Texas Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What this document covers

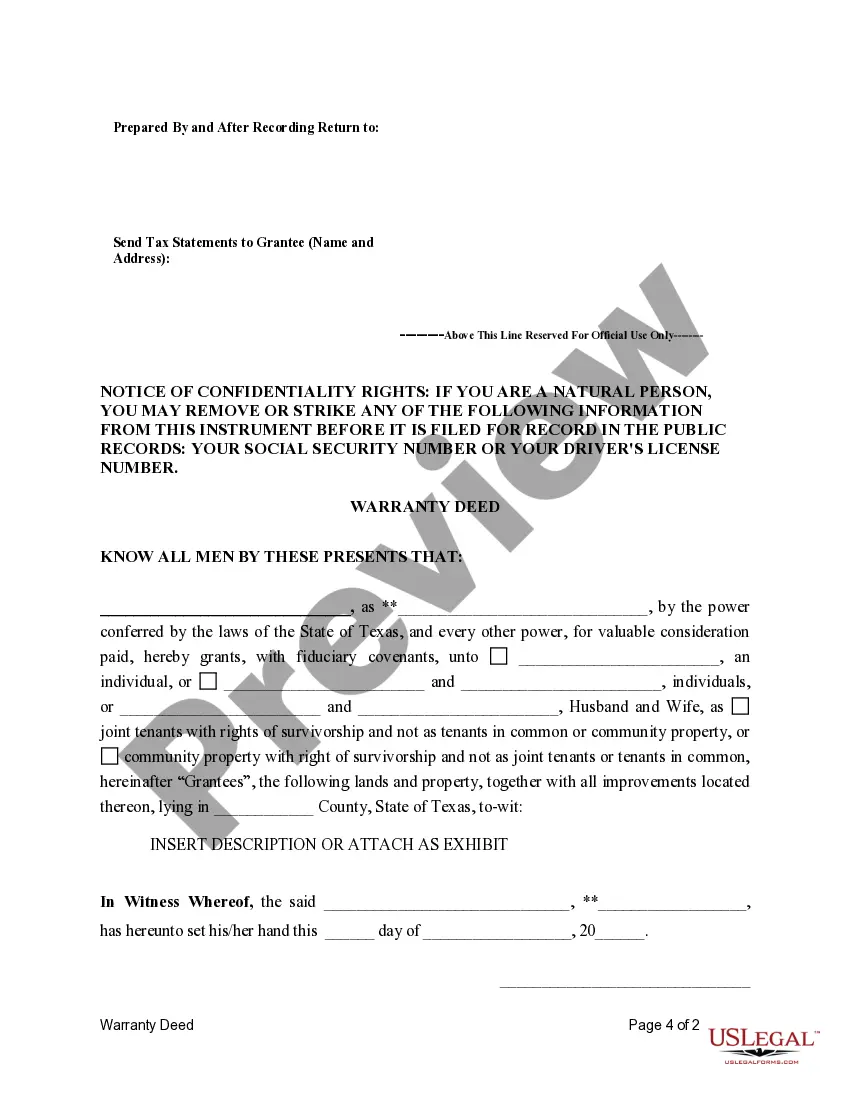

The Fiduciary Deed is a legal document used for transferring property by a fiduciary, such as an executor, trustee, guardian, or administrator. It allows the fiduciary to convey real estate on behalf of another individual or organization, following the terms outlined in a will or trust. This form is crucial for ensuring the rightful transfer of property while adhering to legal standards and responsibilities unique to fiduciaries.

Key components of this form

- Grantor Information: Details about the fiduciary transferring the property.

- Grantee Information: Information about who is receiving the property.

- Property Description: A detailed legal description of the property being transferred.

