks almost every day.

There are numerous authentic document templates available online, but locating versions you can rely on is not easy.

US Legal Forms provides thousands of document templates, including the Texas Joint Venture Agreement to Develop and to Sell Residential Real Property, which can be customized to fulfill federal and state regulations.

Once you find the right document, click on Buy now.

Choose the pricing plan you desire, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Texas Joint Venture Agreement to Develop and to Sell Residential Real Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you require and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to ensure you have selected the appropriate document.

- If the document is not what you are looking for, use the Search field to find the template that meets your needs.

Form popularity

FAQ

Rules for joint ventures can vary, but a fundamental principle is that all parties must agree on objectives and commitments outlined in the agreement. These agreements, such as the Texas Joint Venture Agreement to Develop and to Sell Residential Real Property, generally specify each partner's responsibilities and profit-sharing arrangements. Understanding and adhering to these rules ensures a smoother and more successful collaboration.

A joint venture is not always structured as a 50/50 partnership. While equal share arrangements occur, it is common for partners to negotiate different profit distribution based on their contributions and roles. When forming a Texas Joint Venture Agreement to Develop and to Sell Residential Real Property, consider defining shares that reflect each partner's investment and expertise.

To write a joint venture agreement, you should begin with a clear outline of the venture’s purpose, which, in this case, involves developing and selling residential real property in Texas. Include essential details such as capital contributions, profit sharing, and decision-making processes. Utilizing platforms like uslegalforms can simplify the process, offering templates specifically tailored for Texas Joint Venture Agreements.

The 40 rule for joint ventures is another guideline that may apply to Texas Joint Venture Agreements to Develop and to Sell Residential Real Property. This rule often states that for a successful joint venture, at least 40% of the profits should be distributed equitably among the partners. It promotes fairness, encouraging all parties to invest their resources fully in the project.

The 3 in 2 rule for joint ventures refers to a principle often applied in Texas Joint Venture Agreements to Develop and to Sell Residential Real Property. This rule typically indicates that three parties can participate in the venture, but two of them must meet specific criteria regarding investment or control. Utilizing this rule can help streamline your agreement and ensure compliance with relevant regulations.

Qualifying for a joint venture involves several key factors, including experience in real estate development and a clear plan for the project. You must demonstrate financial stability and the ability to contribute resources effectively. Understanding these criteria can enhance your chances of successfully entering a Texas Joint Venture Agreement to Develop and to Sell Residential Real Property.

To obtain a Texas Joint Venture Agreement to Develop and to Sell Residential Real Property, you can start by consulting legal experts experienced in real estate law. They can help you understand the specific terms and conditions that fit your objectives. Additionally, using platforms like US Legal Forms can simplify this process, providing you with customizable templates that meet Texas legal requirements.

The four major factors in joint venture success include clear communication, mutually beneficial contributions, aligned goals, and a well-defined agreement. Ensuring that all parties understand their roles and responsibilities fosters a healthier partnership. A Texas Joint Venture Agreement to Develop and to Sell Residential Real Property is essential for establishing these factors clearly, providing a solid foundation for a successful collaboration. Engaging with legal resources can further enhance your partnership's success.

The most typical joint venture in real estate is an equity joint venture, where partners contribute capital and share ownership in the project. This structure is popular because it aligns the interests of both parties for mutual profit and success. By utilizing a Texas Joint Venture Agreement to Develop and to Sell Residential Real Property, you can ensure that all elements are covered. This clarity fosters trust and smoother collaboration.

The four types of joint ventures include equity joint ventures, contractual joint ventures, project-based joint ventures, and international joint ventures. Each type serves specific purposes and can be beneficial depending on your project requirements. Understanding these types helps you choose the most suitable structure for your project. A Texas Joint Venture Agreement to Develop and to Sell Residential Real Property will help formalize your chosen structure.