Texas Affidavit of Death and Heirship or Descent

Description

How to fill out Texas Affidavit Of Death And Heirship Or Descent?

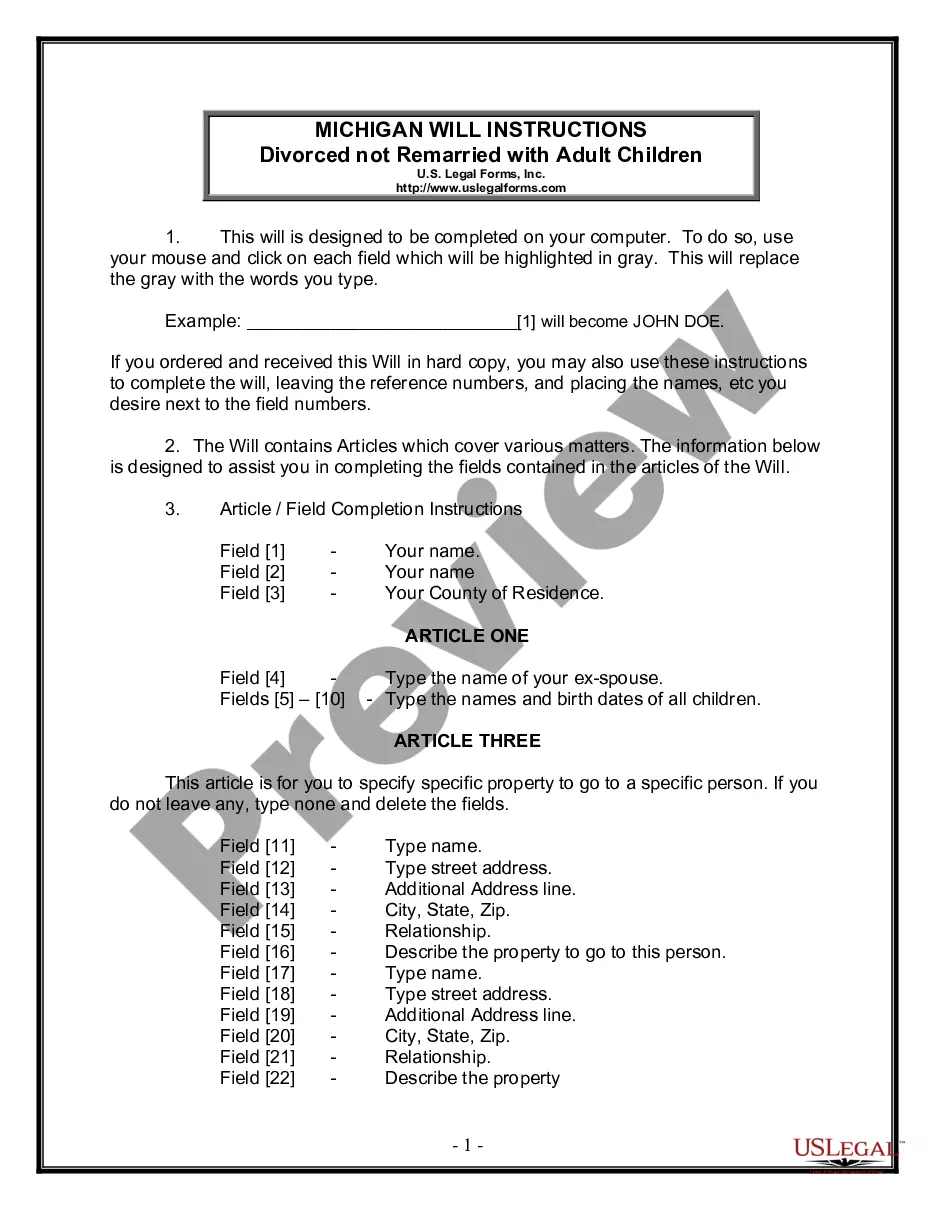

Access to high quality Texas Affidavit of Death and Heirship or Descent forms online with US Legal Forms. Avoid hours of misused time seeking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find around 85,000 state-specific authorized and tax forms that you could save and fill out in clicks within the Forms library.

To receive the example, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Check if the Texas Affidavit of Death and Heirship or Descent you’re looking at is suitable for your state.

