Texas Assignment of Judgment

Description

How to fill out Assignment Of Judgment?

If you wish to aggregate, obtain, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms, which is accessible online.

Employ the site's simple and efficient search to locate the documents you require. Various templates for business and personal purposes are categorized by sections and keywords.

Use US Legal Forms to find the Texas Assignment of Judgment with just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Texas Assignment of Judgment. Every legal document format you purchase is yours indefinitely. You have access to every form you acquired within your account. Visit the My documents section and select a form to print or download again. Be proactive and download, and print the Texas Assignment of Judgment with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the Texas Assignment of Judgment.

- You can also access forms you previously purchased in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct region/country.

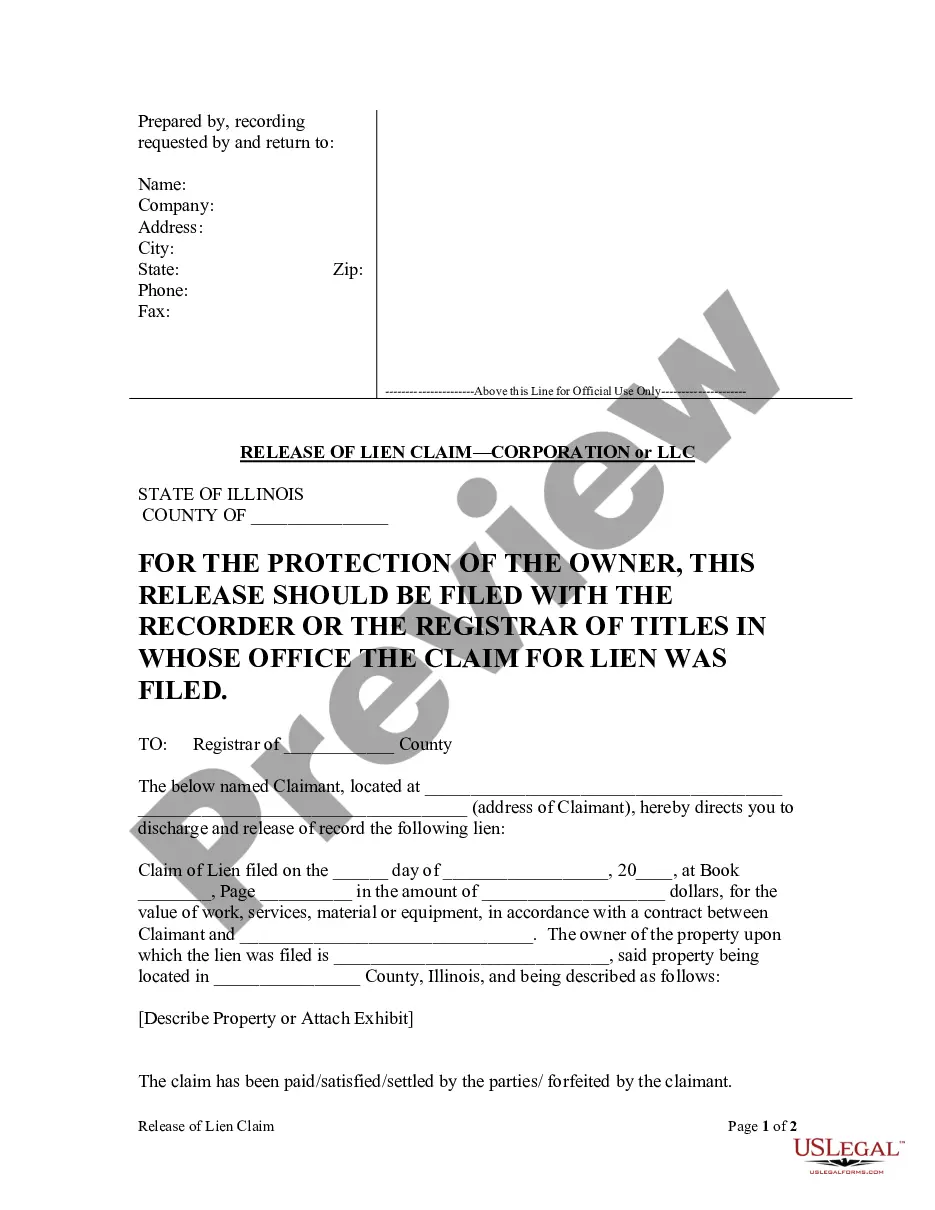

- Step 2. Use the Review feature to examine the form's details. Don’t forget to read through the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other models in the legal form format.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Texas Property Code Section 52.0012(c) states that a judgment lien does not attach to, and does not constitute a lien on, a judgment debtor's exempt real property, including the debtor's homestead.

By filing a judgment lien, if the debtor sells any non-exempt property, you may be able to get all or some of the money you are owed from the proceeds of the sale. A judgment lien lasts for ten years.

Ways to Collect a Judgment in Texas Writ of Execution. Judgment Lien. Writ of Garnishment. Turnover Order.

A receipt, acknowledgement, or release that is signed by the party entitled to receive payment of the judgment or by that person's agent or attorney of record and that is acknowledged or proven for record in the manner required for deeds.

Texas Property Code Section 52.0012(c) states that a judgment lien does not attach to, and does not constitute a lien on, a judgment debtor's exempt real property, including the debtor's homestead.

It is very difficult to collect a money judgment in Texas. Our law provides that only non-exempt property of the judgment debtor may be seized to satisfy the judgment. Most judgment debtors do not have non-exempt property; in other words, most people have only exempt property.

An Assignment for the Benefit of Creditors Texas (ABC) is a legal process in which a debtor assigns all of its assets to an independent third party, called an assignee, for the purpose of liquidating the assets and paying off the creditors.

52.004. RECORDING AND INDEXING OF ABSTRACT. (a) The county clerk shall immediately record in the county real property records each properly authenticated abstract of judgment that is presented for recording. The clerk shall note in the records the date and hour an abstract of judgment is received.