Texas Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

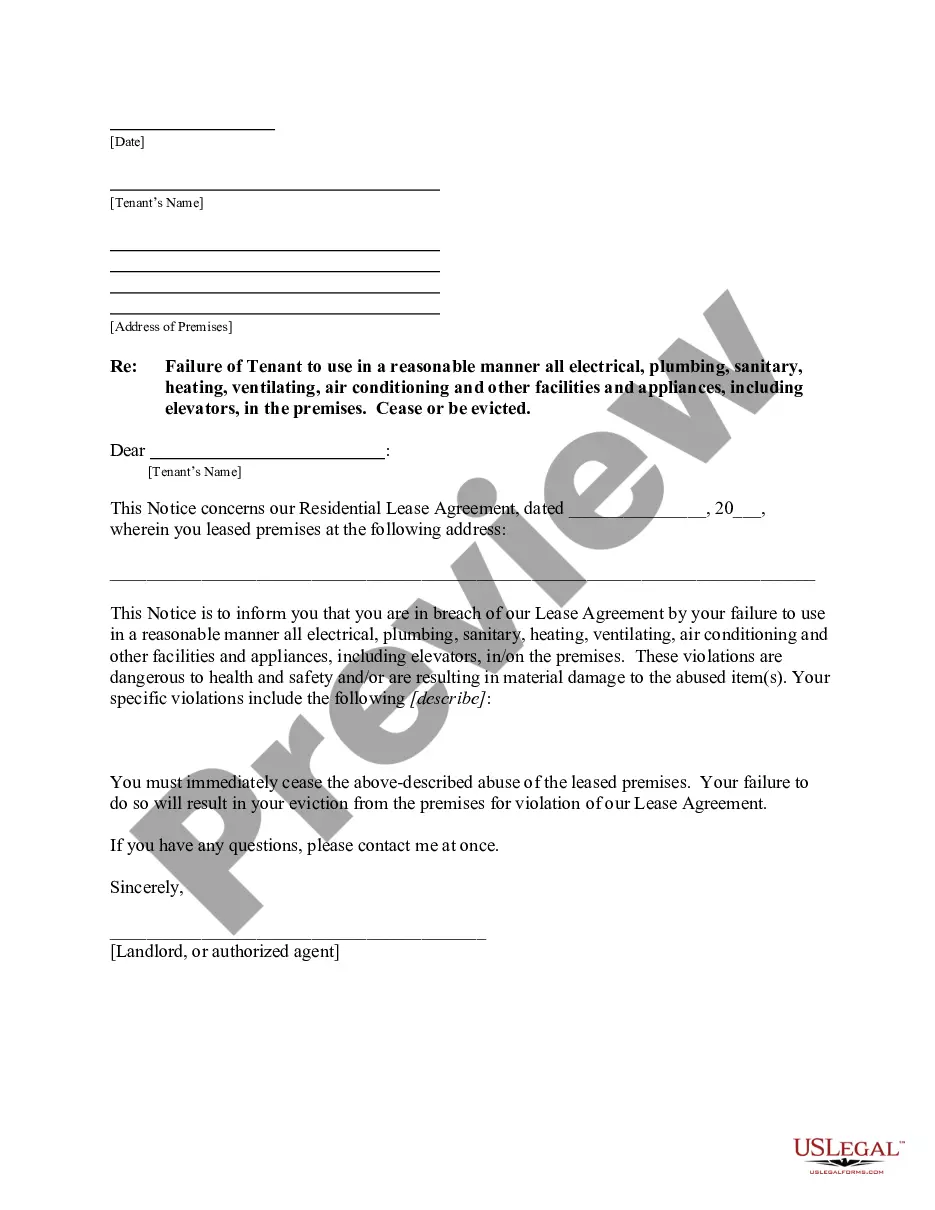

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

If you need to complete, download, or print authentic document templates, utilize US Legal Forms, the largest collection of official forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require. Various templates for commercial and personal uses are organized by categories and states, or keywords.

Use US Legal Forms to acquire the Texas Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Texas Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate. Every legal document template you purchase is yours permanently. You have access to every form you obtained with your account. Click the My documents section and select a form to print or download again. Stay competitive and download, and print the Texas Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to locate the Texas Affidavit by an Attorney-in-Fact in the Role of an Executor of an Estate.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review feature to examine the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other templates from the legal form collection.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

Form popularity

FAQ

Your qualification as executor entitles you to receive Letters Testamentary from the County Clerk. The ?Letters? are an official certificate from the Clerk's office verifying your appointment and qualification as executor and your authority to manage estate property.

By Texas law, persons who were convicted of a felony are disqualified from becoming executor, regardless of where and when the felony conviction occurred. Felons who have been legally pardoned or had their civil rights restored, however, are not disqualified from becoming executor.

In Texas, the executor of the estate must file for probate within four years from the testator's death. Texas probate law is very strict about this statute of limitations. In certain circumstances, there may be alternatives for wills that have expired.

There are three general ways of revoking a will in Texas: through subsequent writing, by a physical act upon the will, or by operation of law.

The probate statute of limitations in Texas is four years. This means that if you don't file a probate case within four years of the person's death, you may not be able to do so.

Section 256.204 - Period for Contest (a) After a will is admitted to probate, an interested person may commence a suit to contest the validity thereof not later than the second anniversary of the date the will was admitted to probate, except that an interested person may commence a suit to cancel a will for forgery or ...

Section 256.156 of the Texas Estates Code provides that ?A will that cannot be produced in court must be proved in the same manner as provided in Section 256.153 for an attested will or Section 256.154 for a holographic will, as applicable.? Holographic wills are wills made in the decedent's handwriting that do not ...