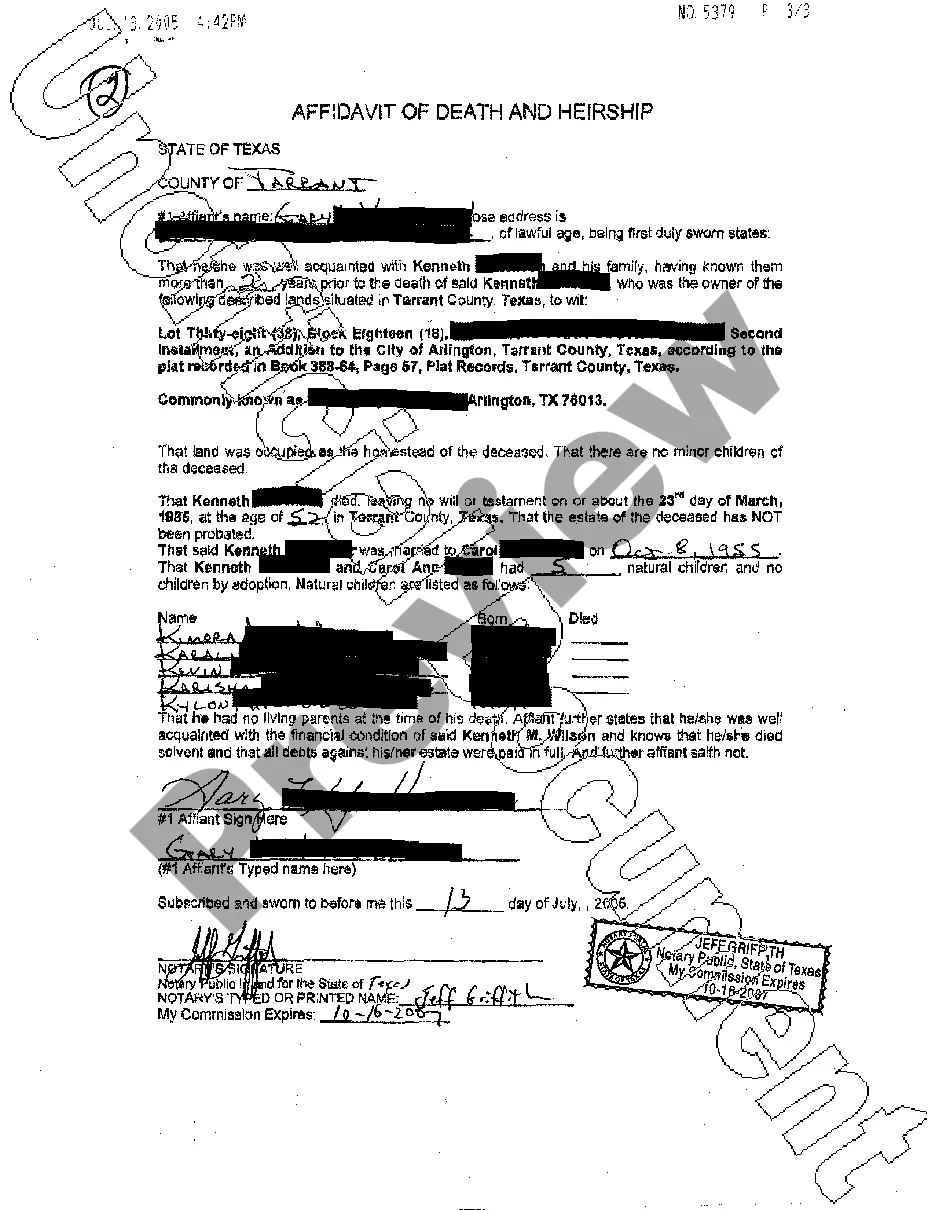

- View the form utilizing the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by credit card or PayPal to finish creating an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open up the Texas Affidavit of Death and Heirship or Descent sample and fill it out online or print it and get it done by hand. Consider mailing the file to your legal counsel to be certain everything is filled in correctly. If you make a mistake, print out and fill application again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access more templates.

