Texas Sample Letter for Request for Tax Clearance Letter

Description

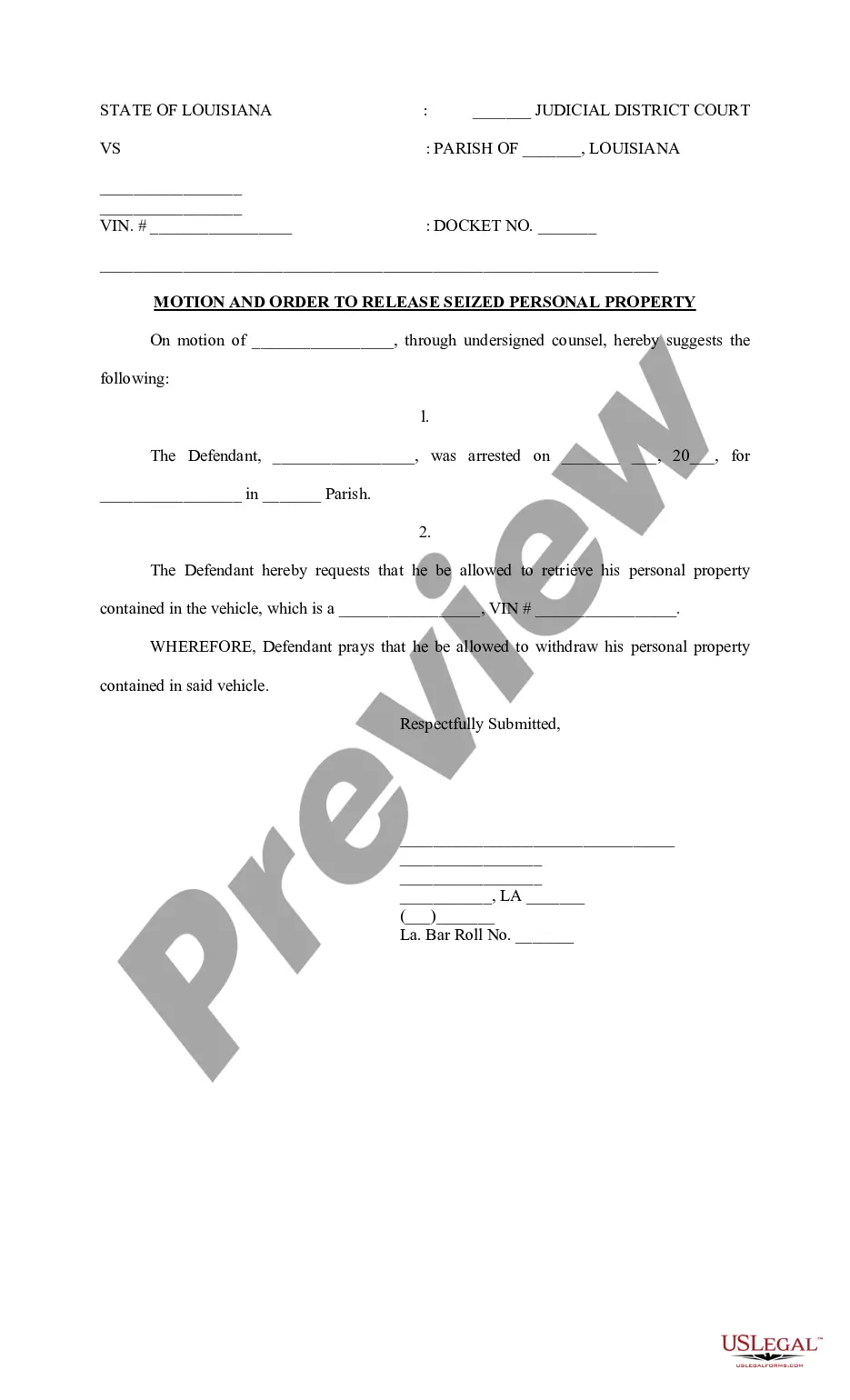

How to fill out Sample Letter For Request For Tax Clearance Letter?

Have you found yourself in a situation where you need documents for either business or personal reasons almost every day? There are numerous legal document templates available online, but finding reliable ones can be challenging. US Legal Forms provides a vast array of form templates, such as the Texas Sample Letter for Request for Tax Clearance Letter, designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Texas Sample Letter for Request for Tax Clearance Letter template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for the correct state/region. Utilize the Review option to examine the form. Check the details to make sure you have selected the right form. If the form is not what you are looking for, use the Search area to find the form that matches your needs and requirements. When you find the correct form, just click Buy now. Choose the pricing plan you want, fill out the necessary information to create your account, and pay for your order with your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Texas Sample Letter for Request for Tax Clearance Letter at any time, if needed. Just click the required form to download or print the document template.

- Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service provides professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb), ...

In general, you'll need to supply the following information to get a tax clearance certificate: the name, address, and phone number of the buyer and seller. a business address or addresses if multiple locations are involved. the date of sale. a bill of sale or purchase agreement for the business.

To ask for a clearance certificate, you can submit the completed form TX19, Asking for a Clearance Certificate with the required documents which are listed on the form. The submission can be sent by mail, fax, or electronically via using the Submit Document feature within CRA Online Portals.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.

In order to reinstate an entity, the Texas Secretary of State requires evidence that the entity has met certain franchise tax requirements. To provide this evidence, the Comptroller's office issues a Tax Clearance Letter, Form 05-377.

Taxpayers who have questions about Texas taxes can receive help from the Comptroller's office through either a general information letter or a private letter ruling. General information letters answer most questions, but taxpayers can request a private letter ruling.