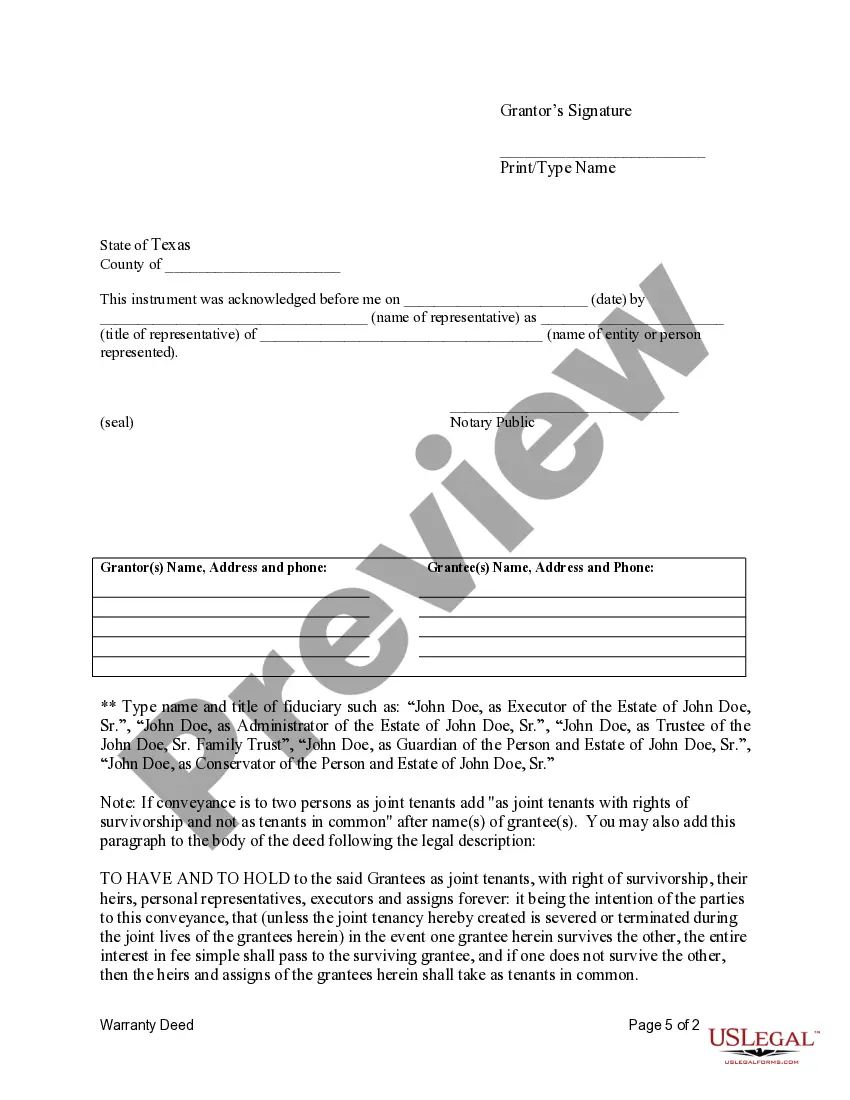

- Witness and Notary Sections: Areas for signatures and verification to validate the transfer.

- Fiduciary Covenants: Clauses that outline the fiduciary's obligations and assurances regarding the property transfer.

When this form is needed

This form should be used in situations where a fiduciary needs to transfer property from an estate or trust to an individual or entity. Common scenarios include the sale of property by an executor of an estate, the conveyance of property by a trustee to beneficiaries, or the transfer of assets by a guardian. This deed ensures that all legal requirements are met while protecting the interests of all parties involved.

Intended users of this form

- Executors of estates following the instructions of a will.

- Trustees managing a trust and distributing its assets.

- Guardians or conservators acting on behalf of wards or minors.

- Administrators handling the estate of an individual who passed without a will.

- Any fiduciaries authorized to convey property as per state law.

Completing this form step by step

- Identify the grantor, specifying their role as executor, trustee, or guardian.

- Provide the name of the grantee, indicating whether they are individuals or entities.

- Clearly describe the property being transferred, using legal descriptions or attached exhibits if necessary.

- Ensure all relevant signatures are provided and dated, including notary acknowledgments.

- Review the completed form for accuracy before finalizing the document.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include accurate property descriptions, which can lead to legal disputes.

- Omitting signatures from necessary parties, which invalidates the deed.

- Not providing notarization when required, leading to issues with enforceability.

- Error in identifying the relationship between the grantor and grantee.

- Incorrectly filling out or misunderstanding fiduciary obligations outlined in the deed.

Why complete this form online

- Convenient access to downloadable forms, allowing for quick completion.

- Editability features make it easy to customize the document as needed.

- Access to forms drafted by licensed attorneys, ensuring legal compliance.

- Reduction of paperwork errors through clear instructions and user-friendly formats.

- Secure storage and easy retrieval of legal documents when needed.

Looking for another form?

Form popularity

FAQ

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

In Texas, you can't add your spouse's name to an existing deed, but you can create a new deed by transferring the property from yourself to you and your spouse jointly. You can do this by using either a deed without warranty or a quit claim deed.

However, in order to be recorded in the county deed records in Texas, the grantor's signature must be acknowledged, for example through a certification by a notary public.Unless the deed is recorded electronically, it must also contain an original signature of the grantor, and not a copy.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

An administrator's deed is a legal document that transfers the property of an intestate individual, who is a person who passes away without a will. In such cases, the property is transferred to descendents or next-of-kin with the use of an administrator's deed since the deceased individual did not have a will.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate.These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case.

The standard executor compensation in Texas is a 5 percent commission on all amounts that the executor receives or pays out in cash in the administration of the estate. This means the executor is entitled to 5 percent of all money the estate takes in, as well as any necessary expenditures, such as the payment of debts.