Form popularity

FAQ

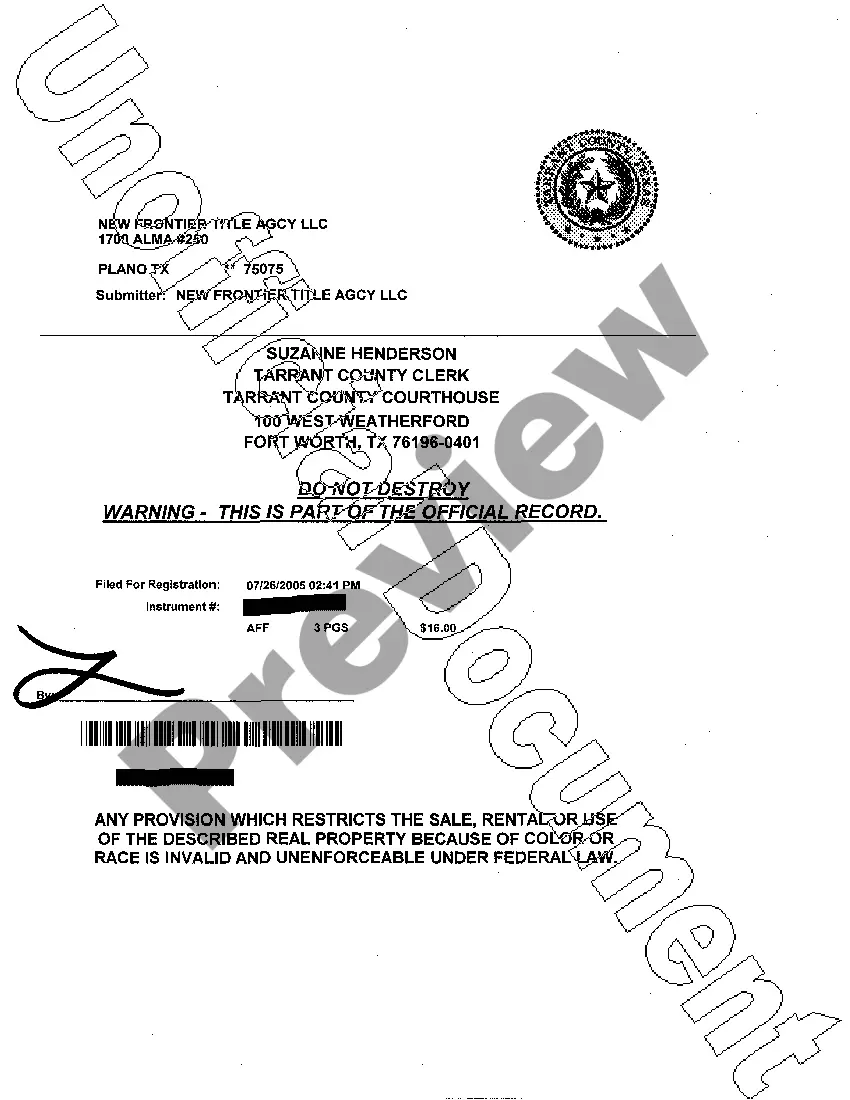

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

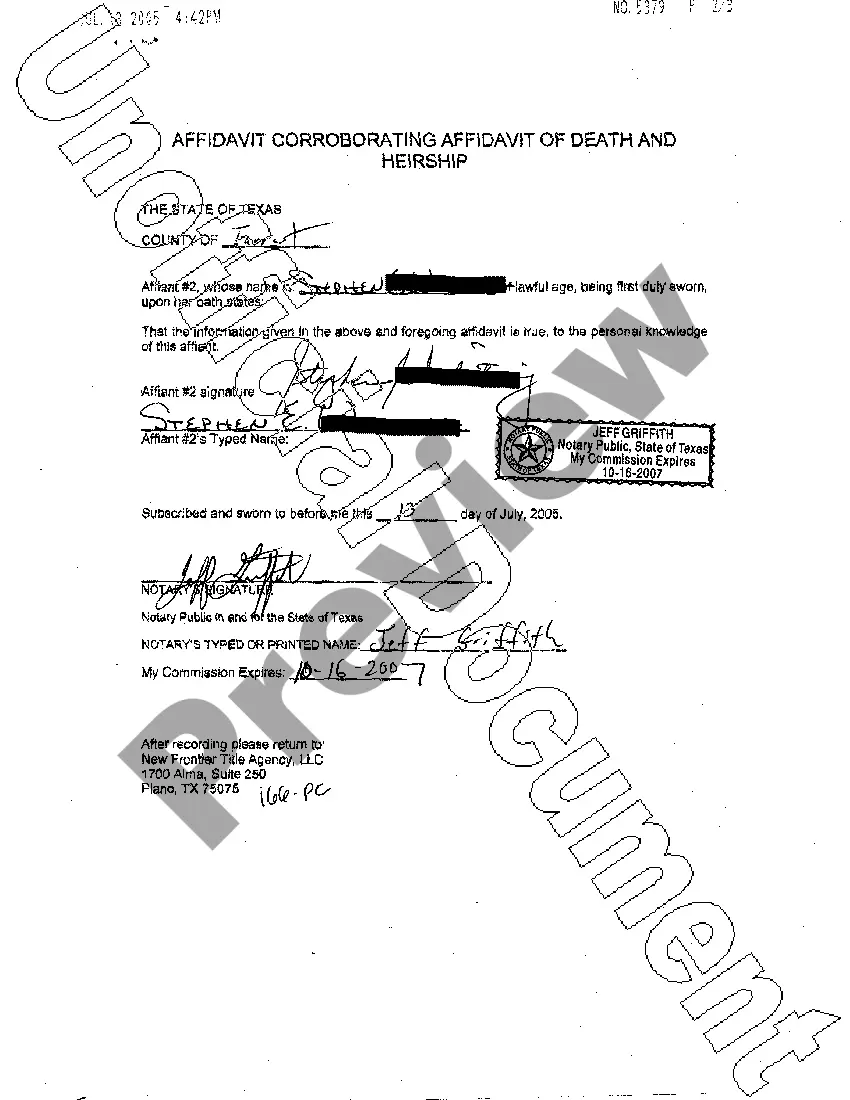

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).It does not transfer title to real property.

An Affidavit of Heirship is a sworn statement that heirs can use in some states to establish property ownership when the original owner dies intestate. Affidavits of Heirship are generally used when the decedent only left real property, personal property, or had a small estate.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Heirship Proceedings in Texas An heirship proceeding is a court proceeding used to determine who an individual's heirs are.This process involves a court-appointed attorney who investigates the deceased individual's family history and confirms to the court the identity of the heirs.