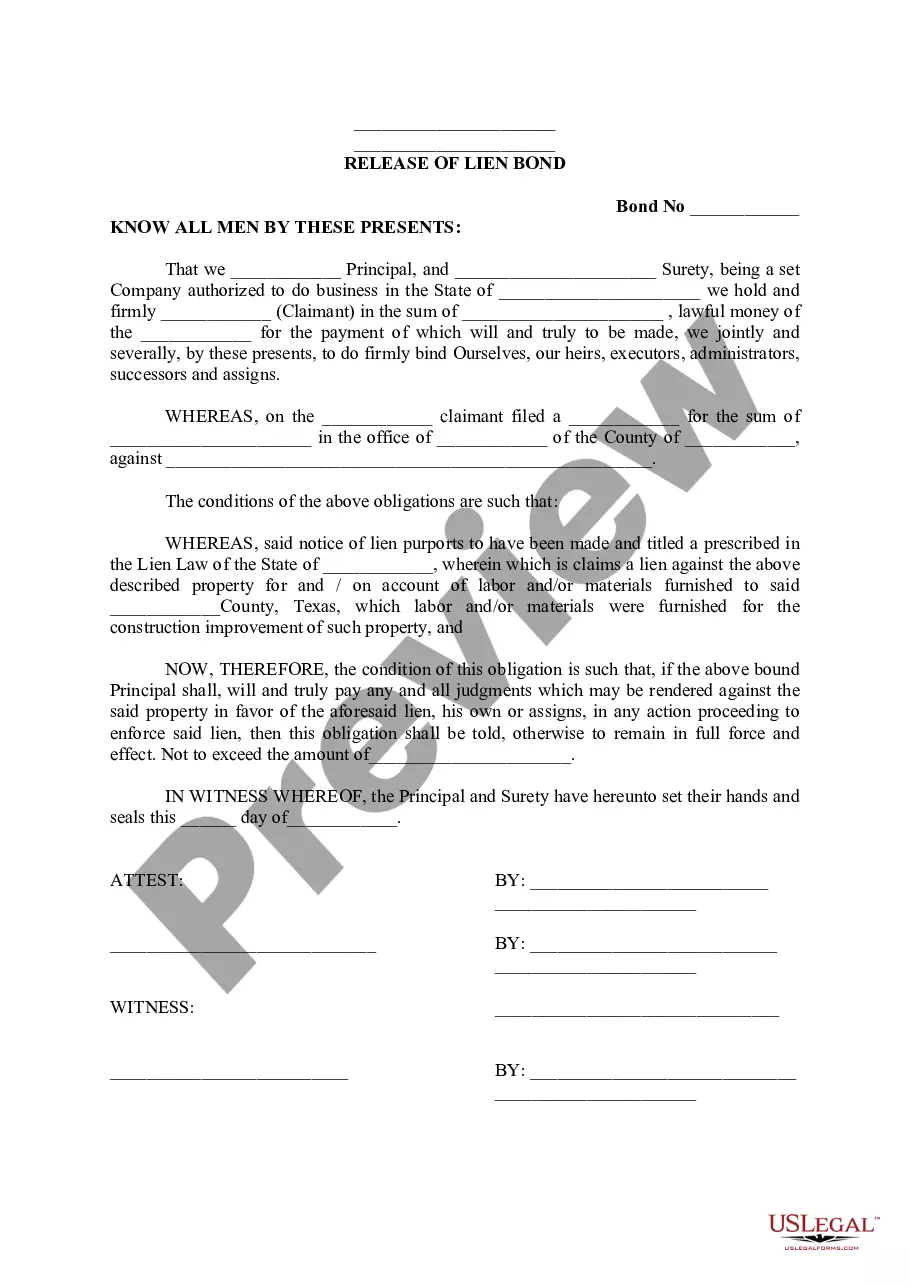

Texas Release of Lien Bond

Form popularity

FAQ

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

Remedial Bonds Under Section 53.171 of the Texas Property Code: Under Section 53.171(c) of the Texas Property Code, a mechanic's lien can be discharged with a bond even after the dispute has arisen and the lien has been filed. The bond must be substantially higher than the lien amounts.

