Texas Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

Are you in a situation where you require documents for business or specific reasons every day.

There are numerous legal document templates accessible online, but finding credible ones can be challenging.

US Legal Forms provides thousands of document templates, such as the Texas Executive Employee Stock Incentive Plan, that are designed to comply with state and federal regulations.

If you locate the correct document, click on Purchase now.

Select the pricing plan you prefer, provide the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Texas Executive Employee Stock Incentive Plan template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the template you need and confirm it is for the correct city/area.

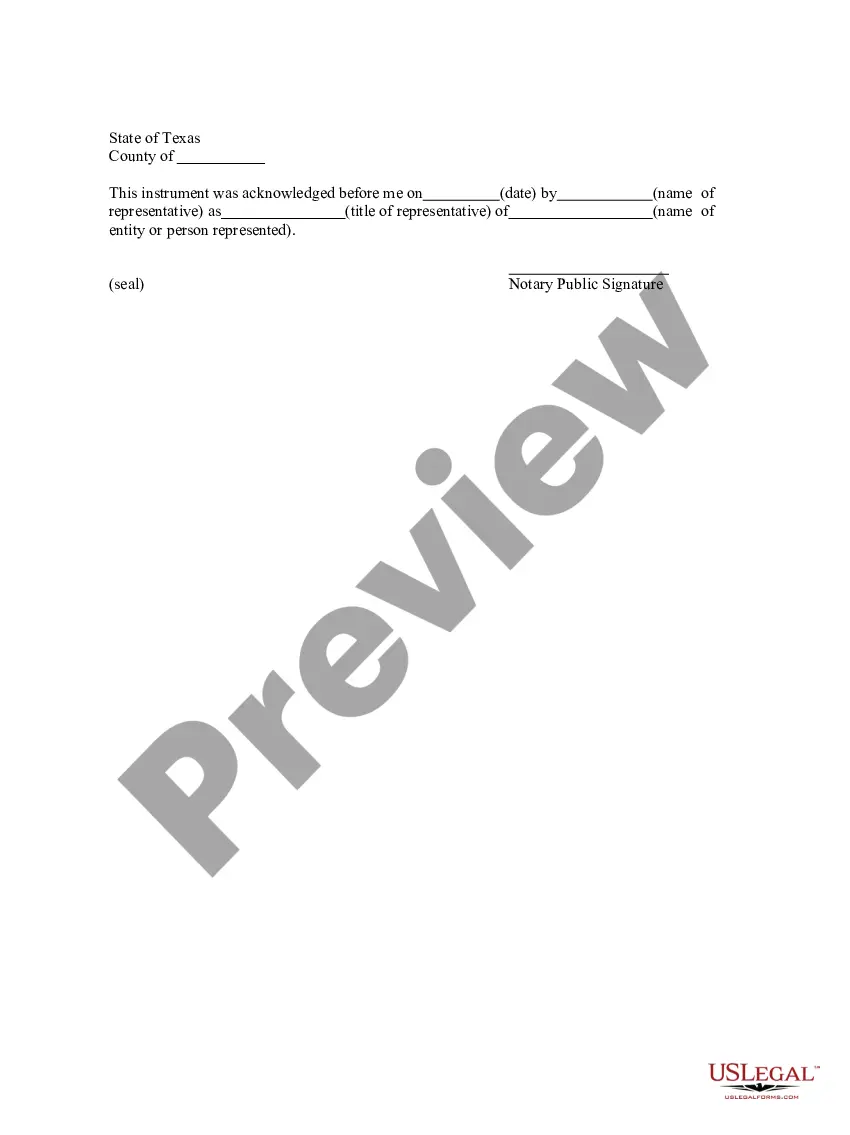

- Use the Review button to examine the form.

- Check the details to ensure you have selected the right document.

- If the document isn't what you're looking for, employ the Search field to find the form that suits your needs.

Form popularity

FAQ

A typical executive compensation package includes a mix of base salary, bonuses, and benefits like stock options. In many cases, the Texas Executive Employee Stock Incentive Plan enhances these packages, allowing executives to benefit directly from the company's growth. Other elements may include retirement contributions and health benefits, all tailored to attract and retain top talent. Understanding these components helps companies craft appealing offers to executive candidates.

An executive bonus plan operates by providing bonuses based on individual and company performance metrics. These plans incentivize top executives to meet predetermined objectives, such as financial targets or project milestones. The Texas Executive Employee Stock Incentive Plan often integrates a bonus system, offering stock options and other financial rewards as part of the package. This alignment encourages executives to work towards the long-term success of the company.

The executive compensation incentive is a structured program designed to reward top management for achieving specific performance goals. This often includes bonuses, stock options, and other benefits that align their interests with those of the company. In Texas, the Executive Employee Stock Incentive Plan is a popular choice, helping executives maximize their contributions while gaining financial benefits. By using this plan, companies can create a motivated workforce focused on growth and profitability.

One significant advantage of a Non-Qualified Stock Option (NQSO) is its flexibility regarding eligibility and conditions. Unlike Incentive Stock Options (ISOs), which have stricter requirements, NQSOs can be granted to a broader range of employees, including those who do not meet specific income tests. This makes NQSOs appealing in diverse business situations. To maximize the benefits of NQSO, consider integrating it into your strategy using the Texas Executive Employee Stock Incentive Plan.

Choosing between an ISO and an NQSO often hinges on your financial situation and future goals. An ISO provides potential tax benefits, while an NQSO offers flexibility in certain situations. Additionally, consider your company's structure and your long-term investment strategies. The Texas Executive Employee Stock Incentive Plan can guide you, offering clarity on which option aligns best with your financial objectives.

One key disadvantage of a Non-Qualified Stock Option (NQSO) compared to an Incentive Stock Option (ISO) lies in the tax implications. When you exercise an NQSO, you face ordinary income tax, which can increase your tax burden significantly. In contrast, with an ISO, you can benefit from potential tax advantages if you hold the shares for a specific period. For a comprehensive understanding of these options, consider exploring the Texas Executive Employee Stock Incentive Plan to make informed decisions.

Filing taxes with stock investments, including those from a Texas Executive Employee Stock Incentive Plan, involves reporting your capital gains or losses. You'll need to fill out Schedule D and Form 8949 to report each trade accurately. Additionally, ensure you have all relevant documentation, such as trade confirmations and year-end statements from your brokerage. Utilizing a platform like US Legal Forms can simplify your filing process by providing templates and guidance tailored to your specific stock investments.

When you exercise incentive stock options under the Texas Executive Employee Stock Incentive Plan, the tax implications depend on whether you sell the stock immediately or hold it. If you sell right after exercising, you typically need to report the income as ordinary income on your tax return. However, if you hold onto the stock, you might be looking at capital gains taxes when you eventually sell, which could be more favorable. Regularly consulting a tax professional can help ensure you stay compliant and optimize your tax outcome.

An employee stock ownership incentive plan is designed to provide employees with shares of the company, promoting a sense of ownership among the workforce. This plan can foster greater loyalty and productivity, as employees are directly invested in the company's success. The Texas Executive Employee Stock Incentive Plan embodies this concept, creating a mutually beneficial relationship between the company and its employees.

Employee stock options can be a rewarding addition to a compensation package, as they give employees a vested interest in the company's performance. However, they come with risks, including market volatility and changes in company valuation. It's essential to weigh the pros and cons carefully and consider the Texas Executive Employee Stock Incentive Plan to determine if it's a suitable fit for your organization.