The vehicle title. a release of lien letter and/or other notifications from the lienholder(s) currently named on the vehicle title. a completed Application for Texas Title and/or Registration (Form 130-U)

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

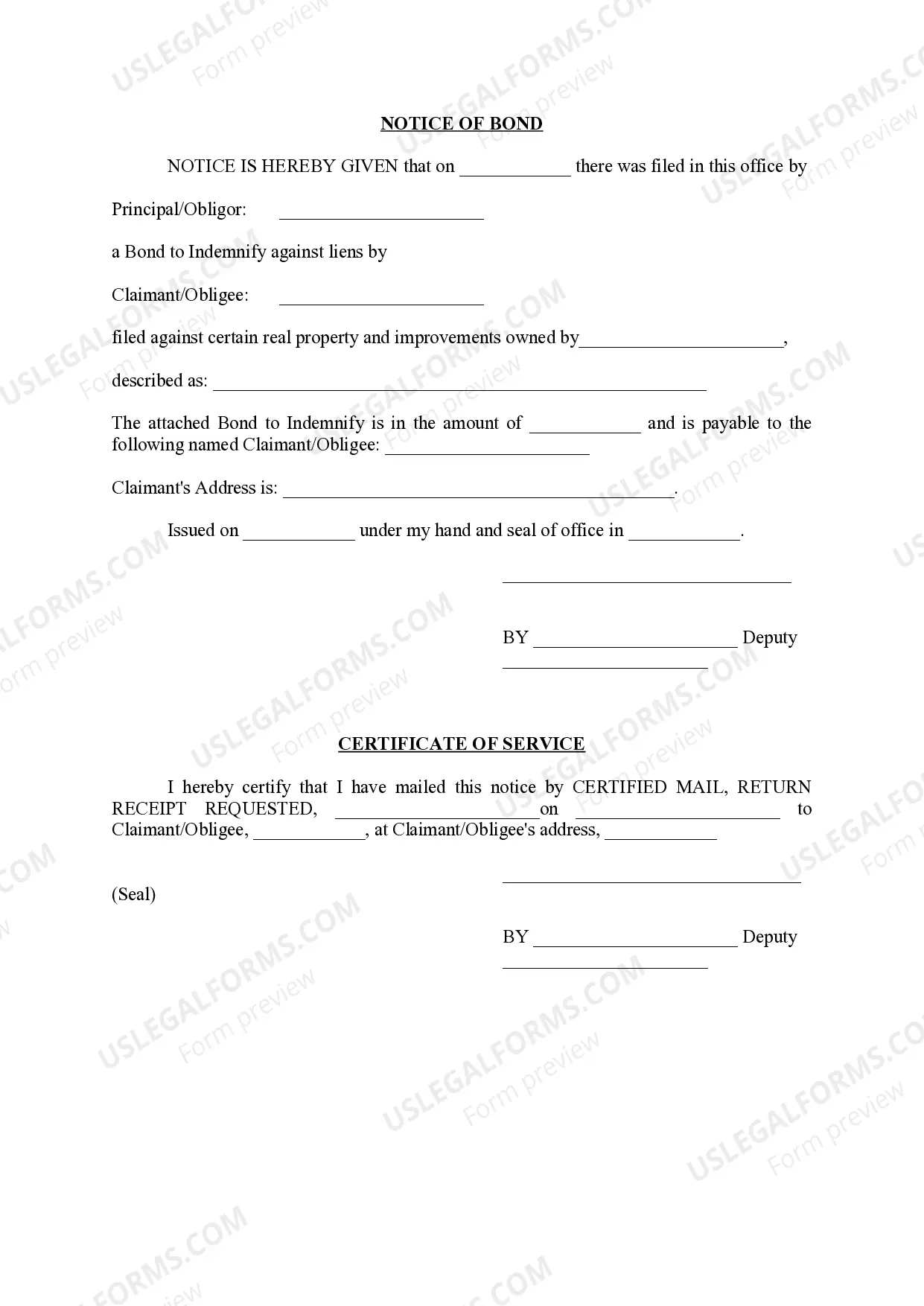

The final method for removing a Texas mechanics lien is to have the lien bonded off. The requirements and procedure to bond off a mechanics lien claim is set forth within an entire chapter from the lien law statutes, in Subchapter H: Bond to Indemnify Against Lien.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

Call your bonding company -- or the broker or agent who arranged the bond for you -- to inform the company that you no longer need the bond and want it released. Fill out the bond release request form you receive from the bonding company and return it.